The Short-Term Uptrend Surprisingly Continues

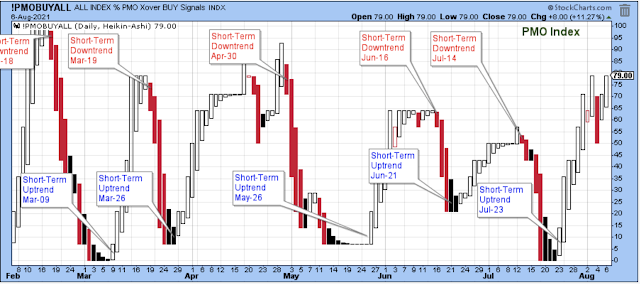

The short-term uptrend continues, although I am quite surprised. I thought for sure that we were close to another downtrend on Wednesday, with an elevated number of new lows and a declining PMO index.

However, by mid-morning Thursday, the market was drifting upwards with improving market internals along with a number of leading stocks that were breaking higher. Thursday's session had a solid close followed by Friday's strong jobs report and a positive market response that gained strength for most of the day.

Last Saturday I was quite bearish towards stocks short-term, but by mid-Friday morning, I felt that I had been proven wrong. So, on Friday, I had to scramble and rearrange my stock holdings to be positioned for higher prices in the short-term, and also to participate in higher prices among the market sectors that benefit when there is a strong jobs report.

Of course, I'm not happy about being wrong but I am happy that I have learned over time to recognize and admit to an error and act accordingly. It's a liberating feeling, and definitely beneficial for my trading account.

It will really be a kick in the head if the market decides to tilt bearish again next week, but I'm open to that possibility considering the fact that strong jobs implies higher rates sooner than expected.

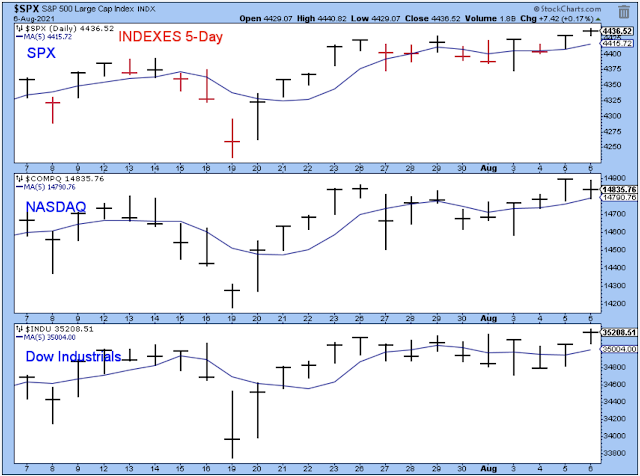

As mentioned above, the market was weakening on Wednesday with the Dow having a bad day, but by the end of the week, the indexes recovered and closed above their 5-day averages. I would have preferred to see a strong close similar to Thursday for the Nasdaq, but with the strong jobs report, we are probably seeing another shift away from Nasdaq stocks to the NYSE.

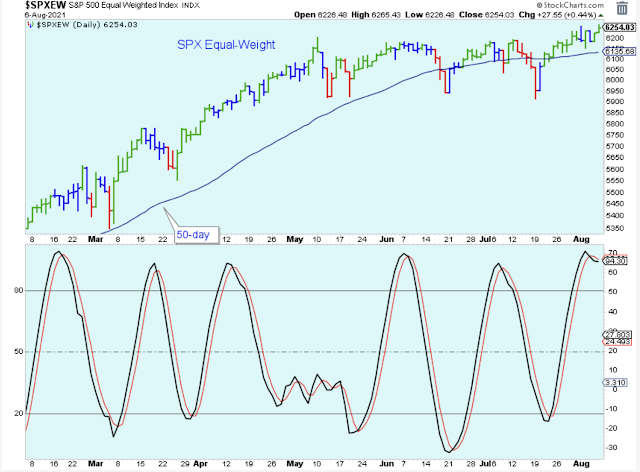

The SPX equal-weight broke out of its consolidation into new highs, although it did stumble a bit and it isn't yet convincing. Also, the momentum indicator has peaked, which means that even if the index continues to move higher, it will probably be a choppy advance.

Obviously there are times when the market advance is so strong that the market just ignores the peak in the momentum indicator, such as April of this year. However, I think that it is generally a decent indication of when to be aggressive in the market and when to be a bit cautious.

Here is another look at the SPX equal-weight that does a better job showing the break out. I like the convergence of the moving averages as a signal of consolidation and opportunity. This chart makes the index look a lot more promising.

The chart below of the 10-day Call/Put ratio was one of the few that I showed last week that did not support my bearish view. It was just starting to point higher after trending lower for a number of weeks. The ratio continues to favor higher stock prices in the short-term, but I'm sure we would rather see a much stronger pattern, such as the reversal into an uptrend mid-May. I'll be watching this chart carefully next week.

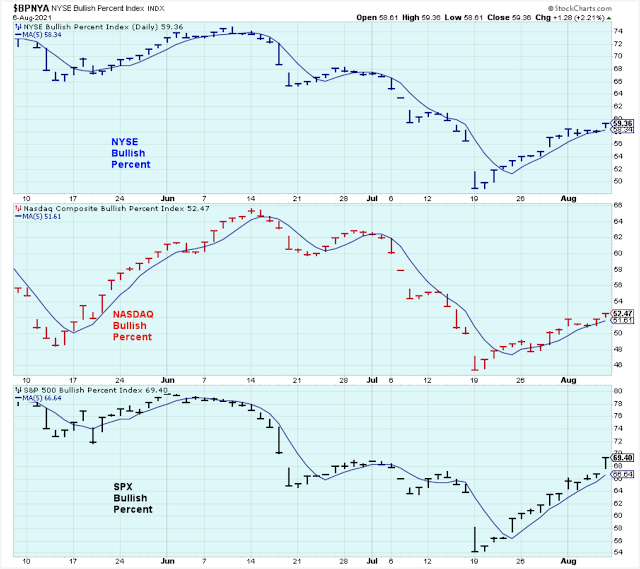

The bullish percent indexes of the three major price indexes also seem to favor higher stock prices short-term. There is obviously a slow and steady increase in the number of stocks participating in the current rally, and there was a decent move higher on Friday, which is bullish.

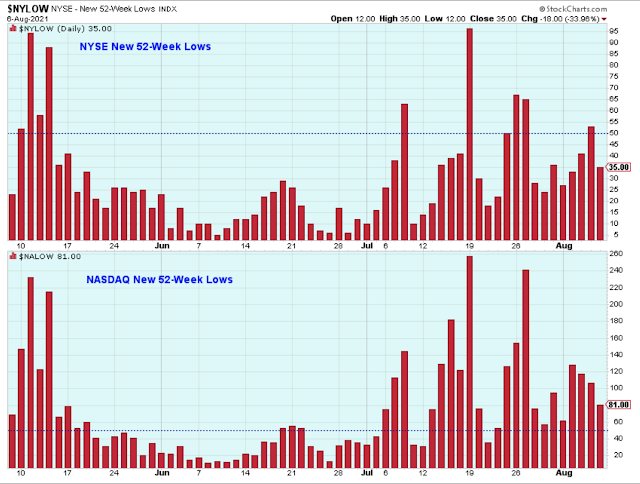

Here is the chart that continues to make me uneasy about stock prices because there are too many new 52-week lows on the Nasdaq. But let's see if the number of new lows settles down below 50 early next week before making too much of this today.

There has been a lot of discussion on CNBC about the narrow participation during the stock market advance for the last few months. The red arrows in the chart below illustrate this by showing prices increasing and net advance/declines decreasing. Now, it looks as though the advance/decline ratio is showing just a little bit of life, although it still has a lot more work to do to be convincing.

The small-caps had a good showing on Thursday and Friday. Let's see if they can rally from here. The first step is to start to trade above the 50-day average.

One of the aspects of the market that I think is not getting enough attention is the trend of the US dollar because it has such a large influence over which areas of the market outperform. At the moment, based on this chart, I believe the longer-term trend continues to be lower, but the downtrend may be in the process of giving way to a new longer-term uptrend.

I had thought that if we got a spike in the dollar it would be a risk-off event, but as it turns out, Friday's strong jobs report implies higher short-term rates, and this pushed up the dollar, which I take as a risk-on event.

Here is a look at the weekly chart of the dollar, which shows that it is battling against the long-term downtrend with a significant double bottom, and now it appears to have bullishly settled above the 40-week average. If it starts to trade above the March 2021 high, then I think we must declare a new longer-term uptrend.

Treasury Bonds reacted immediately to the strong jobs report with a sharp decline that sliced below the 20-day. Now, the short-term trend for bonds certainly looks lower, and we should be on watch for a change in the larger trend. Not too surprising was Friday's jump in bank stock prices, and next week we should be watching all the rate-sensitive and inflation-sensitive stock prices to see if they follow the banks higher.

That is more than enough about stock prices. For now, stocks look like they are headed higher in the short-term, but it is a difficult market to navigate for certain.

Outlook Summary

- The short-term trend is up for stock prices as of July 23.

- The economy is in expansion as of Sept. 19.

- The medium-term trend is up for treasury bond prices as of June 11 (prices higher, rates lower).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more