The S&P 500 Has Rough Week As Geopolitics Adds Noise To Market

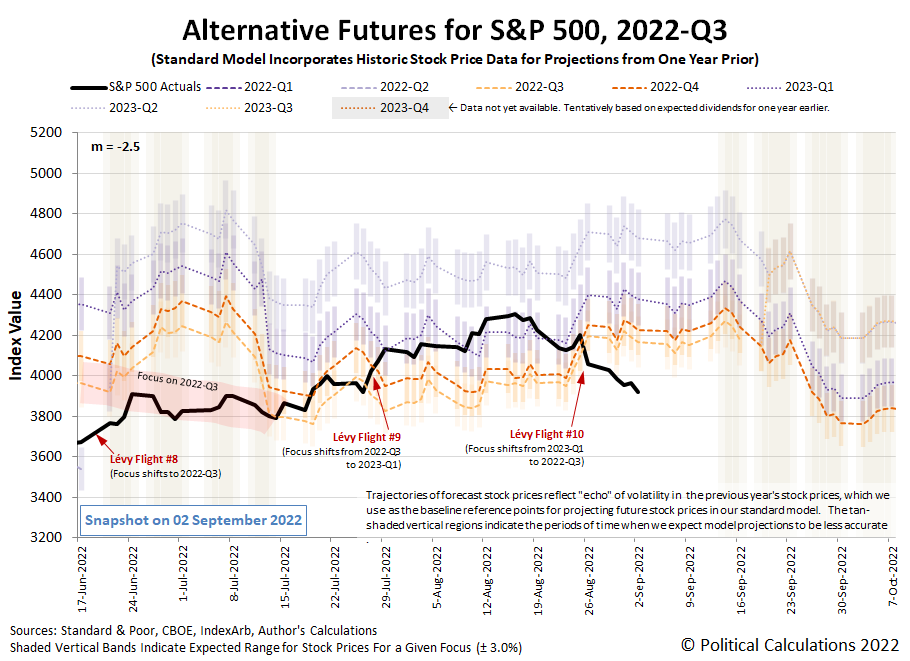

The S&P 500 (Index: SPX) moved back toward bear territory in the trading week ending on 2 September 2022. Geopolitics, particularly those emanating from the Eurozone, played an outsize role in sending stock prices to their lowest level in weeks.

The biggest reversal came on Friday, 2 September 2022, when the index swung from being up as high as 1.3% in the morning to instead close down by 1.2%. The major factor driving that development was Vladimir Putin's announcement that Russia would shut down gas pipelines going to the European Union indefinitely. The action will likely drive the Eurozone fully into recession.

And if not that, the higher interest rates the minions of the European Central Bank are considering to combat the inflation caused in good part by having the continent's Russian supply of oil cut off may also do the job. The Eurozone doesn't lack bad options and its problems appear to be bleeding over into the U.S. stock market.

If not for the geopolitical noise event, we think the S&P 500 would be tracking more closely to the alternative trajectory associated with investors focusing on 2022-Q3, which is where they had clearly set their focus as early as last week. At least, until the deep hole, the Eurozone is in got deeper. The market-moving headlines of the week that was captured those developments along with the U.S.-based market drivers that primarily influence the U.S-based index.

Monday, 29 August 2022

- Signs and portents for the U.S. economy:

- Fed minions "happy" with reaction to Powell's Jackson Hole message:

- Bigger stimulus, trouble developing in China:

- Bigger trouble developing in the Eurozone:

- ECB minions thinking about multiple, bigger rate hikes:

- Wall Street retreats as rate hike concerns persist

Tuesday, 30 August 2022

- Signs and portents for the U.S. economy:

- Fed minions say recession they're making won't be all that bad, want to end rate hikes before 2023:

- Bigger stimulus developing in China:

- ECB minions getting excited about developing recession, thinking they need higher interest rates:

- Wall St closes down for 3rd straight session on Fed rate hike worry

Wednesday, 31 August 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in China:

- Positive signs in India:

- BOJ minions determined to keep never-ending stimulus alive:

- ECB minions thinking about having orderly, larger rate hikes:

- Wall Street ends August with a whimper on Fed worry

Thursday, 1 September 2022

- Signs and portents for the U.S. economy:

- Fed minions say fighting inflation is Job #1:

- Bigger trouble developing in Canada, Mexico, Eurozone:

- Japanese factories get whipsawed:

- Much bigger trouble developing in China:

- ECB minions worry they might make things worse:

- S&P 500 snaps four-session losing streak with payrolls on deck

Friday, 2 September 2022

- Signs and portents for the U.S. economy:

- Fed minions preying on hope they can deliver soft landing despite their awful track record:

- Bigger trouble developing in the Eurozone:

- ECB minions being pressured to stop thinking and start hiking bigger:

- Wall St ends week on down note as jobs report gain fade

The CME Group's FedWatch Tool still projects a three-quarter point rate hike in September (2022-Q3), but now forecasts that will be followed by a series of quarter-point rate hikes that will top out in the target range of 3.75-4.00% in February 2023.

Meanwhile, the Atlanta Fed's GDPNow tool's forecast for real GDP growth in 2022-Q3 jumped from 1.6 to 2.6% over the past week.

More By This Author:

Dividends By The Numbers In August 2022

Median Household Income In July 2022

Average Earned Personal Income Grows In July 2022

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more