These 3 Stocks Are Decade-Long Outperformers: Cintas, Domino's Pizza, Caterpillar

Image: Bigstock

Investors are always looking to beat the market, searching for stocks that deliver consistent long-term gains. And perhaps to the surprise of some, many non-tech stocks have delivered outsized gains over the last decade.

Several factors can contribute to long-term outperformance, including consistent sales growth, margin expansion, efficient capital deployment, and innovation.

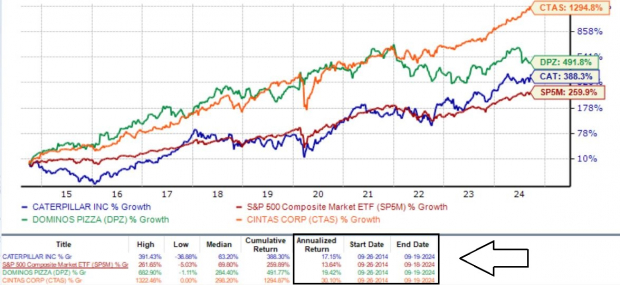

Three stocks – Caterpillar (CAT - Free Report), Domino’s Pizza (DPZ - Free Report), and Cintas (CTAS - Free Report) – have all outperformed the S&P 500 over the last decade, and all have posted at least a 15% annualized return.

Below is a chart illustrating the performance of all three stocks over the last 10 years, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Here is a closer look at each.

Caterpillar Flexes Shareholder-Friendly Nature

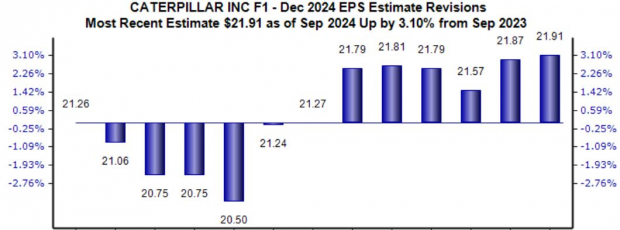

Caterpillar, known for its iconic yellow machines, is the largest global construction and mining equipment manufacturer. The earnings estimate revisions trend has remained bullish for its current fiscal year, up 3% over the last year to $21.91 per share.

Image Source: Zacks Investment Research

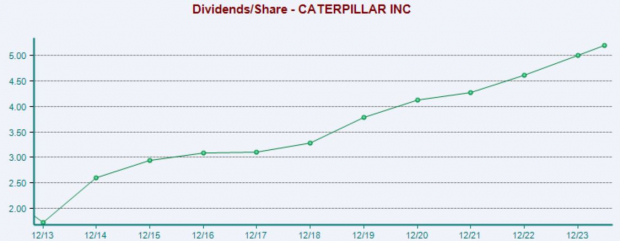

The stock has long been a favorite among income-focused investors, currently holding the ranks of a Dividend Aristocrat thanks to 25+ years of increased payouts. The company currently sports a 6% five-year annualized dividend growth rate paired with a sustainable payout ratio sitting at 23% of its earnings.

Below is a chart illustrating the company’s dividend payouts on an annual basis.

Image Source: Zacks Investment Research

Domino's Pizza Keeps Delivering Growth

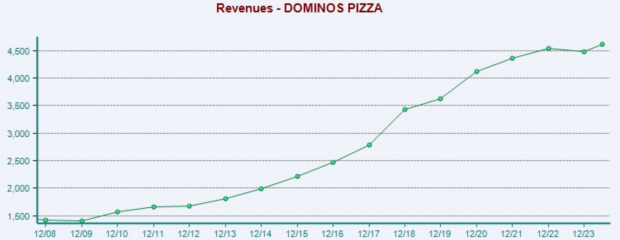

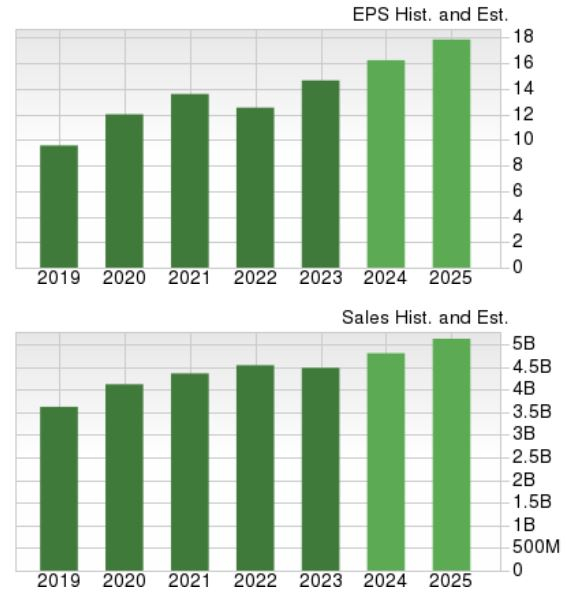

Domino’s is a top player in the Quick-Service Restaurant Pizza category. Consistently strong sales growth has aided the company’s shares in a big way, as we can see in the annual chart below. Please note that the final value is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Growth is expected to continue, with consensus expectations for its current fiscal year suggesting 11% earnings growth on 7% higher sales. Peeking ahead to FY25, consensus expectations suggest an additional 10% of EPS growth paired with a 7% sales climb. Additionally, the stock sports a Style Score of ‘B’ for Growth.

Image Source: Zacks Investment Research

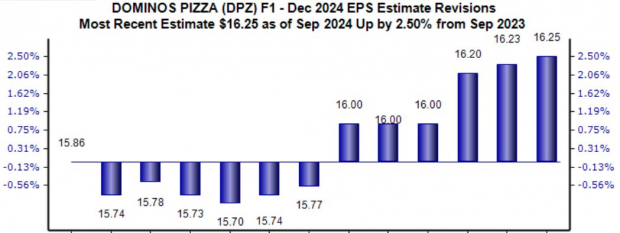

The outlook for its current fiscal year has remained positive, with the $16.25 Zacks Consensus EPS estimate up nearly 3% over the last year.

Image Source: Zacks Investment Research

Cintas Enjoys Consistent Margin Expansion

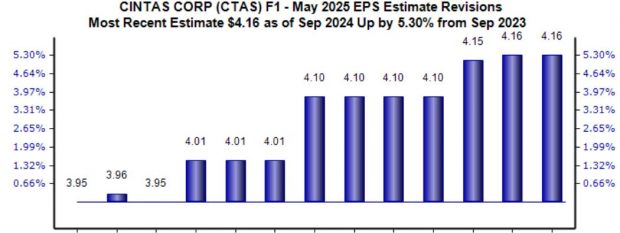

Cintas’ products and services include uniforms, floor care, restroom supplies, first aid, and safety products, taking care of any business needs. Like those above, the outlook for its current fiscal year has remained bullish, with the $4.16 per share expected up 5% over the last year, suggesting 10% year-over-year growth.

Image Source: Zacks Investment Research

Margin expansion has helped aid share performance nicely over the last decade, as we can see illustrated below. Similar to Caterpillar, s shareholder-friendly nature has also kept investors happy, with Cintas sporting a sizable 22% five-year annualized dividend growth rate.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Bottom Line

All investors look to reap outsized gains, which is precisely what all three stocks above – Caterpillar (CAT - Free Report), Domino’s Pizza (DPZ - Free Report), and Cintas (CTAS - Free Report) – have provided over the last decade, giving annualized returns in excess of 15%.

Several factors have contributed to their long-term outperformance, including consistent sales growth, meaningful margin expansion, efficient capital deployment, and innovation.

More By This Author:

3 Top Large Cap Stocks For A Stable Approach: ETN, DECK, UNH

3 Hot Stocks Suited For Momentum Investors

Bear Of The Day: Dollar Tree