These 3 Companies Generate Some Serious Cash

Image: Bigstock

Strong cash flows reflect financial stability, allowing companies to pay down debt, pursue growth opportunities, and shell out dividend payments. These companies are also better equipped to weather downturns, providing another beneficial advantage for investors from a long-term standpoint.

And for those seeking cash-generating machines, three companies – Visa (V - Free Report), UnitedHealth (UNH - Free Report), and Alphabet (GOOGL - Free Report) – all fit the criteria nicely. Outside of their strong cash-generating abilities, let’s take a closer look at how each currently stacks up.

Visa

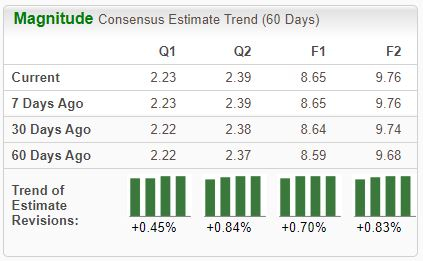

Visa is a global payments technology company providing transaction processing services (primarily authorization, clearing, and settlement) to financial institutions and merchant clients. The company has seen modest positive earnings estimate revisions across all timeframes.

Image Source: Zacks Investment Research

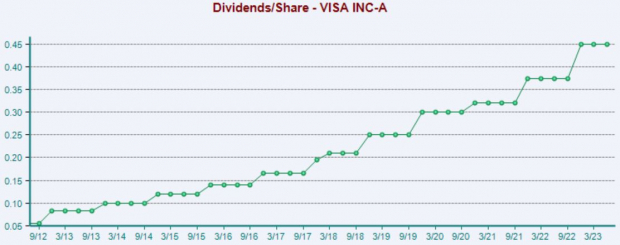

Shares could interest those with a preference for income, with Visa shares currently yielding a respectable 0.7% annually. The company’s cash flow strength has allowed it to consistently boost its payout, carrying a 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Impressively, the company’s cash and cash equivalents totaled $20.9 billion as of June 30, 2023, up nicely from the year-ago period.

Alphabet

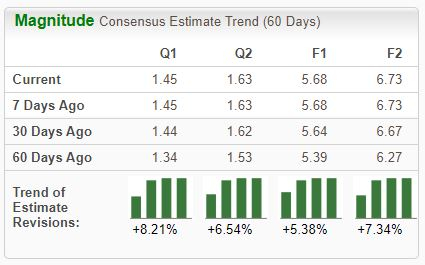

Analysts have taken a bullish stance on Alphabet’s earnings outlook, with expectations increasing across all timeframes over the last several months.

Image Source: Zacks Investment Research

In addition, GOOGL shares aren’t expensive given the company’s growth trajectory, with the current 23.9X forward earnings multiple nicely beneath the 24.5X five-year median and highs of 26.8X in 2022. Earnings are forecasted to climb 25% on 9% higher revenues in its current year.

Image Source: Zacks Investment Research

The technology titan generated a mighty $21.8 billion in free cash flow throughout its latest quarter, improving nicely from the year-ago period.

UnitedHealth

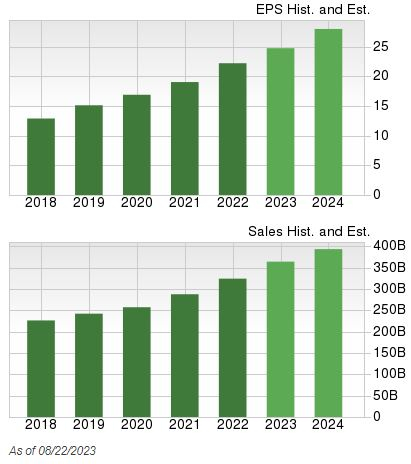

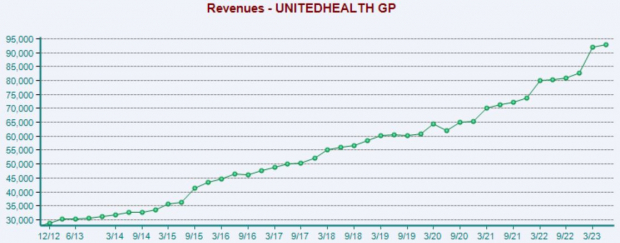

UnitedHealth provides various healthcare products and services, such as health maintenance organizations (HMOs) and preferred provider organizations (PPOs). The company sports a favorable growth profile, with earnings forecasted to climb 12% on 14% higher revenues in its current year.

Image Source: Zacks Investment Research

The company posted solid results in its latest release, with Q2 revenue of $92.9 billion improving 16% year-over-year. In addition, UNH posted a 4% EPS beat, with earnings also improving nicely from the year-ago period.

As shown below, the company’s revenue has remained on a steady trajectory.

Image Source: Zacks Investment Research

UNH’s operating cash flow totaled $11.0 billion throughout its latest quarter, improving by a substantial 60% from the year-ago period.

Bottom Line

Companies boasting strong cash-generating abilities can be great investments, as they have plenty of cash to fuel growth, pay dividends, and easily wipe out debt. And as mentioned previously, these companies are better equipped to handle an economic downturn, which is undeniably a positive.

For those seeking cash-generators, all three discussed above – UnitedHealth (UNH - Free Report), Visa (V - Free Report), and Alphabet (GOOGL - Free Report) – fit the criteria.

More By This Author:

These 3 Companies Boast Big Growth Expectations3 Stocks to Watch After Impressive Earnings Beats

Bear of the Day: Dick's Sporting Goods

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more