The S&P 500 Falls On Surge In Treasuries And Fed's Signal Of More Rate Hikes

Two big things happened to the S&P 500 in the past week, as the index fell to 4224.16 through Friday, 20 October 2023, a 2.4% week-over-week decline.

The first big thing to happen was a surge in the yield of the 10-year U.S. Treasury, which was accompanied by mortgage rates spiking up to their highest levels since the early 2000s.

The second big thing to happen came on Thursday, 21 October 2023, when Federal Reserve Chair Jerome Powell spoke and signaled the Fed might resume hiking short term interest rates, even though Fed officials were saying the surge in the interest rate yields of Treasuries were doing their job for them.

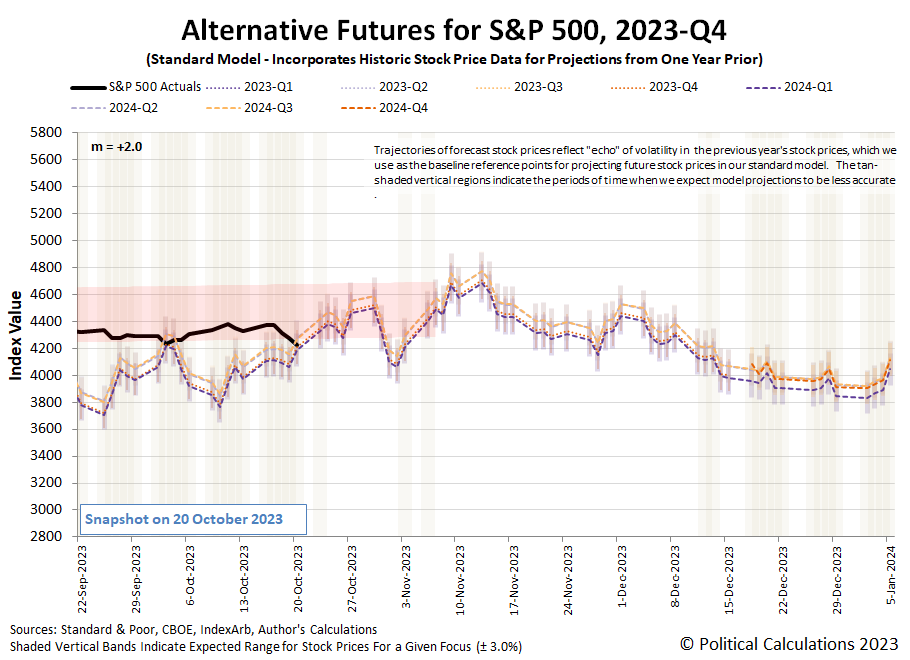

For the market, that statement came as a number of mid-size banks reported lower earnings because of rising interest rates increasing their costs. The combined effect of this new information for investors pushed the trajectory of the S&P 500 below the lower end of the latest redzone forecast range on the dividend futures-based model'a alternative futures chart. Here's the latest update for the chart:

(Click on image to enlarge)

The S&P 500's trajectory breaking below the bottom end of the redzone forecast range comes as the index coincidentally dropped below its 200-day moving average. For the record, the upper and lower limits we set for the redzone forecast range are not based on the moving averages used in technical analysis, which we view as unreliable indicators at best. It's more useful to ask if that change is an an outlier event or a warning signal indicating order is breaking down in the stock market. We'll find out which of these options is the correct reading of what's going on in the stock market soon enough.

While those were the biggest events to move markets during the week that was, here are the week's other market moving headlines to provide more context in what new information investors had to absorb.

Monday, 16 October 2023

- Signs and portents for the U.S. economy:

- Fed minions claim inflation is over, acknowledge they are choking off first time new home buyers, think they have a tough messaging job:

- Bigger trouble, provincial government bailouts, more stimulus developing in China:

- ECB minions getting results they wanted from rate hikes, claim they won't cut rates any time soon:

- Wall Street ends up on earnings optimism; eyes remain on Middle East

Tuesday, 17 October 2023

- Signs and portents for the U.S. economy:

- Fed minions thinking they should still worry about inflation, may need to hike rates again:

- Bigger provincial government bailout developing in China:

- Nasdaq, S&P, Dow end with small moves as yields soar after hot retail sales data

Wednesday, 18 October 2023

- Signs and portents for the U.S. economy:

- Fed minions thinking about sitting on their hands for a longer time:

- Signs of bigger stimulus getting traction in China:

- Signs of less bad trouble developing in China:

- BOJ minions thinking about raising inflation target to keep never-ending stimulus alive:

- Wall St falls more than 1%; yields rise, investors assess earnings

Thursday, 19 October 2023

- Signs and portents for the U.S. economy:

- Fed minions speak, threaten more rate hikes, worried about risk of more bank failures:

- BOJ minions get data to absorb, happy about some of it:

- Wall St ends lower on Powell remarks as benchmark Treasury yields near 5%

Friday, 20 October 2023

- Signs and portents for the U.S. economy:

- Fed minions starting to think they'll need to cut interest rates in second half of 2024:

- Bigger trouble developing in China:

- BOJ minions get unwelcome sign of inflation, really want to keep never-ending stimulus alive despite signs it shouldn't:

- Nasdaq, S&P, Dow end week with hefty losses as focus turns to Q3 earnings deluge

- US mid-sized bank shares slump after downbeat interest income forecasts

The CME Group's FedWatch Tool continues to project the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through May (2024-Q2), unchanged from last week. Starting from 12 June (2024-Q2), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's forecast of annualized real growth rate during 2023-Q3 increased to +5.4% from last week's forecast of +5.1%. The so-called "Blue Chip Consensus" estimates range from a low of +2.4% to +4.5%, with a median estimate of +3.5%.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "megan duncanson style painting, angry bear on Wall Street, early stages of sunset, psychedelic effects --ar 16:9".

More By This Author:

A First Look At The Future For S&P 500 Dividends Through 2024Campbell's Tomato Soup Prices Stabilizing At Inflated Level

S&P 500 Mostly Unswayed by Geopolitics

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more