The Top Department Store Stocks Beyond 2018, Ranked By Total Return Potential

The department store industry has been important in the U.S. economy for decades. Consumers used to spend a significant portion of their disposable incomes in one of the thousands of department stores across the country. However, changes in the retail industry have made department stores less prominent over the years, as online shopping and more specialized, smaller retailers stole market share.

Due to the changes in the way consumers shop, department store stocks have underperformed the market over the last couple of years, as many investors shifted towards e-commerce companies like Amazon (AMZN) or others.

For those department stores that offer a compelling product portfolio, top-notch customer service and stores in optimal locations where traffic will remain high, the outlook is not all bad. A strong economy, low unemployment, and rising disposable incomes mean that consumer spending is poised to remain strong over the foreseeable future.

Many department stores still generate enough cash flow to pay compelling dividends to shareholders. Of the eight stocks on this list, five pay dividends to shareholders. They can be found on our list of 674 consumer cyclical dividend stocks.

More information can be found in the Sure Analysis Research Database, which ranks stocks based upon their dividend yield, earnings-per-share growth potential and valuation to compute total returns. The stocks are listed in order below, with #1 being the most attractive for investors today.

Read on to see which department store stock is ranked highest in our Sure Analysis Research Database.

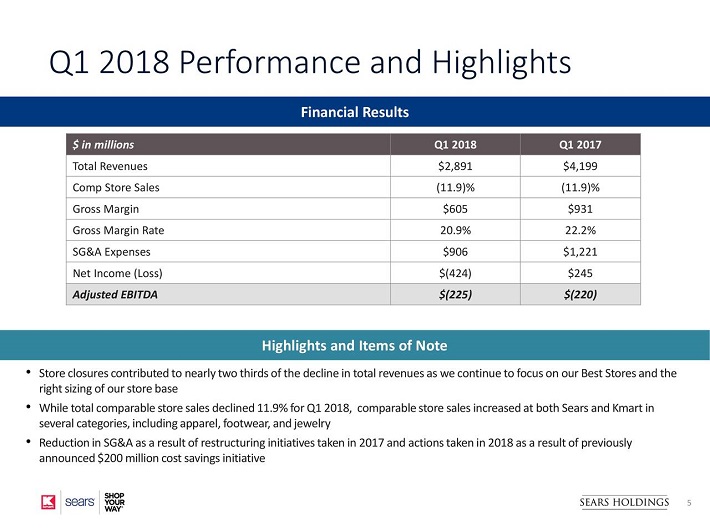

Department Store Stock #8: Sears Holdings

Sears Holdings (SHLD) is the parent company that controls Sears as well as Kmart. The current market capitalization is just $232 million, which is not surprising, as Sears Holdings’ share price crashed from well above $100 to just $2.30. The 2018 first quarter showed continued sales declines, and a net loss.

Source: Investor Presentation

Sears Holdings’ retail brands, Sears and Kmart, have both performed very badly over the last several years. Its existing store base continues to see its comps sales fall, at an 11.9% pace during the most recent quarter, while losing money, even when company-level expenses are backed out.

Sears Holdings has negative equity on its balance sheet, and net earnings as well as cash flows have been negative for years. The company still owns valuable assets, such as its Kenmore brand of appliances. But with negative operating margins, falling sales, and high debt levels, it seems unlikely that the company will be able to recover meaningfully.

Since CEO Eddie Lampert is also one of the major debt holders, restructuring deals or debt-for-equity swaps that could be beneficial for the company’s balance sheet are possible. Management has been able to keep the company alive for longer than some investors believed. As a result, total returns will most likely be negative.

The company can’t be valued based on its book value, its cash flows or its earnings, as these are all negative. Therefore, the only viable metric is the price to sales multiple. Due to falling sales from store closures and comps sales declines, and pressure on its valuation multiples, we estimate that total returns over the coming years will be negative. We expect negative total returns of 20% per year, which would cut the share price by two thirds over the coming five years. In our opinion, investors should avoid Sears Holdings stock.

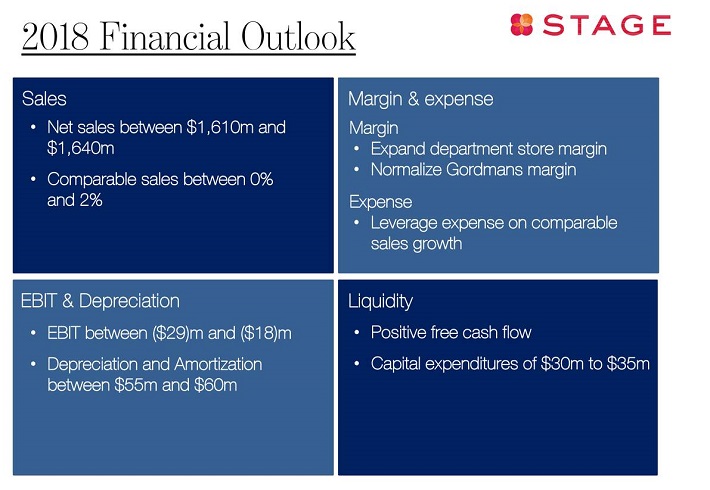

Department Store Stock #7: Stage Stores

Stage Stores Inc. (SSI) is a retail company that operates department stores, smaller retail shops, and off-price shopping locations. It primarily sells accessories such as cosmetics and shoes. Stage Stores stock has a market capitalization of just $64 million.

Stage Stores is investing heavily to grow its store base, but unfortunately that growth has been of a relatively low quality. The company has not been reliably profitable, and during the most recent quarter Stage Stores reported a net loss of $1.14 per share.

Source: Investor Presentation

Stage Stores is not operating at a profit, even when we back out company-level expenses such as interest and taxes. One positive is that Stage Stores produces positive cash flows, even after capital expenditures.

With comps growth at a low-single-digits level and new store openings, Stage Stores might become profitable in the future. The company has stated that Q2-Q4 would be much better than Q1 from a profitability standpoint.

Due to its positive free cash flows, Stage Stores is able to pay dividends to its owners. The low share price has made the dividend yield spike to 8.7%. Stage Stores is one of 402 stocks in our database with a 5%+ dividend yield.

Click here to download your spreadsheet of all 421 high dividend stocks now.

However, the sustainability of the dividend is in question, as Stage Stores is not consistently profitable. The company already cut its dividend last year, so there is precedent for reductions in the dividend when times are tough.

Due to the fact that the company is not reliably profitable, the best way to value the stock is its book value. Future book value declines (as net earnings will likely remain negative over the coming years) will impact total returns negatively by 5%, multiple contraction will be a headwind of ~2% annually. Thanks to the high dividend yield of 8.6% total returns could still be marginally positive, in the 1%-2% range.

Department Store Stock #6: J.C. Penney

J.C. Penney (JCP) is a department store company whose offerings include appliances, clothes, shoes, handbags, jewelry, and more. The company was founded in 1902, and it has a market capitalization of $760 million.

J.C. Penney has been operating profitably during the most recent years, but the company lost $0.22 per share in the 2018 first quarter.

Source: Investor Presentation

J.C. Penney guides for a low-single digits comps sales growth rate during the current year. It expects to be marginally profitable or report a small loss. Sales performance has been positive lately, but margins remain pressured. Cost-cutting efforts that lowered its SG&A expenses were offset by lower gross margins, due to discounts and clearance sales during the most recent quarter.

As the company is not reliably profitable, we value the company based on its book value. We forecast a 1.5% annual book value growth rate, and some multiple expansion towards a 0.65 times price to book ratio. As a result, we believe investors will see total returns of 4%-5% over the coming years.

Department Store Stock #5: Dillard’s

Dillard’s (DDS) is an apparel, cosmetics and home furnishing selling department store company, which operates 290 stores. Dillard’s was founded in 1938, with a market capitalization of $2.6 billion.

Dillard’s reported its highest ever profits during 2014, but has struggled with falling earnings since. Fortunately, the company could return to earnings growth in 2018. It is off to a good start this year, as the company reported 2% comparable sales growth in the first quarter. Sales growth and higher margins led to 17% adjusted earnings growth from the same quarter a year ago.

Share repurchases will help further boost Dillard’s earnings growth. Over the last year its share count declined by 11%. Dillard’s recently authorized a new $500 million share repurchase, which represents close to 20% of the current market capitalization.

Dillard’s has a relatively low dividend yield of 0.4%, which makes it a poor selection for income focused investors. And, the stock trades at an above-average valuation (~17 times this year’s earnings), which will be a headwind for total returns going forward.

Through a combination of 8%-9% earnings per share growth annually, a 3%-4% annual headwind from multiple contraction, and a 0.4% dividend yield, shares of Dillard’s should provide total returns of 5% to 6% annually over the coming five years.

Department Store Stock #4: TJX Corporation

TJX Corporation (TJX) is an off-price retailer that sells apparel as well as home fashion goods, primarily in the U.S., but with international operations as well. TJX has a market capitalization of $59 billion.

TJX has produced compelling earnings growth over the last decade, unlike most of the department store companies in this article. Profits did not decline once during those ten years, which is not surprising, as the company’s comps sales performance has been excellent as well. Over the last 40 years comps declined only once, on an annual basis. The start to the year has been successful as well, as TJX had comps sales growth of 3% in the most recent quarter.

TJX also keeps opening new stores, which is why total revenue growth was quite strong at 12%. Earnings-per-share rose by an even-better 17%. In the long run, earnings per share growth could level off somewhat, as keeping growth at a high level becomes more difficult as a company grows larger. It also will become more difficult for the company to find attractive locations for new stores. We believe that TJX will be able to grow its earnings per share by ~7% annually over the coming five years, through revenue growth, some margin expansion, and share repurchases.

The company has a very strong balance sheet, the company’s interest coverage ratio is above 80. This, combined with the strong operational track record, makes TJX look like one of the strongest department store companies based on its fundamentals. Unfortunately its valuation is higher than it used to be, which will be a headwind for total returns going forward.

We forecast annual total returns of 6%-7% going forward, due to 7% earnings-per-share growth, a 1.6% dividend yield, and negative returns of 2%-3% from valuation compression.

Department Store Stock #3: Kohl’s Corporation

Kohl’s (KSS) operates 1,100 stores, with a market capitalization of approximately $12 billion. Kohl’s earnings were pressured during 2015 and 2016, but started to rise again during 2017, and should continue to do so in 2018. Company management expects for positive comparable sales growth and margin expansion, which should lead to earnings growth this year.

Source: Kohl’s Investor Presentation

Kohl’s expects this year’s earnings per share to increase 26% from 2017, which is a very compelling growth rate. Profits will be also be helped by tax reform.

We believe that earnings per share growth will fall into the mid-single digits range from 2019 to 2023, based on a low-single digits comps sales growth rate, share repurchases, and some margin expansion. Thanks to its strong cash generation, Kohl’s can buy back shares, while also investing in its stores and paying an attractive dividend to its owners.

Kohl’s stock has a 3.4% dividend yield, and the dividend is secure, with a payout ratio below 50%. With positive earnings growth, there is also room to grow over the coming years. Shares of Kohl’s trade at a price-to-earnings ratio of approximately 13.5, which is in line with the historic valuation multiple. Going forward, we expect total returns of 8%-9% for Kohl’s, through the 3.4% dividend yield and 5% annual earnings growth.

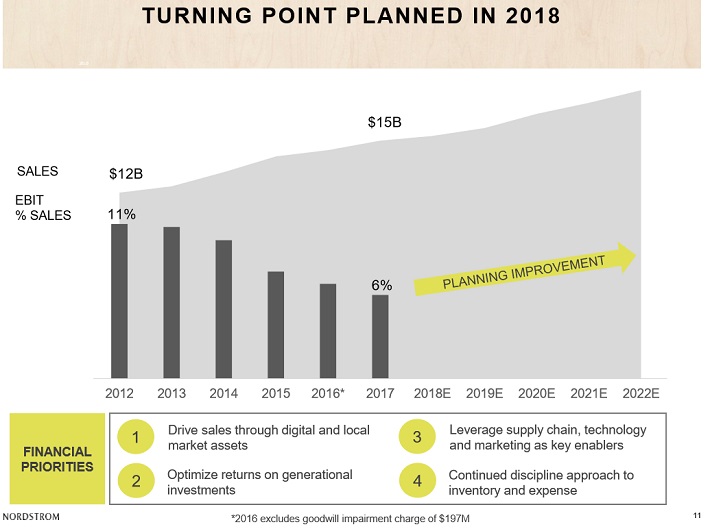

Department Store Stock #2: Nordstrom

Nordstrom (JWN) sells clothes, shoes, accessories and jewelry. It has nearly 400 stores, and the company is focused on the higher-price, premium segment of retail. Nordstrom was founded in 1901.

Nordstrom’s profitability declined slightly over the last couple of years, due to margin pressures, while revenue has held up better.

Source: Nordstrom Investor Presentation

The margin pressure resulted from a shift toward its lower-margin off-price stores, whereas its full-priced stores’ sales did not grow as much over the last couple of years. Management states that 2018 earnings-per-share will return to growth, as guidance for the current year calls for 19% growth. Earnings will be positively impacted by tax reform.

Nordstrom will likely start repurchasing shares again, because the company holds a sizeable cash position. Share buybacks would positively impact earnings per share growth going forward. Due to its dividend payout ratio being just above 40%, the company has a lot of room to repurchase stock, while also lowering debt levels.

Shares of Nordstrom trade almost exactly in line with the historic average, around 15 times earnings. As a result, total returns over the next five years will consist of the 2.9% dividend yield, and 6% annual earnings growth.

Department Store Stock #1: Macy’s (M)

Macy’s (M) operates department stores under three brands–Macy’s, Bloomingdale’s and Bluemercury. It has a sizable e-commerce business as well. Macy’s was founded in 1929 and has a market capitalization of $11.3 billion.

Macy’s reported declining profits during 2015 and 2016, but 2017 was a more successful year for the company. Management anticipates continued earnings growth in 2018. The start to the year was relatively strong, as Macy’s reported 3.9% same-store sales growth in the first quarter.

Macy’s forecasts see an earnings per share increase of 2% during 2018, while we forecast 3% annual earnings growth over the next five years. Earnings growth will be driven by comparable sales growth and some margin expansion.

Shares of the company trade at 9.5 times this year’s earnings, which is a low valuation relative to the broad market, and also a discount relative to how the company’s shares were valued in the past. Investors also get a relatively high dividend yield of 4.1%, and the dividend payout appears to be secure. Macy’s has a dividend payout ratio below 50%.

We expect that Macy’s will provide annual total returns of a slightly more than 9% through 2023, through a combination of 3% earnings per share growth, 2% returns from a higher valuation multiple, and the 4.1% dividend yield.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more