The S&P 500 Rises As Investors Find Silver Lining In Darker Jobs Cloud

The S&P 500 had one of its best weeks of 2023. The index closed the trading week ending on 1 September 2023 at 4515.77, which was up 2.5% from the previous week's close.

The reason why stock prices rose however is because of negative changes in the outlook for jobs in the U.S. The biggest driver was a large reduction in the number of job openings, which dropped to their lowest level since March 2021.

That assessment of a softening job market was reinforced with 1 September 2023's employment situation report, which showed an increase in the unemployment rate.

For the stock market however, these negative developments produced a positive result, as investors bet on the bad jobs news taking any additional interest rate hikes in 2023 off the table. Prior to the week's jobs-related news, investors were giving a greater than 50% probability of at least one more quarter point rate hike in 2023. The elimination of that probability is positive for stocks, especially for those firms that rely heavily on debt financing, who investors believe will benefit from having higher profits from lower-than-previously-expected interest costs. It's the proverbial silver lining on a dark cloud.

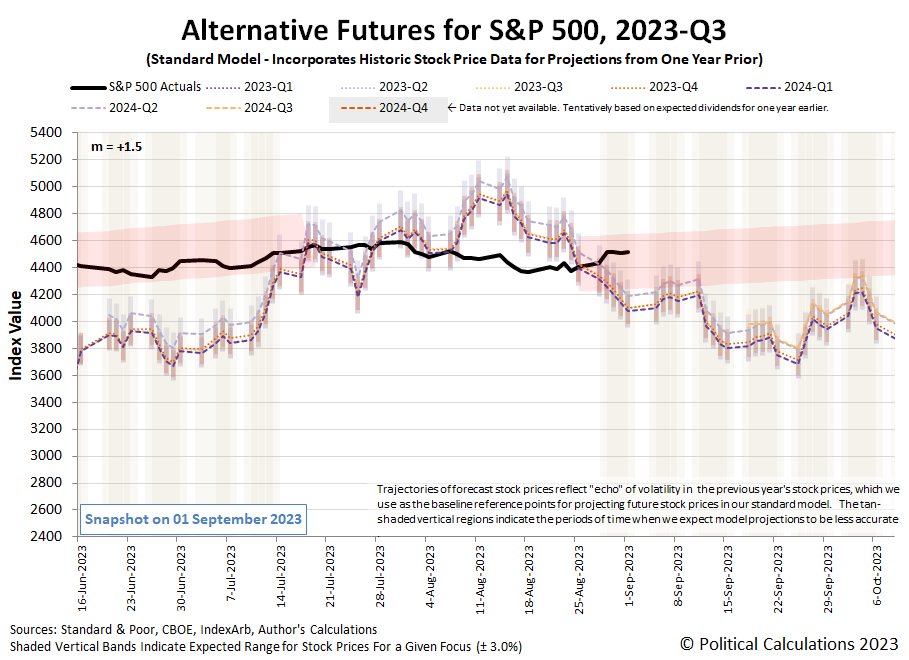

The S&P 500 moved up into the upper portion of the newly added redzone forecast range in the latest update of the dividend futures-based model's alternative futures chart.

(Click on image to enlarge)

Overall, stock prices are behaving as expected with investors continuing to focus their attention on the final quarter of 2023 in setting current day stock prices.

Here's our summary of the week's market moving headlines:

Monday, 28 August 2023

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Canada?

- Bigger trouble, stimulus developing in China:

- BOJ minions wonder if they can blame China, want reasons to keep never-ending stimulus alive:

- ECB minions getting the results they wanted, think pausing rate hikes might be mistake:

- Nasdaq, S&P 500, Dow kick off final week of August with gains, helped by 3M

Tuesday, 29 August 2023

- Signs and portents for the U.S. economy:

- Former Fed minions say current Fed minions want to jerk investors around:

- Bigger trouble developing in China:

- BOJ minions get data that suggests it’s time to end never-ending stimulus:

- ECB minions getting results they wanted:

- S&P 500 ends sharply higher, jobs data fuels interest rate optimism

Wednesday, 30 August 2023

- Signs and portents for the U.S. economy:

- Fed minions worried about potential risk from more regional bank failures, hint they can stop hiking rates:

- Bigger trouble developing in China:

- Bigger stimulus developing in China:

- BOJ minions says changes to never-ending stimulus may happen next year:

- Wall Street ends higher as economic data fuels rate-pause bets

Thursday, 31 August 2023

- Signs and portents for the U.S. economy:

- Fed minions expected to hold interest rates steady at September meeting:

- Bigger trouble developing in China:

- BOJ minions get reason to continue never-ending stimulus:

- ECB minions getting results they wanted, still worried about inflation:

- Nasdaq, S&P, Dow end mixed a day ahead of jobs report; stocks close out August in the red

Friday, 1 September 2023

- Signs and portents for the U.S. economy:

- Things Fed minions say:

- Full impact of Fed hikes still to be seen in real economy, ex-vice chair Blinder says

- Bigger stimulus developing in China:

- Bigger trouble spreading out from China:

- Bigger trouble still developing in China:

- BOJ minions getting mixed signals on whether to keep never-ending stimulus alive:

- Eurozone economy sees some signs of life, ECB minions play coy about their plans for future rate hikes:

- Stocks start September mixed; S&P posts best week since June, Dow, Nasdaq also up

The CME Group's FedWatch Tool continues to show no rate hike in September (2023-Q3). The big change from last week came as investors stopped betting one last quarter point rate hike later in 2023 following the past week's jobs report and downward revisions in previous months' employment numbers. Now investors expect the Fed will hold rates steady until 1 May 2023, when they anticipated the Fed will start a series of quarter point rate cuts that will continue at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool predicts an annualized real growth rate of +5.6% during 2023-Q3, down from the previous week's estimate of +5.9% growth.

Image credit: Every Cloud Has a Silver Lining photo by Colin Smith via Geograph Britain and Ireland. Creative Commons. Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0).

More By This Author:

Median Household Income In July 2023How Many S&P 500 Companies Pay Dividends?

Less Than Useful Data: Weekly Chain Store Sales

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more