These 3 Buy-Rated Stocks Have Been Red-Hot

Image Source: Unsplash

Momentum investors ride bullish trends where buyers are in control, with the strategy particularly potent over the last year amid the market’s turnaround.

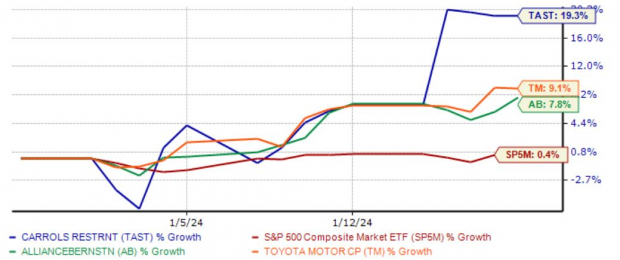

And the momentum has carried over into 2024 for several stocks, including Carrols Restaurant Group (TAST), AllianceBernstein (AB), and Toyota Motor (TM). Below is a chart illustrating the performance of each year-to-date, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

In addition to favorable price action, all three sport a favorable Zacks Rank and carry sound valuations, with the former reflecting optimism among analysts. Let’s take a closer look at each.

Carrols Restaurant Group

Carrols Restaurant Group, a Zacks Rank #1 (Strong Buy), is one of the largest restaurant franchisees in the United States, presently operating over 1,000 Burger King and 62 Popeyes restaurants.

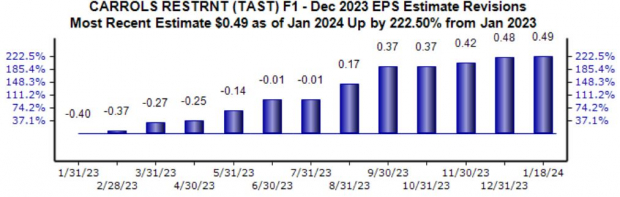

Analysts have become notably bullish for its current fiscal year, with the $0.49 Zacks Consensus EPS Estimate well above the -$0.40 per share loss expected last January.

Image Source: Zacks Investment Research

The company’s shares saw buyers step up in a big way following its latest quarterly print. Concerning the headline figures within the release, Carrols exceeded the Zacks Consensus EPS Estimate by nearly 130% and posted revenue a hair below expectations.

TAST’s cash-generating abilities also saw a nice improvement, with free cash flow throughout the period totaling $33.9 million, well above the $14 million reported last year. Shares are fairly priced given the company’s forecasted growth, with the current 0.3X forward price-to-sales ratio marginally above the five-year median.

Image Source: Zacks Investment Research

AllianceBernstein

AllianceBernstein is a leading global investment management firm that offers high-quality research and diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

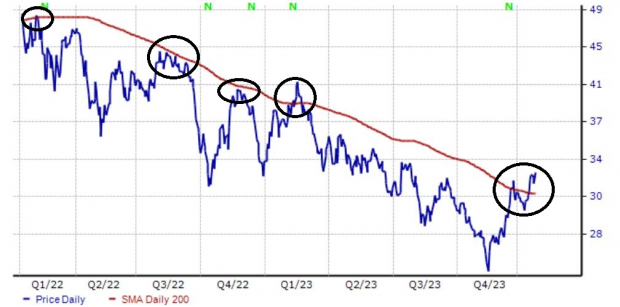

Shares have had a strong run since their lows in November of last year, recently reclaiming the 200-day moving average. As we can see below, the level has been influential for shares, reflecting a positive change in trend.

Image Source: Zacks Investment Research

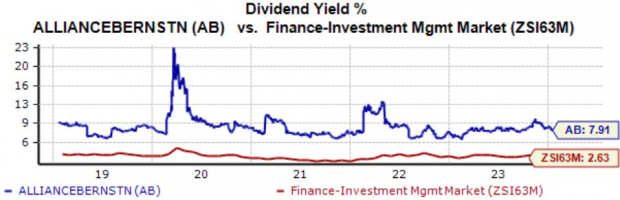

Those with a preference for income could find AB shares attractive as well, currently yielding a sizable 7.9% annually and easily crushing its Zacks Industry average of 2.6%. The payout has also grown nicely, as AB presently sports a 3.5% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Toyota Motor

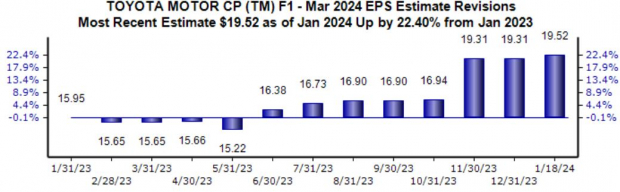

Toyota Motor, a Zacks Rank #1 (Strong Buy), is one of the leading automakers in the world in terms of sales and production. Analysts have taken their expectations well higher for its current fiscal year, with the $19.52 Zacks Consensus EPS Estimate up 22% over the last year.

Image Source: Zacks Investment Research

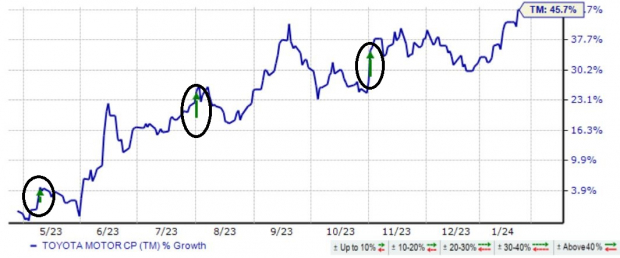

The company’s strong share performance has been aided by better-than-expected quarterly results, further illustrated below by the green arrows. In fact, Toyota has exceeded the Zacks Consensus EPS Estimate by an average of 46% across its last four releases, with its electrified fleet catching serious momentum.

Image Source: Zacks Investment Research

Toyota’s earnings are forecasted to recover nearly 45% in its current year on 11% higher sales.

Bottom Line

Momentum investors have been rewarded handsomely over the last year, with the theme looking to remain strong throughout 2024.

And for those seeking stocks that have continued climbing as the calendar flipped, all three above – Carrols Restaurant Group, AllianceBernstein, and Toyota Motor – fit that criteria nicely.

In addition to positive momentum, all three stocks sport a favorable Zacks Rank and sound valuations.

More By This Author:

3 High-Octane Momentum Stocks To Watch Next WeekTop Stocks To Buy As Earnings Approach

Bull Of The Day: Navigator Holdings