These Mag 7 Members Shattered Quarterly Records

Image: Bigstock

The 2024 Q4 earnings season has continued to roll along, as this week’s reporting docket was notably stacked. It’s been a positive cycle so far, kicked off by inspiring results from the big banks.

Throughout the period, we’ve seen several companies, namely Mag 7 members Apple (AAPL - Free Report) and Meta Platforms (META - Free Report), break quarterly records, reflecting their operational successes.

Let’s take a closer look at these record-breaking releases.

Meta Reports Record Sales & Profit

Concerning headline figures in its release, Meta Platforms posted adjusted EPS of $8.02 and record sales of $48.4 billion, reflecting growth rates of 50% and 21%, respectively. Net income of $20.9 billion was the company’s highest read ever.

Shares were red-hot over the last year on the back of strong quarterly results, as they gained by nearly 80% and crushed the S&P 500.

Image Source: Zacks Investment Research

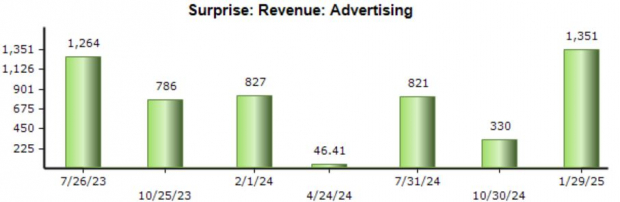

Importantly, the company’s ad business continued to perform at a high level, with revenue of $46.8 billion again exceeding our consensus estimate and reflecting 20% year-over-year growth. As shown below, the advertising results for Meta Platforms have been rock-solid over recent periods, regularly bringing sizable beats.

Image Source: Zacks Investment Research

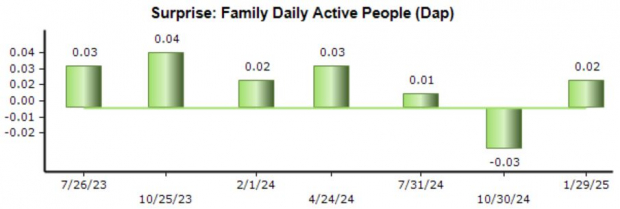

In addition, Meta Platforms has continued to see nice user growth, with Family Daily Active People (DAP) improving 4% year-over-year to roughly 3.4 billion. Average revenue per user has increased likewise amid the strong advertising efforts, improving by a sizable 41% year-over-year.

As shown below, DAP results have regularly exceeded our expectations over recent quarters. The Family Daily Active People metric includes the company’s entire family of apps, encompassing Instagram, WhatsApp, Facebook, and Messenger, providing a consolidated view of activity.

Image Source: Zacks Investment Research

Apple Breaks Multiple Records

Concerning headline figures in its release, Apple posted adjusted EPS of $2.40 and sales of $124.3 billion, reflecting growth rates of 10% and 4%, respectively. Both EPS and sales figures reflected all-time records for the company, with Services revenue also touching an all-time high.

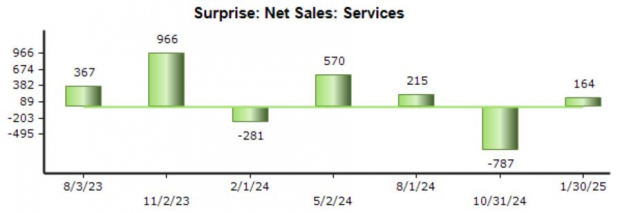

Services results have regularly exceeded our consensus expectations in recent releases, as shown below.

Image Source: Zacks Investment Research

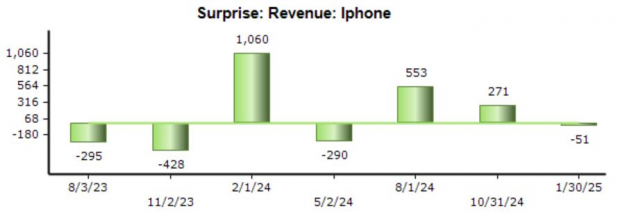

iPhone results came in a tad soft, which was an interesting development given the implementation of Apple Intelligence. iPhone sales of $69.2 billion fell roughly 1% year-over-year, also marginally falling short of our consensus estimate.

Image Source: Zacks Investment Research

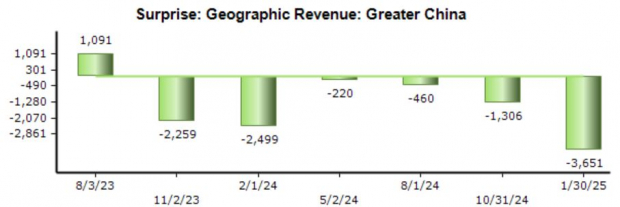

In addition, it’s worth noting that China sales continue to decelerated amid stiffer competition, with sales of $18.5 billion in the region down notably from the $20.8 billion mark in the year-ago period. While China continued to negatively impact results, the risk and growth cooldown have been well-known here for multiple periods; not really anything ‘new’ for the market to digest.

Image Source: Zacks Investment Research

The company’s installed base of active devices also reached a new all-time high across all products and geographic segments. Shares popped nicely following the print in after-hours trading. The stock nearly matched the S&P 500’s return over the last year, as it gained approximately 27.6%.

Image Source: Zacks Investment Research

Bottom Line

We have continued to wade through the 2024 Q4 earnings cycle, with this week’s reporting docket coming in notably rich. The period has been positive so far, underpinned by an initial strong showing from the banks and forecasted tech strength yet again.

And so far, Mag 7 members, namely Apple (AAPL - Free Report) and Meta Platforms (META - Free Report), have posted results that broke company records.

More By This Author:

Microsoft & Meta Earnings: Are DeepSeek Assumptions Premature?Microsoft Earnings: Is DeepSeek A Threat?

Visa & Mastercard Earnings: A Closer Look

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more