The Top Performing S&P 500 Stocks Of 2025: Can Momentum Sustain?

Image Source: Unsplash

It’s been another great year for stocks so far, with the resilience notable given tariff-induced fears among other economic concerns.

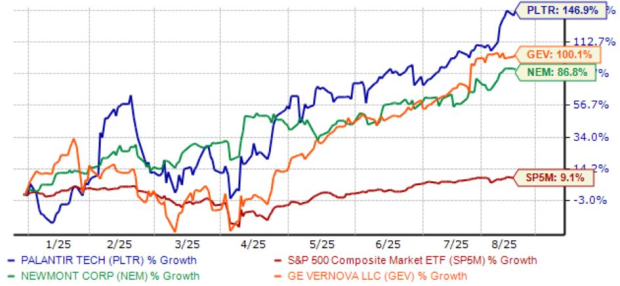

And leading the pack for the S&P 500 this year is none other than AI-favorite Palantir (PLTR - Free Report), energy titan GE Vernova (GEV - Free Report), and gold miner Newmont (NEM - Free Report). As shown below, all three have soared YTD, heavily outpacing the S&P 500’s also impressive 9% gain.

Image Source: Zacks Investment Research

Let’s take a closer look at what’s been driving the positivity.

Palantir Remains Perfect

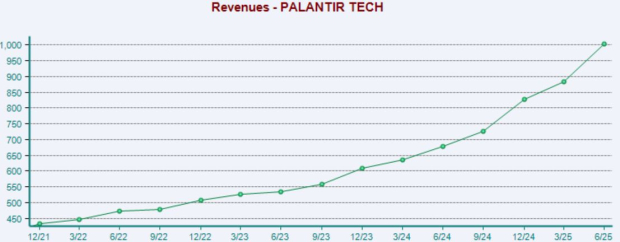

Palantir has rapidly become one of the top AI stocks for investors, with robust quarterly results stemming from red-hot demand paving a highly positive outlook. US commercial revenue grew 93% YoY throughout its latest period, with US government revenue also up an impressive 53%.

Total sales grew 48% year-over-year. Below is a chart illustrating Palantir’s sales on a quarterly basis.

Image Source: Zacks Investment Research

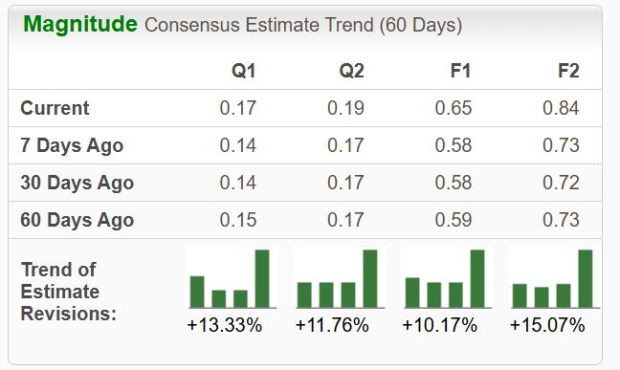

While shares are undoubtedly expensive, the growth can’t be ignored, with consensus expectations for its current fiscal year suggesting 60% EPS growth on 45% higher sales. Analysts have raised their EPS expectations across the board, a bullish sign concerning near-term price action.

Image Source: Zacks Investment Research

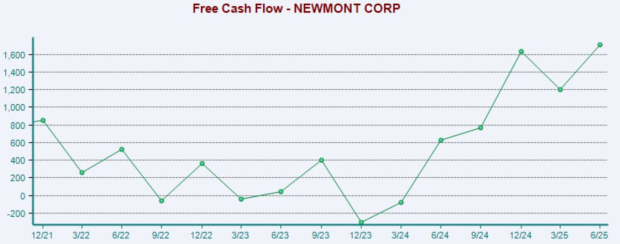

Newmont Posts Record Cash Flows

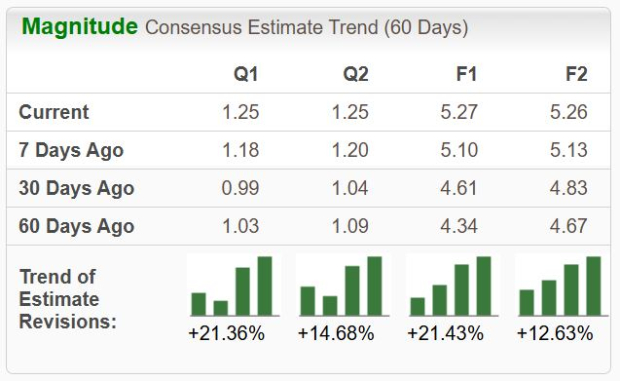

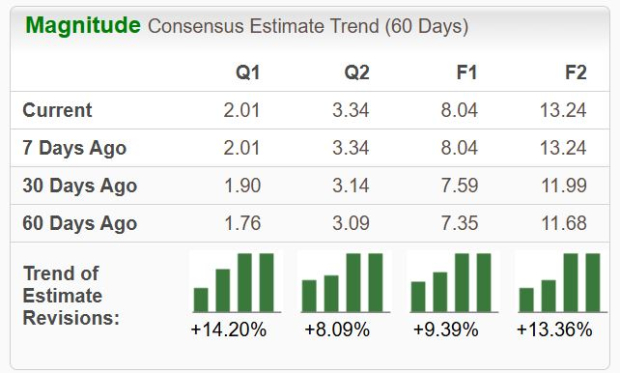

Newmont, one of the world's largest producers of gold, has benefited significantly from the rise in gold. The favorable operating environment has led analysts to revise their EPS expectations notably higher across the board, with the stock also sporting the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The average gold price per oz reached $3,320 throughout Newmont’s latest period, melting higher from the $2,347 mark in the same period last year. Free cash flow of $1.7 billion throughout the period was the company’s highest read ever.

As shown below, the company’s cash-generating abilities have been a notable boost over recent periods. The amplified cash-generating abilities bring about many positives, such as increased dividends and buybacks. And speaking of buybacks, NEM announced an additional $3 billion repurchase program, further adding to the positivity.

Image Source: Zacks Investment Research

GEV Raises Guidance

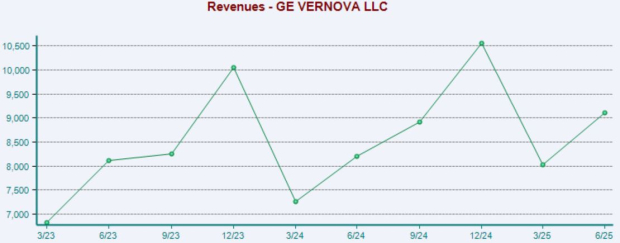

GE Vernova similarly posted robust results in its latest release, raising revenue, adjusted EBITDA margin, and free cash flow guidance for its current fiscal year. The company is an energy equipment manufacturing and services company, benefiting nicely from increased demands for power as we increasingly wade into the digital era.

Analysts have taken note of its favorable position, raising their EPS expectations across the board. The company is expected to see 44% sales growth on 6% higher earnings in its current fiscal year.

Image Source: Zacks Investment Research

Notably, GEV’s orders grew 4% organically year-over-year, also reporting $5.2 billion sequential backlog growth. And to top it off, GEV enjoyed margin expansion thanks to volume, price, and productivity, more than offsetting its investments and the impact of tariffs.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

All three stocks above have helped lead the S&P 500 in 2025, reflecting the top three gainers.

All three companies have benefited big from favorable operating environments, with red-hot demand for Palantir and GE Vernova keeping outlooks bullish. A serious rise in gold prices has similarly benefited Newmont, with its quarterly results reflecting the trend.

Given their positive EPS outlooks, all three stocks look to remain strong in the near-term.

More By This Author:

These Three Companies Shattered Quarterly Records

Dividend-Watch: Three Companies Boosting Payouts

Should You Buy Stock-Splits?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more