These 3 Non-Tech Stocks Have Delivered Outsized Gains

Image Source: Pexels

Tech stocks have been the craze for some time, with excitement surrounding the AI story and a resilient economy providing favorable tailwinds for many stocks in the sector.

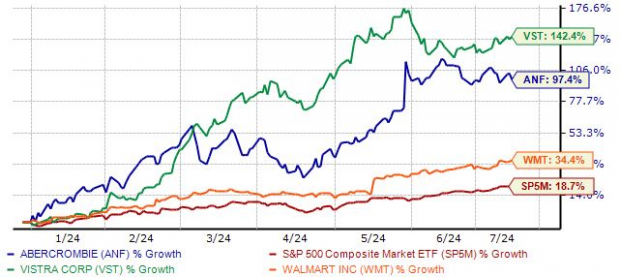

But perhaps to the surprise of some, several non-tech stocks have delivered outsized gains in 2024, a list that includes Vistra (VST - Free Report), Walmart (WMT - Free Report), and Abercrombie & Fitch (ANF - Free Report). Below is a chart illustrating the YTD performance of each, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, VST and ANF shares have been in a league of their own, muting WMT’s impressive 35% gain. Let’s take a closer look at what’s been driving the bullish behavior.

Vistra Goes Nuclear for AI

Vistra safely operates a reliable, efficient, power generation fleet of natural gas, nuclear, coal, solar, and battery energy storage facilities with an innovative, customer-centric approach. The stock sports a Zacks Rank #1 (Strong Buy), with its earnings outlook moving higher nearly across all timeframes.

Shares reflect a unique angle to tap into the AI play, with its nuclear offerings pairing nicely with the high-power needs within data centers. It’s also worth noting that the stock recently joined the S&P 500 back in early May, undoubtedly a positive development.

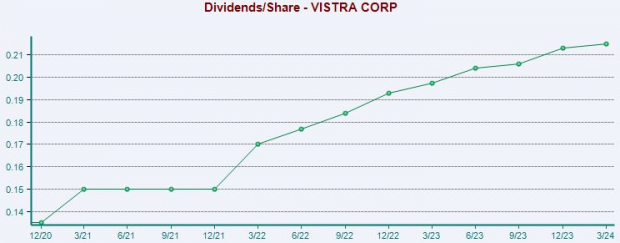

Income-focused investors could also be attracted, with shares currently yielding a modest 1% annually. While the yield has decreased amid the positive price action, Vistra’s 14% five-year annualized dividend growth rate reflects a commitment to increasingly rewarding shareholders.

Image Source: Zacks Investment Research

Shares have found support near the 50-day moving average after its pullback, now making higher highs and reflecting overall healthy price action.

Image Source: Zacks Investment Research

Walmart Shares Climb Post-Split

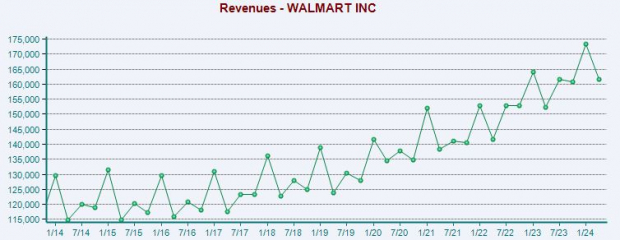

Walmart shares have continued to climb higher amid favorable quarterly results, with the company’s profitability seeing a nice improvement. Earnings saw year-over-year growth of 22% throughout its latest period, whereas sales climbed 6% from the same period last year.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

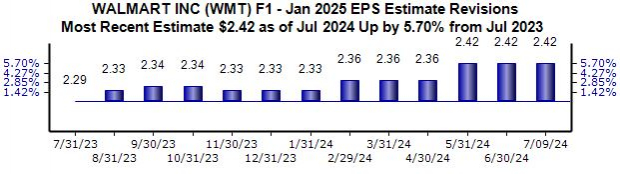

It’s worth mentioning that the retail giant underwent a 3-for-1 split this year, with shares trading on a split-adjusted basis starting on February 26. The revisions trend for its current fiscal year has remained positive, with the stock sporting a favorable Zacks Rank #1 (Strong Buy).

The $2.42 per share estimate suggests 10% annual earnings growth year-over-year.

Image Source: Zacks Investment Research

Walmart’s eCommerce sales have been a great story for the company, pleasing investors with their digital efforts. Global eCommerce sales throughout its latest period grew 21% year-over-year, reflecting yet again another strong quarter for the company in the metric.

Abercrombie & Fitch Sees Brand Revival

Abercrombie & Fitch, a current Zacks Rank #1 (Strong Buy), has posted consistently robust quarterly results. Over its last four releases, the apparel favorite has exceeded the Zacks Consensus EPS estimate by an impressive average of 210%.

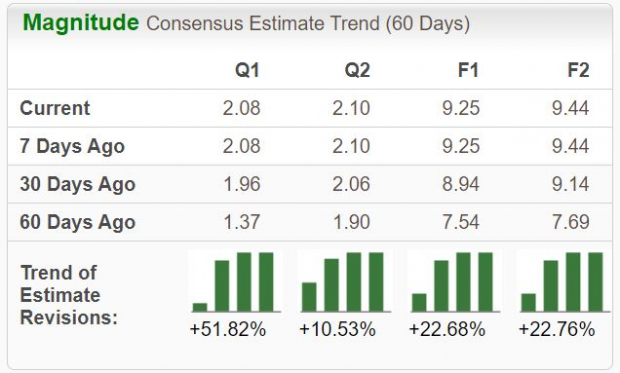

Analysts have become bullish, raising their earnings expectations across the board.

Image Source: Zacks Investment Research

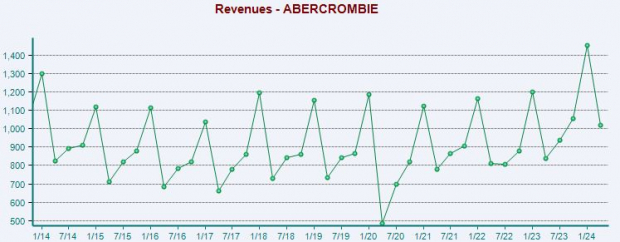

Concerning the above-mentioned results, ANF posted record Q1 sales of $1.0 billion in its latest release, climbing 22% year-over-year thanks to continued brand momentum. ANF raised its full-year sales outlook following the strong period, helping explain the post-earnings pop in shares.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

The company’s growth profile remains bright, with consensus expectations for its current fiscal year suggesting 48% EPS growth on 10% higher sales. The stock sports a Style Score of ‘B’ for Growth.

Bottom Line

While it can sometimes feel that tech stocks have hogged all the gains, it certainly hasn’t been the case, as shown by the above examples of Vistra, Walmart, and Abercrombie & Fitch.

All three stocks sport a favorable Zacks Rank, reflecting near-term bullishness among analysts.

More By This Author:

3 Key Reports To Watch This Earnings SeasonRide Bullish Momentum With These 3 Buy Rated Stocks

These 3 Companies Generate Significant Cash