This Could Be One Of The Biggest Winners Of The Electric Car Boom (SPONSORED POST)

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

There’s a new metal in town, and it’s bigger than lithium—and hotter than any other commodity on the market right now.

Supply is fantastically tight and set to get phenomenally tighter.

Analysts at Macquarie Research project deficits of 885 tonnes of this resource next year, 3,205 in 2019 and 5,340 in 2020.

That’s a deficit increase of 503 percent. More importantly, it’s a massive opportunity for first-in investors.

The panic over future supply has already broken out.

The metal is cobalt, and hedge funds are already hoarding the physical metal to gain exposure, with Swiss-based Pala Investments and China’s Shanghai Chaos stockpiling 17 percent of last year’s global production.

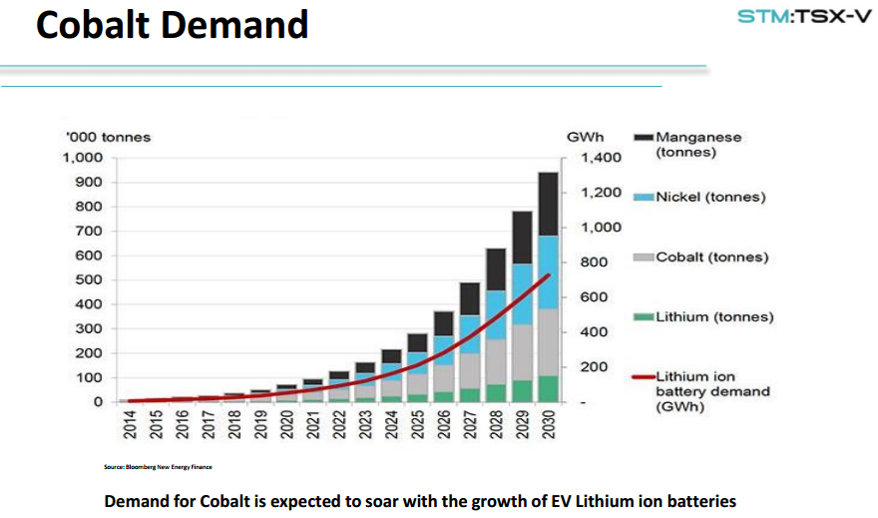

Cobalt is critical to the electric vehicle (EV) revolution, and it makes up some 35 percent of the lithium-ion battery mix—but we can’t source enough of it now, and the future supply is uncertain at best.

A huge uptick in EV production and a dozen battery gigafactories coming on line will more than strain cobalt supplies. But the bottlenecks are already worrisome; especially since some 60 percent of the world’s supply is unethical, and mined by children under inhuman conditions in the Democratic Republic of Congo (DRC).

It’s time for an all-American source of cobalt, and Scientific Metals (TSX:STM.V; OTC:SCTFF) is stepping up to the plate with a pure play cobalt project that could put the U.S. on the cobalt map for the first time in history. It would be the 5th home run for Scientific Metals CEO Wayne Tisdale and his team, whose last home run was lithium. The panic over future lithium supply to feed the EV boom drove prices of lithium up over 400 percent.

Tesla’s bigger problem is now shaping up to be cobalt. And Tisdale’s next big bet is cobalt. It’s a good one because this metal is set for a demand explosion that could blow lithium away.

Here are 5 reasons to keep a close eye on Scientific Metals (TSX:STM.V; OTC:SCTFF):

#1 The Cobalt Shortage Starts…Now

Lithium has been getting all the attention, but cobalt is just as important. By weight, lithium-ion batteries use more cobalt than lithium. We’ve already seen the lithium craze, and now it’s cobalt’s turn, and the supply and demand situation is a new producer’s dream.

Not only are we looking at a shortage already in 2017, but we’re looking at 20 percent demand growth every year. Simply put, EV makers are dependent on value chains that simply might not exist if we don’t get to new supply, fast.

GM, Toyota and Ford have no battery manufacturing experience, and all are taking cue from Tesla and China’s BYD because they make both. Likewise, Volkswagen, BMW and Mercedes don’t produce batteries, sourcing them to Samsung, LG Chem and Panasonic.

And for whoever is producing batteries, there just isn’t enough cobalt. The battery industry already uses some 42 percent of global cobalt production, while the rest is used in industrial and military applications—all competing for supply.

Tesla’s massive $50-billion market cap says all we need to know about EV growth. The company is redefining the auto industry. Tesla launched its $5-billion battery gigafactory in Nevada in January, and by the end of this year already it will have double the entire global battery production capacity. By 2018, Tesla expects to be putting out more batteries that the rest of the world combined.

This alone means a definitive run on cobalt, and the small-cap explorers like Scientific Metals who offer up new North American supply first could be the biggest winners.

Last year, electric vehicle production grew 41 percent. Now, sales are up more than 60 percent year on year. The EV market has grown over 15 times, with an amazing compound annual growth rate of over 72 percent from 2011-2016. This year, analysts expect it to gain another 25-26 percent.

The supply chain can’t hack it because we don’t have nearly enough ethical sources. With more than half of the world’s supply coming from the DRC, and the Western buyers under pressure to find more ethical sources, there a “complete vacuum out there” in terms of supply, traders told the Financial Times on 23 February.

Scientific Metals plans to be among the first to fill that vacuum.

#2 Cobalt Hoarding Has Already Begun

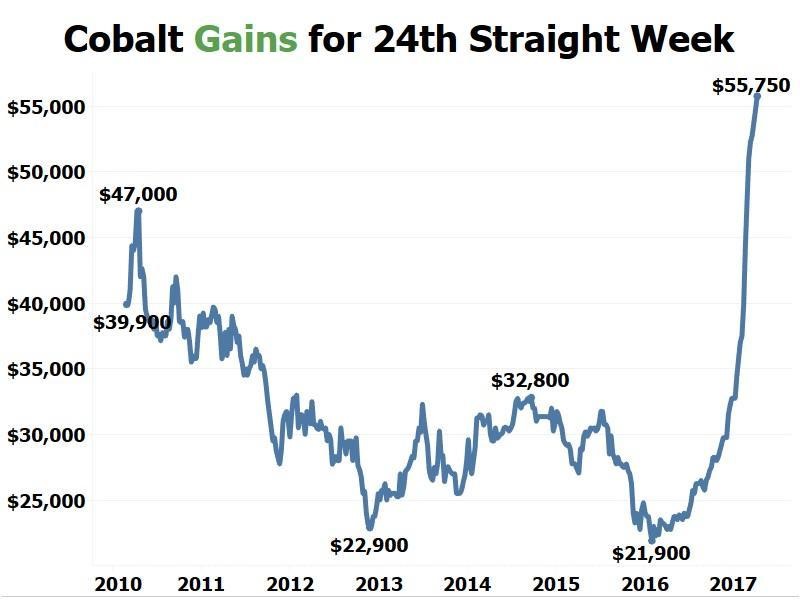

The battle for batteries is on, and cobalt is now taking the front-line position, while speculators are betting big, pushing up prices ahead of a major shortage.

A group of hedge funds in late February started a run on cobalt by amassing a huge stockpile because of its scarcity. This sent suppliers to Tesla and other EV makers into a mad rush to secure new shipments of cobalt, according to a 23 February Financial Times article.

Until now, there hasn’t been much to choose from outside of pure cobalt companies listed in China, so hedge funds have buying up the physical metal in a seriously bullish mentality. One trader told the Financial Times that they “decided that buying physical cobalt was the only way to get proper exposure to the cobalt price.”

Swiss-based Pala Investments and China’s Shanghai Chaos scooped up some 6,000 tonnes of cobalt and put it in storage, worth around $280 million at today’s prices. When they take it out of storage it is likely to be worth much more.

Since November, cobalt prices have rallied more than 50 percent, and this is only the beginning. Cobalt’s make impressive gains for 24 straight weeks.

Source: Inflation.us (metric tonnes)

#3 Smart Acquisition in America’s Most Prolific Cobalt Trend

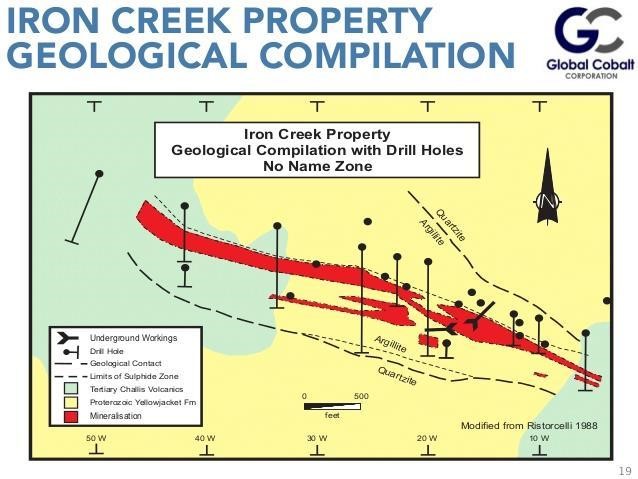

Scientific Metals (TSX:STM.V; OTC:SCTFF) in September entered into an agreement to acquire an amazing cobalt property, Iron Creek, right in the heart of the Idaho Cobalt Belt. This is the most prolific cobalt mineralization trend in the entire United States.

They scooped up property that has already seen a substantial amount of historical exploratory work that includes 30,000 feet of diamond drilling. Iron Creek has a historic resource of 1.3 million tons grading 0.59 percent of cobalt with encouraging indications of up to 10 million tons.

And right next door they have the only cobalt mine in the U.S. that is slated to come into production--and it’s got an estimated 3 million-plus tons of cobalt.

This was a strategic move on a strategic commodity—and there has never been a better time for homegrown exploration. Safe and ethical cobalt is virtually non-existent, and Scientific Metals could be among the first to put the US definitively on the cobalt production map just as EVs and batteries hit feverish demand.

With more than half of the world’s entire cobalt supply ethically off-limits, Scientific Metals has the potential to become one of only two pure play cobalt companies in the United States. And the client list is only getting bigger, with companies like Apple (Nasdaq:AAPL), LG Chem and Samsung all under pressure over unethical cobalt.

This is a huge opportunity for a small-cap explorer to play a role in our definitive EV revolution.

#4 The Legend Continues with Billion-Dollar Homerun Management

If you haven’t heard of Wayne Tisdale—Scientific Metals’ CEO—then now is the time to get familiar with this legendary figure. Tisdale and his team at Intrepid Financial have in recent years created $2.7 billion in value by building and financing 5 companies in completely different industries—and one of them was a homerun hit in lithium.

Take a look at their successes:

- Rainy River (gold) was worth $1.2 billion at its peak

- Xemplar (uranium) hit $1 billion at its peak

- Ryland Oil (oil and gas) sold for $114 million

- Webtech Wireless (tech) was worth $300 million at peak

- Pure Energy (lithium) is worth $65 million (and counting)

When Tisdale helped start Pure Energy in 2012 it was another strategic move: The price of lithium was only around $5,000 per tonne, and it’s since spiked 450 percent.

The game plan of Tisdale’s success is simple and savvy: Find the industry trends and get in early by acquiring, developing and financing the right assets at the right time—and put in place a world-class team to bring it across the finish line.

So far, so good. They’ve been spot on five times in a row, and cobalt is their next big bet.

#5 Financed and Ready to Redefine the Cobalt Playing Field

Demand for cobalt for rechargeable batteries to power our energy revolution is set to explode over the next five years. Scientific Metals isn’t crashing this party, it’s planning on being one of the key hosts. To do that, it’s perfectly positioned itself in the prolific Idaho Cobalt Belt, and it’s eyeing more acquisitions to expand.

Tisdale and the team are major stakeholders in STM, with 35 percent ownership, and they are focused on maintaining sound structure while creating shareholder value. So far, they’ve secured $3.5 million in financing to develop this project, and they’re fully financed for this year’s exploration program.

The goal for this year is to prove up at least 10 million tons of cobalt resource. At .59 percent cobalt and using today’s prices, this resource could be worth a potential $1 billion. Scientific Metal’s strategic vision is to become the largest pure play cobalt, advance projects towards production and sell to a major.

With cobalt prices set to experience a major spike that goes beyond the lithium craze, and a growing numbers of buyers under pressure to source only ethical cobalt right when demand starts to surge, Scientific Metals (TSX:STM.V; OTC:SCTFF) has carved out an ideal project that could put it on the map as one of only two U.S. producers to corner this market.

If you thought lithium was exciting, try cobalt. As global consumption for refined cobalt is set to reach 100,000 tonnes in 2017, Scientific Metals could be sitting on its ‘own private Idaho’ in the definitive break-out period.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase ...

more

#Cobalt is becoming a more and more critical element to electric cars.

I've always associated #lithium with #ElectricCars and #Tesla but lately I've been hearing more and more about #Cobalt. Hadn't realized it played such a crucial role. I'll be looking more closely at $SCTFF and related companies.

What other companies besides #ScientificMetals could produce/supply #cobalt to #Tesla and other electric car companies? $SCTFF $TSLA

Love reading about this stuff. Unfortunately the link you included to the Financial Times article is for members only.

Really impressive, personally I'm very interested in the electric car boom.