These 3 Tech Companies Recently Broke Quarterly Records

Image Source: Unsplash

The Q1 earnings season is now largely behind us, with more than 480 S&P 500 companies already delivering quarterly results. Technology companies contributed significantly to the growth pace, and the same is expected for Q2; earnings and revenue for the sector are currently expected to be up +14.4% and +9.3%, respectively. Three companies leading the trend are Nvidia, Apple and Vertiv.

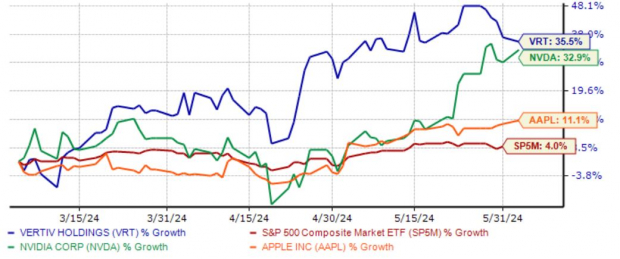

Throughout the Q1 cycle Nvidia (NVDA - Free Report), Apple (AAPL - Free Report), and Vertiv (VRT - Free Report) posted quarterly records. All three stocks have enjoyed bullish price action over the last three months, as illustrated below.

Image Source: Zacks Investment Research

Let’s take a closer look at each.

Vertiv Stock Gains on AI Interest

Vertiv shares have been big beneficiaries of the AI frenzy, exiting its latest quarter with its highest backlog in company history totaling $6.3 billion. The company provides services for data centersthrough a portfolio of power, cooling, and other services.

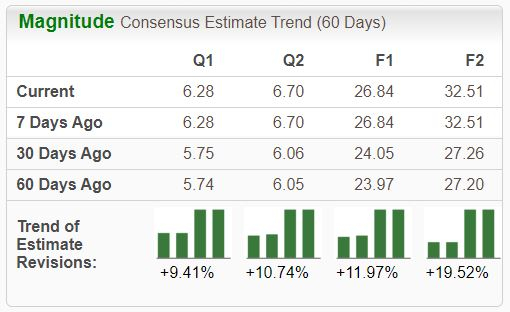

The stock sports a favorable Zacks Rank #2 (Buy), with the revisions trend notably bullish for its current fiscal year, up nearly 80% over the last year. VRT’s growth is expected to remain robust, with the Zacks Consensus EPS estimate suggesting a 36% year-over-year pop in earnings.

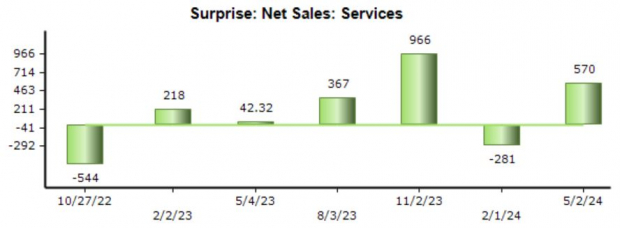

Image Source: Zacks Investment Research

Following the release, Vertiv upped its full-year guidance, causing shares to soar post-earnings. Other notable highlights from the release include 60% organic order growth and $600 million in share buybacks throughout the period.

The company has also enjoyed margin expansion as of late, aiding its profitability in a big way.

Image Source: Zacks Investment Research

Apple Stock Surges on Services Growth

Up 7% over the last month, Apple shares have seemingly regained their mojo after a slow start to 2024. The tech titan’s latest set of quarterly results and recent news from the WSJ regarding the development of chips for AI software in data centers have aided performance nicely.

The company’s Services portfolio has been a solid growth driver over recent periods, helping decrease the reliance on the iPhone. Services revenue totaled $23.9 throughout its latest period, climbing 14% year-over-year and reflecting a quarterly record.

As shown below, Apple has consistently surprised positively regarding Services sales, with the most recent beat totaling $570 million.

Image Source: Zacks Investment Research

Share performance has been boosted by recent favorable reports of iPhone shipments in China, easing concerns over demand issues in the area.

Nvidia Stock Remains Strong Buy for AI Exposure

Investors are beginning to run out of phrases to describe Nvidia’s unbelievable performance over the last year, driven by unrelenting demand for chips needed in AI applications. The company has exceeded our consensus EPS expectations by an average of nearly 20% across its last four releases, also seeing a bright earnings outlook across the board.

Thanks to the positive earnings outlook, the stock remains a highly coveted Zacks Rank #1 (Strong Buy) and represents a prime consideration for those seeking AI exposure.

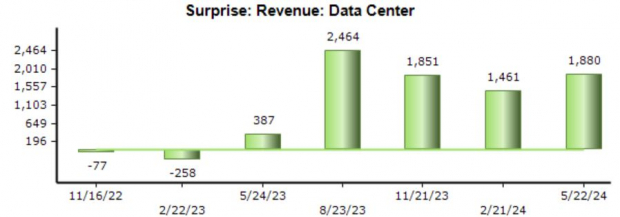

Image Source: Zacks Investment Research

Data Center revenue of $22.6 billion once again blew away our consensus estimate and reflected another quarterly record, continuing the recent streak of robust results. As shown below, NVDA has exceeded our consensus Data Center expectations by a minimum of $1.4 billion across the last four periods.

Image Source: Zacks Investment Research

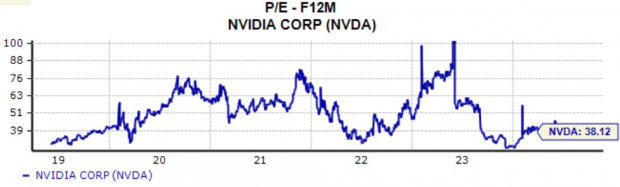

And perhaps to the surprise of some, NVDA shares haven’t become expensive amid the incredible run, currently trading at a 38.1X forward 12-month earnings multiple compared to a 50.7X five-year median and five-year highs of 106.3X in 2023.

Image Source: Zacks Investment Research

Bottom Line

The Q1 earnings season has slowly winded down, with just a few S&P 500 companies yet to deliver their Q1 results at this stage. The period was primarily better than expected, underpinned by a strong performance from technology companies.

And concerning positivity, all three companies above – Nvidia, Apple, and Vertiv – posted quarterly records.

More By This Author:

3 Stocks To Buy For Big GrowthAre These Beaten-Down Stocks Worth A Look? Tesla, Intel And Starbucks

Dividend Watch: Three Companies Boosting Payouts