The Top 6 Beer Stocks For Dividends And Growth

Beer stocks, just like the beverages, come in several different forms. Companies that are engaged in the beer industry offer direct exposure through manufacturing and distribution of beer, while companies in adjacent industries offer indirect exposure through equity stakes in beer companies.

The beer industry is attractive for long-term income investors. Beer companies enjoy tremendous recession-resistance and consistent profits, which are used in large part to pay dividends to shareholders.

Beer Stock #6: Anheuser-Busch InBev SA/NV (BUD)

- 5-year expected annual returns: 3.4%

Anheuser-Busch InBev SA/NV is the largest brewer in the world thanks to the 2008 merger of InBev and Anheuser-Busch and the 2016 acquisition of SABMiller. The company produces, markets and sells over 500 different beer brands around the world and owns five of the top ten beer brands and 18 brands with over $1B in sales. These include Budweiser, Stella Artois and Corona.

The company is also well diversified geographically, with about 70% market share in Brazil and 50% market share in the U.S. In 2018, revenue was globally sourced in the following percentages: 28.4% North America, 40% Latin America, 15.3% Europe, Middle East and Africa, and 15.5% Asia Pacific.

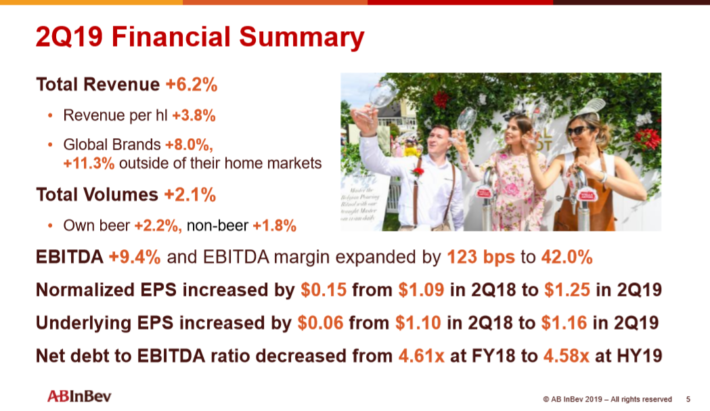

Source: Investor Presentation

Second-quarter fiscal 2019 earnings were strong. AB InBev achieved solid growth as total revenue increased 6.2%, revenue per hl was up 3.8%, global brands grew by 8%, and they saw 11.3% growth outside of home markets, reflecting increasing global brand adoption. Total volumes overall were up 2.1%, driving EBITDA growth of 9.4% and EBITDA margin expansion by a very strong 123 basis points.

These results reflect the staying power of the company’s two main competitive advantages: a material cost advantage over its peers and its brand power. AB InBev’s production, distribution, and procurement scale are much larger than competitors, enabling it to exert both pricing power in sourcing its products as well as achieve economies of scale.

Its brand power is significant given that it owns five of the world’s largest beer brands, three of which are considered premium. These result in strong customer loyalty while also attracting many new beer consumers given their popularity and reputation for excellence.

Furthermore, the premium brands enjoy higher margins than non-premium brands, making them more profitable for the company and drive its superior returns on invested capital.

The main risk for AB InBev is its significant international exposure, meaning that fluctuating foreign exchange rates materially impact its results. The company is also highly exposed to Latin America (48% of EBIT), making it heavily dependent on one of the more economically and geopolitically volatile regions of the world.

Overall, we expect the company to deliver 3.4% annualized returns over the next half-decade as the 2.1% dividend yield and the 3% expected annual earnings-per-share growth will be somewhat offset by a 1.4% annual headwind from a compressing valuation multiple.

Beer Stock #5: Constellation Brands (STZ)

- 5-year expected annual returns: 3.9%

Constellation Brands was founded in 1945 and has grown into a global alcoholic beverage giant, producing and distributing over 100 brands of beer, wine, and spirits, including Corona, Modelo Especial, Modelo Negra, Pacifico, Ballast Point, Funky Buddha Brewery, Robert Mondavi, Clos du Bois, Kim Crawford, Mark West, Black Box, SVEDKA Vodka, Casa Noble Tequila and High West Whiskey. The company also has a stake in cannabis company Canopy Growth.

Q1 fiscal year 2020 results for the period ending May 31st, 2019 included $2.097 billion in total sales (2% year-over-year growth), 7.4% year-over-year growth in beer sales, flat year-over-year earnings-per-share of $2.21, and updated guidance for FY 2020 that raised the midpoint earnings-per-share number by $0.15 to $8.80. The beer business (70% of total sales) is expected to grow at a solid clip while wine and spirits are both expected to decline due to dispositions.

Constellation Brands has enjoyed strong growth over the past decade, and it expects to continue leveraging its strong brands portfolio (including six of the top fifteen imported beer brands in the United States) to continue its impressive growth streak. A strong growth tailwind will be the demographic shift towards more Hispanics and Millennials in the United States, both of which tend to consume more of the company’s products than the rest of the population.

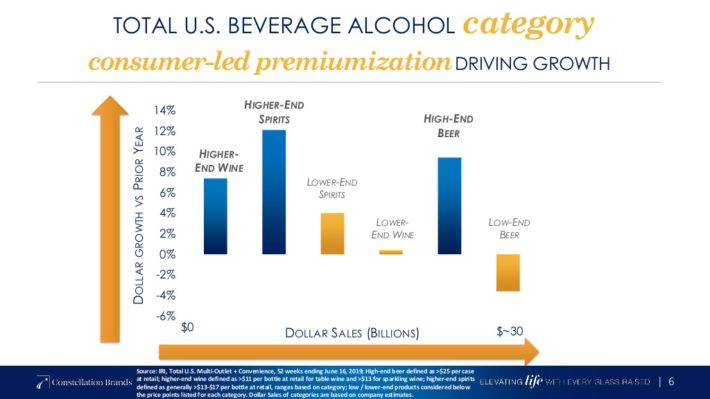

Source: Investor Presentation

Furthermore, Constellation Brands’ positioning as the third-largest beer producer in the U.S. with the accompanying economies of scale and its large portfolio of brands with deep relationships with distributors, retailers, and other channels and strong consumer loyalty give it durable competitive advantages.

These competitive advantages have driven steady margin expansion over time and very robust returns on invested capital which have averaged over 21% over the past five years.

Despite its clear strengths, Constellation Brands does have some risks. These include its heavy dependence on Mexican Beer (which supplies over two-thirds of its operating profits), ongoing and intensifying competition from sizable rivals, and its large stake in Canopy Growth.

Overall, we view Constellation Brands as a high risk, high reward stock with an uncertain outlook and anticipate it delivering an uninspiring 3.9% total returns due to a shrinking valuation multiple posing a -5.2% annualized headwind that offsets much of the returns from its expected 8% annual earnings-per-share growth and its 1.5% dividend yield.

Beer Stock #4: Diageo (DEO)

- 5-year expected annual returns: 5.8%

Diageo is one of the oldest and largest alcoholic beverages companies. It dates all the way back to the 17th century and today owns 20 of the world’s top 100 spirits brands and has a market capitalization of around $100 billion.

Diageo manufacturers popular spirits and beer brands, such as Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and many more.

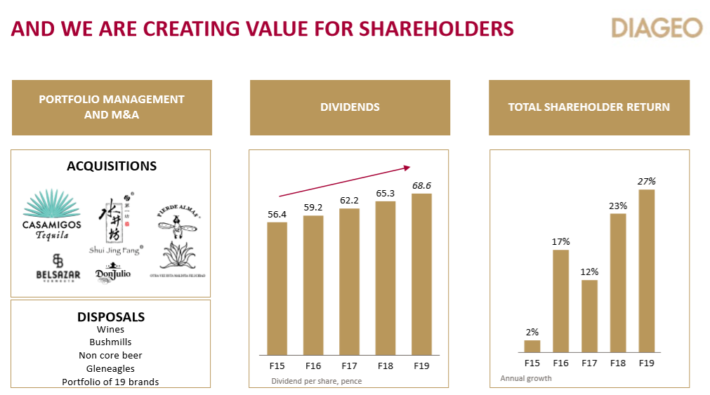

Source: Investor Presentation

In fiscal year 2019, the company saw continued solid growth as net sales grew by 5.8% to $16.1 billion. Excluding currency fluctuations, organic revenue improved by 6.1% with a 2% increase in volumes. While beer volumes declined by 4%, revenues still grew by 1% organically due to price increases. The company saw strong 18% volume growth in ready to drink beverages.

Overall, the majority of Diageo’s brands reported an increase in sales during the quarter, led by Don Julio (up 32%), Ketel One (up 15%), Crown Royal (up 10%) and Smirnoff (up 7%). Ciroc vodka sales were down 6% and was the lone brand to show a decline.

The company also saw organic growth across all of its globally diversified geographies: 9% organic growth in Asia Pacific and Latin America/Caribbean and U.S. organic sales were up 5%.

Even more impressive was the fact that the company’s profitability improved substantially even as sales were also growing, with operating margin rising by 107 bps to 31.4%. Management used this improved profitability to increase shareholder returns by repurchasing $3.5 billion worth of stock during the fiscal year.

Similar to its peers, Diageo’s strong growth is driven by its brand power and lower cost competitive advantages. With 3 of the top 10, 13 of the top 50, and 20 of the world’s top 100 global premium distilled spirits brands, the company enjoys strong consumer loyalty and new consumer preference.

This not only leads to steady sales and strong access to sellers (i.e., bars, pubs, restaurants, and retailers), it also enables them to charge higher prices and increase their margins and returns on invested capital.

Furthermore, the company’s large global volume gives them strong pricing power with suppliers and better economies of scale in production and distribution, cutting costs and further improving margins and economies of scale.

In addition to the typical geopolitical, economic, and foreign exchange risks shared by all global alcoholic beverage producers, Brexit poses a unique risk to Diageo. Given that it is headquartered and produces much of its product in Scotland, potential increases in tariffs with the E.U. could hurt the firm’s competitiveness and/or profitability in one of its major markets.

Overall, we expect the company to generate 5.8% annualized total returns over the next half-decade as 8% earnings-per-share growth and a 2.6% dividend yield are somewhat offset by a 4.8% annual headwind from a compressing valuation multiple.

Beer Stock #3: Ambev SA (ABEV)

- 5-year expected annual returns: 9.0%

Ambev SA is the largest brewer in Latin America, with a presence in 16 countries and producing and distributing alcoholic and non-alcoholic beverages.

Its main business is beer, with brands including Skol, Brahma, Antarctica, Quilmes, Labatt, Presidente, and also has a licensing agreement to produce, bottle, sell and distribute Budweiser, Stella Artois, and Corona in South America.

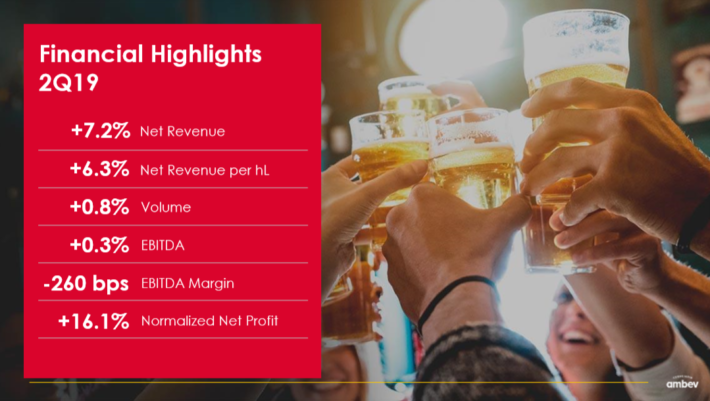

Source: Investor Presentation

Ambev’s second-quarter fiscal 2019 results were strong, with growth across the business. Net revenue increased 7.2%, net revenue per hl was up by 6.3%, and volumes across the business grew by 0.8%, driving 0.3% EBITDA and 16.1% normalized net profit growth.

The one downside was that inflation and currency exchange volatility in the company’s outsized Latin American market exposure ate into EBITDA margins, resulting in a significant 260 basis point decline. Still, the company’s business continues to achieve healthy growth and we believe that over the long term, these inflationary and foreign exchange figures will generally revert to the mean. As a result, our positive long term outlook for the company remains intact.

The company boasts dominant market share in several countries (68% market share in Brazil, 81% in Argentina, 96% in Bolivia, 90% in Paraguay and 95% in Uruguay) that gives it economies of scale, pricing power, and strong brand loyalty. As a result, we expect Ambev to remain a major force in the alcoholic beverages industry for a long time.

Its risks include 86% revenue exposure to South and Central America, meaning that it is heavily dependent on the health and stability of Latin American economies, currencies, and government.

Thanks in large part to its attractive 5.1% dividend yield, we anticipate the company delivering 9% annualized total returns over the next five years as a 2% annual headwind from a shrinking multiple will be more than offset by 5.9% expected annual earnings-per-share growth.

Beer Stock #2: Molson Coors Brewing Company (TAP)

- 5-year expected annual returns: 11.6%

Molson Coors Brewing Company was founded all the way back in 1873 and has since grown into one of the largest U.S. brewers, with a variety of brands including Coors Light, Coors Banquet, Molson Canadian, Carling, Blue Moon, Hop Valley, Crispin Cider, and Miller Lite through a joint venture called MillerCoors.

In addition to its sizable U.S. presence, the company has diversified internationally into Canada, Europe, Latin America, Asia, and Africa.

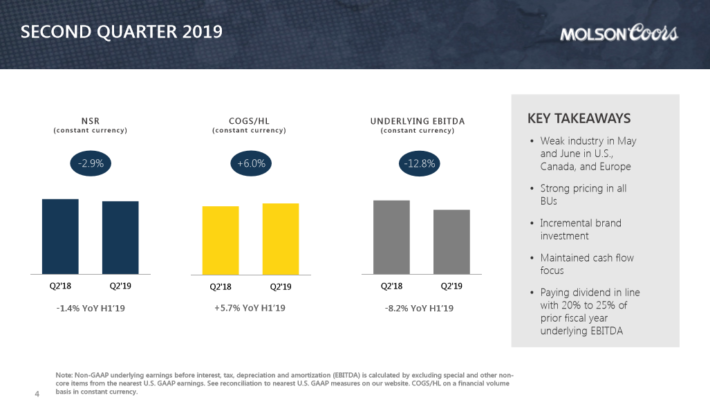

Source: Investor Presentation

Second-quarter fiscal 2019 results showed a mid-single-digit (4.4%) decline in revenue year-over-year thanks to volume declines and unfavorable foreign currency shifts. This also weighed on the bottom line, as adjusted earnings-per-share came in at $1.52 compared to $1.88 in the prior-year period.

On the bright side, the company is continuing its deleveraging efforts and increased the dividend by a dramatic 39% to $0.57 per quarter, providing a strong bullish signal to investors of management confidence in the company’s future.

This confidence stems from the company’s brand power. As the second-largest brewer by volume in the United States with 24% market share, Molson Coors enjoys long-standing, entrenched relationships with distributors, retailers, restaurants, bars, and pubs as well as strong consumer loyalty.

As a result, even though recent results have disappointed, the long term outlook for the company remains solid, especially as their balance sheet continues to improve. Furthermore, the company’s international markets will likely continue to be a source of growth, offsetting any lingering sluggishness in the U.S. beer market.

The primary risk facing the company is its heavy dependence on the U.S. beer market, which recently has been lackluster and weighing down its overall results significantly. Furthermore, as the business grows internationally, they will face increasing foreign exchange, geopolitical, acquisition/integration, and regulatory risks.

Overall, we view Molson Coors as a highly attractive opportunity, which combines a 2.6% annualized boost from P/E multiple expansion, 5.0% annualized earnings-per-share growth, and a 4.0% dividend yield, resulting in an attractive annualized total return projection of 11.6%.

Beer Stock #1: Altria Group (MO)

- 5-year expected annual returns: 20.9%

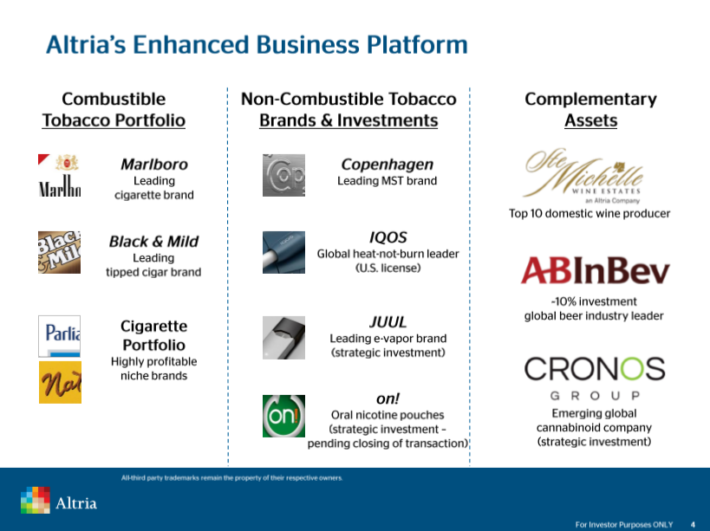

Altria Group was founded by Philip Morris in 1847 and today has grown into a consumer staples giant. While it is primarily known for its tobacco products, it is significantly involved in the beer business due to its 10% stake in global beer giant Anheuser-Busch InBev.

Source: Investor Presentation

Altria’s second-quarter earnings showed that its smokeable products shipment volume surprised analysts by rising 0.4% whereas they expected the business to experience a 10.6% decline. On the other hand, the smokeless products shipments declined by 3.6%.

However, the company’s investments in growing businesses such as vaping and Anheuser-Busch InBev should help offset this headwind.

The company is also planning to invest up to a billion dollars in a new buyback program to further bolster its earnings-per-share numbers. Management is also in talks with Philip Morris International to engage in an all-stock merger that could result in numerous synergies, thereby unlocking more value for shareholders.

Altria has several other reasons to be bullish about its future. These include aggressive investments in new growth products, strong brand power and customer loyalty, high barriers to entry, recession resistance, and a growing international presence that would only increase with a merger with Phillip Morris.

That being said, several risks remain here. First and foremost, there is no escaping the fact that cigarette volumes seem bound for continued declines. Additionally, management is paying heavily for efforts to sustain earnings-per-share growth, such as the high multiple for equity in JUUL (which faces its own public image, legal, and regulatory challenges right now).

However, despite these risks we continue to view Altria favorably, due in large part to its excellent dividend history and high yield. Altria recently raised its dividend for the 50th consecutive year, which placed it on the list of Dividend Kings.

The video below examines Altria’s dividend safety in detail following its most recent quarterly results.

Video Length: 00:08:38

It is not only our most attractive pick in the beer stock space, but it is one of the most attractive stocks in our entire coverage universe, with 20.9% annualized expected total returns stemming from 8.8% annualized margin expansion, forecasted 4% annual earnings-per-share growth, and an 8.1% dividend yield.

Final Thoughts

The beer industry has numerous players with global diversification and strong competitive advantages. Each offers investors a unique angle on the market. Some focus heavily on individual geographies, such as Molson Coors in the U.S. market and Ambev in Latin America, while Altria offers indirect exposure to the beer industry.

Companies that operate in beer widely enjoy strong profits and the ability to withstand even the deepest recessions. Beer is a product that should continue to see steady demand each year, and the largest beer stocks enjoy high-profit margins thanks to their ability to raise prices over time.

These six beer stocks have positive growth prospects and return cash to shareholders through hefty dividends. Risk-averse income investors looking for high yields and steady dividend payouts should take a closer look at beer stocks.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

Beer... a consumer good that does great in both good times and bad!