These 3 Companies Could Positively Surprise Investors

Image Source: Pexels

Earnings season is always an exciting time for investors, with companies finally revealing what’s transpired behind closed doors.

As usual, the big banks shifted the cycle into a much higher gear, with many other companies scheduled to follow suit.

Concerning looming surprises, Arista Networks (ANET - Free Report), Coinbase (COIN - Free Report), and KB Home (KBH - Free Report) could all bring positivity, with each boasting a positive Earnings ESP Score.

But how do expectations stack up heading into the releases? Let’s take a closer look.

Coinbase

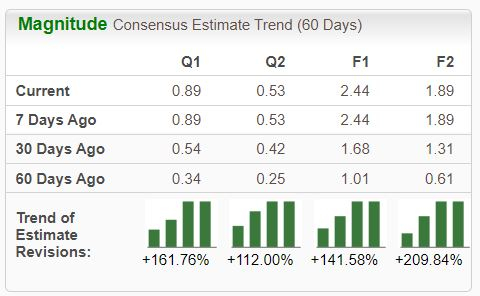

Coinbase, a current Zacks Rank #1 (Strong Buy), is the largest U.S. cryptocurrency exchange. Thanks to the rebound in crypto prices, analysts have become notably bullish on the company’s earnings outlook, with earnings expectations melting higher across the board.

Image Source: Zacks Investment Research

Big growth is expected, with the $0.89 Zacks Consensus EPS estimate suggesting a nearly 500% climb from the year-ago period. Our consensus revenue estimate stands at $1.2 billion, 55% higher than the same period last year.

In addition, our consensus Transaction Revenue estimate stands at $666 million, nearly doubling last year’s mark of $375 million. The company posted a solid beat on the metric in its latest release, $185 million higher than expected.

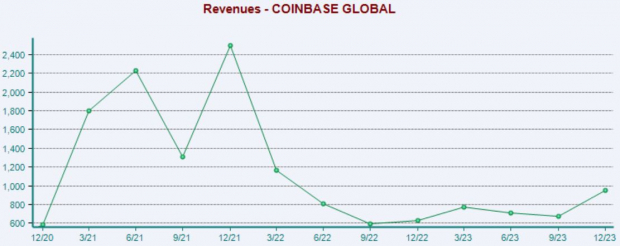

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Arista Networks

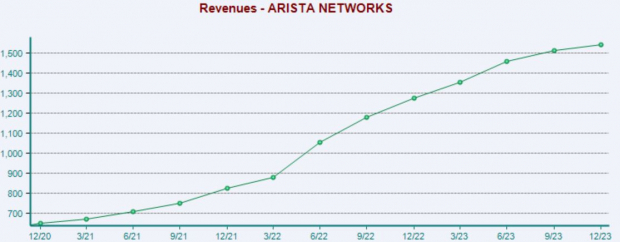

Arista Networks, a Zacks Rank #2 (Buy), is an industry leader in data-driven, client-to-cloud networking for large data centers, campus, and routing environments.

Benefitting from the AI frenzy, analysts have raised their earnings expectations given the AI frenzy, with the $1.74 Zacks Consensus EPS estimate up 5% since February and suggesting 22% year-over-year growth.

Image Source: Zacks Investment Research

Revenue revisions have followed suit, with the $1.5 billion expected up a modest 1% over the same time frame and suggesting 14% year-over-year growth. The company’s top line has expanded nicely, as we can see below.

Image Source: Zacks Investment Research

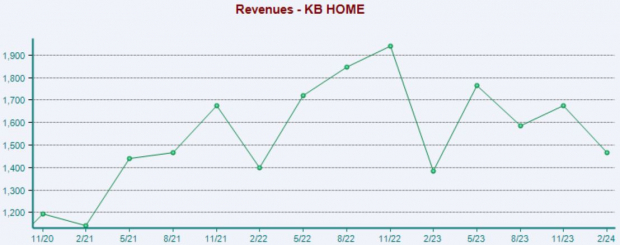

KB Home

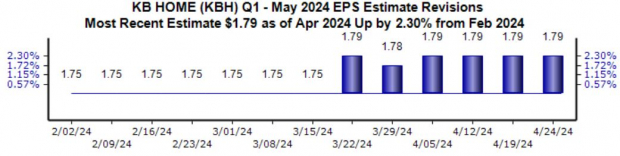

KB Home, a current Zacks Rank #1 (Strong Buy), is a well-known homebuilder in the United States. Like those above, analysts have taken a bullish stance for the quarter to be reported, with the $1.79 Zacks Consensus EPS estimate up 2% since February.

Growth is expected to cool, with the estimate suggesting an 8% pullback from the year-ago period.

Image Source: Zacks Investment Research

Revenue revisions have also been notably positive, up more than 4% to $1.6 billion since February and reflecting a 7% decline year-over-year. It’s worth noting that the company has been a big-time earnings performer as of late, exceeding our consensus EPS estimate by an average of 26% across its last four releases.

Image Source: Zacks Investment Research

A solid quarterly release could breathe life into shares, which are down roughly 6% over the last month.

Bottom Line

Earnings season has arrived, with a plethora of companies scheduled to unveil quarterly results in the coming weeks.

And concerning positive surprises, all three companies above – Arista Networks, Coinbase, and KB Home – could deliver just that.

In addition to a positive Earnings ESP Score, all three sport a favorable Zacks Rank, reflecting optimism among analysts.

More By This Author:

Airliner Earnings: What Can Investors Expect?3 Buy-Rated Stocks Fit For Value Investors

This Combination Of 3 Stocks Provides Monthly Income