The Top 10 Semiconductor Stocks Now

Industry Overview

A semiconductor is a material with an electrical conductivity value that is in-between conductors and insulators.

The investment case for semiconductors is fairly straightforward: they are a crucial component in manufacturing electronic devices, such as smartphones, tablets, and computers. But they are also used across a number of other industries such as healthcare, defense, communications, transportation, and more.

With such importance to our daily lives, it’s no wonder the semiconductor industry has grown to its current size. In 2021, semiconductor sales were expected to reach nearly $553 billion. According to Statista, the global semiconductor market is expected to surpass $600 billion in 2022.

![]()

Source: Statista

Looking at this kind of impressive growth, it is understandable for investors to be interested in the top semiconductor stocks.

The following section will discuss the top 10 semiconductor stocks today, ranked by expected annual returns according to the Sure Analysis Research Database.

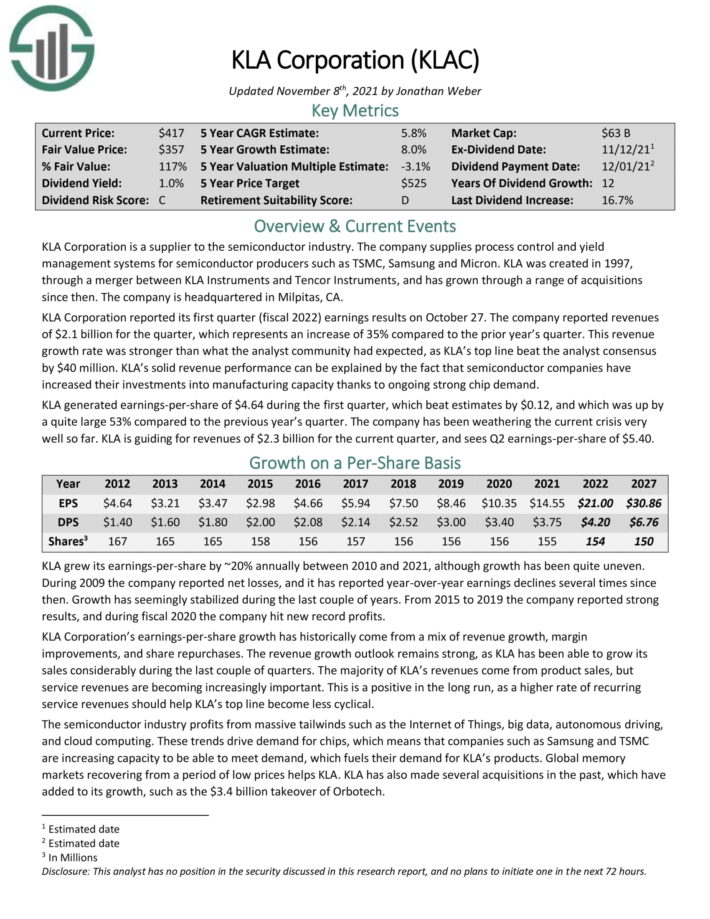

Semiconductor Stock #10: KLA Corp. (KLAC)

- 5-year expected annual returns: 7.4%

KLA Corporation is a supplier to the semiconductor industry. The company supplies process control and yield management systems for semiconductor producers such as TSMC, Samsung and Micron. KLA was created in 1997, through a merger between KLA Instruments and Tencor Instruments, and has grown through a range of acquisitions since then.

KLA Corporation reported its first quarter (fiscal 2022) earnings results on October 27. The company reported revenues of $2.1 billion for the quarter, which represents an increase of 35% compared to the prior year’s quarter. This revenue growth rate was stronger than what the analyst community had expected, as KLA’s top line beat the analyst consensus by $40 million. KLA’s solid revenue performance can be explained by the fact that semiconductor companies have increased their investments into manufacturing capacity thanks to ongoing strong chip demand.

Click here to download our most recent Sure Analysis report on KLAC (preview of page 1 of 3 shown below):

(Click on image to enlarge)

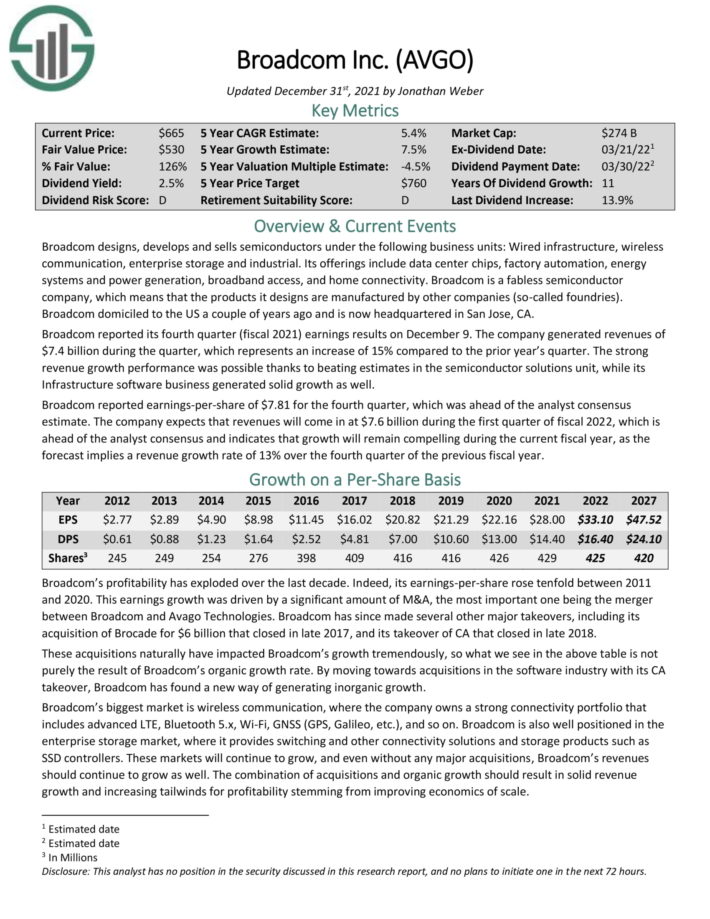

Semiconductor Stock #9: Broadcom Inc. (AVGO)

- 5-year expected annual returns: 7.5%

Broadcom designs, develops and sells semiconductors under the following business units: Wired infrastructure, wireless communication, enterprise storage and industrial. Its offerings include data center chips, factory automation, energy systems and power generation, broadband access, and home connectivity. Broadcom is a fabless semiconductor company, which means that the products it designs are manufactured by other companies (so–called foundries).

Broadcom reported its fourth quarter (fiscal 2021) earnings results on December 9. The company generated revenues of $7.4 billion during the quarter, which represents an increase of 15% compared to the prior year’s quarter. The strong revenue growth performance was possible thanks to beating estimates in the semiconductor solutions unit, while its Infrastructure software business generated solid growth as well.

Click here to download our most recent Sure Analysis report on AVGO (preview of page 1 of 3 shown below):

(Click on image to enlarge)

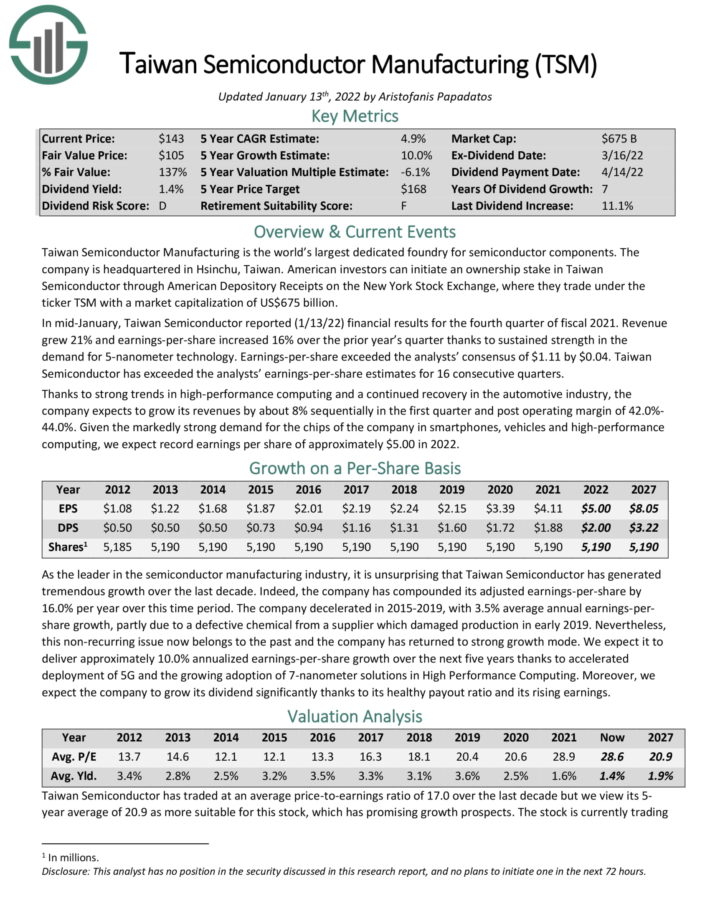

Semiconductor Stock #8: Taiwan Semiconductor Manufacturing (TSM)

- 5-year expected annual returns: 7.9%

Taiwan Semiconductor Manufacturing is the world’s largest dedicated foundry for semiconductor components. The company is headquartered in Hsinchu, Taiwan. TSM has a market capitalization of US$642 billion.

In mid–January, Taiwan Semiconductor reported (1/13/22) financial results for the fourth quarter of fiscal 2021. Revenue grew 21% and earnings–per–share increased 16% over the prior year’s quarter thanks to sustained strength in the demand for 5–nanometer technology. Earnings–per–share exceeded the analysts’ consensus of $1.11 by $0.04. Taiwan Semiconductor has exceeded the analysts’ earnings–per–share estimates for 16 consecutive quarters.

Click here to download our most recent Sure Analysis report on TSM (preview of page 1 of 3 shown below):

(Click on image to enlarge)

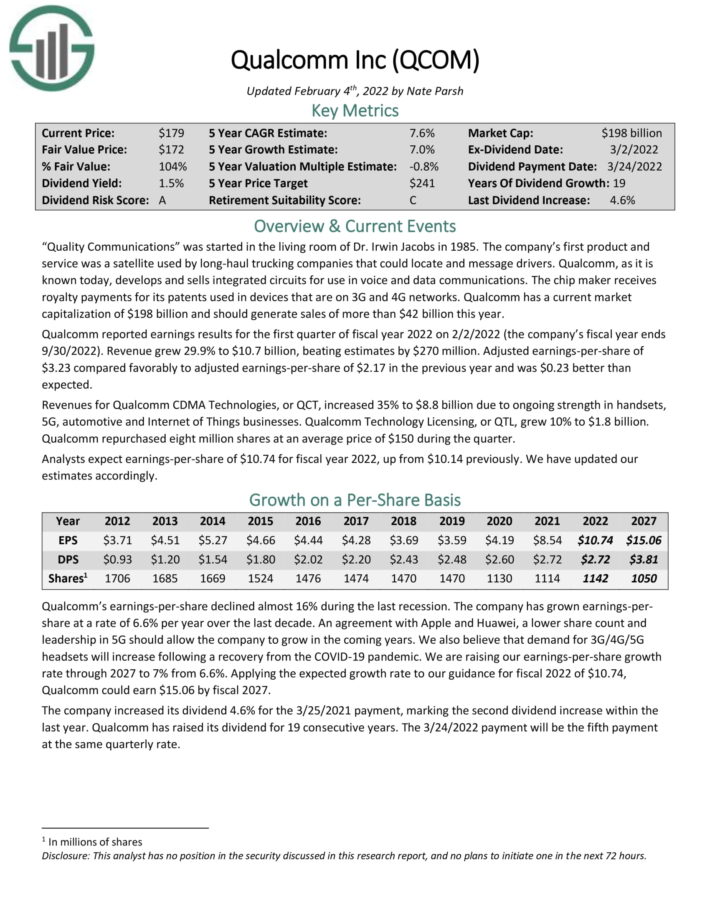

Semiconductor Stock #7: Qualcomm Inc. (QCOM)

- 5-year expected annual returns: 8.3%

“Quality Communications” was started in the living room of Dr. Irwin Jacobs in 1985. The company’s first product and service was a satellite used by long–haul trucking companies that could locate and message drivers. Qualcomm, as it is known today, develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G and 4G networks. Qualcomm should generate sales of more than $42 billion this year.

Qualcomm reported earnings results for the first quarter of fiscal year 2022 on 2/2/2022 (the company’s fiscal year ends 9/30/2022). Revenue grew 29.9% to $10.7 billion, beating estimates by $270 million. Adjusted earnings–per–share of $3.23 compared favorably to adjusted earnings–per–share of $2.17 in the previous year and was $0.23 better than expected.

Click here to download our most recent Sure Analysis report on QCOM (preview of page 1 of 3 shown below):

(Click on image to enlarge)

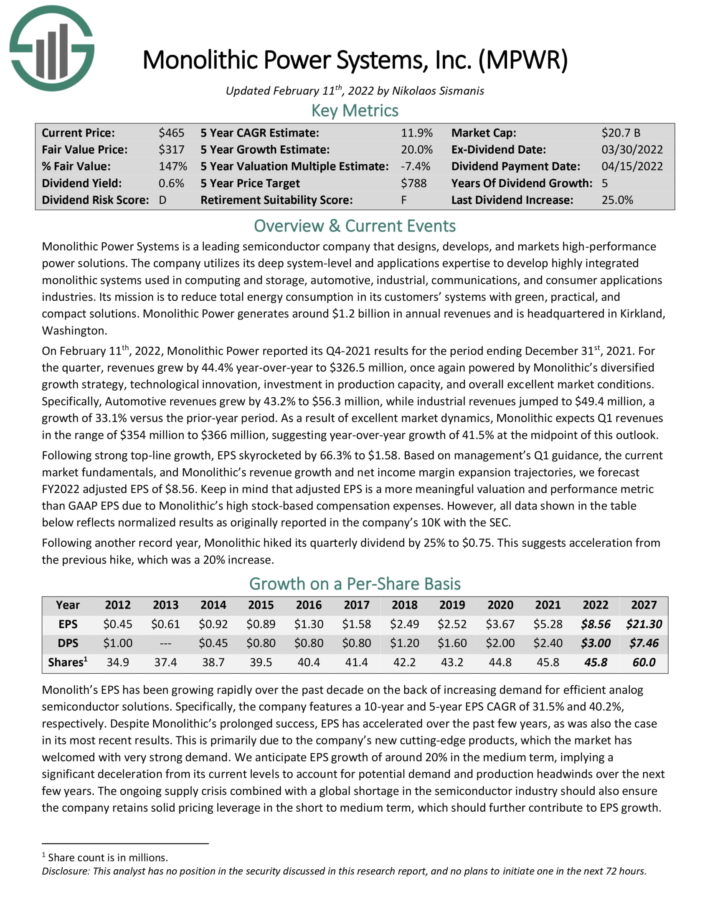

Semiconductor Stock #6: Monolithic Power Systems (MPWR)

- 5-year expected annual returns: 11.2%

Monolithic Power Systems is a leading semiconductor company that designs, develops, and markets high–performance power solutions.

The company utilizes its deep system–level and applications expertise to develop highly integrated monolithic systems used in computing and storage, automotive, industrial, communications, and consumer applications industries. Its mission is to reduce total energy consumption in its customers’ systems with green, practical, and compact solutions. Monolithic Power generates around $1.2 billion in annual revenues.

On February 11th, 2022, Monolithic Power reported its Q4–2021 results for the period ending December 31st, 2021. For the quarter, revenues grew by 44.4% year–over–year to $326.5 million, once again powered by Monolithic’s diversified growth strategy, technological innovation, investment in production capacity, and overall excellent market conditions.

Specifically, Automotive revenues grew by 43.2% to $56.3 million, while industrial revenues jumped to $49.4 million, a growth of 33.1% versus the prior–year period.

As a result of excellent market dynamics, Monolithic expects Q1 revenues in the range of $354 million to $366 million, suggesting year–over–year growth of 41.5% at the midpoint of this outlook.

Click here to download our most recent Sure Analysis report on MPWR (preview of page 1 of 3 shown below):

(Click on image to enlarge)

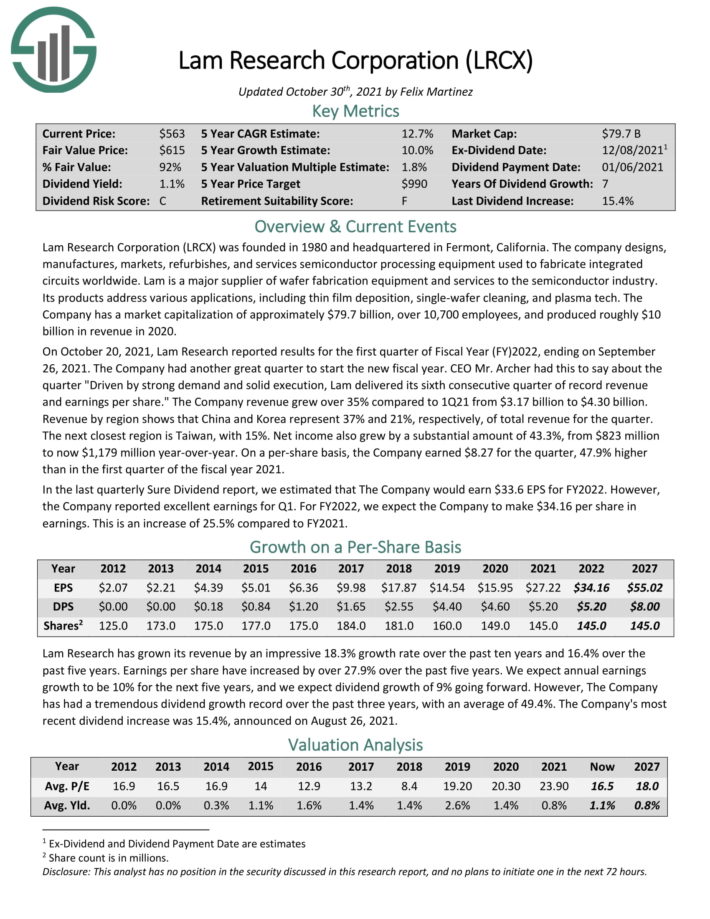

Semiconductor Stock #5: Lam Research Corp. (LRCX)

- 5-year expected annual returns: 11.5%

Lam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used to fabricate integrated circuits worldwide. Lam is a major supplier of wafer fabrication equipment and services to the semiconductor industry.

Its products address various applications, including thin film deposition, single–wafer cleaning, and plasma tech. The company produced roughly $10 billion in revenue in 2020.

Click here to download our most recent Sure Analysis report on LRCX (preview of page 1 of 3 shown below):

(Click on image to enlarge)

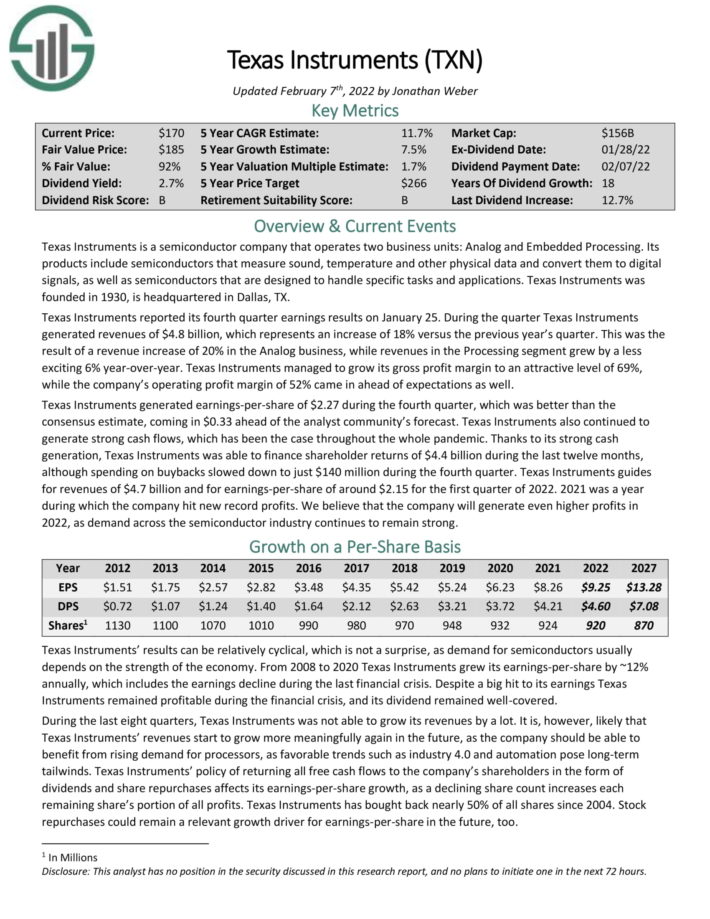

Semiconductor Stock #4: Texas Instruments (TXN)

- 5-year expected annual returns: 12.2%

Texas Instruments is a semiconductor company that operates two business units: Analog and Embedded Processing. Its products include semiconductors that measure sound, temperature and other physical data and convert them to digital signals, as well as semiconductors that are designed to handle specific tasks and applications.

Texas Instruments reported its fourth quarter earnings results on January 25. During the quarter Texas Instruments generated revenues of $4.8 billion, which represents an increase of 18% versus the previous year’s quarter. This was the result of a revenue increase of 20% in the Analog business, while revenues in the Processing segment grew by a less exciting 6% year–over–year. Texas Instruments managed to grow its gross profit margin to an attractive level of 69%, while the company’s operating profit margin of 52% came in ahead of expectations as well.

Click here to download our most recent Sure Analysis report on TXN (preview of page 1 of 3 shown below):

(Click on image to enlarge)

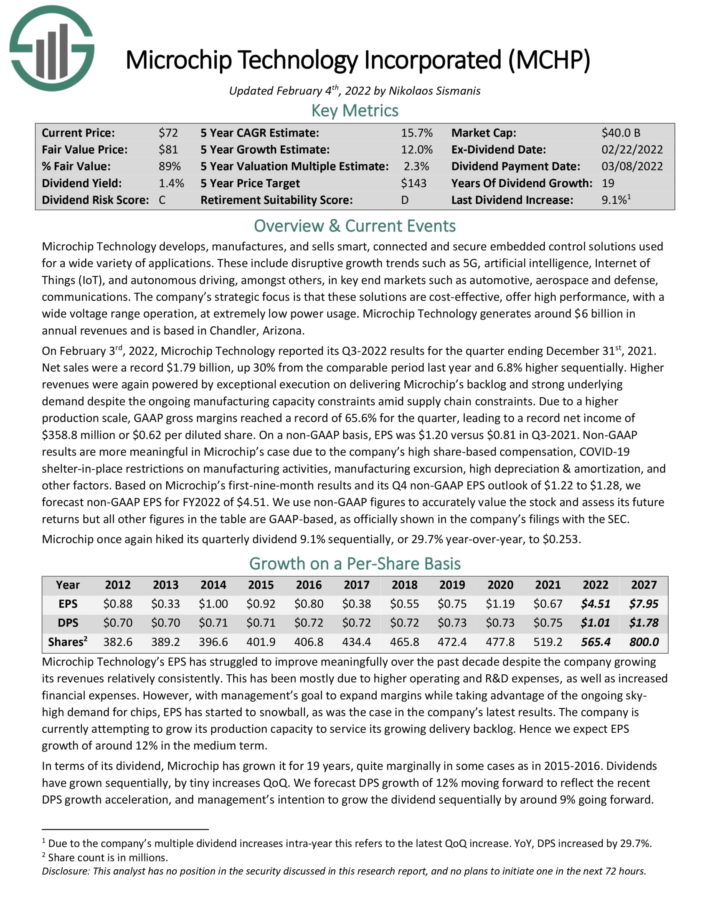

Semiconductor Stock #3: Microchip Technologies (MCHP)

- 5-year expected annual returns: 14.9%

Microchip Technology develops, manufactures, and sells smart, connected and secure embedded control solutions used for a wide variety of applications. These include disruptive growth trends such as 5G, artificial intelligence, Internet of Things (IoT), and autonomous driving, amongst others, in key end markets such as automotive, aerospace and defense, communications.

The company’s strategic focus is that these solutions are cost–effective, offer high performance, with a wide voltage range operation, at extremely low power usage. Microchip Technology generates around $6 billion in annual revenues and is based in Chandler, Arizona.

On February 3rd, 2022, Microchip Technology reported its Q3–2022 results for the quarter ending December 31st, 2021. Net sales were a record $1.79 billion, up 30% from the comparable period last year and 6.8% higher sequentially. Higher revenues were again powered by exceptional execution on delivering Microchip’s backlog and strong underlying demand despite the ongoing manufacturing capacity constraints amid supply chain constraints.

Due to a higher production scale, GAAP gross margins reached a record of 65.6% for the quarter, leading to a record net income of $358.8 million or $0.62 per diluted share

Click here to download our most recent Sure Analysis report on MCHP (preview of page 1 of 3 shown below):

(Click on image to enlarge)

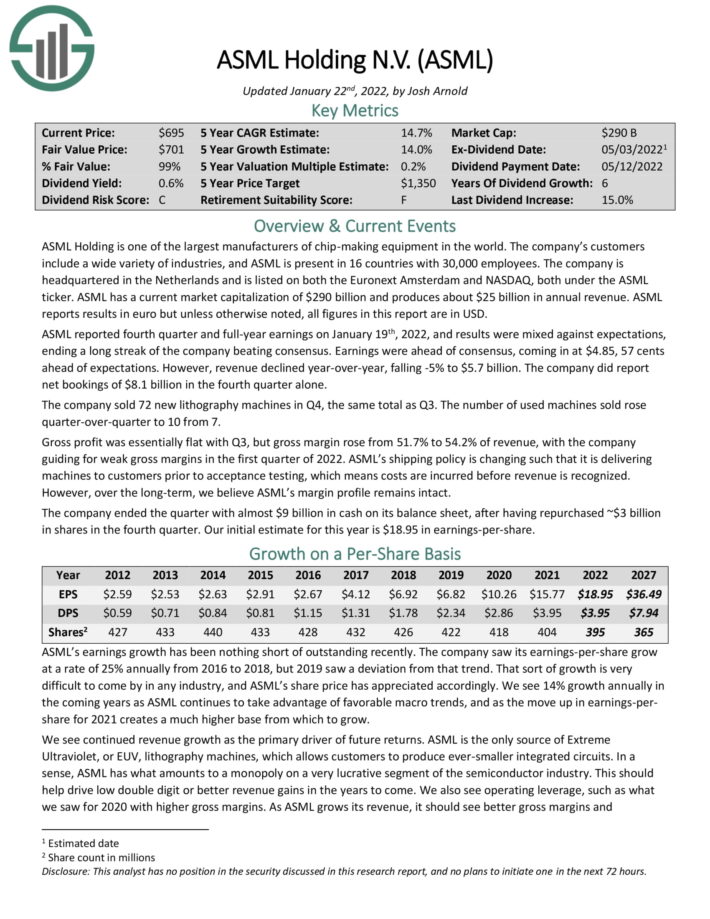

Semiconductor Stock #2: ASML Holding NV (ASML)

- 5-year expected annual returns: 16.0%

ASML Holding is one of the largest manufacturers of chip–making equipment in the world. The company’s customers include a wide variety of industries, and ASML is present in 16 countries with 30,000 employees. The company is headquartered in the Netherlands and is listed on both the Euronext Amsterdam and NASDAQ.

ASML has a current market capitalization of $290 billion and produces about $25 billion in annual revenue. ASML reports results in euro but unless otherwise noted, all figures in this report are in USD.

ASML reported fourth quarter and full–year earnings on January 19th, 2022, and results were mixed against expectations, ending a long streak of the company beating consensus. Earnings were ahead of consensus, coming in at $4.85, 57 cents ahead of expectations. However, revenue declined year–over–year, falling –5% to $5.7 billion. The company did report net bookings of $8.1 billion in the fourth quarter alone.

Click here to download our most recent Sure Analysis report on ASML (preview of page 1 of 3 shown below):

(Click on image to enlarge)

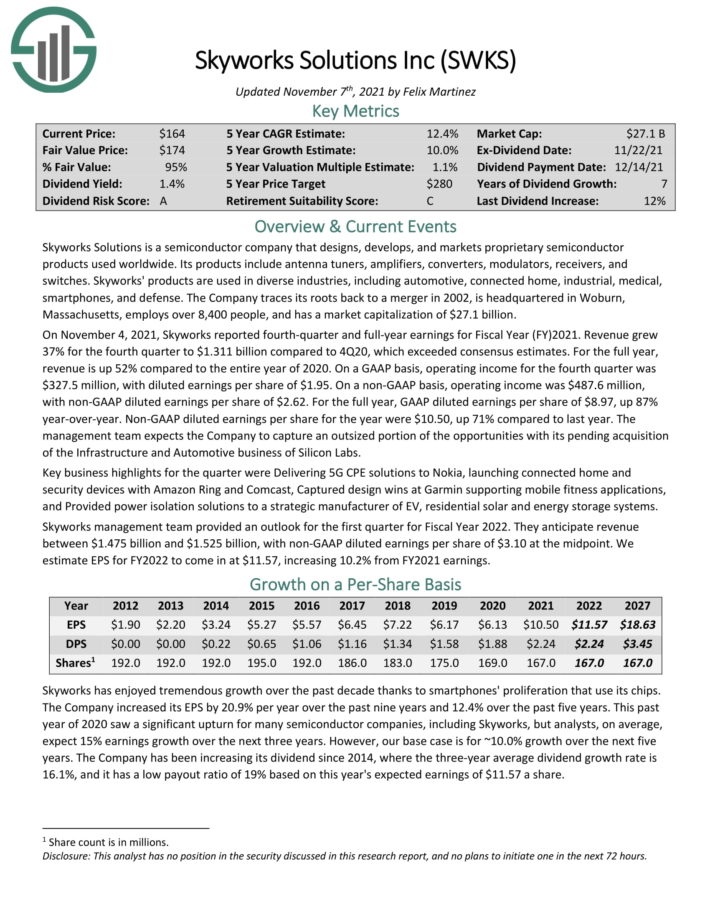

Semiconductor Stock #1: Skyworks Solutions (SWKS)

- 5-year expected annual returns: 16.1%

Skyworks Solutions is a semiconductor company that designs, develops, and markets proprietary semiconductor

products used worldwide. Its products include antenna tuners, amplifiers, converters, modulators, receivers, and

switches.

Skyworks’ products are used in diverse industries, including automotive, connected home, industrial, medical, smartphones, and defense. The company traces its roots back to a merger in 2002, is headquartered in Woburn, Massachusetts, employs over 8,400 people, and has a market capitalization of $23.1 billion.

We expect annual returns above 16% per year, making Skyworks our top semiconductor stock right now. Returns will be driven by expected EPS growth of 10% per year, the 1.7% dividend yield, and a sizable boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on SWKS (preview of page 1 of 3 shown below):

(Click on image to enlarge)

Final Thoughts

Semiconductor stocks are risky, as their profits depend largely on the health of the broader economy. As always, investors should assess the individual risk factors before buying semiconductor stocks.

That said, many semiconductor stocks could generate strong returns, as the growth of the tech sector shows no signs of slowing. Some of the major semiconductor stocks also pay strong dividends to shareholders, and raise their dividends each year.

Therefore, for investors willing to take the risk, the long-term potential of semiconductor stocks could be rewarding.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more