These Top Engineering Stocks Are Industrial Products Standouts

Image: Bigstock

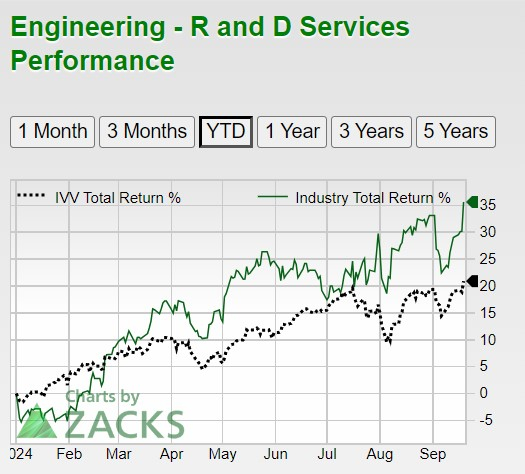

Recently in the top 35% of over 250 Zacks industries, The Zacks Engineering R&D Services Industry continues to stand out among the industrial products sector. With a captivating total return of around +35% year-to-date, this industry has impressively outperformed the broader indexes in 2024.

That said, here are a few of the industry’s top stocks that investors may want to consider.

Image Source: Zacks Investment Research

Top Infrastructure Stocks

Boasting Zacks Rank #1 (Strong Buy) ratings, Arcadis NV (ARCAY - Free Report) and Sterling Infrastructure (STRL - Free Report) have been two top contributors regarding the strong price performance of the Zacks Engineering R&D Services Industry.

Arcadis' stock spiked approximately +33% this year as an international provider of consultancy, planning, and architectural design for buildings, among other infrastructure-related activities. Also specializing in infrastructure for building and transportation solutions, Sterling Infrastructure's shares have soared nearly +70% in 2024.

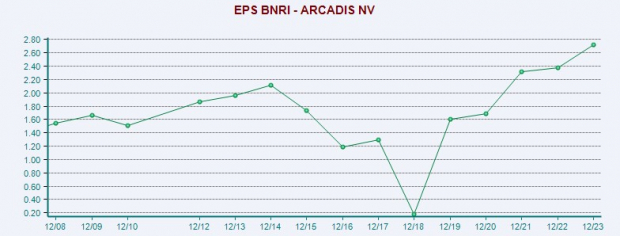

Their stellar rallies could continue as earnings estimate revisions have trended higher, making their increased probability and steady top line growth even more compelling. While expecting over 20% EPS growth in fiscal 2024 and FY25, Arcadis’ bottom line has expanded significantly since the pandemic.

Image Source: Zacks Investment Research

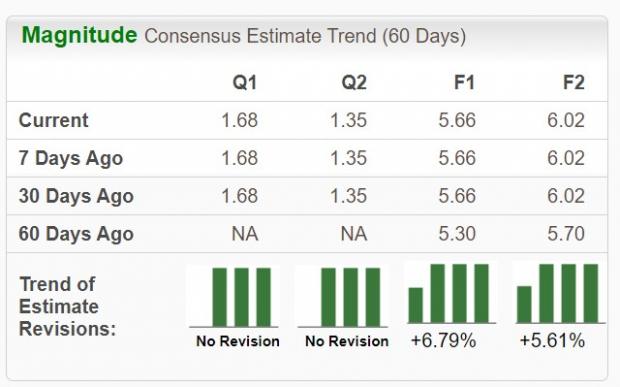

Sterling Infrastructure’s annual earnings have hit new heights as well, with EPS expected to increase 26% in FY24 and projected to rise another 6% next year to $6.02 per share. Plus, FY24 and FY25 EPS estimates have risen over 5.3% and 5.7%, respectively, in the last 60 days.

Image Source: Zacks Investment Research

Aerospace Engineer Leader

Similarly sporting a Zacks Rank #1 (Strong Buy) rating is Howmet Aerospace (HWM - Free Report), a provider of engineered solutions for customers in the transportation and aerospace industries. With its reach extending to commercial and defense aerospace markets, Howmet’s stock has shot up around +80% year-to-date.

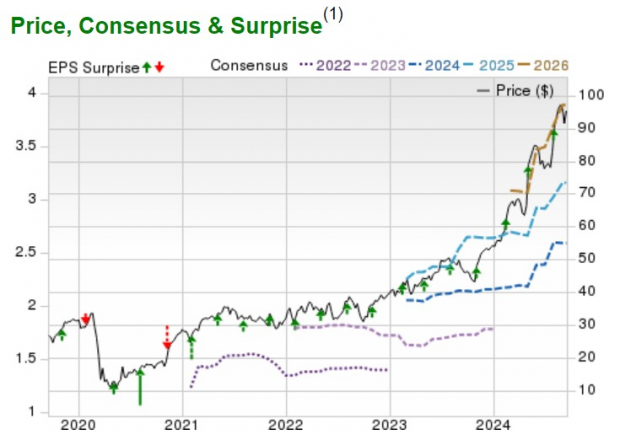

This comes as Howmet has now reached or exceeded earnings expectations for 15 consecutive quarters, as illustrated by the green arrows in the EPS surprise chart below.

Image Source: Zacks Investment Research

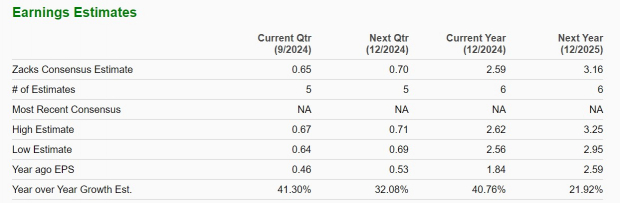

Despite such an extensive rally, earnings estimates have remained higher in the last two months, with Howmet’s EPS projected to climb 41% in FY24 and forecasted to soar another 22% in FY25 to $3.16 per share.

Furthermore, the company's total sales are projected to increase over 10% in FY24 and FY25, with projections edging toward $8 billion.

Image Source: Zacks Investment Research

Bottom Line

The expansion of these top engineering companies has led to stellar gains for their stocks. Now may be a good time to look into buying shares, as EPS estimates are higher, with Arcadis, Sterling Infrastructure, and Howmet Aerospace checking an “A” Zacks Style Scores grade for Growth.

More By This Author:

Stocks Make Record Highs: 3 Top Buys For The Next Bull RunPost-Fed Rate Cut: Buy, Hold, Or Sell Nvidia Stock?

Buy 3 High Dividend-Paying Stocks With Attractive Short-Term Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more