The S&P 500 Recovers Lost Ground

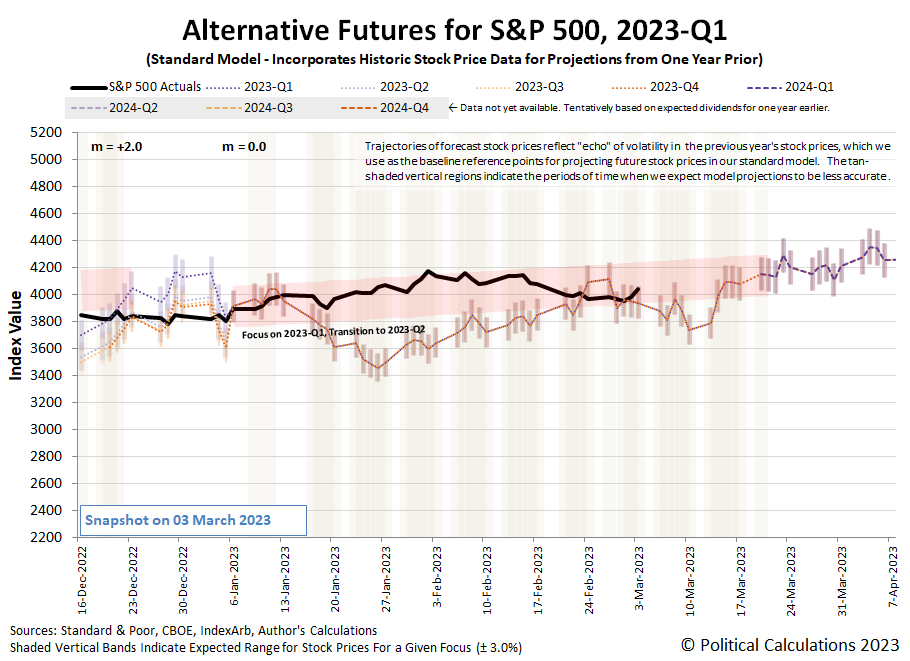

The S&P 500 (Index: SPX) recovered a large portion of the ground in a loss in the trading week ending on 3 March 2023. Much of that gain however came on the final day of the trading week, as the index jumped 1.6% to close at 4045.64.

Before that, the index mostly treaded water, drifting within a narrow range with respect to where it closed the previous week.

As it did, the trajectory of the S&P 500 bounced off the bottom edge of the alternative futures chart's redzone forecast range. The index climbed back toward the middle of the range as investors' attention remained locked on 2023-Q1 and 2023-Q2.

This latter move makes sense because these are the quarters they expect will contain the last of the Fed's series of rate hikes that began in March 2022, which is why they've held the forward-looking focus of investors since the beginning of the year. That stability of investor focus, combined with the week's action in stock prices, means our working hypothesis that a new market regime began on 6 January 2023 still holds after being tested in the past week.

Meanwhile, the flow of new information presented a mixed picture for the U.S. economy, while more positive signs are developing in China and in the Eurozone, both of whose previous pictures had been much more negative. Here are the week's market-moving headlines:

Monday, 27 February 2023

- Signs and portents for the U.S. economy:

- Fed minion buys into higher rates to fight inflation:

- Positive growth signs developing in China after government lifts its failed zero-COVID lockdown policy:

- New BOJ minion politely suggests never-ending stimulus may need to end someday:

- Wall St gets respite from positive data, dollar pullback

Tuesday, 28 February 2023

- Signs and portents for the U.S. economy:

- Fed minions say government data and market reactions aren't good enough for them to make decisions:

- Bigger trouble developing in Canada?:

- BOJ minions want to keep never-ending stimulus alive longer as Japan's factory output falls:

- ECB minions have higher inflation than they expected to worry about, claim their winning battle against it:

- Wall Street closes out weak February as Fed concerns remain

Wednesday, 1 March 2023

- Signs and portents for the U.S. economy:

- Fed minions expected to keep delivering rate hikes:

- Growth signs developing in China after government's failed zero-COVID lockdowns lifted:

- Eurozone sees growth signs… and inflation:

- BOJ minions really want to keep never-ending stimulus alive:

- ECB minions worried about Eurozone inflation, want more and bigger rates hikes:

- S&P, Nasdaq weak as manufacturing stokes Fed concerns

Thursday, 2 March 2023

- Signs and portents for the U.S. economy:

- Fed minions looking forward to more, smaller rate hikes:

- Bigger trouble developing in Brazil:

- Bigger stimulus, growth developing in China:

- Central bank minions thinking they may not be done with rate hikes:

- ECB minions fear sticky inflation:

- Stocks gain as Bostic backs quarter-point hike

Friday, 3 March 2023

- Signs and portents for the U.S. economy:

- Fed minions say they know what damage their letting inflation get out of hand is causing as they prep for more rate hikes and to deal with a bond market in stress:

- More growth signs developing in China, Eurozone:

- Wall Street closes sharply higher, notches weekly gains as Treasury yields ease

The CME Group's FedWatch Tool continued to project three consecutive quarter point rate hikes at the Fed's upcoming 22 March (2023-Q1), 3 May and 14 June (2023-Q2) meetings, with rates topping out in a target range from 5.25%-5.50%. After that, the FedWatch tool anticipates the Fed will hold rates steady through the end of 2023 but will begin cutting them in March 2024.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the first quarter of 2023 dropped to +2.3% from its previous +2.7% estimate. The so-called average "Blue Chip" consensus forecast however rose to about +0.5%.

More By This Author:

Dividends By The Numbers In February 2023Median Household Income In January 2023

U.S. New Home Market's Downward Momentum Slows In January 2023

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more