This Is The Trade To Make With DoorDash Wildly Overvalued

020 has been a year unlike any other, especially for the stock market. There has been a crash, a recovery, a massive sector rotation, persistent high volatility, and a host of IPOs. Despite the pandemic’s impact on the global economy, investors can’t seem to get enough of new stocks hitting the market this year.

We’ve seen a fair share of IPOs and reverse-mergers already…but December may end up being the biggest IPO month of all time. Just last week, we saw the launch of DoorDash (DASH) and Airbnb (ABNB) stocks. As of this writing, both stocks are skyrocketing, with investor demand seemingly through the roof.

Airbnb is an intriguing company and will likely be the topic of a future article, but for now, I’m going to focus on food delivery giant DoorDash. In a nutshell, DASH may be the most overvalued new stock of 2020…and that’s in a year full of crazy valuations.

At the current price of around $180 per share, DASH is valued at around $70 billion. That compares roughly with oil giant BP (BP) or consumer goods company Colgate-Palmolive (CL). Unlike BP and CL, DASH is nowhere near becoming a profitable company.

Despite being the market leader in the food delivery space during a time when consumers have had little choice but to order in, DASH lost nearly $150 million in the first nine months of 2020. In 2019, the company lost $667 million. While startups typically lose money, conditions are as good as they’ve ever been for food delivery services (plus, DASH has been around for seven years).

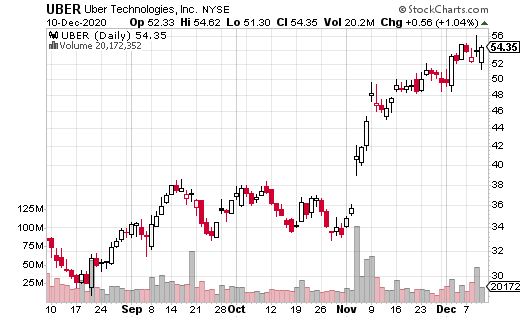

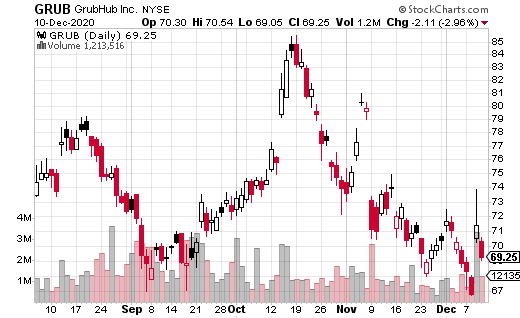

The problem with food delivery is there really isn’t a way for a company to differentiate itself. There’s essentially no barrier to entry. Moreover, there’s some massive competition already in the space. GrubHub (GRUB) and Uber’s (UBER) Uber Eats, which recently acquired Postmates, both come to mind. (By the way, GRUB is very similar to DASH and only has a market cap of around $6.5 billion.) Finally, food delivery is a low-margin industry to begin with.

Searching the internet for stories on food delivery companies brings up mostly negative commentary. Restaurants rarely break even using delivery services. Customers get charged a huge fee for using the service. Even the delivery drivers barely get compensated for doing their jobs. It does not seem to be an industry with a lot of profit potential given the constraints.

At the time of this writing, DASH does not have options listed. It usually takes a week or two before options come out on new stocks. What’s more, those options tend to be very expensive when they launch on a heavily-traded name.

That being said, there may certainly be some opportunities in DASH options, especially on the bearish side. In order to keep the cost of trading to a minimum, I recommend using vertical spreads (such as bear put spreads). Credit spreads may be reasonable to use as well, but the risk is a lot higher with that strategy.

You may also want to wait a few weeks after the options launch to start trading. At that point, bid/ask spreads may start to tighten up, and volatility may settle down a bit as investors move on to new IPOs set for later in the month.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more