These Are The 50 Most Popular Hedge Fund Longs And Shorts

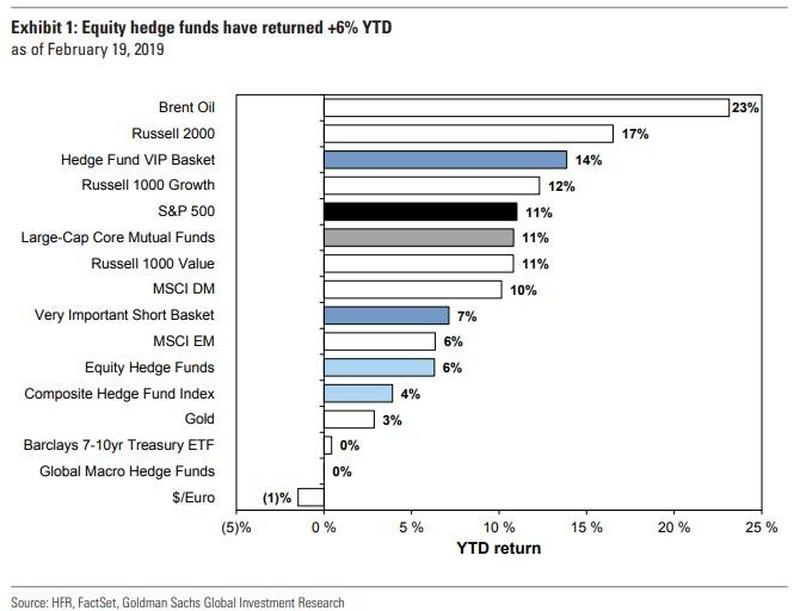

After a dreadful year for professional (carbon-based) money managers, when in 2018 the average hedge fund posted the worst return since 2011, equity hedge funds have had a strong start to 2019, returning 6% YTD.

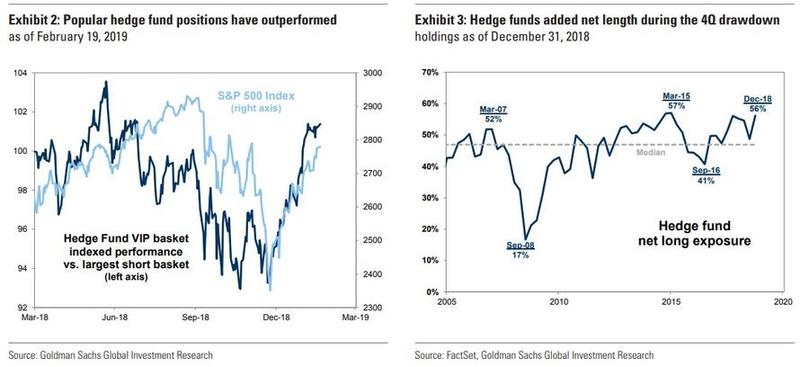

Although far from discovering some new source of alpha, according to Goldman's analysis of the latest batch of 13F filings, the recent strong hedge fund returns have benefited from the outperformance of the most popular long positions as well as the decision to increase net length ahead of the equity market bottom in December 2018.

Furthermore, the relative performance of Goldman's Hedge Fund VIP basket and hedge fund net long exposure each bottomed in the days before the S&P 500 reached its low on December 24. So far in 2019, the VIP basket, which tracks the most popular long positions, has returned +14%, outperforming both the S&P 500 (+11%) and Goldman's basket of the largest short positions (GSTHVISP, +7%), which is to be expected in light of the massive short squeeze that has taken place in the past 9 weeks.

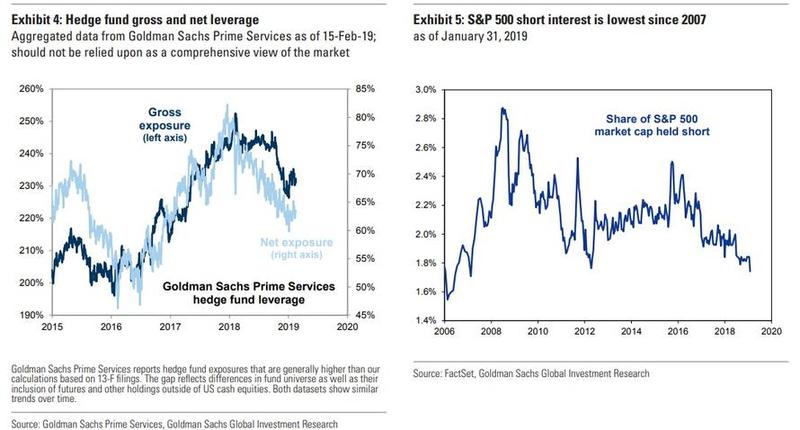

Also benefitting hedge funds, aggregate net leverage calculated based on publicly-available data registered 56% at year-end, a sharp increase from the 49% net length at the start of 4Q. According to Goldman, gross exposures rebounded modestly alongside the equity market but remains well below levels registered during most of the prior 18 months. According to data from Goldman Sachs Prime Services, gross exposures declined sharply as the S&P 500 turned lower in early October 2018. At roughly 230%, current gross exposures are similar to levels in late November 2018. Mirroring the decline in gross exposures, the share of S&P 500 market cap held short is now at the lowest level since 2007.

Confirming that the recent move has been driven by one giant short squeeze, after spiking to 2.5% in late 2015, short interest as a share of S&P 500 market cap has tumbled and is now just 1.7%, matching the lowest since 2007.

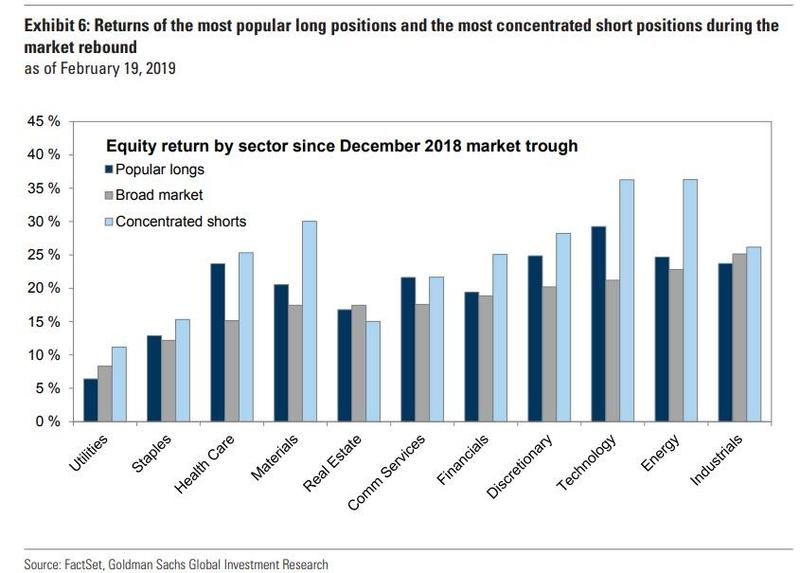

Due in part to this reduction in short activity, the stocks with the highest ratio of short interest to float cap have outperformed in most sectors during the recent market rebound (see Exhibit 6). As shown in Exhibit 33, the 50 stocks with market caps larger than $1 billion with the highest short interest outstanding relative to cap have posted a median YTD return of 24%.

In other words, the blistering hedge fund outperformance in Q1 has been the result of two things: i) doing more of the same as hedge funds rushed into the same stocks that "worked" during previous market moves higher, i.e., "beta", and ii) going long the most shorted stocks, a strategy which we noted first in 2013 has been the most successful outperformer of the market for the duration of the artificial central-bank driven bull market.

* * *

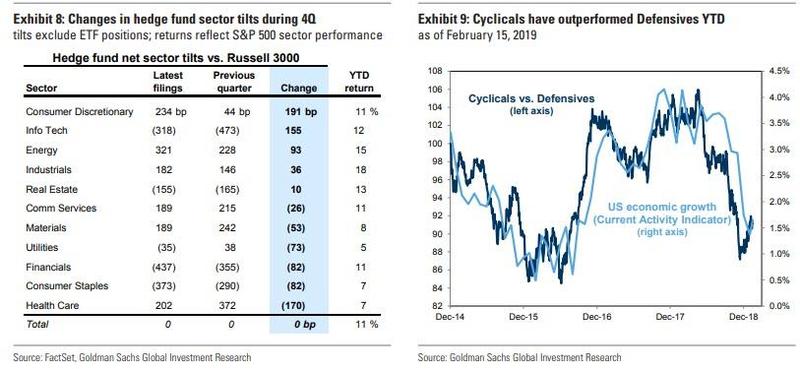

With that in mind, Goldman next looks at the most recent sector positioning for the "2 and 20" crowd and finds that hedge funds shifted away from defensive sectors and back toward cyclicals ahead of the market rebound, adding that whereas funds generally tilt toward cyclical sectors, during 3Q 2018 hedge funds became relatively defensive, with Utilities representing a net overweight relative to the Russell 3000 for the first time since 2008. However, during the fourth quarter - as noted above - hedge funds reengaged with cyclicals, cutting their net tilts to the Consumer Staples, Utilities, and Health Care sectors while increasing tilts toward Consumer Discretionary, Energy, and Industrials.

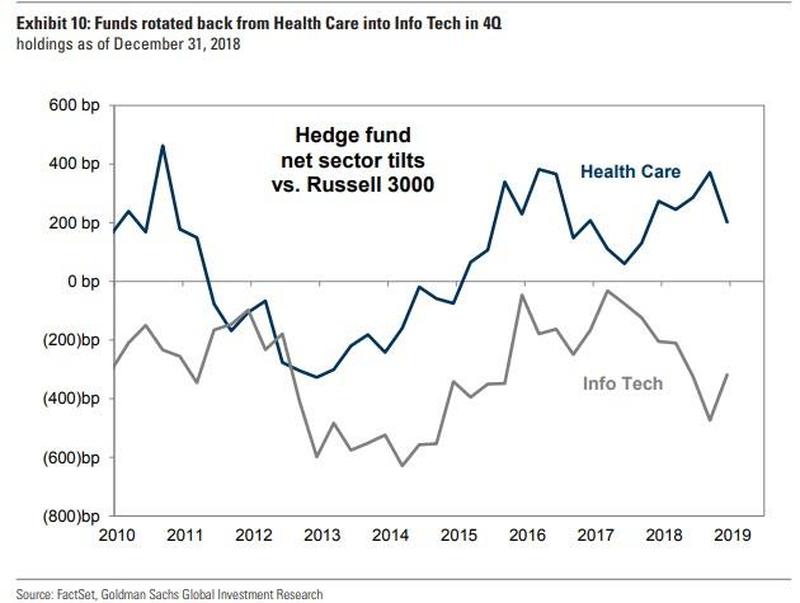

Additionally, funds rotated back toward the perennial favorite Consumer Discretionary and Info Tech sectors at the expense of Health Care, in a reversal from the 2017-18 trend. According to Goldman's Ben Snider, Health Care now accounts for 16.5% of hedge fund net exposure, the most of any sector. However, after steadily adding exposure to Health Care during the past two years, funds cut their tilt to the sector by 170 bp, the largest decline in any sector. Within the Consumer Discretionary sector, hedge funds carry their largest net tilt toward the Internet & Direct Marketing Retail industry. Application Software represents the largest net tilt within Info Tech.

Going into 2019, energy represented funds’ largest net overweight at the start of the year and has been the second best performing sector YTD. Curiously, the hedge fund overweight in the Comm Services sector, which combines fund favorites FB, GOOGL, and NFLX with Telecom and Media companies, ranks in just the 8th percentile relative to the past 10 years. In other words, the HF love affair with "growth" and FAANGs appears to have fizzled for the time being.

That about covers the macro picture.

What about at the micro, single-stock level? Here, too, there were some notable shifts.

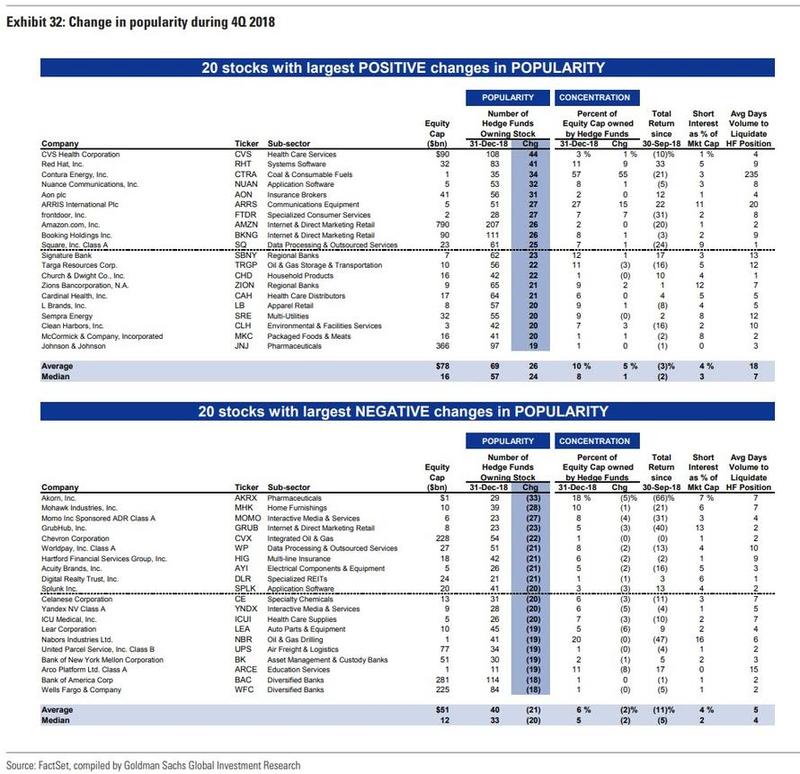

First, as Goldman noted previously, during Q4, healthcare became the most desired sector, and nowhere more so than in CVS Health Corp., and as a result 44 funds built a new position in the company. Other stocks that saw a big jump in popularity were Red Hat (RHT), which is pending an acquisition by IBM, and Contura Energy (CNTE).

Meanwhile, on the other end - the stocks that saw the largest drop in popularity - the list was led by Akorn (AKRX), Mohawk (MHK) and Momo Inc (MOMO), with GrubHub (GRUB) and Chevron (CVX) rounding out the 5 most shunned stocks in Q4.

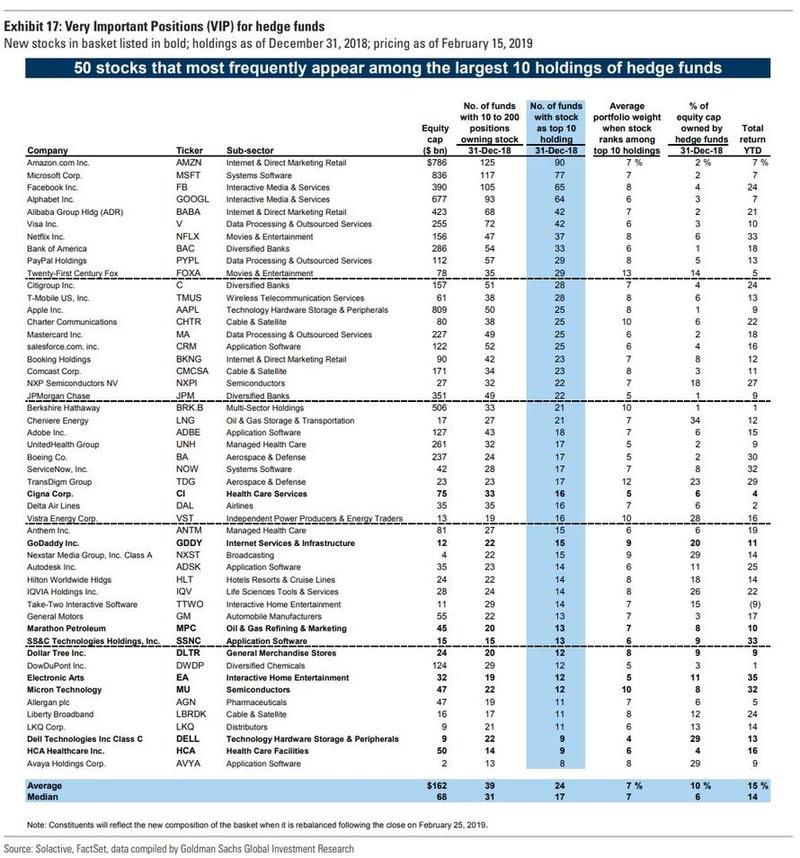

Which brings us to the 50 stocks that matter the most to hedge funds, i.e. the Goldman Hedge Fund VIP list, also known as the "Hedge Fund Hotel California." Not surprisingly, the world's most valuable companies - Amazon, Microsoft, Facebook and Alphabet - still make up the top 4 names with Alibaba rounding out the top 5, although the number of funds with these names as a top 10 holding has declined notably from Q3 and certainly Q2 2018.

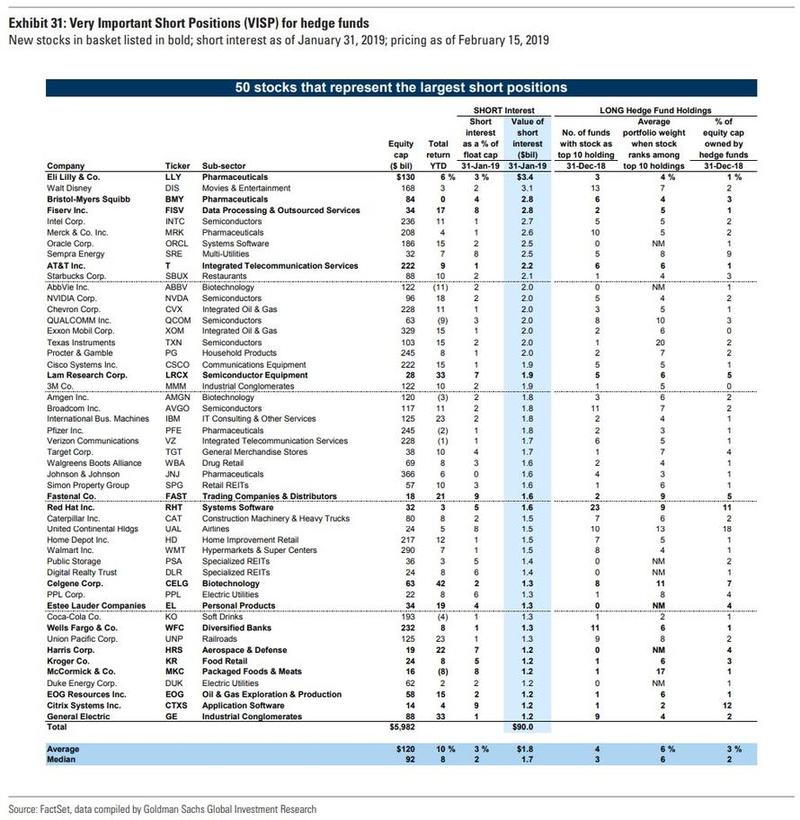

Finally, for those who are confident that the massive short squeeze noted above continues, resulting in a continued surge in the most shorted names soaring, here is the list of the 50 stocks representing the largest short positions among hedge funds.