These 3 Large-Caps Roared In April

Image Source: Pixabay

Investors who target stocks displaying relative strength often find themselves in favorable trends, no matter the direction of the general market. For a quick explanation, relative strength focuses on stocks or other assets that have performed well relative to the market as a whole or a relevant benchmark.

And in April, several stocks – Meta Platforms (META - Free Report), Barclays (BCS - Free Report), and Intuitive Surgical (ISRG - Free Report) – have displayed notable relative strength, as we can see illustrated below.

Image Source: Zacks Investment Research

Can the momentum continue? Let’s take a closer look.

Meta Platforms

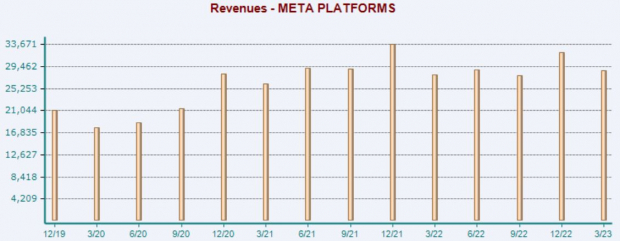

Meta Platforms’ quarterly results stole the show, with the company delivering a sizable 35% EPS surprise and revealing optimistic guidance. Quarterly revenue totaled $28.6 billion, surpassing expectations and reflecting the first year-over-year revenue increase in four quarters.

Image Source: Zacks Investment Research

Analysts have become bullish, with the company’s earnings outlook shifting notably higher as of late. Meta Platforms sports the highly-coveted Zacks Rank #1 (Strong Buy).

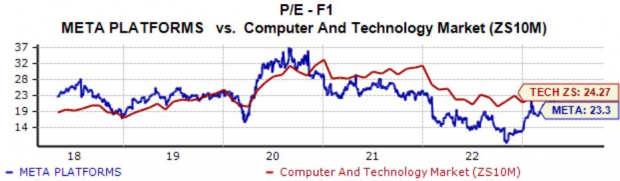

Image Source: Zacks Investment Research

In addition, the company’s shares have become notably cheaper, with the current 23.3X forward earnings multiple well off its high of 29.2X in 2021 and nearly in line with the five-year median.

Image Source: Zacks Investment Research

Despite a big run-up post-earnings, META shares still appear attractive, with the company’s focus on efficiency being a significant tailwind.

Barclays

Barclays is a major global banking and financial services company with 325 years of expertise in the realm. Currently, the stock sports a Zacks Rank #3 (Hold), with analysts upping their earnings expectations for the current and next fiscal year.

Image Source: Zacks Investment Research

For those with an appetite for income, Barclays has that covered; the company’s annual dividend presently yields 5.8%, more than double the Zacks Finance sector average.

Image Source: Zacks Investment Research

Intuitive Surgical

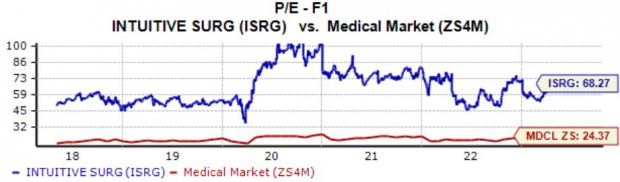

ISRG shares got a massive boost following its latest quarterly release, as we can see illustrated in the chart below. So far, the momentum has held, which is undoubtedly a positive sign.

Image Source: Zacks Investment Research

The company reported earnings of $1.23 per share, exceeding our consensus estimate by roughly 3.3%. Intuitive generated $1.7 billion in revenue throughout the period, well above expectations and improving a solid 14% year-over-year.

Image Source: Zacks Investment Research

Regarding valuation, the company’s 68.3X forward earnings multiple undeniably resides on the higher end of the spectrum, well above the 59.4X five-year median and the Zacks Medical sector average.

Image Source: Zacks Investment Research

Bottom Line

These stocks’ performances raise a valid question: can they keep climbing, or has the move already ended?

For Meta Platforms (META - Free Report), the favorable earnings results and guidance provide solid momentum for time to come, with the stock still staging a significant rebound from last year’s less-than-ideal performance.

In addition, analysts have become notably bullish on META’s outlook, pushing the stock into a Zacks Rank #1 (Buy). These aspects, paired with a relatively sound valuation picture, make META shares appear much more attractive and capable of delivering gains in the near-term than Barclays (BCS - Free Report) and Intuitive Surgical (ISRG - Free Report) shares.

More By This Author:

Kellogg Expected to Beat Earnings Estimates: Should You Buy?

Colgate-Palmolive Q1 Earnings And Revenues Surpass Estimates

Peloton Expected To Beat Earnings Estimates: What To Know Ahead Of Q3 Release

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more