The Week Ahead: July CPI, Long WMT Short HD & AMAT

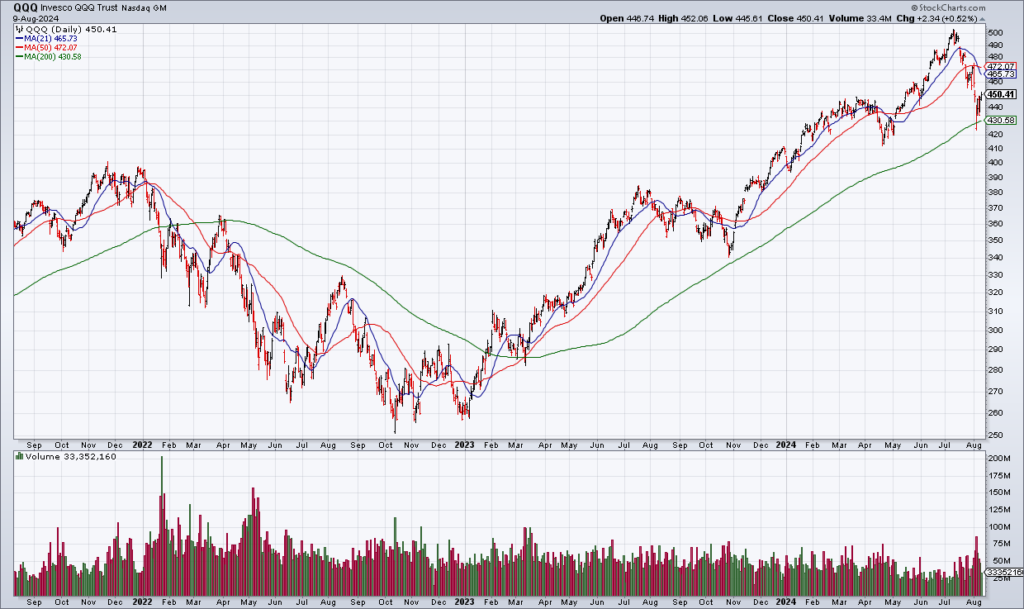

Exactly one week ago the market was setting up for a scary open on Monday August 5. Buffett had sold half his Apple (AAPL) position and the BOJ had hiked interest rates to 0.25% threatening the yen carry trade. The Nikkei – the Japanese stock market – had its worst day since Black Monday 1987 falling more than 12%. But the open was the low of the day for the US markets and stocks gained back everything they lost then over the course of the week. QQQ held its 200 DMA and the bulls continue to maintain control.

(Click on image to enlarge)

The macro highlight this week is the July CPI Report to be released Wednesday August 14 at 8:30am PST. As you can see in the chart above, the market is split on whether the Fed will cut 25 or 50 basis points on September 18. The July CPI Report – along with the August Jobs Report and August CPI Report – will play a decisive role in which way the Fed goes.

(Click on image to enlarge)

On the earnings front, I’m focusing on three companies I have positions in. First in importance for Top Gun is Walmart (WMT) which I have a large long position in and has been a big winner for me. I continue to see WMT as a bastion for the struggling middle class in a tight economy with elevated prices. The low price leader continues to be one of my favorite stocks at the moment and I expect another good report Thursday morning.

(Click on image to enlarge)

First up though is Home Depot (HD) on Tuesday morning which I have a small short position in. The logic is: WMT = Staples, HD = Discretionary. While HD hasn’t really sold off the way I hoped even given five straight quarters of notably negative comps, I expect that eventually it will give way.

(Click on image to enlarge)

Last up is Applied Materials (AMAT) the semiconductor capital equipment maker which I have a marginal short position in. AMAT has sold off hard since early July and the guidance they gave three months ago suggests another mediocre quarter which I don’t expect to reverse the current downtrend.

Note that my long WMT position is 6x the size of my combined short positions in HD and AMAT.

(Click on image to enlarge)

More By This Author:

ABNB Flashes Recession WarningUBER Continues To Crush

The Market Is Starting To Price In A Recession, The Magnificent 7 Are Played Out