The Top 3 Candy Stocks For Growth & Dividends

The candy industry sits at a crossroad. On one hand, the industry must adapt to changing consumer preferences toward healthier, fresher food choices.

Consumers are steadily moving away from center aisle staples, including processed and pre-packaged foods.

On the other hand, many of the well-known candy makers have exceptional brand names that still lead their portfolios.

These brands can continue to generate profits and cash flow that will support the industry’s future of innovation through new products, and acquisitions.

If candy makers can effectively respond to changing consumer preferences, investors could stand to generate sweet returns.

All three stocks on this list pay dividends to shareholders. You can see the entire list of consumer-cyclical dividend stocks here.

With that in mind, this article will discuss three of the top U.S. candy companies, including their business models, growth outlooks, and total expected returns.

Candy Stock #1: Hershey (HSY)

Hershey needs no introduction. It is arguably the most well-known candy company in the U.S., with a large number of popular brands.

With its leading market share and multiple brands among the leaders in the candy industry, Hershey claims to be the “undisputed U.S. Leader in Confection:”

Source: Hershey 2019 CAGNY Conference

With six of the top 10 brands, including namesake Hershey, along with Reese’s, Kit Kat and Ice Breakers, it’s not difficult to make a case for Hershey being included as a top candy business.

The case for the stock is not quite as straight forward, but Hershey does have positive qualities.

First, the company has a proven history of success. Since 2007, Hershey has been able to grow earnings-per-share by a compound rate of 9% per year. Even during the last recession, Hershey posted earnings-per-share of $2.08, $1.88, $2.17 and $2.55 during the 2007 through 2010 stretch.

Moreover, Hershey has an attractive dividend, which has increased by a compound rate of 8.4% per year. The combination of steady growth and dividends fueled annual returns of nearly 12% since 2007.

This year the expectation is for Hershey to earn approximately $5.65 per share, and generate annual growth of 7%-8% over time. Scaling this back slightly, If Hershey were able to accomplish 6% growth over the intermediate-term, this would imply ~$7.50 in earnings-per-share after five years.

Over the past couple of decades, shares of Hershey have traded hands with an average P/E ratio of about 20 times earnings or higher. At 20 times earnings, this would imply the potential for a future price of $150.

Add in five years’ worth of dividends, likely to total $15 or more in the coming half-decade, and Hershey stock could have a future value of $165.

Against the current share price near $116, this implies the possibility of 7-8% annual total returns. Granted this is not spectacular, but it is important to note that this takes into account earnings and dividend growth that has been below the company’s historical rate.

Candy Stock #2: Mondelez International (MDLZ)

After Kraft Foods Group spun-off its North American grocery business in 2012, the company became Mondelez International. In its current form, Mondelez has several powerful brands:

Source: Mondelez 2019 CAGNY Conference

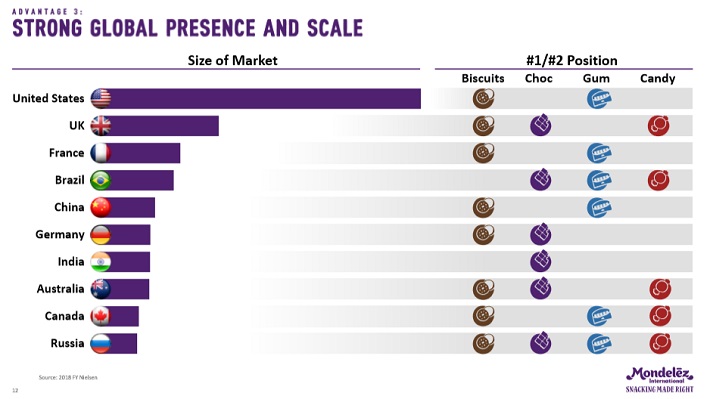

Popular names like Oreo, Cadbury and Chips Ahoy stand out. While the company does not have quite the same recognition as Hershey in the U.S., you can see that it has a strong position in candy and other markets throughout the world:

Source: Mondelez 2019 CAGNY Conference

Since 2012, Mondelez has grown earnings-per-share by nearly 10% per year, while shares returned nearly 13% per year. Moving forward the company anticipates being able to grow earnings at a high single-digit rate.

If this growth were to come at 7% per year, from the base of an adjusted $2.43 posted in 2018, this would mean the potential for Mondelez to earn $3.40 or so after five years.

At 20 times earnings, on par with the company’s historical average, this would imply the potential for a future share price of $68.

In addition, investors would anticipate collecting $6 or more in cash dividends along the way, or a total value of ~$74, keeping in mind that this is one possibility out of a wide variety of potential outcomes.

Against the current share price near $50, this would imply 8-9% annual returns. Much like with Hershey, it is worth remembering both the quality of the underlying business and the idea of presuming a slower growth rate moving forward.

Candy Stock #3: Tootsie Roll Industries (TR)

Tootsie Roll is known for its iconic namesake brand, but it also has a variety of additional brands like Tootsie Pop, Dots, Andes, Junior Mints, Double Bubble, Sugar Daddy, Caramel Apple Pops, and others:

Source: Tootsie Roll

Since 2008, Tootsie Roll grew earnings-per-share by roughly 6.5% per year, while the dividend is increased each year by a nominal amount. Shares have returned about 7% annually since the end of 2007, a respectable albeit unspectacular rate of return.

Tootsie Roll is unique in that it does not grow particularly fast, but the stock continues to trade at a lofty valuation – around 30 times earnings. The reasoning is likely two-fold: a conservative and consistent business paired with being a majority-owned, family business.

Still, if the business were to earn $1.25 after five years – implying roughly 5% annual growth from today – a P/E ratio of 30 would mean the potential for a share price of ~$37.50, more or less in line with the current price.

In other words, the $0.36 annual dividend – representing a 1% starting yield – may be all investors could expect from this point. This expected return is perhaps not so sweet.

Final Thoughts

In short, the candy industry has two main problems today. Much like many of its processed food peers, a declining interest in the core product puts into question the future growth rate of the industry.

In addition, the major candy stocks widely trade at above-average valuations. Collectively these two points could make for sour investor returns.

Of course, there are reasons for a positive outlook as well. The well-known candy brands are still very profitable, allowing the companies to fund growth initiatives, whether that means innovating new products, or entering new product categories through acquisitions.

In the meantime, shareholders at least receive solid dividend yields from the major candy stocks.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

Yummy article.