These Are The Top 20 Hedge Fund Long And Short Positions

Nearly six years ago, back in 2013, we presented what we then viewed (and still view) as the best trading strategy of the New Abnormal period, when we said that buying the most hated/shorted names while shorting the names that have the highest hedge fund and institutional ownership is the surest way to generate alpha, to wit:

... in a world in which nothing has changed from a year ago, and where fundamentals still don't matter, what is one to do to generate an outside market return? Simple: more of the same and punish those who still believe in an efficient, capital-allocating marketplace and keep bidding up the most shorted names.

Fast forward to today, when Bank of America confirms that, with just one exception, the historically unvolatile 2017, this strategy has continued to be consistently profitable, as "over the last several years, buying the most underweight stocks by large-cap active funds and selling the most overweight stocks by large-cap active funds has consistently generated alpha." This is shown in the chart below which reveals that buying the 10 most underweight stocks and selling the 10 most overweight stocks by active funds has generated alpha every year in the past five except 2017.

(Click on image to enlarge)

And despite the market's torrid gains in January, this strategy continued to generate profits even in 2019, because after another year of near-record active outflows from active funds(~$370bn), this trend persisted in January, generating an annualized spread of 5ppt according to BofA.

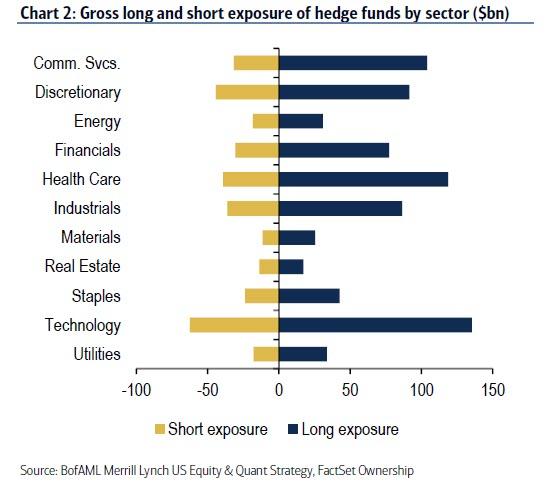

So with institutional ownership seemingly a liability for one more year, we decided to take a look at which sectors are most exposed to hedge fund ownership.

Conveniently, overnight BofA equity and quant strategist Savita Subramanian put together her latest analysis looking at "what your neighbors are doing", i.e., where active fund managers are most concentrated. She found that the two consensus picks are Communication Services (the "new TMT") which now carries the highest relative exposure at 1.26x in the average funds, and Health Care where almost two-thirds of funds are overweight the sector, the second most BofA has seen in the sector since 2015. In particular, HC Providers & Services industry is now a record overweight at 1.5x. Tech and Discretionary also carry modest overweights, as they have over the history of our data.

Additionally, funds now own more Industrials than Financials (0.95x) for the first time in two years. In particular, Aerospace & Defense saw positioning rebound from July’s record low levels to a 16-month high (1.21x), and Road & Rail also rose to its highest exposure in 2+ years (1.15x). Machinery remains unloved, falling to near-record positioning lows. Positioning in the classically defensive Consumer Staples fell for the third month to a new record underweight of 0.65x in Jan, over two standard deviations below its decade average. A clear tilt toward domestics over multinationals was also evident in January.

(Click on image to enlarge)

Meanwhile, several stocks with high short interest that were previously in Discretionary (e.g. Media stocks) have moved into the new Communication Services sector. As a result, hedge funds’ short exposure to Discretionary has fallen significantly compared to their pre-GICS change positioning.

(Click on image to enlarge)

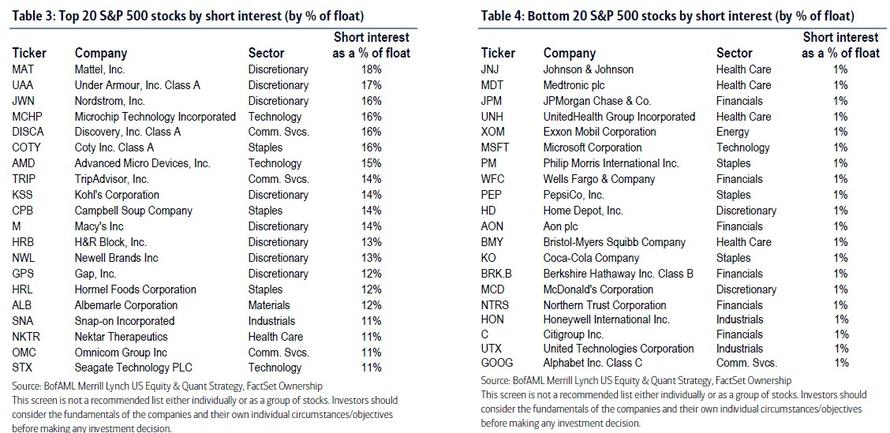

What about at the individual stock level?

To answer this question, BofA screened for stocks with the most (Table 3) and the least (Table 4) short interest (as a % of float), where the most (~85%) short interest in stocks is from hedge funds. What the analysis found is that the most hated, or shorted, stocks are the following:

- Mattel

- Under Armour

- Nordstrom

- Microchip Technology

- Discovery

- Coty

- AMD

- TripAdvisor

- Kohl's

- Campbell Soup

Meanwhile, the least shorted names are, not surprisingly, the blue chips:

- Johnson & Johnson

- Medtronic

- JPMorgan

- UnitedHealth Group

- Exxon Mobil

- Microsoft

- Philip Morris

- Wells Fargo

- PepsiCo

- Home Depot

The full list is below:

(Click on image to enlarge)

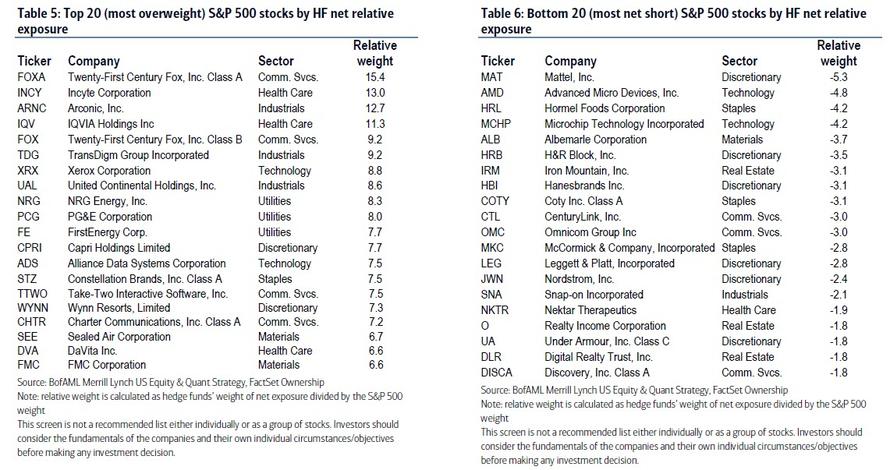

To complete the hedge fund exposure picture, BofA also performed a screen of 1) stocks which are most overweight by hedge funds based on their net relative weight in the stocks vs. its weight in the S&P 500 and 2) a screen of stocks which have the largest net short positioning by hedge funds relative to the stocks’ weight in the S&P 500.

According to BofA, these are the 10 stocks where hedge funds have the most net relative exposure:

- Twenty-First Century Fox Class A

- Incyte

- Arconic

- IQVIA

- Twenty-First Century Fox Class B

- TransDigm

- Xerox

- United Continental

- NRG Energy

- PG&E Corporation

While the 10 most net short names relative to net exposure are the following 10 companies:

- Mattell

- Advanced Micro Devices

- Hormel Foods

- Microchip Technology

- Albermarle

- H&R Block

- Iron Mountain

- Hanesbrands

- Coty

- CenturyLink

And summarized:

(Click on image to enlarge)

The take home: with the Fed once again actively micromanaging the market and flipping financial and economic logic on its head, the best trade continues to be the one that has worked almost every single year (with one exception) since 2009: buy the most shorted names, and hedge this pair trade by shorting the most popular/overweight stocks, a simple trade yet the one which remains the biggest source of alpha this decade.

(Click on image to enlarge)