Thinking Of Buying Visa Before Q1 Earnings? You Might Want To Wait

Image: Bigstock

Key Takeaways

- Visa is set to report fiscal Q1 2026 on Jan. 29, with EPS seen up 14.2% and revenues expected to rise 12.3%.

- The company's volumes are forecast to grow, with processed transactions up 9.5% and payment volumes up 8.6%.

- Visa faces pressure from higher expenses and client incentives, with shares valued above the industry.

Visa Inc. (V - Free Report) is set to report its first-quarter fiscal 2026 results on Jan. 29, 2026, after the market close. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at $3.14 per share on revenues of $10.68 billion.

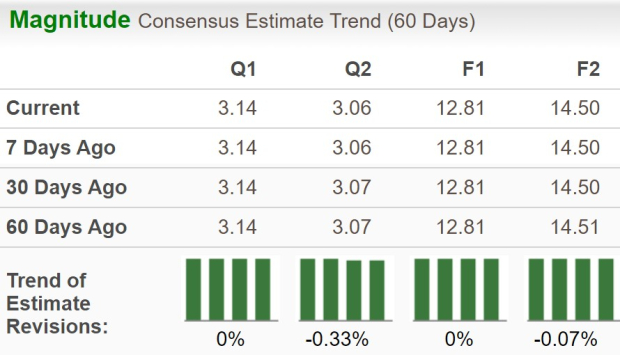

The estimate for fiscal first-quarter earnings has remained stable over the past 60 days. The bottom-line projection indicates a year-over-year increase of 14.2%. The Zacks Consensus Estimate for quarterly revenues suggests year-over-year growth of 12.3%.

Image Source: Zacks Investment Research

For fiscal 2026, the Zacks Consensus Estimate for Visa’s revenues is pegged at $44.44 billion, implying a rise of 11.1% year-over-year. The consensus mark for EPS is pegged at $12.81, suggesting a jump of around 11.7% on a year-over-year basis.

The payments juggernaut has a robust history of surpassing earnings estimates. It beat estimates in each of the last four quarters, with the average being 2.7%. This is depicted in the graph below.

Visa Inc. Price and EPS Surprise

Image Source: Zacks Investment Research | Visa Inc. Quote

Q1 Earnings Whispers for Visa

However, our proven model does not conclusively predict an earnings beat for the company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy), or #3 (Hold) rating increases the odds of an earnings beat, but that is not the case here.

Visa has an Earnings ESP of -0.07% and a Zacks Rank #3 (Hold) rating. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Factors Shaping Visa’s Q1 Results

The Zacks Consensus Estimate suggests a 6.4% increase in total Gross Dollar Volume from the previous year, while our model predicts 6.2% growth. The growing adoption and popularity of digital payment methods are likely to contribute positively to Visa's overall fiscal first-quarter results.

As the company draws revenues as a set percentage of total transaction value every time a customer makes payments with a debit/credit card, higher spending means more revenues in the form of transaction processing fees. The Zacks Consensus Estimate for fiscal first-quarter total processed transactions indicates 9.5% year-over-year growth.

The consensus mark for total payment volumes indicates an 8.6% year-over-year increase. We expect the metric for U.S. operations alone to jump 6.7% year-over-year. Similarly, our model predicts 10% year-over-year growth in Latin America and 15% in CEMEA.

The Zacks Consensus Estimate for data processing revenues indicates 14.6% growth in the fiscal first quarter from the year-ago level of $4.7 billion, while our estimate suggests a 14.9% increase. Similarly, the consensus mark for service revenues suggests 11.2% year-over-year growth, whereas we expect the metric to grow by 9.2% from $4.2 billion.

Furthermore, the consensus estimate for international transaction revenues indicates 11.8% growth from a year ago, whereas our model predicts a 10.8% increase. Continuous growth in cross-border volumes is expected to have supported the metric.

The factors stated above are expected to have positioned Visa for strong year-over-year growth in the fiscal first quarter. However, rising expenses and client incentives (a contra-revenue item) are likely to have partially offset the positive impact of higher volumes.

We expect adjusted total operating expenses for the quarter under review to increase 12% year-over-year due to increased Personnel, Professional Fees, and Network and Processing expenses. Also, the Zacks Consensus Estimate for client incentives is pegged at $4.4 billion for the to-be-reported quarter.

Visa Price Performance & Valuation

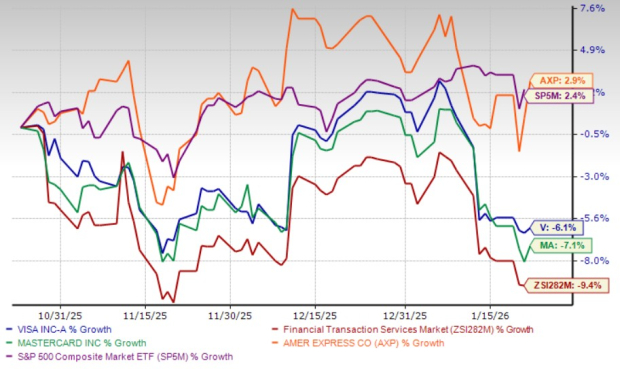

Visa's stock has declined 6.1% in the past three months. It shed less value than the industry’s 9.4% fall but underperformed the S&P 500’s rise of 2.4%. In comparison, its peers Mastercard Incorporated (MA - Free Report) and American Express Company (AXP - Free Report) have decreased 7.1% and gained 2.9%, respectively, during this time.

Three-Month Price Performance – Visa, Mastercard, American Express, Industry, & S&P 500

Image Source: Zacks Investment Research

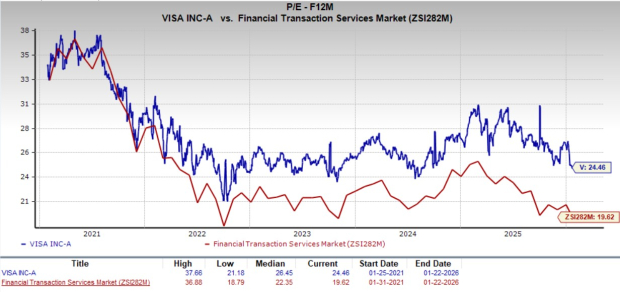

Now, let’s look at the value Visa may offer investors at recent levels.

The company’s valuation looks somewhat stretched compared with the industry average. Visa has been trading at 24.46X forward 12-month earnings, which is above the industry’s average of 19.62X.

Image Source: Zacks Investment Research

In comparison, Mastercard appears to be even less attractively valued, as it has been trading at 27.71X forward 12-month earnings. American Express, on the other hand, has been trading at 20.80X, seemingly offering a better value at the moment.

How Should You Play Visa Ahead of Q1 Earnings?

Visa remains a high-quality compounder, backed by its asset-light model, resilient transaction volumes, expanding value-added services, and long-term relevance in global payments. Structural tailwinds, stemming from cross-border recovery, stablecoin enablement, and emerging AI-led commerce, support its long-term growth outlook.

However, near-term risks are rising. Expense growth and higher client incentives are pressuring margins, regulatory scrutiny is intensifying across key markets, and competitive threats from potential large-merchant stablecoins could weigh on transaction economics. Despite a recent pullback, Visa’s valuation remains elevated versus the industry, limiting near-term upside.

Given these factors, Visa looks fundamentally strong but not compellingly priced. Investors may be better served waiting on the sidelines for a more attractive entry point, either through further price correction or clearer visibility on cost and regulatory pressures.

More By This Author:

Japan ETFs To Shine As BOJ Upgrades Economic Growth ForecastDefense ETFs To Watch Before Q4 Earnings Season Unfolds

Buy General Motors Or Tesla Stock As Q4 Results Approach?

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more