The Stock Market Is Overextended And Needs To Correct

The S&P 500 finished slightly lower today by around 30 bps, but it really doesn’t tell the whole story. The S&P 500 equal-weight ETF fell sharply nearly 1%, this after eking out an all-time yesterday. Additionally, declining stock far outweighed advancing.

S&P 500 (SPX)

Notice the diverging trend of the RSI of the price of the S&P 500 since September 2020, with the RSI making a series of lower highs and the S&P 500 making higher highs. This is a very long-term bearish divergence that is taking place in the market. This divergence at some point is likely to be a problem in the index.

(Click on image to enlarge)

Overall, this is a market that is very over-extended here and needs to correct some. The first ideal spot comes at 4320. This market is not nearly as “strong” as it is made out to seem.

(Click on image to enlarge)

S&P 500 EW (RSP)

The RSP ETF has really struggled and has gone nowhere since the middle of May and is also losing serious momentum, with an RSI clearly in a short-term downtrend. The RSP is telling us that not all is well as the broader S&P 500 may indicate.

(Click on image to enlarge)

When we add the advance/decline inline to the RSP chart, we can clearly see how the RSP ETF and the advance/decline follow one another closely. This is telling us that the S&P 500 is being led higher by just a handful of stocks. Additionally, the percentage of stocks above their 50-day moving average in the S&P 500 has slipped below 50%.

(Click on image to enlarge)

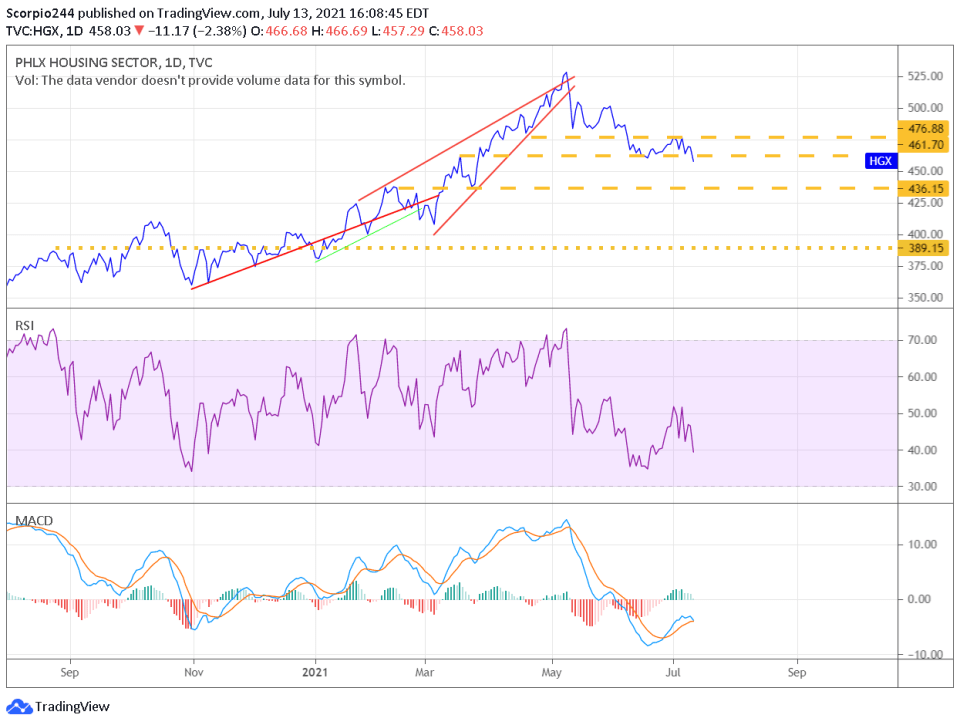

Housing (HGX)

Meanwhile, the housing sector struggles to find its footing and fell almost 2.5% today, to its lowest level since March. It hasn’t even reached oversold levels, which could suggest the decline is far from over.

(Click on image to enlarge)

Dollar (DXY)

Also, the dollar index pushed higher today, despite the hotter inflation reading of the CPI report. The dollar is getting very close to a significant breakout, with the next major resistance level resting around 93.20 for now.

(Click on image to enlarge)

Amazon (AMZN)

Amazon fell some today, and I noted over the weekend, the stock is extremely overbought at these levels. Bad things tend to follow when the stock has an RSI this high in the days that follow. Could a drop back to $3,150 be in the cards? Yes, it seems incredibly possible.

(Click on image to enlarge)

Micron (MU)

Micron fell today, but the stock has really managed to hold on to support around $77. That really needs to break, and it should, eventually. The momentum trends suggest the stock breaks lower and that $69 is coming.

(Click on image to enlarge)

Comcast (CMCSA)

Comcast doesn’t want to break out; resistance has been so tough at $58. I think momentum needs to turn because the RSI has been trending steadily lower for some time; maybe it just needs to consolidate for a bit longer.

(Click on image to enlarge)

Disclosure: Mott Capital Management, LLC is a registered investment adviser. Information ...

more