The Short Guide To Dividend Investing With Coronavirus Spreading

China-centered Coronavirous outbreak has caused volatility and havoc in the financial and commodity markets. Last Friday’s 600 point drop in the Dow Jones Industrial Average (DJIA) pushed the weekly decline to 733 points. This decline was the worst drop for the U.S. stock market since August 2019, when recession fears gripped investors.

At this time, it appears the pandemic nature of the virus will be restricted to China. U.S. authorities are undertaking adequate steps to prevent a widespread outbreak here in the United States. The bigger questions are how long it will take China to get the outbreak there under control and how much the pandemic in China will affect global business results.

In the energy sector, predictions are that Chinese crude oil consumption has dropped by 3 million barrels per day or 20%. Energy consumption has dropped because the Chinese citizens in the most heavily infected regions are not going to work. They are staying at home, which means factory workers aren’t in the factories producing goods.

It also means the Chinese aren’t out spending money, consuming goods and services. One big unknown that needs an answer is how long the Coronavirus pandemic will keep a large number of people in China restricted to their homes.

Three Directions for Your Portfolio to Take Now

For stock market investors, the uncertainty about how the Coronavirus story will play out makes putting money into stocks a dicey bet. I have several recommendations for investors trying to decide what they should do with their stock market holdings.

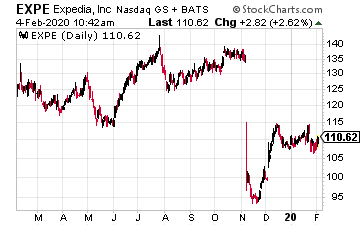

#1: Stay away from or get out of stocks that have international businesses. These will be businesses such as cruise ship operators, airlines with large numbers of international flights, and travel companies such as Expedia (EXPE).

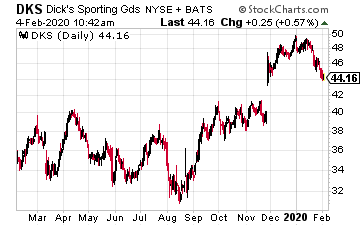

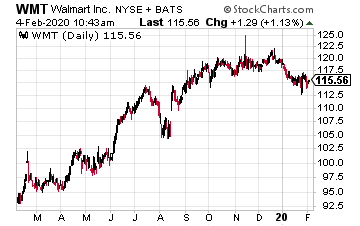

#2: Stay away from companies dependent on Chinese factories that produce the goods they sell or even the components for the goods they produce and sell. This factor is big because it seems like everything is manufactured in China. Clothing, sporting goods, appliances, mobile phones, and computers are all largely produced there. Stocks to avoid range from specialty retailers like DICK’S Sporting Goods (DKS) to Walmart (WMT).

#3: What to buy if you need to put money to work in the market. Think of businesses that operate and generate revenue almost exclusively in the U.S. Look to invest in companies that are not dependent on international trade for either customers or the goods they sell. You also want to stick to income stock categories, where you will earn an attractive dividend yield. The income from dividends will cushion your brokerage account and mental state if the stock market stays volatile until there is a resolution of the Coronavirus situation.

Investment Ideas That Fill the Goals of Recommendation Three

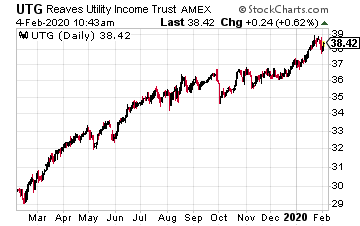

Public utility stocks are a great investment sector in troubled times, and these companies are primarily U.S. based operators.

I like the way the folks at Reaves Asset Management put their utility sector expertise to work for investors.

The Reaves Utility Income Fund (UTG) has paid a steady and growing monthly dividend for over 15 years. I have been recommending UTG to my Dividend Hunter subscribers since 2015.

It has been a great investment, with an average annual return of 11.5% over the last five years. The current yield is 5.7%.

Net lease real estate investment trusts (REITs) primarily own stand-alone retail properties leased to businesses that are resistant to online retail sales.

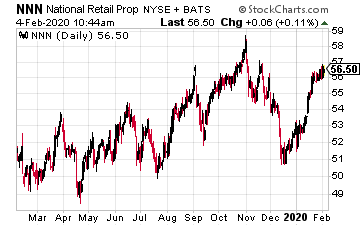

National Retail Properties, Inc. (NYSE: NNN) is a triple-net lease REIT that 3,000 single-tenant retail properties in 48 states.

The properties are leased and operated by businesses that won’t go out of business in an economic recession. Think of your local convenience stores, auto parts shops, and movie theaters.

This company has increased its dividend for 30 consecutive years, which means the dividend has grown through the last several economic recessions.

That’s a record a Board of Directors will not want to stop. NNN shares yield 3.7%.

Healthcare is another business sector with operations that will be U.S. focused, and not affected by what happens in the rest of the world.

Healthcare REITs own properties that are leased to companies that operate in the sector.

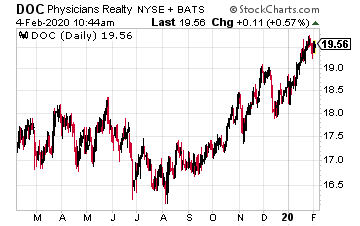

Physicians Realty Trust (DOC) has a portfolio that is composed of medical office, physician group practice clinics, outpatient care, ambulatory surgery centers, specialized hospitals, rehabilitation facilities, and small specialized long-term acute care hospitals.

All of DOC’s properties are located in the U.S. The shares currently yield 4.7%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

Wow, we only make REITS and Utilities. How arrogant is Trump to think we could survive very well without China!