These 10 Dividend Growth Stocks Could Increase Their Dividends By 10%+ Per Year

Income investors may have a tendency to focus on stocks with the highest dividend yields. But dividend growth is also an important consideration when constructing an income-focused portfolio.

While high-yield stocks are appealing for the income they provide today, dividend growth stocks are equally appealing due to the potential for even higher dividends down the road.

10%+ Dividend Growth Stock #10: Caterpillar (CAT)

Caterpillar has grown since its founding in 1925 to a massive, global manufacturer of construction and mining equipment, as well as a variety of industrial engine applications. Caterpillar is a high-quality dividend growth stock, as the company recently joined the list of Dividend Aristocrats with its 25th consecutive annual dividend increase.

The $69 billion market capitalization company operates a financial services segment, as well as construction, resource industries, and energy & transportation businesses, respectively.

Source: Investor presentation, page 5

Caterpillar’s customers generally operate in very cyclical industries, including construction, forestry, mining, and others. This leads to boom and bust cycles for Caterpillar’s earnings prospects based upon global economic growth, which can lead to volatility in the stock price.

However, Caterpillar’s recent results and its current prospects are quite good, and for that reason, we see the stock continuing to increase the dividend over time.

The following YouTube video discusses Caterpillar’s dividend safety in greater detail:

Video Length: 00:08:27

We expect Caterpillar will grow earnings at a mid-single-digit rate annually in the coming years through modest revenue increases, a declining share count, and margin improvements. This will help fuel the company’s payout growth, as it has for many years, despite volatile earnings production.

Given this level of earnings growth, which expands the base from which the company can pay dividends, as well as the low payout ratio, which is currently at ~30% of earnings, Caterpillar looks poised to deliver when it comes to dividend growth in the coming years.

10%+ Dividend Growth Stock #9: Johnson & Johnson (JNJ)

Johnson & Johnson is a global diversified health care company, and is a leader in pharmaceuticals, medical devices, and health care-related consumer products. The company was founded in 1886 and now has a market capitalization of $347 billion.

The company’s three divisions combine to produce $82 billion in annual revenue, with about half of that coming from pharmaceuticals. Johnson & Johnson also has a large consumer products business with multiple billion-dollar brands.

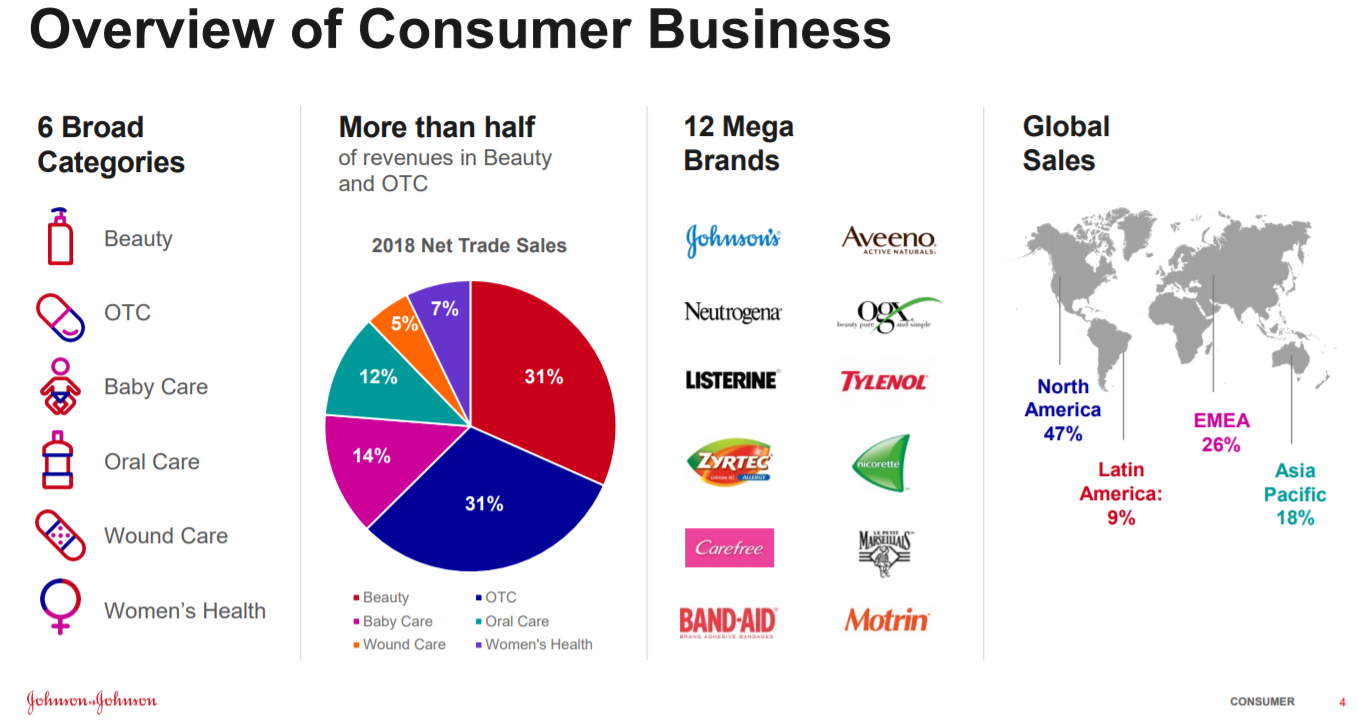

Source: Investor presentation, page 4

Johnson & Johnson sells products in six categories with huge brands such as Aveeno, Zyrtec, and Tylenol as anchors in the categories. It gets only about half of its total revenue from North America, so it is highly diversified geographically. It is heavily dependent upon the OTC and Beauty categories, however, as they make up a combined ~60% of total revenue.

We see this contributing to mid-single-digit earnings growth annually in the coming years, consistent with what Johnson & Johnson has accomplished in recent years. These gains will accrue from modest revenue growth and share repurchases, primarily.

The following video further analyzes Johnson & Johnson’s future growth potential:

Video Length: 00:10:54

This growing base of earnings-per-share will afford Johnson & Johnson the ability to continue to increase the payout, which it has done for 57 consecutive years. Johnson & Johnson is a Dividend Aristocrat, and a Dividend King as well.

With a payout ratio of just 43% in 2019, Johnson & Johnson has ample room to continue to grow the payout ratio while simultaneously growing earnings-per-share. This could easily afford the company the ability to produce double-digit payout growth in the coming years. Johnson & Johnson has a steady, predictable earnings base that grows relatively smoothly, which is highly attractive for dividend growth investors.

10%+ Dividend Growth Stock #8: Apple Inc. (AAPL)

Apple Inc. is a global technology company that designs, manufactures, and sells consumer products such as smartphones, smartwatches, and personal computers. Apple has also recently grown immensely in the service space in recent years, growing its App Store business through music, apps, and subscription sales.

Apple was founded in 1976, enjoys $260 billion in annual revenue, and is valued at $984 billion, making it one of the most valued companies in the world.

Apple has done a remarkable job in recent years growing its earnings-per-share, which has afforded it the ability to return capital to shareholders on a scale that is unlike any other company. We expect 6%-7% annual earnings-per-share growth over the next five years, which represents a slight slowdown from its historical rate.

Earnings growth should slow simply because of Apple’s huge scale, and the fact that the installed base of iPhones, which is easily the company’s largest product, is already fairly saturated in most developed markets. However, the services segment continues to produce strong growth, and we think Apple still has a very bright future.

And, even with a slightly lower EPS growth rate, Apple could reach double-digit dividend increases, thanks to its low payout ratio and huge amount of cash on the balance sheet.

The current payout ratio is just 26% of earnings, meaning Apple has a huge runway for dividend growth in the coming years. Fueled by the mid-single-digit growth in the earnings base, as well as room to materially increase the payout ratio without undue stress on the financials, Apple could deliver very strong dividend growth in the years to come.

Finally, Apple has a huge amount of cash on its balance sheet that is unencumbered, which could also be used to fuel dividend growth in the coming years. As of the most recent quarter, Apple held $95 billion in cash and securities, as well as $116 billion of marketable securities on its balance sheet.

10%+ Dividend Growth Stock #7: Bank OZK (OZK)

Bank OZK is a regional financial services provider, offering traditional checking, loans, and mortgages to consumer and business clients. The bank was founded in 1903 and has since grown into a $3.5 billion market capitalization.

Bank OZK operates mostly in the southeastern United States, having branches in Arkansas, Florida, North Carolina, Alabama, South Carolina, Texas, New York, and California.

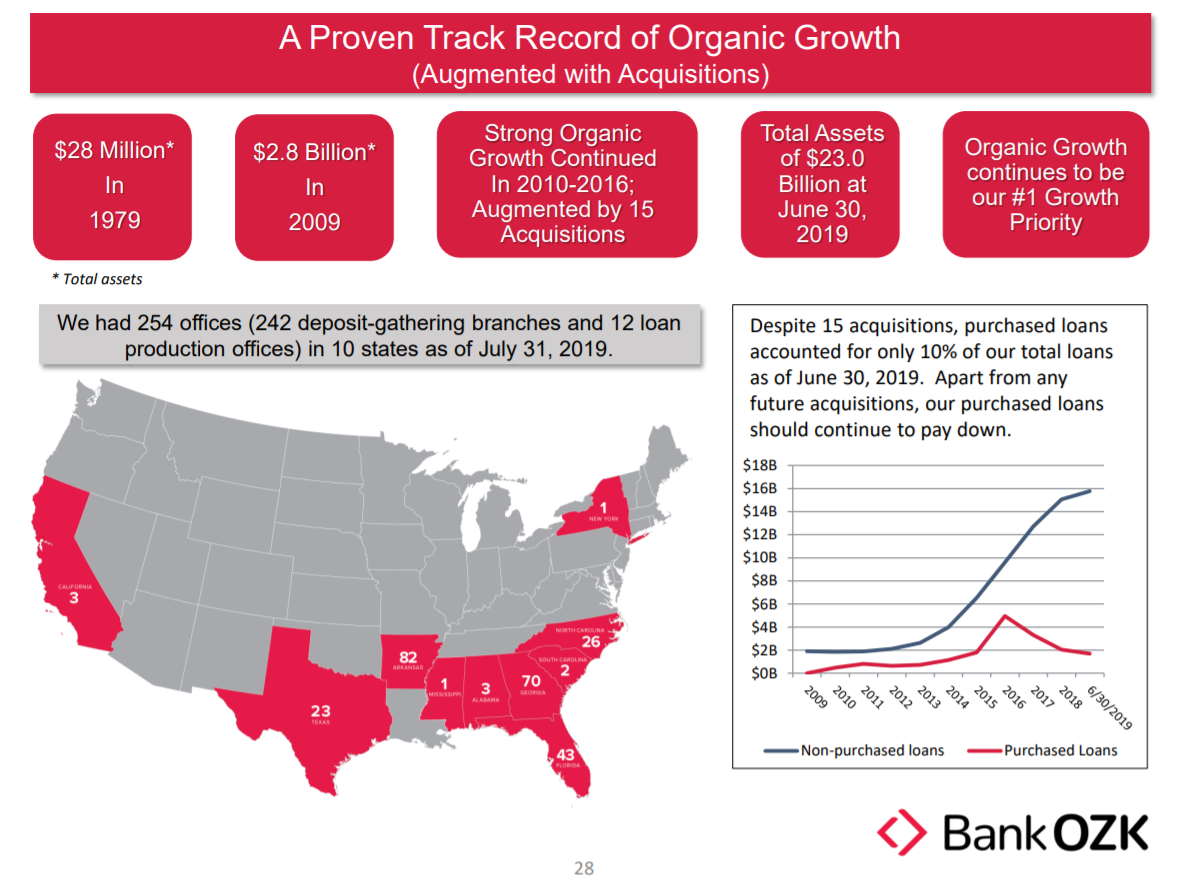

Source: Investor Presentation, page 28

The company has increased its earnings-per-share every year since the financial crisis, which is outstanding for a bank. Indeed, the company has grown earnings-per-share from 2011 at a rate of 12% annually. We are more conservative looking forward given the late stage of the current economic cycle, forecasting mid-single-digit growth annually in the coming years.

Organic growth is the primary driver as Bank OZK continues to collect deposits in its markets and lending them out, growing the balance sheet over time. However, in addition to organic growth, Bank OZK continues to grow through acquisitions, including scooping up the assets of failed banks over time. Bank OZK continues to have industry-leading efficiency ratios, meaning it operates with a very low support cost model.

This robust earnings growth, along with a very low current payout ratio of just 27%, means Bank OZK is setup for success when it comes to dividend growth. Bank OZK’s management team is also committed to raising the payout. The company has increased its dividend for 36 consecutive quarters. The dividend has grown by 22% annually over the past 10 years.

10%+ Dividend Growth Stock #6: Home Depot (HD)

Home Depot was founded in 1978, and since its humble beginning as a single hardware store, has expanded across North America. Today, the company has 2,300 stores, mostly in the U.S., with $111 billion in annual revenue.

Home Depot trades with a market capitalization of $247 billion, making it one of the largest retailers in the market.

Source: Investor Presentation, page 4

Home Depot has posted outstanding earnings growth in recent years as the company has benefited from the housing and commercial construction boom that followed the Great Recession. Even though housing prices have slowed recently, remodel activity continues to drive strong comparable sales growth for Home Depot.

Given this, as well as a steady tailwind from the share repurchase program, we see 7%-8% earnings-per-share growth annually in the coming years. These gains should accrue from comparable sales driving revenue gains, as well as those revenue gains driving gradual margin improvements. This is the formula Home Depot has used for many years and it continues to work.

In the past 10 years, Home Depot stock raised its dividend by 20% per year on average. Its most recent dividend increase was a hefty 32% raise.

The current payout ratio is 54% of earnings, which is higher than many of the other companies on this list. However, Home Depot’s very high projected earnings growth should help it produce strong dividend growth, even with a higher starting base in terms of the payout ratio. Because of this, we see growth in the dividend coming primarily from earnings growth, and not necessarily payout ratio expansion, as is the case with some other companies listed here.

10%+ Dividend Growth Stock #5: Lowe’s Companies (LOW)

Lowe’s Companies is the second-largest home improvement retailer in the U.S., a market which is totally dominated by Lowe’s and rival Home Depot. The duopolistic nature of the industry is why both Home Depot and Lowe’s can thrive at the same time.

Lowe’s was founded in 1946 as a single store in North Carolina, but has since grown into a 2,000-unit chain across the US and Canada. The company enjoys $73 billion in annual revenue and a market capitalization of $85 billion.

Lowe’s is a unique dividend growth stock. It has increased its dividend each year for over 50 years in a row, which qualifies it on the exclusive list of Dividend Kings.

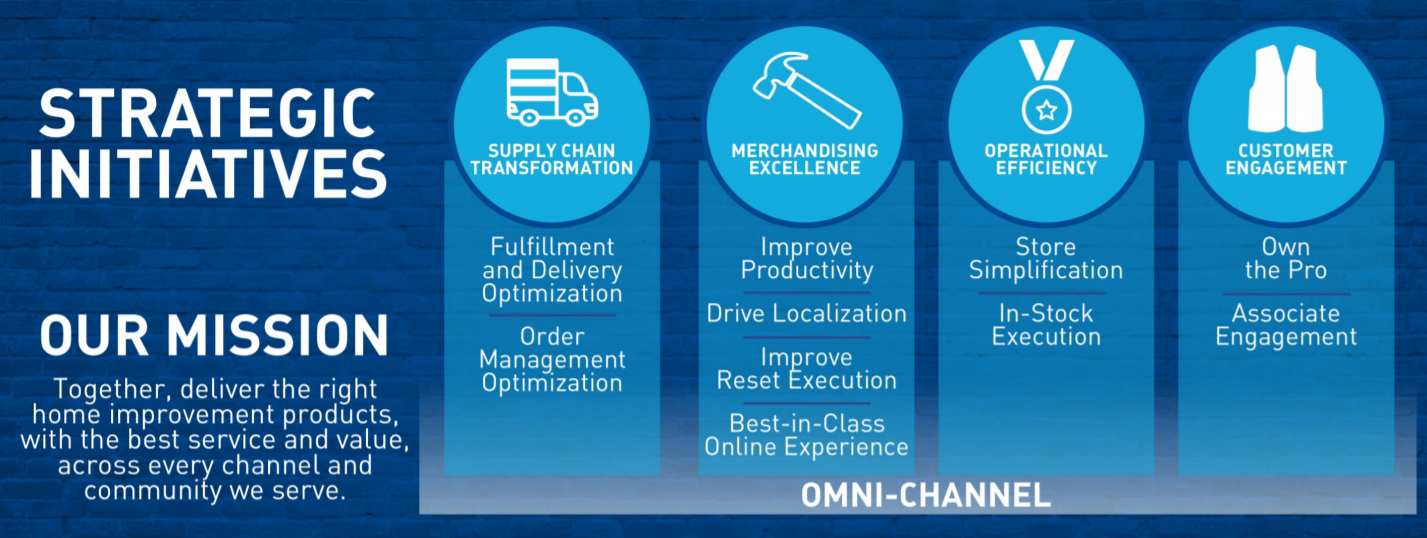

Lowe’s has been working recently to improve its growth prospects by focusing on four strategic pillars. The company has been focusing on improving the guest experience through better merchandising practices, improving inventory positions, and focusing on the lucrative Pro segment.

In addition, Lowe’s has been trying to revamp its supply chain, removing inefficiencies to boost margins.

Source: Investor Presentation, page 2

These factors should produce stronger revenue through comparable sales growth and better margins, and are expected to drive high-single-digit earnings-per-share growth in the coming years. We also see share repurchases as a steady tailwind to earnings-per-share growth, which will help drive the base from which the company can continue to build the dividend payment over time.

Lowe’s has boosted its dividend by 21% annually in the past five years, so we see double-digit dividend growth as highly achievable in the next few years. The current payout ratio is 40%, so there is room to run in terms of increasing the payout ratio, but earnings-per-share growth in the high-single-digits should be a strong tailwind on its own.

10%+ Dividend Growth Stock #4: Nike, Inc. (NKE)

Nike was founded in 1964, and in the past 55 years, it has expanded into the world’s largest athletic footwear, apparel, and equipment maker. Nike operates in six segments: running, soccer, training, basketball, sportswear, and Jordan. Nike also owns the Converse and Hurley brands. Nike trades for a $145 billion market capitalization, and posts $42 billion in annual revenue.

In the past decade, Nike has grown its earnings-per-share at an average annual rate in excess of 10%. Revenue growth has been the primary driving factor, but Nike has improved margins gradually and has reduced the share count through its buyback program. We see Nike producing nearly double-digit earnings-per-share growth in the coming years, primarily attributable to continued revenue growth and share repurchases.

Nike’s push to accelerate direct-to-consumer sales, instead of its legacy wholesale model, could be a tailwind for future growth.

Nike’s dividend increase streak is up to 17 years. While it is not yet a Dividend Aristocrat, it has joined the list of Dividend Achievers. Nike has grown the payout by an average of 15% in the past decade. The robust earnings-per-share growth we forecast will provide a strong tailwind for the dividend in the coming years.

Nike’s payout ratio is just 33% this year, so it has a lot of room to grow the dividend in excess of earnings growth, should it continue to do so. The very low payout ratio, combined with outstanding earnings growth prospects, mean that Nike’s dividend growth outlook is exemplary.

10%+ Dividend Growth Stock #3: Texas Instruments (TXN)

Texas Instruments is a semiconductor company that provides products, including semiconductors, that measure physical data, such as sound or temperature, in addition to a variety of other applications. Texas Instruments is organized in two segments: Analog, and Embedded Processing. The company was founded in 1930 and enjoys nearly $15 billion in annual revenue. The stock trades with a market capitalization of $119 billion.

Texas Instruments has produced cyclical results in its history, which is unsurprising given the demand for semiconductors is very cyclical. To its credit, Texas Instruments remained profitable through the Great Recession, and has grown its earnings at a double-digit rate over the long-term.

We expect 10.5% annual earnings-per-share growth in the coming years, which we believe will accrue from a combination of revenue increases, margin gains, and share reductions through the company’s formidable buyback program.

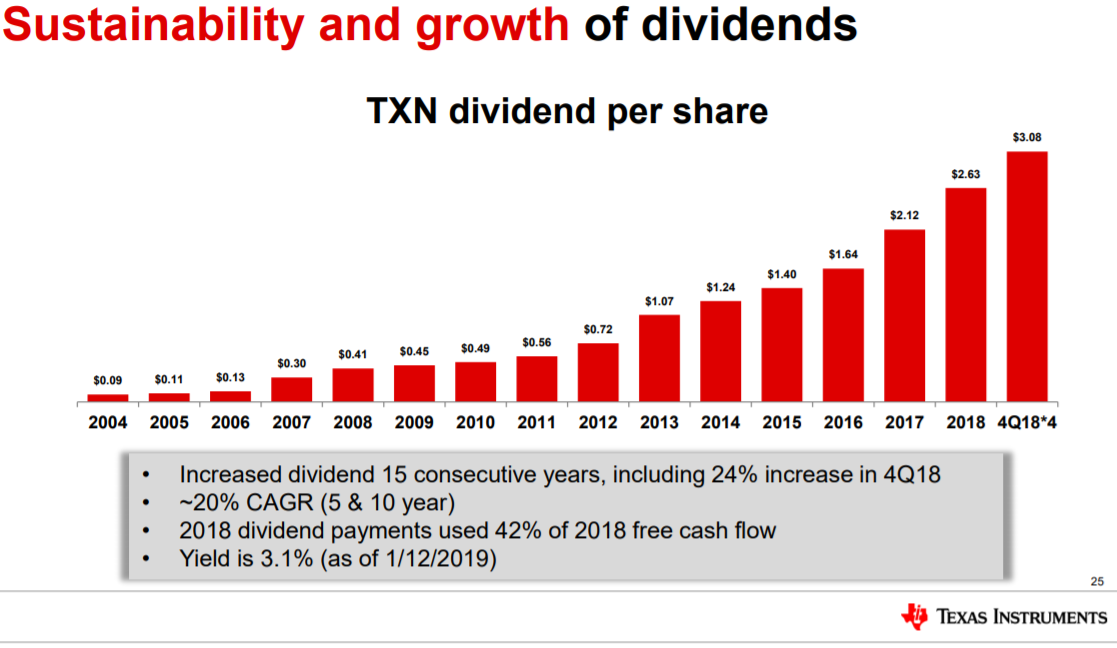

Source: Investor Presentation, page 25

Texas Instruments has used its impressive earnings growth to commit to outstanding capital returns. The dividend has grown by a compound annual growth rate in excess of 26% since 2004, an astounding number that very few companies can rival. Texas Instruments recently raised its dividend by 17%.

Even so, Texas Instruments’ payout ratio is just 56% for this fiscal year. We believe that the company’s tremendous earnings growth outlook, its modest payout ratio, and its commitment to returning all of its excess capital to shareholders combine for a very bright dividend growth outlook.

Texas Instruments has proven the willingness and ability to boost the dividend at very high rates over long periods of time despite the inherent cyclicality in its revenue streams, so we find it to be very attractive for those seeking dividend growth.

10%+ Dividend Growth Stock #2: Microsoft Corp. (MSFT)

Microsoft Corporation was founded in 1975 and today, is one of most valuable companies in the world. It manufactures and distributes software and hardware to businesses and consumers.

The company’s product lines include its ubiquitous Windows operating system, suite of business software offerings, video games through its Xbox platform, and cloud services, among others. The company accrues $140 billion in annual revenue, and has a market capitalization of $1.06 trillion.

The following video further analyzes Microsoft’s business model:

Video Length: 00:12:02

Microsoft has experienced very strong growth in the past few years. The company struggled from 2011 to 2015 until its strategic shift to cloud computing help boost earnings growth through its Azure platform and others.

Cloud growth has continued to fuel the company’s revenue and earnings growth this year.

Source: Earnings Slides

In addition, the company’s extremely popular Office suite of software is now delivered primarily in a SaaS model.

We see high-single-digit earnings-per-share growth annually on the horizon as Microsoft continues to deliver through its cloud platforms, which will allow for revenue and margin growth, in addition to continued share repurchases.

Source: Investor Relations

Microsoft has done a very nice job of returning capital to shareholders, including through the dividend. The company has nearly tripled the amount of cash it allocates to dividends in just the past decade, and we believe it is poised to deliver very strong dividend growth in the future.

Indeed, Microsoft recently raised its quarterly dividend by 11%, and simultaneously approved a new $40 billion share repurchase.

Strong earnings growth and the $130+ billion in unencumbered cash on the company’s balance sheet, combined with a very reasonable payout ratio of just 39% means that Microsoft has lots of runway to grow the payout in the coming years.

10%+ Dividend Growth Stock #1: Visa Inc. (V)

Visa is the world leader in digital payments, as it is active in nearly every country around the world. Visa traces its roots back to 1958 with the first credit card for middle-class consumers. Since then, Visa has grown exponentially, and is now valued at $393 billion and enjoys $23 billion in annual revenue.

Visa has delivered outstanding earnings growth for a long time, as its earnings-per-share rose at an annualized rate of 22% in the past decade. The company’s duopoly with MasterCard (MA) in the payments processing industry has proven to be very profitable over time for both companies, and we see Visa’s outlook as robust.

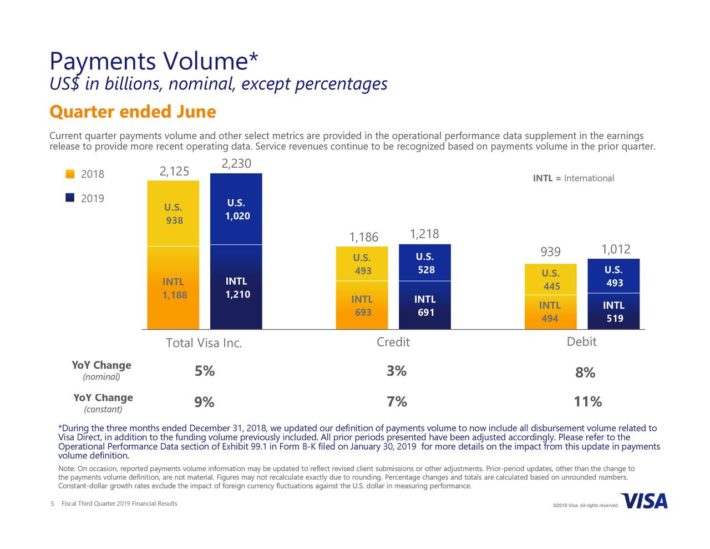

Visa has had a good start to 2019 as well. For the most recent quarter, Visa reported revenue of $5.84 billion, which represented 11.5% growth compared to Q3 2018. This result was aided by continued growth in payments volume (up 5%), cross-border volume (up 2%) and processed transactions (up 12%). Meanwhile, earnings-per-share equaled $1.37 or a 14% year-over-year improvement, as strong bottom line results were helped by a lower share count.

Source: Earnings Slides

We expect 13% annual earnings-per-share growth in the next five years. The company’s outlook is very bright given the move for developed economies to go largely cashless. Visa stands to gain immensely over time as this mega-trend continues. For instance, India and China, two of the most populous countries in the world, still largely lack access to cashless payments, so Visa’s growth runway is still immense.

Given 13% earnings-per-share growth and the diminutive 19% payout ratio, Visa’s runway to materially increase the dividend is huge. We think Visa will have a very easy time producing double-digit dividend growth in the years to come, and believe that investors looking for a dividend growth stock can do much worse than owning this payments processor.

Final Thoughts

Investors should not ignore dividend growth stocks simply because many have low current dividend yields. Companies with strong business models, competitive advantages, and growth potential are attractive regardless of their starting yields. In fact, stocks with lower dividend yields today could actually outperform high-yield stocks if they can grow their earnings and dividends at a high rate over the long-term.

Dividend growth unleashes the power of compounding interest. There are many cases in which dividend growth stocks could produce a higher yield on cost over time than a stock with a higher current yield but little or no dividend growth. These 10 dividend growth stocks have the potential to raise their dividends by 10% per year or more for the foreseeable future, which makes them an attractive combination of dividend yield and growth.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more