The Truth About Tariffs, Inflation And Markets

Image source: Pixabay

If I hear the phrase, “tariffs are a tax” one more time, I’m going to puke!

Listen, can tariffs create higher prices for consumers, sure. However, that isn’t defined as inflation. Inflation is the general rise in prices over time.

For example, if we posted a CPI inflation of less than 2% over the next few months, would anyone in the financial media talk about inflation? No, in fact, they would say that inflation has been tamed. You might ask about the higher level of prices, but they’d still tell you “there isn’t any inflation.”

A tariff is a one-time adjustment, assuming that the tariff level isn’t adjusted higher over time. As a result, there will be no lasting inflationary impact of a tariff on prices.

If a tariff is instituted, it’s important to understand who pays the tariff. Is it end consumers, nope! The rhetoric is constantly misleading in this respect. If Apple Inc. (AAPL) produces an iPhone in China, is it the end consumer who pays it? Nope! Then who does? AAPL pays the tariff!

Of course, the rebuttal will be that Apple will just pass along the higher costs to consumers, as if Apple has perfect pricing power for all of their products. A new iPhone is, after all, a necessity like toilet paper, right?

The answer is no.

Apple is considered a cyclical company for a reason. Their profitability is certainly impacted by the economic cycle. As a result, Apple will go to their supplier and ask them to reduce the price they pay and they will attempt to pass along as much as they can to consumers, but, at the end ofthe day, consumers will decide the price they’re willing to pay.

It goes even deeper than that…

Then There’s the Cognitive Dissonance

Consider those who’ve been advocating for a higher corporate tax: Shouldn’t they be on board with tariffs as a means of getting the largest companies in the world to pay their “fair share” of U.S. taxes?

See, companies like Apple use Ireland and other jurisdictions and methods to reduce their corporate taxation rate substantially. A tariff will force companies like Apple, NVIDIA Corp. (NVDA), and others that produce their products abroad to pay higher taxes.

Commerce Secretary Lutnick had a pretty good moment during a recent interview on CBS. Rhetoric aside, he stated very well the issue we have in the U.S….

We are borrowers from the rest of the world.

We consume more than we produce, and we go deep into debt to be the consumer of the world’s goods. Essentially, we subsidize the world through higher prices for everything domestically - over and above providing other significant subsidies. This is all being done as our debt is exploding.

Are tariffs a tax? Yes, but on those importing goods to the U.S..

Is it a tax on foreign manufacturers? No, but companies will likely be able to negotiate some reduction in the price of goods purchased from them as a result of the tariff.

Is it a tax on consumers? No, but companies may pass on some of the increase in prices to the extent consumers will bear it.

Is it inflationary? No! This is because the increase in prices, if passed on to consumers, will be more of a one-time increase. The tariffs in 2018 to 2019 didn’t see much of any increase in prices over time.

Understanding the Impact on the Stock Market

In this breakdown, who is the only group that is for sure going to pay the tariffs? It is the companies that are importing foreign-produced goods to the United States. Companies like Apple and Nvidia will certainly see margins reduced to the extent that they can negotiate lower prices from producers and pass on to consumers.

As we speak, Walmart Inc. (WMT) is negotiating with producers in China to offset the costs of tariffs. This is especially impactful due to the elimination of the so-called de minimis exemption for goods less than $800 coming from China. The ability to be able to flood our markets with low-dollar goods and ship them for virtually nothing may be over.

The only certainty is that corporate profit margins for importers will be impacted. The only question is the degree of impact. This is leading to uncertainty for equity prices. How do you value a company when you don’t know what margins will look like?

As a result, we’re going to see profitability of some of the biggest companies be hit to some degree. Is it any wonder that we’re experiencing the weakness and uncertainty we’re seeing?

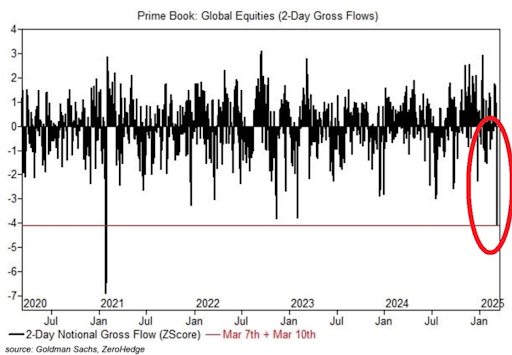

Here is a graph from Goldman Sachs (GS) showing the level of institutional selling.

What this means is that there is a rotation out of the equity markets.

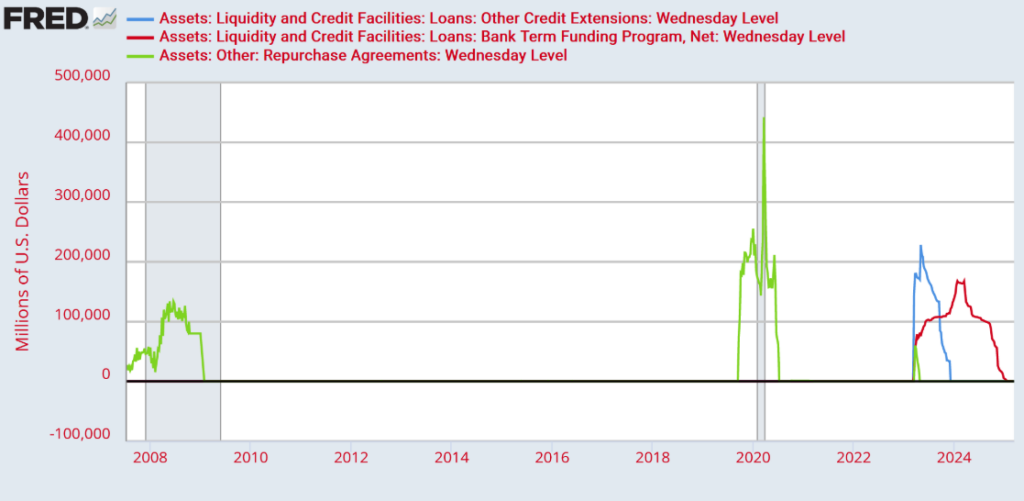

As rotation out of equities is happening, the Fed’s liquidity programs are drying up.

(Click on image to enlarge)

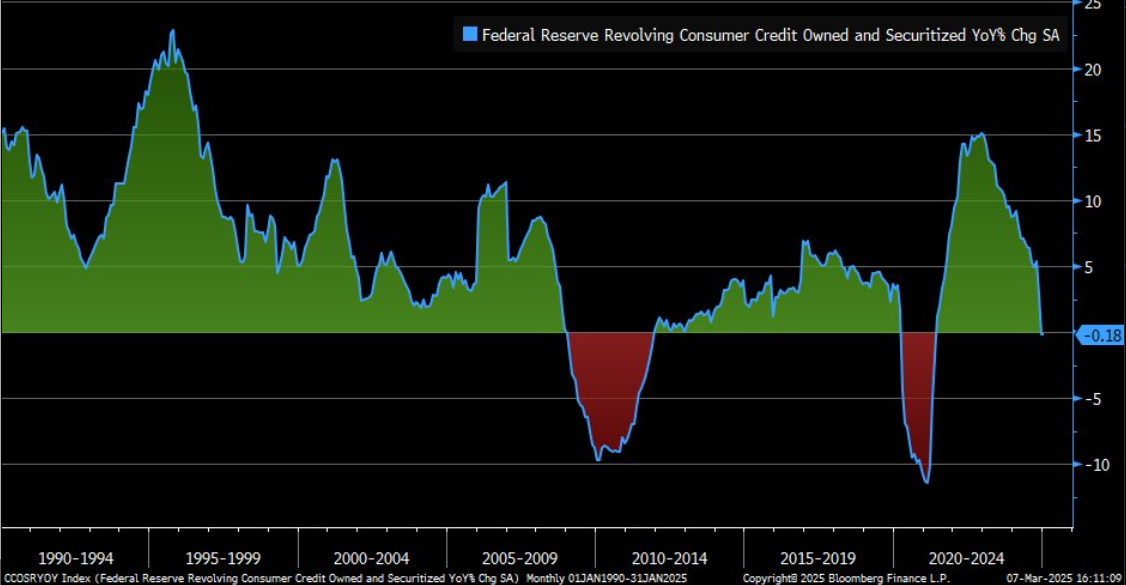

Consumer credit is turning negative.

Here’s the Bottom Line

We’re definitely oversold and may see a bounce here. However, the uncertainties with corporate earnings, the reduction in liquidity operations and the lack of desire for the U.S. to continue to run up the credit card, is a limiting factor for the market at this time.

Yes, there are trading opportunities, but most people have more of the money in 401Ks than they do in their trading accounts. What this means is that any rally could be seen as an opportunity to raise cash levels and reduce market exposure. The unwind of years of buying a bunch of useless crap at 20% interest may be over as we transition to more of a production and savings-based economy. Unfortunately, for socialized equity investors in mutual funds, this may mean hard times ahead. Volatility is a trader’s game and you’ll need to learn the rules. I’ll be there to teach you every step of the way.

More By This Author:

Inflation Isn’t Going Away, But These Sectors Don’t Care

This Market Just Can’t Get Up From The Mat

How To Play Silver During Tariff-Driven Volatility

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more