The S&P 500 Rises On News Of Fed Pause, Slowing Wage Inflation Data

The S&P 500 (Index: SPX) had its best week as it exited May and entered June 2023, rising over 1.8% to reach 4282.37, its highest level since 18 August 2022. That also puts the level of the index some 10.7% below its record high peak of 4,796.56 that it set on 3 January 2021.

All of that positive increase was achieved after two major news events during the week. The first came on Thursday, 1 June 2023, shortly after the Federal Reserve's Patrick Harker announced the Fed "really should skip" hiking rates in June 2023.

The second news event came at 8:30 AM on Friday, 2 June 2023, when the May employment situation report was released. While reporting higher-than-expected employment levels, it more significantly reported slowing wage growth.

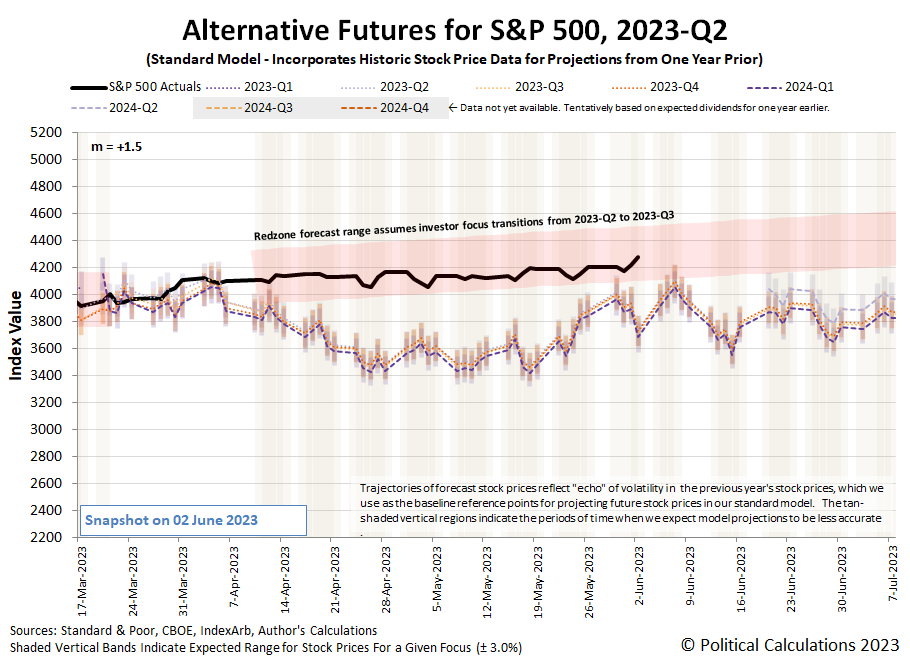

The two actions together signal slowing inflation and a more positive environment for stock prices, which rose both sharply and shortly after each of these news events. The two events boosted the redzone forecast trajectory on the latest update of the alternative futures chart.

A deal to raise the U.S. government's debt ceiling was also reached during the week, but all the news related to that development proved to have little to no impact on the trajectory of stock prices. We're basing that assessment on the lack of notable changes in the trajectory of E-Mini S&P 500 futures at the times significant news related to the debt ceiling deal occurred, but which do show significant changes in the trajectory of stock prices that correspond to the timing of the two market moving news events we've highlighted.

Speaking of the week's market moving headlines, here's our recap of what happened during the Memorial Day holiday-shortened trading week.

Tuesday, 30 May 2023

- Signs and portents for the U.S. economy:

- Fed minions, biggest holders of U.S. government debt, excited by debt ceiling deal:

- Bigger trouble developing in China:

- BOJ minions looking to keep never-ending stimulus alive, worry about wage hikes:

- ECB minions rate hikes producing desired result:

- Tech stocks help Nasdaq close higher; S&P ends largely unchanged while Dow slips

Wednesday, 31 May 2023

- Signs and portents for the U.S. economy:

- Fed minions getting excited to keep hiking rates after pausing in June, upset by rebound in housing market:

- Bigger trouble developing in Asia:

- BOJ minions start prepping for end of never-ending stimulus, ECB minions worry that may cause global problems:

- Bigger trouble developing in the Eurozone:

- S&P 500 ekes out slight gain in May, extends monthly-win streak to three

Thursday, 1 June 2023

- Signs and portents for the U.S. economy:

- Fed minions say no rate hike in June, more coming after….

- Mixed signs emerging in Asia:

- Bigger trouble developing in the Eurozone:

- ECB minions see end of rate hikes, still excited to keep hiking rates:

- Nasdaq ends +1%, S&P, Dow also gain on hopes for rate hike pause at June Fed meet

Friday, 2 June 2023

- Signs and portents for the U.S. economy:

- Fed minions using other means to signal June pause for rate hikes:

- Much bigger stimulus developing in China:

- BOJ minions okay with taking lots of time to hit low inflation target, JapanGov minions draft their own never-ending fiscal stimulus plan:

- Dow ends 700 points higher as stock-market rally puts S&P 500 on verge of bear-market exit

After Fed officials signaled they will pause in hiking the Federal Funds Rate in June, the CME Group's FedWatch Tool changed its projections to match that expectation. It now projects the Federal Reserve will not hike rates until the Fed's Open Market Committee meets on 26 July 2023, when a quarter point rate hike is anticipated. That would put the Federal Funds Rate at a target range of 5.25-5.50%, which the tool also anticipates will be the peak for the series of rate hikes that began in March 2022. The FedWatch Tool still anticipates the Fed will hold rates at that peak level until its 31 January (2024-Q1) meeting, at which it is will initiate a series of quarter point rate cuts at six-to-twelve-week intervals to address recessionary conditions in the U.S. economy.

The Atlanta Fed's GDPNow tool estimate of the real GDP growth rate for 2023-Q2 ticked up to +2.0% from the +1.9% growth rate it forecast a week earlier.

More By This Author:

Dividends By The Numbers In May 2023Median Household Income In April 2023

A Rising Tide Of Chapter 11 Bankruptcy Filings

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more