These 26 AI Stocks Are Up 58% In Just 11 Weeks

Image Source: Unsplash

26 artificial intelligence and AI-related (AI&R) stocks have advanced in excess of 50% since the bubble began to develop at the end of April into early May. 20 of them have market capitalizations in excess of $1B and 6 between $100M and $999M. This article list their performances below in descending order since the bubble began to inflate up until last Friday, July 21st (i.e. 11 weeks). Future articles will track their performances on a weekly and monthly basis as well as their performances since their lows in late April/early May.

Please note: Information on each stock's current market capitalization, current short interest, current stock price, company description, latest quarterly financials and related news and articles are available by clicking on the stock's trading symbol.

+$1B AI&R Bubble Stock Performances Since April 28th

- Upstart Holdings (UPST): +297.7%

- Recursion Pharmaceuticals (RXRX): +194.8%

- Super Micro Computer (SMCI): +187.4%

- IonQ (IONQ): +171.6%

- Lemonade (LMND): +115.6%

- C3.ai (AI): +113.4%

- Palantir Technologies (PLTR): +112.0%

- Advantest (ATEYY): +84.6%

- Datadog (DDOG): +75.3%

- Zscaler (ZS): +71.3%

- Symbotic (SYM): +64.5%

- Snap (SNAP): +61.1%

- Marvell Technology (MRVL): +60.6%

- Wolfspeed (WOLF): +60.0%

- Nvidia (NVDA): +59.7%

- Uber Technologies (UBER): +59.6%

- Exscientia (EXAI): +59.1%

- Tesla (TSLA): +58.0%

- Adobe (ADBE): +54.9%

- Entigris (ENTG): + 50.6%

The above 20 stocks are UP 58.5%, on average, since the end of April.

+$100M to $999M AI&R Bubble Stock Performances Since April 28th

- Applied Optoelectronics (AAOI): +373.7%

- GSI Technology (GSIT): +246.0%

- Rekor Systems (REKR): +198.1%

- Applied Digital (APLD): +168.1%

- Innodata (INOD): +102.2%

- Verses (VRSSF): +60.8%

The above 6 stocks are UP 168.0%, on average, since the end of April but when combined with the 20 larger cap AI&R the 26 stocks are UP an average of 58.4%. In comparison,

- the Nasdaq has gone UP 18.9%,

- the Global X Artificial Intelligence & Technology ETF (AIQ) has gone UP 26.5%, and

- the Invesco PHLX Semiconductor ETF (SOXQ) has gone UP 27.4%

Conclusion

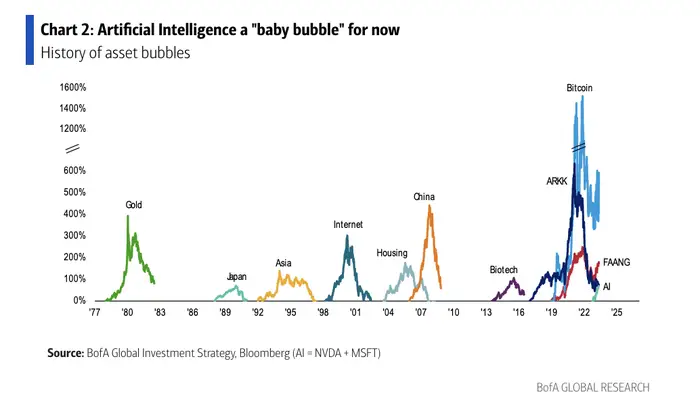

According to the Bank of America, what is unfolding is currently just a "baby bubble" with huge upside potential if past bubbles are any indication.

The Bank of America says the bubble should continue until such time as the Fed pauses their rate hikes and then starts to raise rates again. Such being the case it would appear that it is not too late to do your own due diligence and get invested. The performances of the above stocks will be closely monitored on a weekly basis and be reported in future articles.

More By This Author:

These 9 Fringe ETFs Have Outperformed The S&P 500 And Nasdaq

The Conservative "Cannabis" Stock Index Is Now Up 4% MTD And +11% YTD

Largest Psychedelic Compound-Based Drug Stocks Up 14% MTD; Now Up 27% YTD

Disclosure: None

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more