This Large-Cap Semiconductor Stock Has Been Hot

After a scorching-hot run, semiconductor stocks cooled off in 2022, impacting many portfolios. SOXX, the iShares Semiconductor ETF, is down more than 30% year-to-date, widely underperforming compared to the S&P 500.

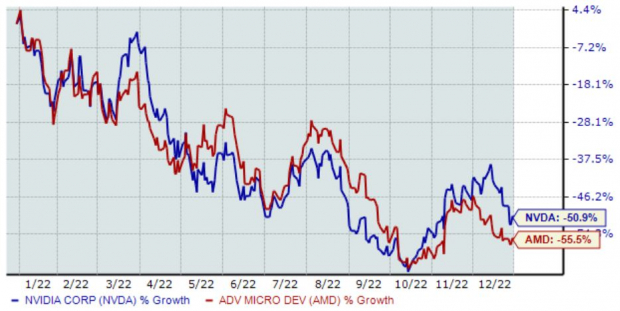

In addition, other popular chip stocks, including NVIDIA (NVDA) and Advanced Micro Devices (AMD), have performed poorly in 2022, as shown in the chart below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

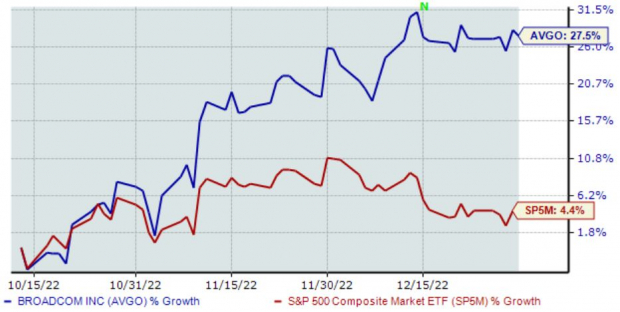

However, Broadcom (AVGO) has entirely snapped the overall bearish trend, with shares climbing more than 25% after bottoming in October. As we can see, the performance has crushed the S&P 500.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. The company’s products are used in end products such as enterprise and data center networking, home connectivity, set-top boxes, and broadband access, to name a few.

Let’s take a closer look at how the company currently stacks up.

Quarterly Performance

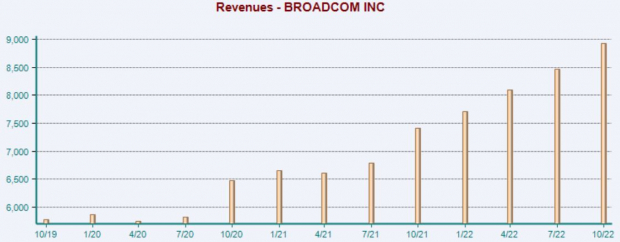

Broadcom’s earnings track record is mighty impressive; AVGO has exceeded top and bottom line estimates in eleven consecutive quarters.

The company penciled in a 1.8% EPS beat paired with revenue 0.4% above expectations in its latest release, providing shares the fuel they needed. AVGO has a favorable revenue trend, as seen in the chart below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Dividends & Cash Flow

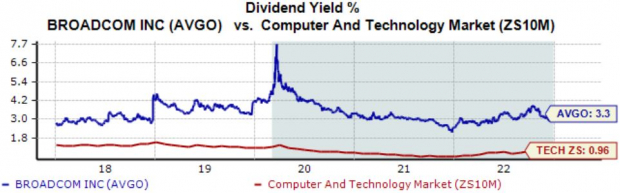

For those that seek income, AVGO has that covered. The company’s annual dividend currently yields a rock-solid 3.3%, notably higher than the Zacks Computer and Technology sector average.

Undoubtedly a positive, the company has shown a commitment to increasingly rewarding its shareholders, upping its dividend payout five times over the last five years and carrying a sizable 26% five-year annualized growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

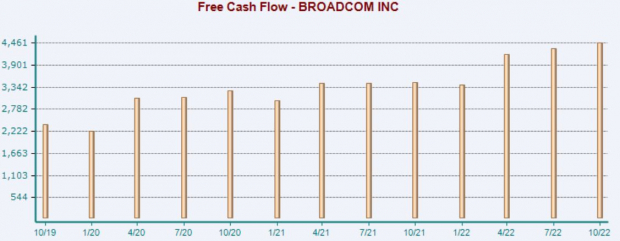

In addition, the company’s free cash flow strength is hard to ignore; in its latest quarter, Broadcom generated roughly $4.5 billion in free cash flow, good enough for a 4% sequential uptick and an even larger 30% Y/Y uptick.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Growth Outlook

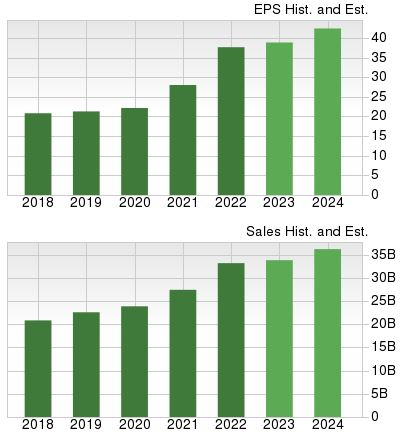

For the cherry on top, Broadcom carries a favorable growth profile, with earnings and revenue forecasted to climb 7.4% and 5% in FY23, respectively.

And in FY24, estimates call for an additional 7% growth in earnings and a 4.9% Y/Y uptick in revenue.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Semiconductors have sailed through challenging waters in 2022, ending stellar runs.

However, Broadcom (AVGO Quick QuoteAVGO - Free Report) has been an exception to the poor performance, widely outperforming other semiconductor stocks and embarking on a strong run since bottoming in October.

The company has consistently exceeded quarterly estimates, rewards investors handsomely, generates solid cash, and has an inspiring growth trajectory for the foreseeable future.

More By This Author:

Should Investors Buy Dollar Tree Or Walmart For 2023?

3 Small-Cap Blend Mutual Funds For Fantastic Returns

Buy These 3 Mid-Cap Blend Mutual Funds For Solid Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more