The Trade Desk: Betting On The Future Of Digital Ads

Image Source: Pixabay

One of the biggest challenges in business is creating awareness of a product or service. That's where advertising comes in.

30 years ago, advertising was an uncertain science. There were only a handful of media outlets that offered any kind of ad distribution. Large companies advertising at a national level had to place ads with the "big 4" television networks, magazines with national distribution (like People or Better Homes and Gardens), or nationally relevant newspapers like The New York Times or USA Today. Local advertisers focused advertising on local TV affiliates, community newspapers, billboards, etc.

Two big issues for buyers in legacy advertising were targeting potential customers and measuring return on investment. Targeting could be done in a broad sense. If you were selling fitness equipment, of course you would want to place more ads in Sports Illustrated than in, say, Vogue.

Return on investment was almost impossible to measure with any reasonable accuracy. That ad your company placed in a national magazine certainly got seen by a lot of people, but did it drive any sales? And if so, how many sales? Enough to earn a return on the cost of placing the ad? Buyers really had little idea.

Enter the internet in the late 1990's and early 2000's.

Of all the businesses the internet upended, advertising has been one of the most affected. The internet began with a digital version of traditional advertising known as "banner ads". Then came the big "walled garden" services like Google (GOOG) and Facebook (META), who used more personalized information such as search terms and history, or "likes" to businesses or organizations, to closely target ads to potential buyers. Now, targeting very specific potential buyers was possible. Instead of broad "potential fitness customers", you could tailor your equipment to people searching specifically for "adjustable weight dumbbells" or "low cost treadmills".

Additionally, digital ad sellers provide super accurate ways to measure ROI on ad spend. Ad dashboards include number of impressions and number of interactions (e.g., clicks). Now, ad buyers knew EXACTLY how their ads performed, allowing them to adjust spend, creative, and targeting to get the maximum return on investment.

Today, digital advertising is evolving again. Virtually all types of media are consumed via digital means. Television consumption has moved to streaming, audio/radio programs to podcasts, newspapers and magazines to websites and mobile apps. Ads are a major part of video games, and even street billboards have turned digital! The "walled garden" approach, though still lucrative, isn't enough to contain the proliferation of digital consumption anymore.

Enter the stock we are looking at today: The Trade Desk (TTD). It has made itself into a "key player" in the next generation of digital advertising. With the stock a long-time member of the Green Screen, and after a 60% share price decline this year, is it a potential buy?

What The Trade Desk Does

When you think about it, there is no possible way most advertisers can efficiently manage their online ad spend.

There are literally tens of thousands of channels offering ad inventory. Every news website, blog, podcast, and ad-supported streaming video presents an opportunity to advertise.

So how can an advertiser know WHERE to spend their money to get the best bang for the buck?

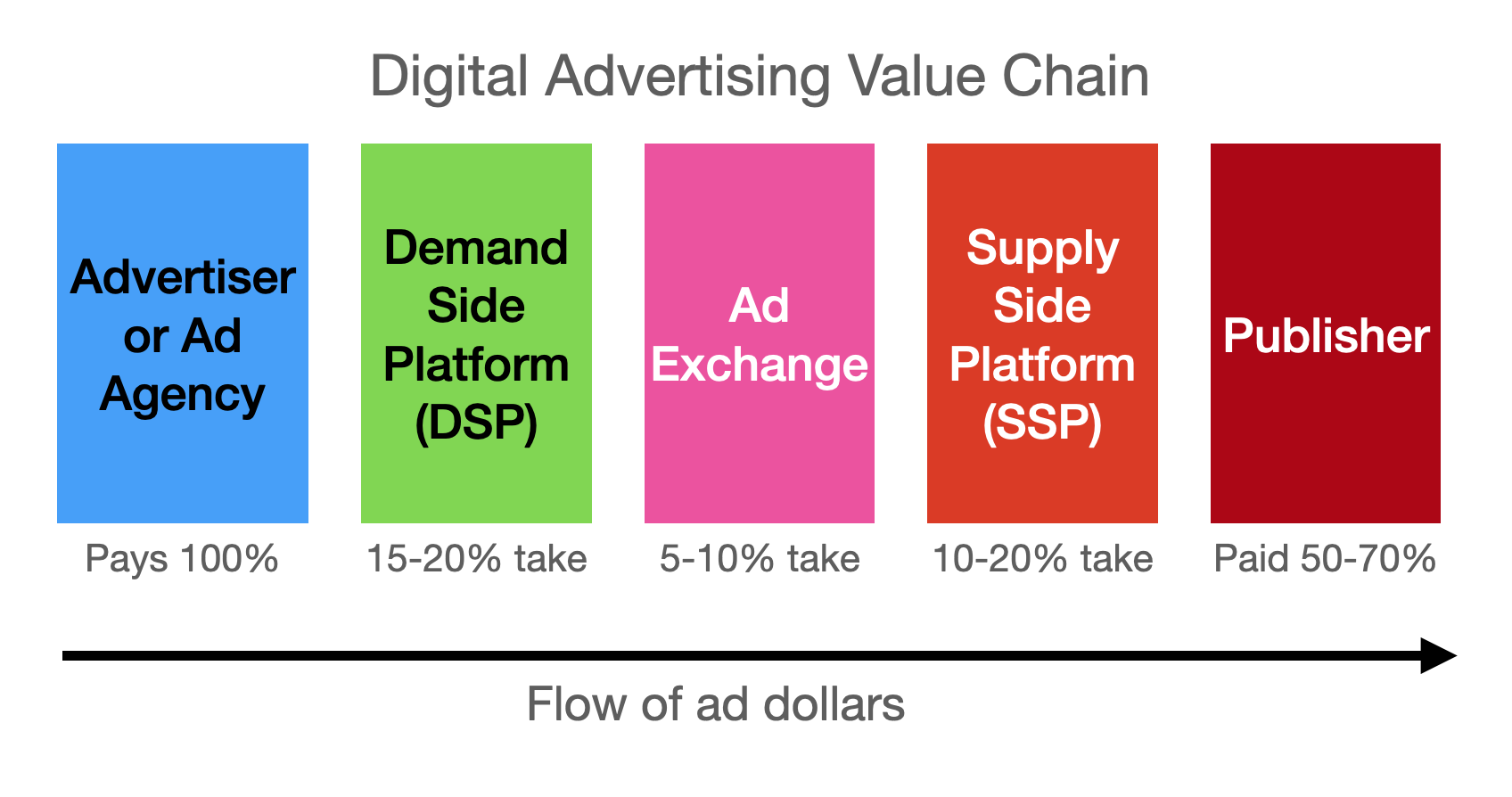

That's where the digital ad value chain comes in. Here's a simplified version:

The Trade Desk's position in this chain is as a Demand Side Platform (DSP). Ad agencies or large advertisers send their ad creatives to TTD and set a budget. They then rely on Trade Desk's programmatic, artificial intelligence (AI) algorithms to distribute those ads to the most relevant and least expensive available ad slots. For this service, Trade Desk takes a 20% cut of the total ad cost.

What value does Trade Desk provide it clients for this cut? 3 things:

- Omni-channel ad opportunities. Trade Desk can place video, audio, or display ads across 350 partners and ad exchanges. It offers its clients visibility everywhere there are digital ads. Connected (streaming) TV ads are about 48% of sales, mobile apps and website ads are 37%, audio/podcast makes up 8%, digital out-of-home (billboards, kiosks, etc.) 5%, and retail media is the remaining 2-3%.

- Audience targeting. Trade Desk has AI that can match the products or services you are advertising to the most relevant audiences at the lowest ad rates. Over time, it gets better and better at targeting its client's ads, improving their ROI without them having to do anything.

- Performance tracking. Trade Desk's advertiser dashboard allows its clients to track the effectiveness of their ad creatives. This helps them develop the highest converting ads possible.

Since Trade Desk's bidding is programmatic, it does all of this with minimal need for a customer to self-manage. With nearly 1 trillion (!) ad impressions per day, Trade Desk is providing a lot of value for a lot of clients!

The Revenue Story

Trade Desk is a growth company. Its 3 year compound annual revenue growth rate stands at 27%.

Going forward, there is every reason to believe Trade Desk can continue 15-20% growth for the foreseeable future. Digital advertising is already an unfathomably large market, over $700 billion worldwide and growing at 10% annually. At a 20% take rate, that would represent a $140 billion revenue opportunity for Trade Desk. Considering the firm does under $3 billion in sales at present, there is massive revenue upside in market share alone.

Perhaps the biggest opportunity is in connected television (e.g. streaming services). Trade Desk already gets nearly half of revenue from this channel, partnering with heavy hitters like Netflix (NFLX), Disney (DIS), Roku (ROKU), and NBC's Peacock service, just to name a few. Ad-supported streaming has become a major trend, with nearly all major streaming services adding ad-supported tiers over the past few years.

The connected TV (CTV) opportunity is clear when you consider traditional TV ad spend. Currently, about $125 billion is spend on traditional TV ads, vs. only about $65 billion on CTV. However, Nielsen reported that streaming TV viewership surpassed cable for the first time ever in 2022, and continues to take viewer share. It is clear that ad spend will continue to move to CTV in the future.

On the recurring side, Trade Desk acts like a "toll collector" on ads run through its platform. Its clients pay the firm many times daily - thousands for large ad buyers! While the volume and cost of ads certainly ebb and flow based on economic conditions, the revenue model can be considered a recurring one.

Leadership and Financials

Without question, one of The Trade Desk's major assets is founder and CEO Jeff Green. He founded the firm in 2009. Through his ownership of 98% of the Class B "super-voting" shares, he controls close to 50% of voting power in the firm.

It's hard to complain about Green's leadership. Not only has he expertly navigated some very competitive waters to establish Trade Desk as one of the leading DSPs, he has done it quite efficiently. Trade Desk is entirely debt-free and generates free cash flow margins exceeding 30%. Cash returns on invested capital exceed 60%. This is one impressive business, financially.

At 48 years old, Green looks poised to continue leading Trade Desk for the foreseeable future. He has received large stock option packages (tied to share price appreciation) and an extension of the Class B sunset provision, both helping to ensure his continued leadership.

The Competitive Picture

Being such a large and emerging market, digital advertising is fiercely competitive. As mentioned, Google and Facebook still own 50% of the market, and other players with natural ad or search inventory like Amazon (AMZN) have entered the fray in a big way. Netflix's recent decision to add Amazon as a favored DSP was an obvious shot across the bow of Trade Desk (previously their primary ad provider).

Even in the "open internet", the DSP portion of the value chain is pretty crowded. Competitors include StackAdapt, Simpli.fi, Criteo, MediaMath, Adelphic, Adform... and many more. There are dozens, as you can see here.

That said, there are some economic moat characteristics at play. Trade Desk retains over 95% of its customers year-to-year through high switching costs, network effects, intangible assets, and economies of scale. It's platform embeds deeply within client's campaign workflows, it has access to some of the most desirable digital ad "real estate" (particularly in streaming TV), its AI-based algorithms have traditionally led to excellent ad ROI for its clients, and its massive reach provides it the ability to fulfill the massive ad needs of large clients. There may be a lot of competition, but few competitors can compete with it in these areas.

Is TTD A Buy?

I've been back-and-forth on Trade Desk since GreenDot Stocks started.

There are definitely risks here. The DSP space has some enormous players - traditionally Google and Facebook, but increasingly Amazon as well. Trade Desk may be the only independent that can compete with these companies in scale, but as we see with the recent Netflix/Amazon deal, they continue to be very challenging competition.

I'm also cognizant that the ad tech space, despite its size and growth, has delivered only a handful of long-term, "pure play" successes. Frankly, that includes Trade Desk, who's stock has been volatile but ultimately has been flat and badly lagged the S&P 500 over the past 5 years.

Then there's the binary event risk of Jeff Green leaving the firm. His acumen is clearly a major competitive advantage. His leaving would instantly make Trade Desk a far less attractive stock. A big pay package in 2021, and the 2025 extension of Class B voting rights were obviously meant to address that concern. There don't seem to be many reasons for him to consider leaving. But it remains a big risk.

All that said, I think now is the time to consider buying it. Much of that under-performance has simply been because the stock has been richly valued - today that is not the case. This remains an addressable market in the hundreds of billions, alleviating the concern of having lots of competition - there is plenty of room for many winners. Trade Desk is an important "neutral" DSP, and also a natural consolidator with its strong financial performance and industry leadership.

What is it worth? I've modeled for about 15% annual revenue growth - well below its 5-year number but more reasonable given guidance. I'm assuming no dilution given the company's increasingly aggressive buyback efforts, a 30% free cash margin (in-line with recent results), and a "par" 10.5% discount rate. That puts the stock's fair value at $59.50, giving us just under the 25% margin of safety we like to see. Let's add Trade Desk to the Watch List and look for an entry point soon.

More By This Author:

Cellebrite: Powering Digital Forensics And GrowthNutanix: A Cloud IT Provider Worth Watching

A Round Of Stock Rejections

Disclaimer: The content is provided for informational purposes only. The material should not be considered as investment advice or used as the basis for stock trades. Content should not be ...

more