These Could Be The Hottest Dividend Stocks Right Now

Over the last six months, different high-yield sectors have caught up with the broader market’s gains kicked off a year ago. Higher share prices mean lower yields for income-focused investors, and with most of these stocks, current yields are markedly lower than they were a few months ago. I have recently reviewed exchange-traded funds (ETFs), exchange-traded notes (ETNs), and closed-end funds (CEFs) that use covered call strategies to boost income and pay attractive dividend yields.

The covered call strategy involves selling call options to boost the income from individual stocks or a portfolio of stocks. Option contract buyers are traders or speculators looking for a quick profit if the underlying stock zooms higher. Options contracts typically expire within a period ranging from a week to a couple of months, so traders must be correct about the direction, timing, and magnitude of a stock price move.

Option sellers play the low-risk side of selling calls to the speculators. The seller gets to keep the option premium and only must deliver the stock if its price rises above the option’s strike price. The strike is the price the option buyer would pay to exercise the call. When calls are sold, the strike price is usually above the current share price, so having a sold call exercised is a win-win with a covered call trade.

Instead of trying to attempt covered call trading on your own, some funds incorporate covered call trading as part of their investment strategy. Here are five closed-end funds with very attractive yields, primarily due to the use of covered calls.

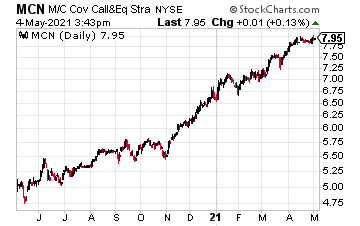

The Madison Covered Call and Equity Strategy Fund (MCN) has paid a $0.18 per share quarterly dividend since March 2009.

The payout gives the fund a 9.2% yield.

The portfolio of high-quality stocks also produces attractive total returns, with a 36% total return over the last three years.

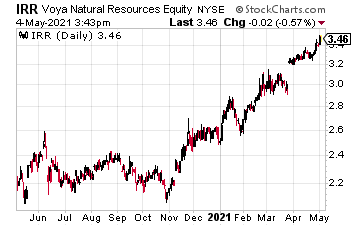

The Voya Natural Resources Equity Income Fund (IRR) invests in shares of companies primarily engaged in the energy, natural resources, and basic materials industries.

The fund’s options strategy will consist of selling call options generally on 30% to 80% of the portfolio’s total value.

The IRR current yield is 9.1%.

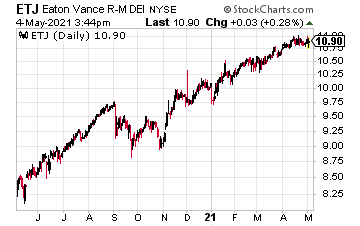

The Eaton Vance Risk-Managed Diversified Equity Income Fund (ETJ) invests in a diversified portfolio of common stocks. Managers purchase out-of-the-money, short-dated S&P 500 index put options and sell out-of-the-money S&P 500 Index call options of the same term as the put options with roll dates that are staggered across the options portfolio.

The put options are a hedge against a falling stock market. ETJ pays monthly dividends and yields 8.4%.

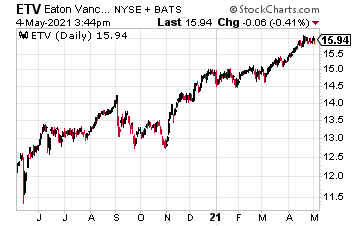

The Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV) invests in a diversified portfolio of common stocks. Fund managers write call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. ETF also pays monthly dividends and yields 8.3%. The ETV share price will be more volatile than ETJ.

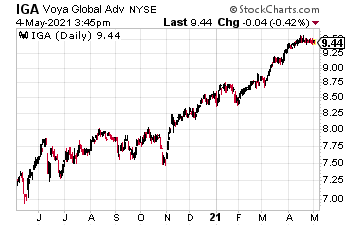

The Voya Global Advantage and Premium Opportunity Fund (IGA) invests in global stocks and sells call options on selected security indexes or ETFs on an amount equal to approximately 50% to 100% of the value of the common stock holdings.

The fund also hedges major currency exposure to reduce volatility. IGA yields 8.3%.

All five funds currently pay stable dividends, while at the same time giving you exposure to stock market gains.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more