This 3 Stock Portfolio Provides Monthly Income

Image: Bigstock

Key Takeaways

- Investors can construct a portfolio that allows them to get paid monthly.

- Dividends can provide a nice buffer against the impact of drawdowns in other positions.

- Coca-Cola, Caterpillar, and McDonald’s could provide the necessary blend needed for monthly income.

While most stocks pay quarterly dividends, investors can still construct a portfolio that allows them to get paid monthly. For example, the first stock discussed pays dividends in January, April, July, and October. The second stock pays out in February, May, August, and November. And finally, the third stock will pay its dividend in March, June, September, and December.

So, investors can reap steady monthly paydays with just a little positioning.

A combination of Coca-Cola (KO - Free Report), Caterpillar (CAT - Free Report), and McDonald’s (MCD - Free Report) shares would provide precisely the blend needed for such a portfolio. Let’s take a closer look at each one.

Coca-Cola Gains Market Share

Shares of Coca-Cola were up nicely following its latest set of better-than-expected results, with the stock also sporting a favorable Zacks Rank #2 (Buy) rating.

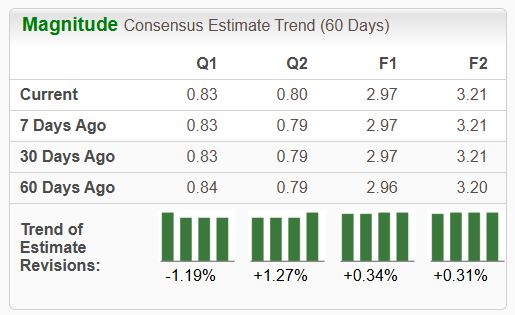

As shown below, analysts have upwardly revised their EPS expectations higher nearly across the board over recent months, with the one exception being a small downward revision concerning its next quarterly release.

Image Source: Zacks Investment Research

Concerning headline figures in its latest release, adjusted EPS grew 5% to $0.77, with the company also gaining value share in total nonalcoholic ready-to-drink (NARTD) beverages. The company is also a member of the elite Dividend Aristocrats group, further underpinning its dividend reliability.

Caterpillar Keeps Paying

Caterpillar is the world’s largest construction equipment manufacturer. We see its iconic yellow machines at nearly every construction site.

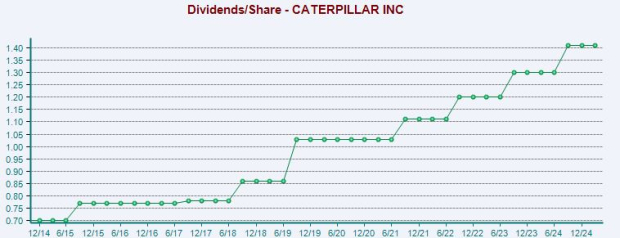

Like Coca-Cola, the company is a member of the elite Dividend Aristocrats group, with shares currently yielding 1.4% annually. While the current yield may be on the lower end, Caterpillar’s 7.9% five-year annualized dividend growth rate picks up the slack.

Below is a chart illustrating the company’s dividends paid on a quarterly basis.

Image Source: Zacks Investment Research

McDonald’s Keeps Growing

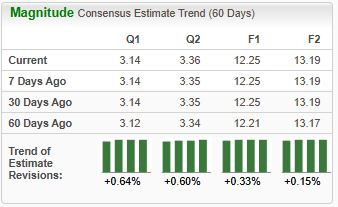

We’re all familiar with the restaurant titan McDonald’s, seeing those golden arches at seemingly every stop. Analysts have modestly upped their EPS expectations across the board over recent months, a positive sign concerning near-term share performance.

Image Source: Zacks Investment Research

Shares of the fast food giant presently yield 2.5% annually, paired with a payout ratio sitting at 61% of the company’s earnings. Dividend growth has been solid, with the stock sporting a 8.4% five-year annualized dividend growth rate.

Bottom Line

Investors love dividends, as they provide a nice buffer against the impact of drawdowns in other positions and provide a passive income stream. And while most companies pay their dividends on a quarterly basis, investors can construct a portfolio that allows for monthly payouts with just a bit of positioning.

For those interested in this type of portfolio, the combination of all three stocks discussed above – Coca-Cola (KO - Free Report), Caterpillar (CAT - Free Report), and McDonald’s (MCD - Free Report) – would likely provide the necessary blend needed.

More By This Author:

These 3 Companies Generate Big CashSeeking Crypto Exposure? 2 Stocks Worth A Look

3 Stocks Seeing Big Investor Interest: NVDA, PLTR, AMZN

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more