The Year Starts With Selling

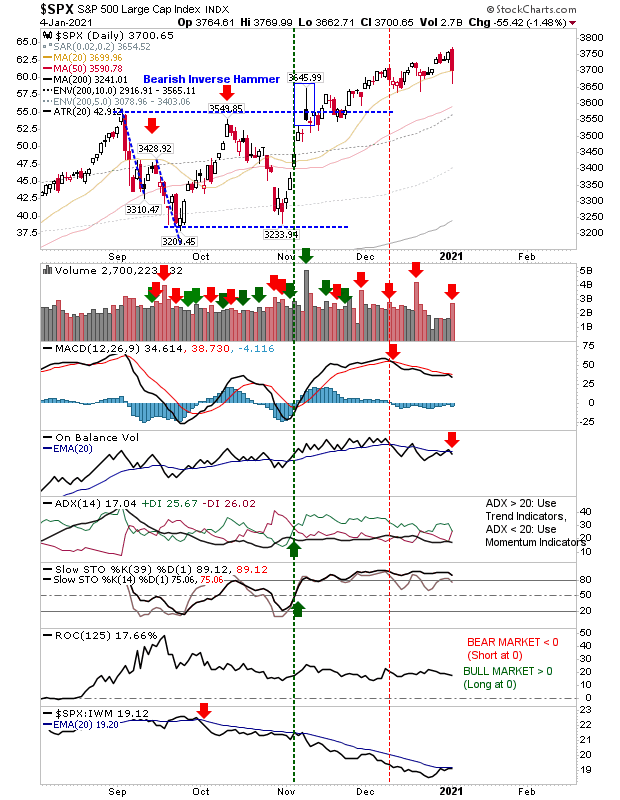

The first day of the New Year starts with selling on heavier volume distribution. Today may be the start of something, but one day's selling does not make a crash.

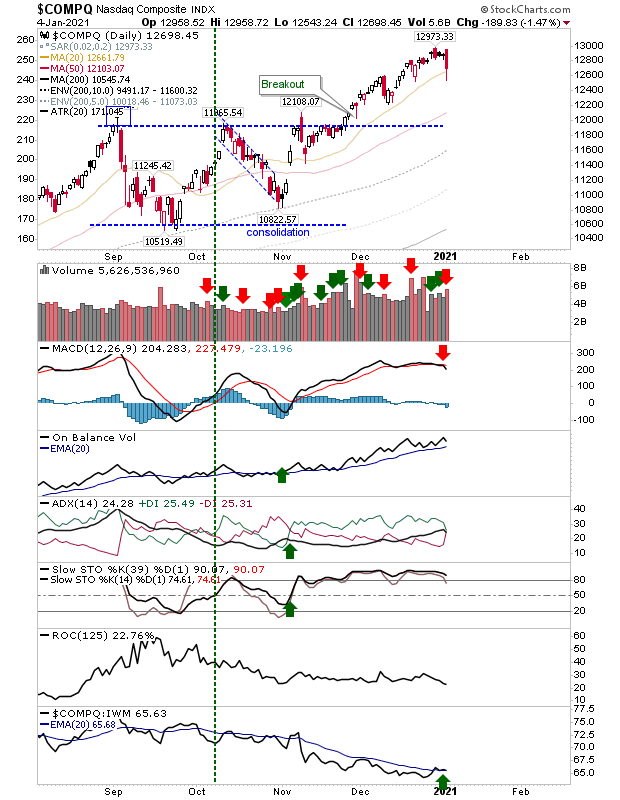

For the Nasdaq, we have the MACD trigger 'sell' but still a bullish cross in relative performance to Small Caps. The selling was looking bad but buyers were able to step in at the 20-day MA.

The S&P similarly sold off on heavy volume with a fresh 'sell' trigger in On-Balance-Volume to follow that of the MACD.

While the Russell 2000 was the first index to turn and did experience distribution today, it was able to successfully defend its 20-day MAs.

The other thing I'm tracking is the relationship of the indices to their 200-day MAs. All are above the 95% zone of historic price extension relative to their 200-day MAs, with the Russell 2000 substantially so at 30.4%, where the 99% level comes in at 21.4% (dating back to 1987) - even after the decline from 201.18 ($IWM). A reversion to mean is coming, and it will look painful, but in real terms, it probably won't make it back to its 200-day MA.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more