These 3 Companies Generate Serious Cash

Image Source: Unsplash

Strong cash flows reflect financial stability, allowing companies to pay down debt, pursue growth opportunities, and shell out dividend payments.

These companies are also better equipped to weather an economic downturn, providing another beneficial advantage for investors from a long-term standpoint.

And for those interested in investing in strong cash flows, three companies – Apple (AAPL - Free Report), Broadcom (AVGO - Free Report), and Visa (V - Free Report) – are all cash-generating machines. Let’s take a closer look at each.

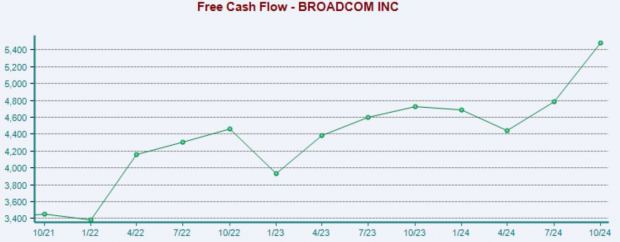

Broadcom

Broadcom has quickly risen to the top concerning AI players, with its latest set of quarterly results confirming robust demand. Its FY24 just ended, with annual revenue of $51.6 billion reflecting a new record and growing 44% year-over-year on the back of strong demand for its solutions.

The stock currently sports a favorable Zacks Rank #2 (Buy), with its earnings outlook shifting bullishly across the board following its latest set of strong quarterly results. It reported free cash flow of $5.5 billion throughout its latest period, showing 15% growth year-over-year.

Image Source: Zacks Investment Research

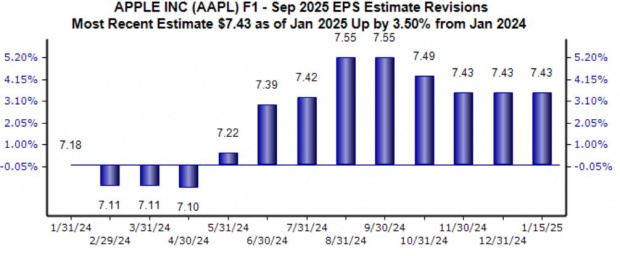

Apple

Apple has also been getting attention during the AI frenzy thanks to Apple Intelligence, which has been implemented into the newest iPhone models. The mega-cap titan posted free cash flow of $16.5 billion in its latest release, owing to its nickname of the ‘Cash King’.

The EPS outlook for its current fiscal year largely remains positive, with the $7.43 per share estimate suggesting 10% growth year-over-year.

Image Source: Zacks Investment Research

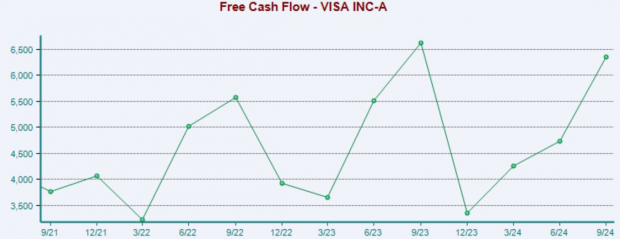

Visa

Payments titan Visa is similarly known for its strong cash-generating abilities, with the outlook for its current fiscal year also reflecting positivity. The $11.23 per share estimate for its current fiscal year suggests an 11% improvement, continuing an established trend.

The financial giant posted free cash flow of $6.3 billion in its latest quarterly release, 34% higher year-over-year.

Image Source: Zacks Investment Research

Bottom Line

Companies boasting strong cash-generating abilities can be great investments, as they have plenty of cash to fuel growth, pay out dividends, and easily wipe out debt.

And as mentioned above, these companies are better equipped to handle an economic downturn, undeniably a positive.

For those seeking cash-generators, all three above – Apple, Broadcom, and Visa – fit the criteria nicely.

More By This Author:

3 Consistent Dividend Stocks To Buy For Passive IncomeInsiders Are Buying These 3 Large Cap Stocks

3 Simple Tips To Managing A Successful Portfolio

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more