These 3 Stocks Have Found Plenty Of Buyers In 2023

Image: Bigstock

Stocks have delivered a strong performance in 2023 so far, with many residing well in the green year-to-date thanks to better-than-expected inflationary data and an earnings “apocalypse” that has failed to materialize.

And with such a strong performance out of the gate, many are now heading toward and breaking 52-week highs, reflecting favorable positive momentum. Further, by selecting stocks near or breaking out to new highs, investors find themselves in favorable trends where buyers have been in control.

Three stocks – Nucor (NUE - Free Report), Applied Industrial Technologies (AIT - Free Report), and United Rentals (URI - Free Report) – are all heading toward or breaking 52-week highs. Below is a chart illustrating the performance of all three year-to-date, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three have found plenty of buyers. In addition, all have witnessed favorable earnings estimate revisions as of late, providing shares the fuel they need. Let’s take a closer look at each one.

United Rentals Inc.

United Rentals is the largest equipment rental company in the world, with an integrated network of rental locations in the United States, Canada, and Europe. URI has seen its earnings outlook improve across all timeframes as of late, pushing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

URI sports a stellar growth profile, with earnings forecasted to soar 27% in its current fiscal year (FY23) and a further 10% in FY24. The projected earnings growth comes on the back of forecasted year-over-year revenue increases of 21% in FY23 and 2% in FY24.

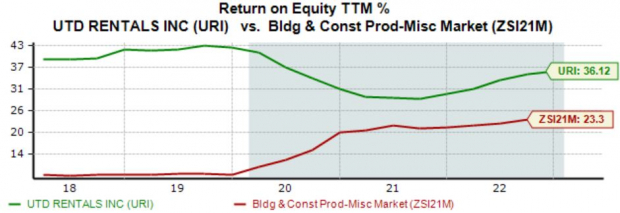

And for the cherry on top, URI’s trailing twelve-month return on equity (ROE) of 36% is well above its Zacks Industry average, indicating a higher level of efficiency in generating profit from existing assets.

Image Source: Zacks Investment Research

Applied Industrial Technologies

Applied Industrial Technologies distributes value-added industrial products, including engineered fluid power components, bearings, specialty flow control solutions, power transmission products, and miscellaneous industrial supplies.

AIT’s earnings outlook has drifted higher across the board, helping to fuel shares on their run.

Image Source: Zacks Investment Research

In addition, the stock does pay a dividend, currently yielding a modest 0.9%. While the yield is below its Zacks sector average, AIT’s 3% five-year annualized dividend growth rate helps to even the playing field.

Image Source: Zacks Investment Research

Nucor

Nucor is a leading producer of structural steel, steel bars, steel joists, steel deck, and cold-finished bars in the United States. Like the stocks above, NUE boasts a Zacks Rank #1 (Strong Buy).

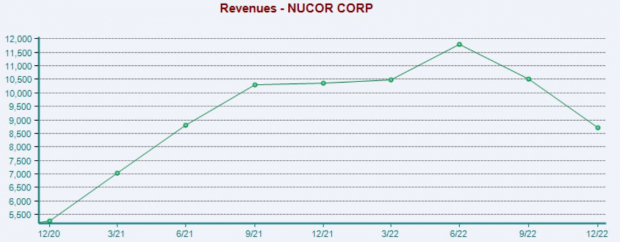

Image Source: Zacks Investment Research

Nucor has delivered strong quarterly results as of late, exceeding both earnings and revenue expectations in four consecutive quarters. Just in its latest release, NUE penciled in a 17% EPS beat and reported revenue more than 10% above expectations.

Image Source: Zacks Investment Research

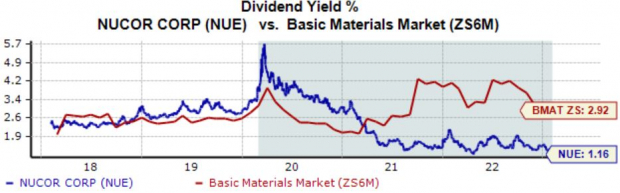

Many stocks in the Zacks Basic Materials sector pay dividends, and Nucor is no different; NUE’s annual dividend yield currently sits at 1.2%, with its payout growing more than 6% over the last five years. Further, the company’s 7% payout ratio is sustainable.

Image Source: Zacks Investment Research

Bottom Line

2023 has certainly gotten off to a much better start than 2022, with favorable inflationary data and earnings season helping keep the market afloat.

All three stocks above – Nucor (NUE - Free Report), Applied Industrial Technologies (AIT - Free Report), and United Rentals (URI - Free Report) – have had little issues finding buyers, all breaking through or near 52-week highs.

And all three sport a favorable Zacks Rank, indicating that their business outlooks have recently shifted positively.

More By This Author:

PayPal Reports Next Week: Wall Street Expects Earnings GrowthFord Motor Company Q4 Earnings Lag Estimates

Bristol Myers Squibb Q4 Earnings And Revenues Surpass Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more