The Top 10 Dividend Growth Stocks For Young Investors

Dividend stocks can generally be separated into two groups. The first group is made up of high-yield stocks. Think telecoms and utilities, which offer higher dividend yields of 4%+. Their high yields are attractive, but the trade-off is that they tend to have low dividend growth rates. Sometimes, their dividend increases barely beat inflation.

The second group is made up of stocks that have lower dividend yields, in the ~2% range, but have high dividend growth rates. These companies typically distribute a lower percentage of their earnings today, so that they can invest in the business to generate growth. The trade-off with these stocks, is that they can raise their dividends 10% each year or more, in some cases.

Investors on the hunt for high-quality dividend growth stocks should review the list of Dividend Achievers, which have raised dividends for 10+ years in a row. You can see the entire list of all 265 Dividend Achievers here.

Dividend growth stocks with lower yields may not appeal to retirees, who might want more income right now, but they are well-suited for young investors with longer time horizons. Over time, a portfolio of these stocks can build higher dividend income streams than stocks with high current yields, but low dividend growth rates.

This article will discuss the top 10 dividend stocks for young investors.

Long-Term Dividend Growth Stock #10: Hasbro

Hasbro (HAS) is a good fit for young investors, as it has increased its dividend by 14% each year over the past 10 years. This includes a 12% dividend increase earlier this year. The company has raised its dividend for 13 out of the last 14 years, and is on the list of Dividend Achievers.

Source: 2nd Quarter Earnings Presentation, page 18

Its high dividend growth rates are the result of strong cash flow. Hasbro generated $620 million of free cash flow in 2016, a 51% increase from the previous year.

The company enjoyed broad-based growth last year. All of its core operating segments posted growth, including 15% revenue growth in the U.S. and Canada, 11% international growth, and 8% growth in Entertainment and Licensing revenue. This drove record revenue and earnings for the company in 2016, surpassing $5 billion in sales for the first time.

Hasbro is off to a great start to 2017. Total revenue increased 7% over the first half, to $1.82 billion. Revenue increased 11% in the second quarter, led by 16% growth in the U.S. and Canada.

Source: 2nd Quarter Earnings Presentation, page 7

Hasbro should continue to grow over the long term. It is one of the top global entertainment companies, with popular brands across toys, games and its upstart content business. Some of the company’s brands include Nerf, My Little Pony, Transformers, Play-Doh, Monopoly, and Magic: The Gathering. Hasbro Studios also produces content.

Hasbro’s Franchise Brands, its largest segment, grew revenue by 21% in the second quarter, thanks to strong growth from Transformers, Magic: The Gathering, Nerf, and Monopoly. The company will also benefit from international growth. Hasbro has a great deal of opportunity in the emerging markets. Currency-neutral revenue rose 5% and 9% in Latin America and the Asia-Pacific segments over the first half, respectively.

Hasbro stock yields 2.4% right now, which is still above the S&P 500 average. With a dividend payout ratio below 50% and a long growth trajectory ahead, Hasbro has a good chance at delivering 10%+ compound annual dividend growth for many years.

Long-Term Dividend Growth Stock #9: Costco Wholesale

Costco’s (COST) current dividend yield is just 1.3%, well below the 2% average yield in the S&P 500 Index. However, Costco is a much more appealing dividend growth stock than the current yield indicates. It delivered an 11% dividend raise earlier this year. Since it initiated a dividend in 2004, it has increased the dividend by 13% annually. And, Costco pays a special dividend on occasion, including a $7.00 per share special dividend for 2017.

You may have heard about the death of retail, but Costco has proved otherwise. It has continued to grow, even in a very competitive retail environment. Last quarter, total sales increased 8%, thanks to 5% growth in comparable-store sales. It has fought off the competitive threat of e-commerce giant Amazon.com (AMZN) with a focus on low prices.

Costco’s competitive advantage is its popular membership program, which has grown rapidly over the years.

Source: 2016 Annual Report, page 3

The highly lucrative Gold Star membership program grew by 38% from 2012-2016. Membership growth drives higher membership fees, which is a significant portion of Costco’s revenue base. For example, membership fees rose by 4% last quarter. Renewal rates continue to be strong, with 90.2% renewal last quarter in the U.S. and Canada.

And, Costco has invested in an e-commerce business of its own. E-commerce sales increased 15% in 2016, and rose 26% in August. Costco continues to invest in growth initiatives to keep up with the changing retail environment. Earlier this year, the company announced a partnership with grocery delivery service Shipt. Costco plans to bring the service to as many as 50 markets by the end of this year.

Overall, Costco’s earnings-per-share increased 12% through the first three quarters of its current fiscal year. Double-digit earnings growth should allow for high dividend growth rates, and regular special dividends moving forward.

Long-Term Dividend Growth Stock #8: Visa

Visa (V) has a very low dividend yield, of 0.7%. A dividend yield less than 1% might be an automatic disqualifier among income investors who focus on high yields. However, even a tiny dividend yield can grow to a high yield over time, especially given Visa’s high dividend growth potential.

Over the past five years, Visa has increased its quarterly dividend by approximately 24% per year, on average. At this rate, Visa’s dividends will double every three years. If Visa can maintain a 24% annual dividend growth rate, investors would earn a 6% yield on cost in 10 years.

Such high dividend growth is made possible by Visa’s tremendous competitive advantages and strong brand. With that in mind, it is not surprising to see that Warren Buffett owns 10.5 million shares of Visa, which is one of Buffett’s highest-quality holdings.

You can see the complete list of Buffett’s top 20 stocks here.

Visa is a giant in the global payments industry. Visa-branded cards and payment products facilitate over $6 trillion in global payments volume every year. The company operates four segments:

Source: Q3 FY17 Earnings Presentation, page 9

The fundamental backdrop for Visa is very strong. In 2016, revenue and adjusted earnings-per-share increased 9% and 8%, respectively. The company is off to an even better start to 2017. Total operating revenue increased 25% over the first three quarters of the current fiscal year.

Visa’s growth stems from the broader shift away from cash. Consumers are using mobile payments processing technology and cards, and are comfortable not carrying cash. There is good reason to go cashless, as physical currency can be lost or stolen. Visa is benefiting from a growing customer base. Debit and credit cards increased 31% and 23%, respectively, last quarter. This drove 40% growth in transactions. It will also benefit from international growth, thanks to the $23 billion acquisition of Visa Europe in 2016.

For 2017, Visa expects approximately 20% growth in both revenue and adjusted earnings-per-share. With a very low payout ratio and high earnings growth potential, Visa could continue to increase its dividend by 20%-25% every year, on average.

Long-Term Dividend Growth Stock #7: UnitedHealth Group

UnitedHealth (UNH) is a diversified healthcare company. It operates two primary segments: UnitedHealthcare, which provides health insurance coverage and benefits services, and Optum, which provides healthcare services through information and technology.

UnitedHealth is a high-growth dividend stock, that should appeal to investors with long time horizons. The 1.5% dividend yield does not seem too impressive, but the company has grown its payout rapidly over the past several years.

From 2012-2017, UnitedHealth raised its dividend at a 29% compound annual rate. The company has more than tripled its quarterly dividend rate in the past five years.

UnitedHealth is growing rapidly, thanks to an influx of new customers. Revenue increased 18% in 2016, to $185 billion. Adjusted earnings-per-share increased 25% for the year. Growth has continued in 2017. In the 12-month period through the end of the second quarter, UnitedHealth grew to serve 2.5 million more customers through its employer and government-sponsored offerings.

This led to 8% revenue growth last quarter, while adjusted earnings-per-share increased 26%. Growth was evenly distributed across operating segments. UnitedHealthcare and Optum grew revenue by 8.6% and 9.9% last quarter, respectively. Operating margins in both segments expanded from last year.

UnitedHealth’s operating results came in better-than-expected over the first half of the year, which compelled the company to hike its guidance for the remainder of the year. For 2017, UnitedHealth expects adjusted earnings-per-share in a range of $9.75-$9.90 per share. At the midpoint, UnitedHealth should grow earnings by 22% this year.

UnitedHealth should continue to pass along generous dividend increases, of at least 20% per year going forward. UnitedHealth had earnings-per-share of $8.05 in 2016. Its current annualized dividend payout of $3 represents a trailing payout ratio of just 37%. Along with earnings growth, UnitedHealth’s dividend has plenty of room to grow.

Long-Term Dividend Growth Stock #6: Starbucks

Starbucks (SBUX) makes the list because it is a high-growth dividend stock. It benefits from a high level of customer loyalty, thanks to its strong brand. This has led to an extended period of growth for the company. In 2016, revenue increased by 11%, to $21.3 billion. Growth was due to new store openings, as well as a 5% increase in comparable sales. Adjusted earnings-per-share increased 17% for the year.

Growth has slowed a bit this year, but the company is still performing well. Over the first three quarters of fiscal 2017, comparable sales grew 3%. This led to 7% growth in total revenue. Adjusted earnings-per-share increased by 6% over the first three quarters. Again, store openings were a big contributor to growth. Starbucks has opened 299 new locations so far this year.

New store openings remain a pivotal aspect of Starbucks’ growth plan. This is especially true when it comes to emerging markets, such as China, where Starbucks has only a small footprint.

Starbucks recently acquired the remaining 50% of its East China joint venture that it didn’t own. In addition, the company plans to open more than 500 new stores in China each year. By 2021, Starbucks expects to operate 5,000 stores, in 200 cities in China.

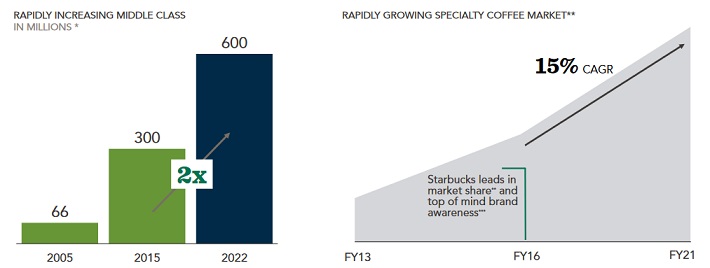

Source: Biennial Investor Day Presentation, page 11

The rapidly-expanding middle class in China represents a major opportunity for Starbucks. The company expects urbanization and rising standards of living to elevate 600 million people in China to the middle class, up from just 66 million in 2005. As a result, from 2017-2021, Starbucks expects to triple its revenue and operating profit in China.

Starbucks currently pays an annualized dividend of $1 per share, which amounts to a 1.9% dividend yield. This is slightly below the S&P 500 Index average, but Starbucks has a great deal of room to increase the dividend going forward.

Starbucks had a payout ratio of 54%, based on 2016 adjusted earnings-per-share of $1.85. The payout ratio is only slightly above 50%, which gives room for continued dividend growth. And, since Starbucks is likely to grow earnings-per-share at a high rate, the company could raise its dividend by 10% each year, and keep the payout ratio steady.

Long-Term Dividend Growth Stock #5: The Home Depot

Like Costco, Home Depot (HD) is an Amazon-proof retailer, because it has differentiated itself. Home Depot is the largest home-improvement retailer, with more than 2,200 stores in all 50 U.S. states, as well as Puerto Rico, the U.S. Virgin Islands, Guam, Canada, and Mexico. Home improvement projects can be complex, which means consumers value the ability to ask questions and inspect products in person.

As a result, Home Depot has successfully fended off Internet-only competitors. It has also benefited from the strong performance of the U.S. housing market, and the improving economy, which have compelled consumers to invest more in their homes.

Home Depot’s adjusted earnings-per-share increased 18% in 2016. The company is off to an equally impressive start so far in 2017. Comparable-store sales increased 6.3% last quarter, thanks to 6.6% U.S. sales growth. Diluted earnings-per-share increased 15% over the first half of 2017. Lumber, electrical, tools, and flooring products grew comparable sales by double-digits last quarter.

Home Depot’s double-digit earnings growth has allowed it to increase its dividend at high rates, going back several years.

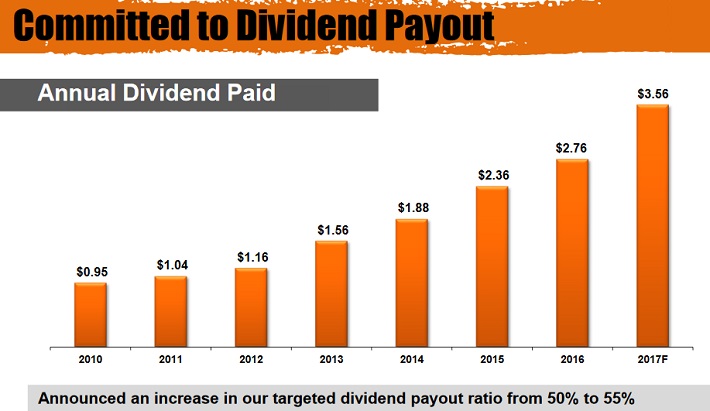

Source: 2017 Annual Shareholder Meeting, page 7

Home Depot has a current dividend yield of 2.3%, and has increased its dividend at double-digit rates consistently going back several years. Based on anticipated 2017 dividends of $3.56 per share, Home Depot’s annual dividends have grown at an 18% compound annual rate over the past five years. The company could continue to increase its dividend by 10% or more each year, thanks to its earnings growth potential.

Home Depot is capitalizing on demand for professionals, including contractor services, and installations. This is part of a growing “do-it-for-me” customer base. Another promising catalyst for Home Depot is e-commerce. Home Depot’s online sales increased 23% last quarter, and now represent 6.4% of total sales.

For 2017, Home Depot expects total sales growth of 5.3%, and comparable sales growth of 5.5%. Adjusted earnings-per-share are expected to reach $7.29 for the full year, which represents 13% growth from 2016. Earnings growth will be driven by revenue growth, in addition to $7 billion of anticipated share repurchases.

Long-Term Dividend Growth Stock #4: Microsoft

The technology sector changes quickly, but Microsoft (MSFT) is likely to be around for a very long time. That’s because it has a proven ability to evolve to changing industry trends.

For example, Microsoft became a giant in the personal computer industry. But as growth in PCs slowed, Microsoft faced a difficult turnaround. Under the leadership of CEO Satya Nadella, the company has successfully transitioned into cloud computing.

Microsoft recently concluded fiscal 2017, and had another very strong year. Adjusted revenue and earnings-per-share increased 5% and 19%, respectively, for the full year. The most recent quarter was particularly strong. Revenue increased 10%, while adjusted earnings-per-share jumped 42% year over year.

Microsoft’s growth is due to its cloud platforms, especially Office 365 and Azure. Revenue in the Productivity and Business Processes segment rose 23% last quarter, to $8.4 billion.

Source: 2017 Earnings Presentation, page 9

This was largely because of a 44% increase in Office 365 commercial revenue. Separately, Dynamics 365 revenue soared 75%, while Azure revenue nearly doubled for the quarter. Other areas across the business are also growing. Last quarter, Intelligent Cloud revenue increased 12% year over year, due to growth in server products and cloud services.

In device hardware, Microsoft is still seeing growth in gaming, thanks to strong sales of the Xbox One console. Surface revenue declined 1% last quarter, but new product releases should help restore growth. Microsoft is a cash machine. The company generated $31.3 billion of free cash flow in fiscal 2017. Such huge free cash flow allows it to pay a dividend, and raise its dividend at high rates each year.

The stock has a current dividend yield of 2.1%, and in the past five years raised its dividend by 14% each year, on average. At this rate, Microsoft’s dividends would double every 5.1 years.

Long-Term Dividend Growth Stock #3: Nike

Nike (NKE) is a very strong business. Its brand strength allows it to command pricing power, and charge hefty prices for its shoes and athletic apparel. This leads to consistent growth, and high returns on capital.

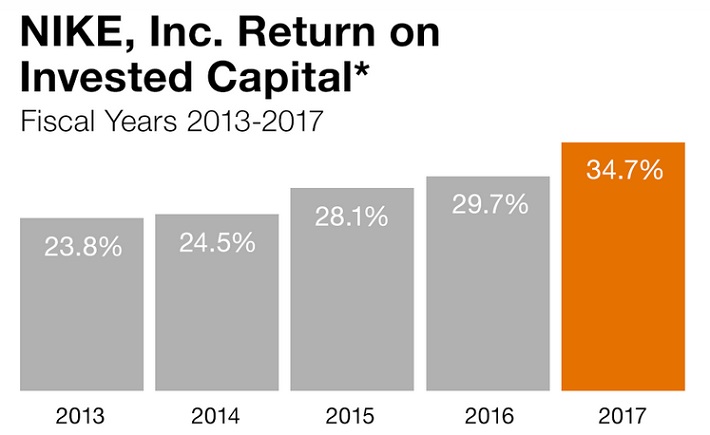

For example, in fiscal 2017, Nike grew revenue by 6%, or 8% excluding the impact of currency exchange. Earnings-per-share increased 16%, to $2.51, and the company generated a return on invested capital of nearly 35%. This is an excellent ROIC that demonstrates Nike is a very effective allocator of investor capital.

Source: 2017 Annual Report

Nike’s ROIC has expanded by more than 10 percentage points since 2013. Nike is among the top stocks for dividend growth investors, because the company dominates the industry, thanks to new product development. Innovation is at the heart of Nike’s growth strategy, to stay ahead of the competition, and provide shoes and apparel that allow athletes to perform their best.

In fiscal 2017, Nike advanced on several strategic growth initiatives. It released several new products. For example, VaporFly features a proprietary carbon fiber plate, which will increase the cushioning of its shoes. In addition, Nike introduced the HyperAdapt 1.0, the company’s first foray into adaptive performance. This is an emerging category with high potential, that involves products which move in synchrony with the body.

Going forward, Nike will continue to innovate new product designs, which will help fuel future growth. The company has a particularly attractive growth opportunity in the emerging markets. For example, Nike grew revenue in China by 17% in fiscal 2017. Total emerging-market revenue increased 14% for the year.

Another promising growth initiative is the recent agreement Nike struck with e-commerce giant Amazon.com (AMZN). Nike will begin selling a limited assortment of footwear, apparel, and accessories on Amazon. This is a positive catalyst for Nike, since direct-to-consumer sales are booming. Nike’s own direct-to-consumer sales increased 18% to over $9 billion last year. The Amazon agreement will help accelerate Nike’s growth in this growing category.

Nike has a current dividend yield of just 1.4%, but it makes up for this with dividend growth. Nike has increased its dividend for 15 years in a row, making it a Dividend Achiever. In the past 10 years, Nike raised its dividend by approximately 15% per year.

Long-Term Dividend Growth Stock #2: Disney

Disney (DIS) has everything a long-term investor should want—it has a strong brand, a highly profitable business, and a great deal of growth potential. Disney is a global entertainment giant. It has several properties that are all extremely valuable. The company operates the following segments:

- Media Networks (43% of revenue)

- Parks & Resorts (32% of revenue)

- Studio Entertainment (16% of revenue)

- Consumer Products & Interactive Media (9% of revenue)

The Media Networks segment is anchored by industry-leading properties ABC, ESPN, and The Disney Channel. This has been a troubled business for Disney, which is under pressure from cord-cutting. Consumers are opting for Internet streaming services in rising numbers, and are increasingly cancelling high-priced cable packages.

As a result, operating profit in Disney’s Media Networks business fell 11% over the first three quarters of 2017. Disney is also seeing declines in Studio Entertainment, where operating profit declined by 8% over the first nine months. But the declines in studio revenue were simply due to very difficult comparisons, as Disney saw great results from several new movies last year. Movie studio revenue increased 28% in 2016, which means a modest decline should be expected.

The long-term remains very positive. Disney has extremely strong movie studios, including Lucasfilm, Marvel, and Pixar.

And, when it comes to the core Media Networks segment, investors should not be discouraged. Cord-cutting is less of a threat to media networks with strong brands. Consumers will still seek out ESPN, regardless of whether that’s on cable or through Internet streaming. The key advantage for ESPN is live sports, which still enjoy high demand in the U.S.

There is also a great deal of growth potential for Disney in China, where the company recently opened a massive new resort, Shanghai Disney.

According to Disney, more than 300 million people live within three hours of the park. The company expects the park to break even next year, with improved profitability thereafter.

Disney has a relatively low dividend yield, of 1.5%. This might be fairly unappealing for income investors, who may desire higher dividend yields. But over the past five years, Disney’s annualized dividends have increased at a 16% compound annual rate. This makes it an attractive pick for dividend growth.

Long-Term Dividend Growth Stock #1: Apple, Inc.

Claiming the top spot is Apple (AAPL). There is simply no better stock for dividend growth investors. Apple is the world’s most valuable brand, and has been for seven years in a row. According to Forbes, Apple’s brand alone is worth $170 billion, 67% more than the second-most valuable brand, Google (GOOGL).

Not only that, Apple is very highly profitable, and arguably possesses the strongest balance sheet of any publicly-traded stock. At the end of last quarter, Apple held $261 billion of cash, marketable securities, and long-term investments on its balance sheet.

Apple’s cash pile is due to its pricing power, and enormously profitable business model. Last quarter, Apple grew revenue and earnings-per-share by 7% and 18%, respectively. Revenue growth was the result of broad-based growth across products and services. For example, iPhone revenue rose 3%, iPad revenue increased 2%, and Mac revenue rose 7%.

But aside from the iPhone, Apple’s Services business may be its most exciting. The lineup of Services includes the App Store, Apple Pay, iCloud, and iTunes. Services revenue increased by 22% last quarter.

Consumers line up to buy Apple products, and are willing to pay higher prices for them each year. This customer loyalty is the result of huge investments in research and development. Apple spent $10 billion on R&D in 2016 alone.

Going forward, investors can look forward to the upcoming release of the iPhone 8. This will be a major growth catalyst for Apple, since the iPhone itself represents more than half the company’s total revenue.

Apple stock has risen significantly in recent years, and is up 39% year-to-date. The good news is, Apple is still not expensive. The stock has a price-to-earnings ratio of 18, based on trailing 12-month earnings. This is still a below-average valuation multiple, considering Apple’s premium brand and growth potential.

The stock has a current yield of 1.6%. Its payout ratio was 25% over the first three quarters of the fiscal year. With such a low payout ratio and growth potential, Apple should have little trouble raising its dividend by 10%+ each year.

Final Thoughts

Stock with 1%-2% dividend yields may not be as attractive as those with high dividend yields of 5%+, but investors should not avoid them just because of their low yields. This is especially the case for stocks that raise their dividends by 10%-20% per year.

With such high dividend growth rates, the stocks on this list can eventually catch up to their high-yielding counterparts over time. With enough time, investors can actually earn higher yields from dividend growth stocks.

As a result, these 10 stocks should have appeal to young investors looking to build a dividend growth portfolio.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more