These 3 Buy-Rated Stocks Have Shown Great Relative Strength

Image Source: Unsplash

Amid the recent favorable price action within the market, many stocks are nearing or breaking 52-week highs, including several highly recognizable names such as Amazon (AMZN), Arista Networks (ANET), and Abercrombie & Fitch (ANF).

In addition to recent momentum, all three sport a favorable Zacks Rank, reflecting upward earnings estimate revisions among analysts. Let’s take a closer look at each for those seeking to tap into the strength.

Amazon

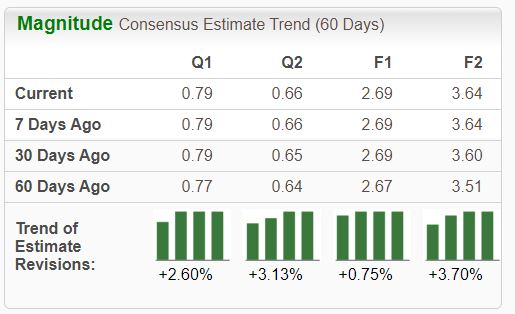

Amazon shares have been big-time performers over the last year, outperforming the general market handily and enjoying a spot within the highly-coveted ‘Magnificent 7’ group. The stock is currently a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board.

Image Source: Zacks Investment Research

The company is expected to return to its high-growth nature in its current fiscal year, with consensus estimates currently suggesting 280% earnings growth on 11% higher sales. Easing costs have been a notable tailwind for the market titan.

Shares aren’t overly expensive given the forecasted growth, currently trading at a 2.5X forward price-to-sales ratio. The present value is well beneath the 3.1X five-year median and highs of 4.8X back in 2020.

Image Source: Zacks Investment Research

Arista Networks

Arista Networks shares have benefited nicely from the AI frenzy. The company provides network switches to hyperscalers that speed up communication between computer servers.

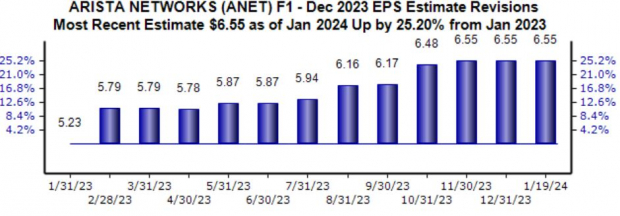

The stock is a Zacks Rank #2 (Buy), with the revisions trend for its current fiscal year particularly strong, up 25% to $6.55 per share over the last year.

Image Source: Zacks Investment Research

Similar to AMZN, the company boasts an impressive growth profile, with consensus estimates for its current fiscal year suggesting 43% earnings growth on 33% higher sales. Growth looks to continue in FY24, as estimates allude to an additional 10% boost in earnings paired with an 11% revenue climb.

Keep an eye out for the company’s next quarterly release scheduled for February 12th, as the Zacks Consensus EPS estimate of $1.70 suggests 20% year-over-year growth and has been taken 8% higher since last October.

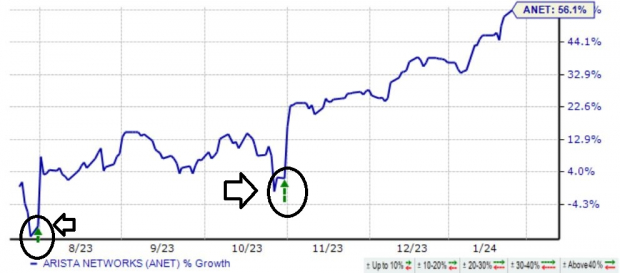

Better-than-expected quarterly results have helped drive shares higher, as we can see illustrated in the chart below by the green arrows circled.

Image Source: Zacks Investment Research

Abercrombie & Fitch

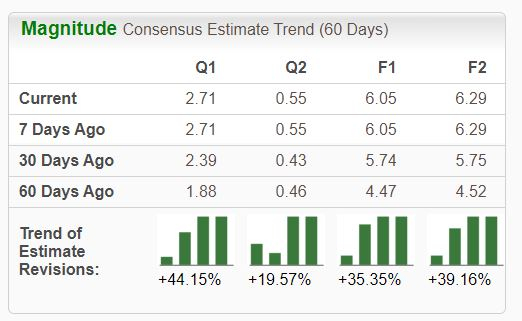

Abercrombie & Fitch, a current Zacks Rank #1 (Strong Buy), operates as a specialty retailer of many types of premium, high-quality casual apparel for men, women, and kids through a vast store network. Earnings expectations have melted higher across the board.

Image Source: Zacks Investment Research

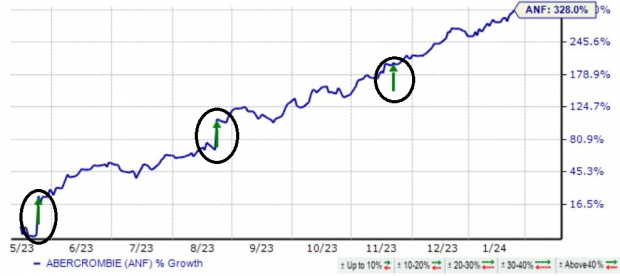

Like ANET, the company’s shares have been supported by better-than-expected quarterly results, as we can see in the chart below. In fact, ANF has exceeded the Zacks Consensus EPS Estimate by an average of 700% across its last four releases.

Shares have moved higher post-earnings in three consecutive releases.

Image Source: Zacks Investment Research

Bottom Line

Momentum has carried over nicely into 2024, with many stocks breaking 52-week highs and undoubtedly pleasing investors.

And for those seeking to tap into the strength, all three stocks above – Amazon, Arista Networks, and Abercrombie & Fitch – could be great considerations.

More By This Author:

Qualcomm Soars 4.6%: Is Further Upside Left In The Stock?Time to Get In On Nvidia's Latest Rally To Almost $600 A Share?

These 3 Buy-Rated Stocks Have Been Red-Hot