These Stocks Led The End Of The Week Rally - Is It Time To Buy?

Image: Bigstock

The past week’s rally was capped off with the S&P 500 rising another 1.45% as shares of Caterpillar (CAT - Free Report) and 3M (MMM - Free Report) drove the market higher. Caterpillar and 3M are two of the larger components of the benchmark, with both ending Friday up over 8%.

The rally in Caterpillar shares could continue outside of Friday’s favorable jobs report increasing market sentiment. Caterpillar currently sports a Zacks Rank #1 (Strong Buy), and its stock has been benefiting from a strong business industry at the moment. To that point, Caterpillar’s Manufacturing-Construction and Mining Industry is in the top 2% of over 250 Zacks industries.

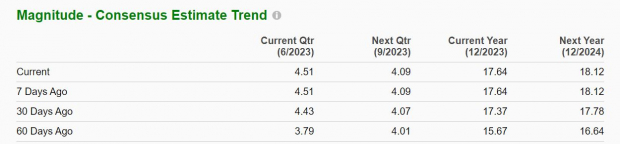

Indicative of such is Caterpillar’s expansive bottom line growth as the largest construction and mining equipment manufacturer in the world. Caterpillar’s earnings are forecasted to jump 27% this year at $17.64 per share compared to EPS of $13.84 in 2022. Better still, fiscal 2024 earnings are projected to rise another 3%, with earnings estimate revisions soaring over the last 60 days.

Image Source: Zacks Investment Research

Looking at 3M, Friday’s spike may have been more centered on optimism in the market, with its stock landing a Zacks Rank #3 (Hold). While 3M’s Diversified Operations Industry is currently in the bottom tier of Zacks industries, the company’s breadth of product lines should sustain its bottom line.

3M has over 60,000 products in its portfolio that cover a variety of end markets and range from adhesives, laminates, and personal protective equipment to medical products and car-care products. Earnings are expected to dip -14% this year but rebound and rise 10% in FY24 at $9.50 per share, with EPS estimates slightly up over the last quarter.

Image Source: Zacks Investment Research

Bottom Line

Caterpillar and 3M are standing out after leading the S&P 500 higher on Friday. With that being said, Caterpillar stock may remain attractive even as the broader rally fades. Caterpillar’s earnings estimate revisions give more conviction of such, but holding on to 3M stock could be rewarding as well.

More By This Author:

Campbell Soup Expected To Beat Earnings Estimates: Can The Stock Move Higher?3 Intriguing Stocks To Watch As Earnings Approach

Ciena To Post Q2 Earnings: Here's What To Expect

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more