The Second Wave Of Selling On The Stock Market Has Begun

Image Source: Unsplash

The stock markets have been on quite a rollercoaster ride over the last six weeks. While the recovery after the low at the beginning of August was already underway, we discussed the idea of a second wave of selling in Pretiorates' Thoughts 45. Sell-offs that come with a heavy dose of panic are almost always subject to a second test.

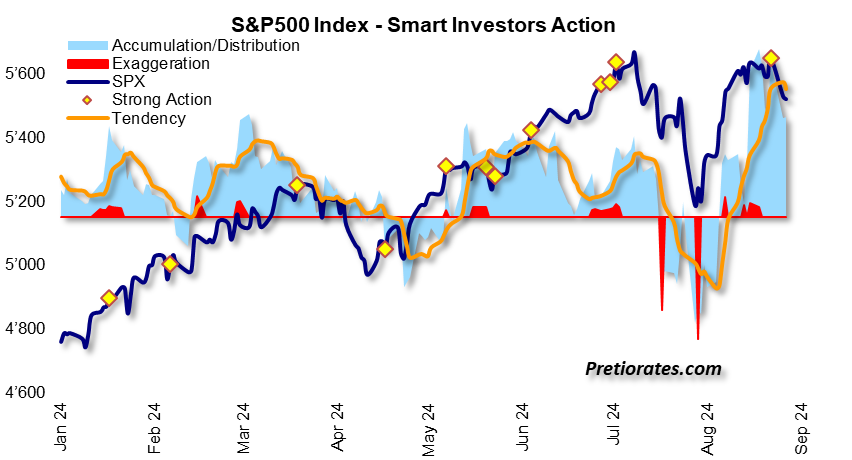

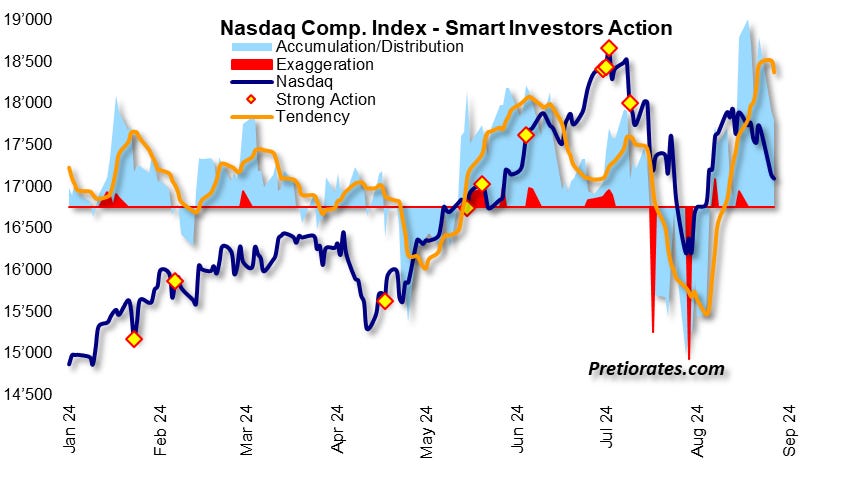

The recovery of the US equity markets has definitely gone further than expected. However, the indicators now show that it has most likely already ended. The 'Smart Investors Action' showed an 'exaggeration' (red area) and accumulation is already declining - from a very high level...

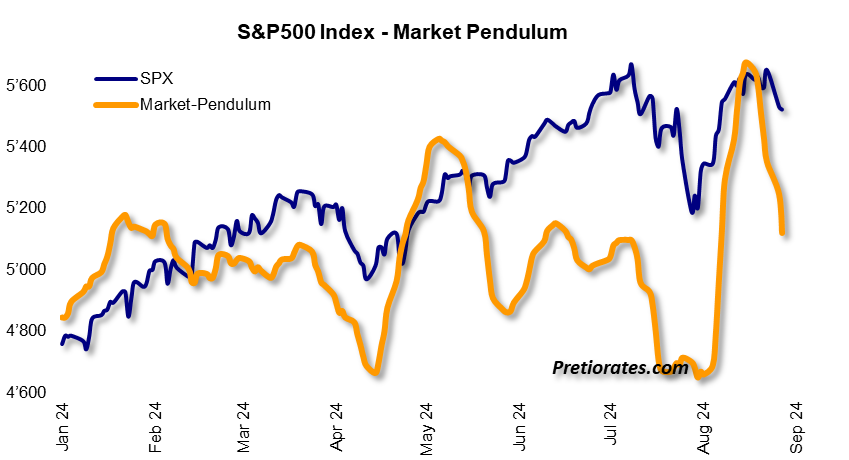

The last few weeks have definitely been a trader's market. During these, the 'Market Pendulum' and 'Balance of Power' indicators work particularly well. The 'Market Pendulum' indicated the end of the technical recovery in perfect time...

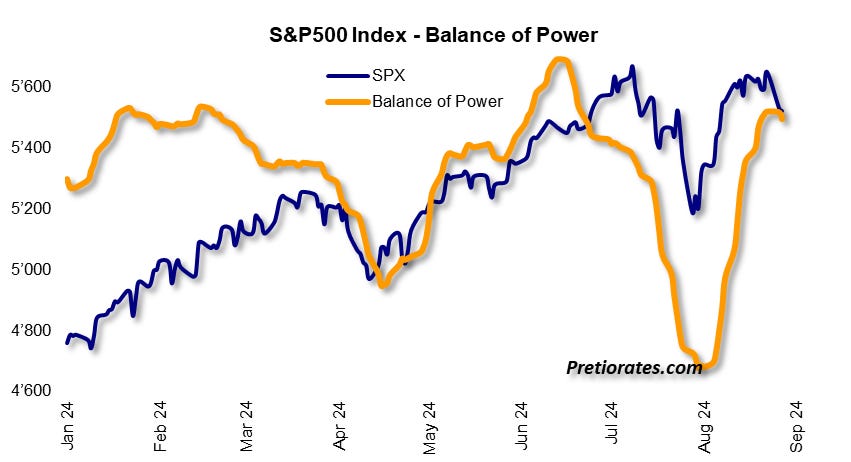

And now comes confirmation from the 'Balance of Power', which measures the forces between the bulls and bears....

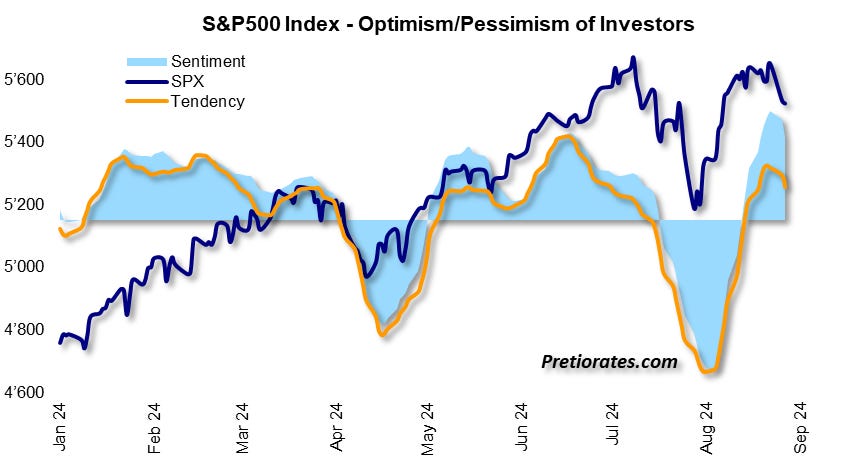

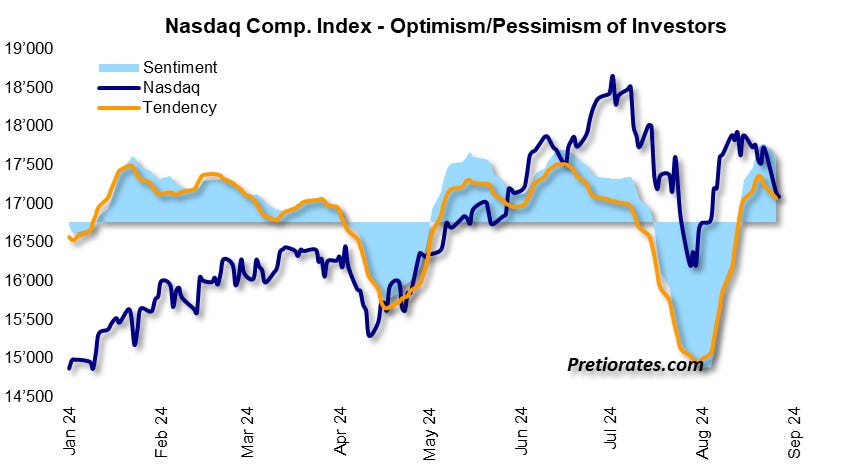

At the beginning of August, there was still a very pronounced pessimism that turned into massive optimism within a month. But this is already crumbling again...

The Nasdaq market shows the same picture: note in particular the red areas (exaggeration), which indicate extreme values during the phases of accumulation and distribution of smart investors (light blue areas)...

Optimism in the Nasdaq market has recently failed to surpass previous levels - and is also declining again...

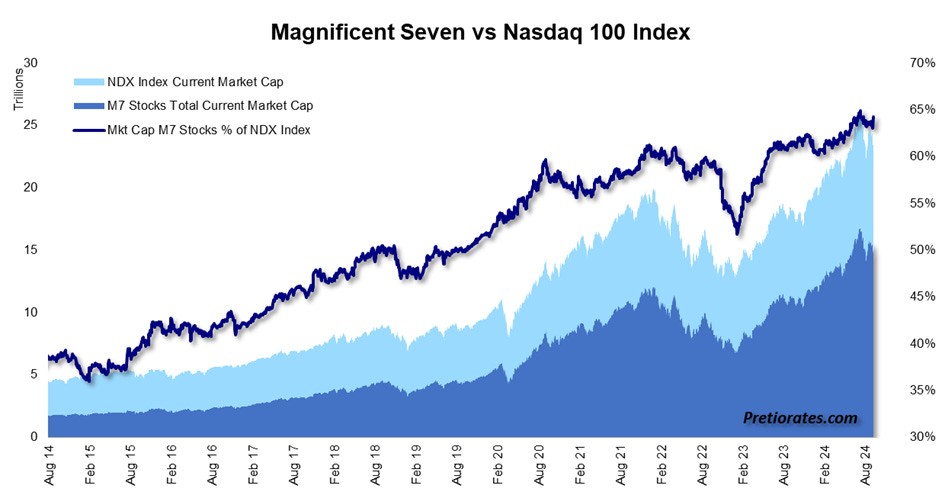

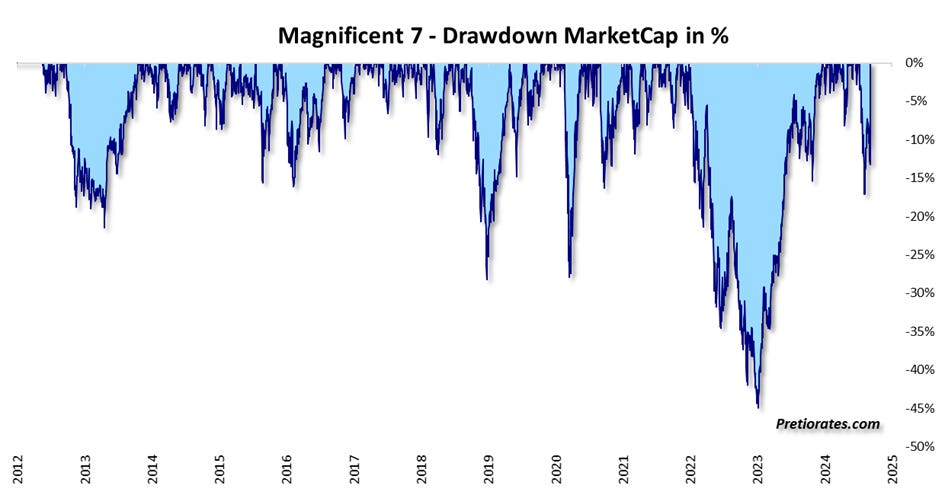

The Magnificent Seven were of course particularly responsible for the rally in recent months. Recently, the market capitalization of just these seven companies has reached almost two thirds of the entire Nasdaq stock market...

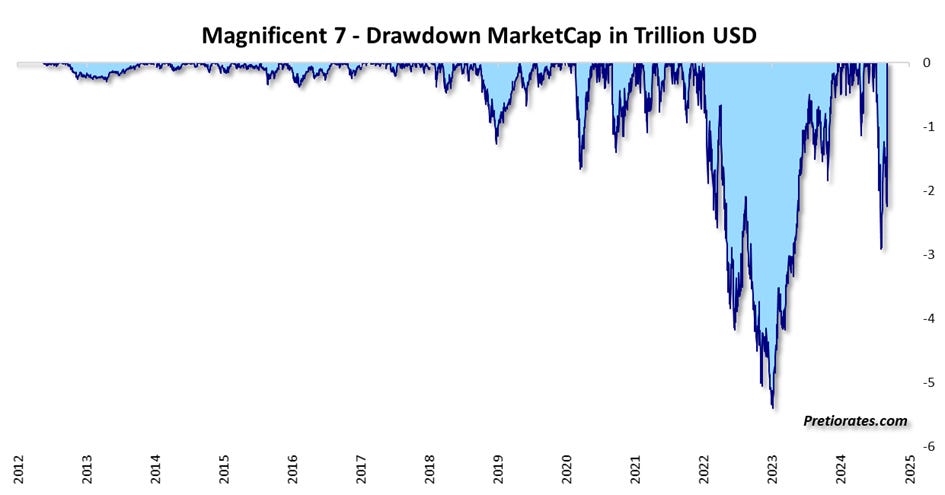

The losses are correspondingly high when they start to correct. In the sell-off a year ago, the losses amounted to over 5 trillion US dollars. The current level of losses since the top: approx. 2.2 trillion dollars...

In percentage terms, the total market capitalization of all seven stocks is down around 12%. In 2023 it was much worse and in percentage terms it was not a big event compared to previous corrections that will go down in the history books - as of today...

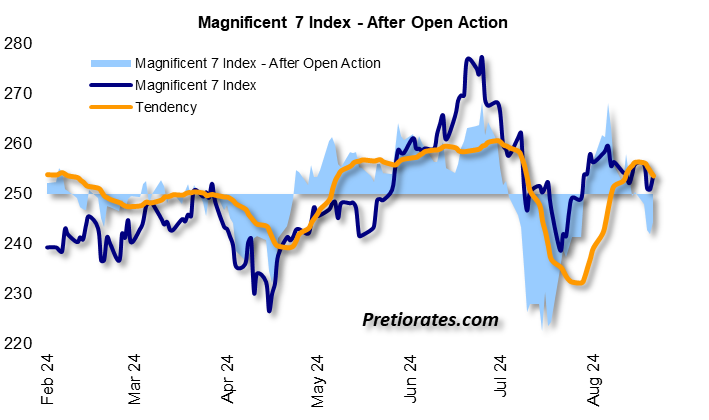

Our Mag-7 index, which takes into account the market capitalization of the seven companies, is likely to remain weak for the time being according to the 'After Open Action'. Investors are continuing to reduce their holdings (blue area negative, orange line indicates the trend)...

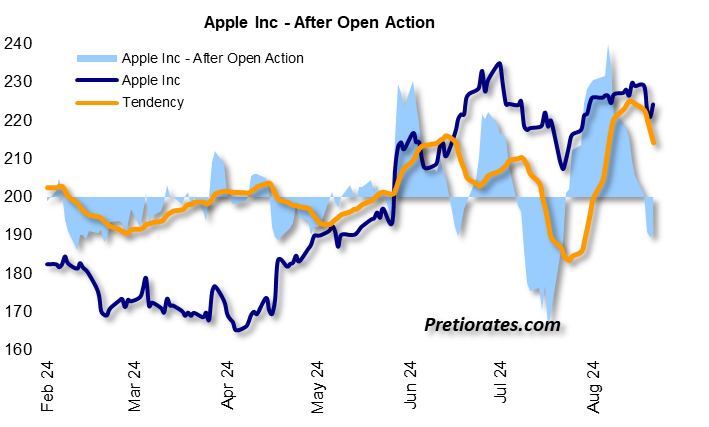

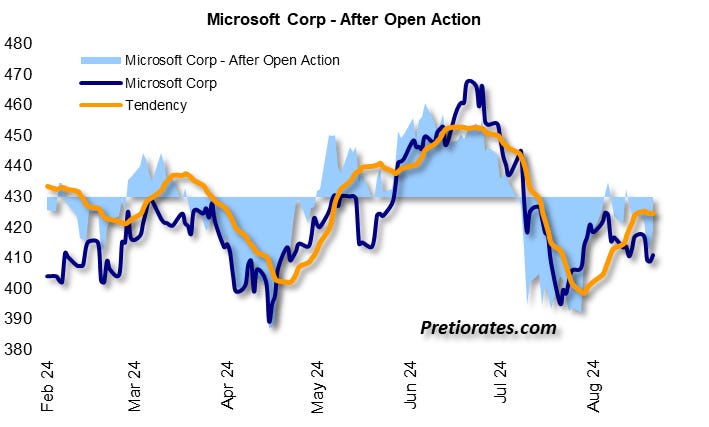

For the sake of completeness, we show the same indicator for all seven stocks:

Apple (AAPL) is in distribution, the tendency indicates a larger down-potential...

Microsoft (MSFT) never made it back to accumulation - and the distribution is increasing again...

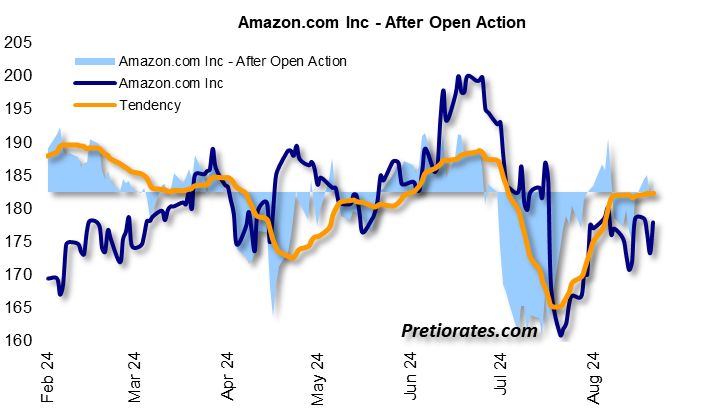

The bulls haven't really been able to convince Amazon (AMZN) either since the sell-off...

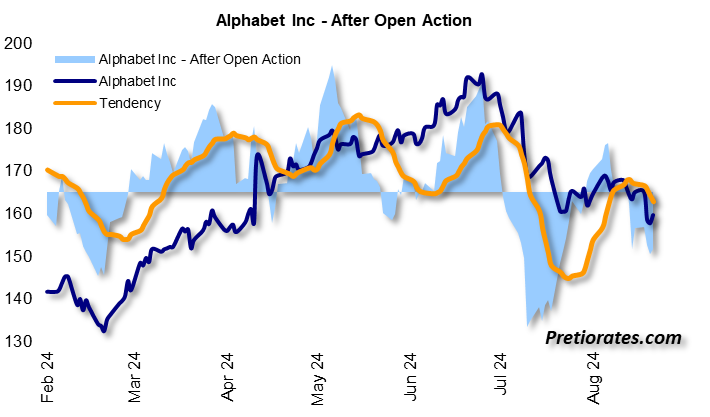

The same picture with Alphabet (GOOGL)...

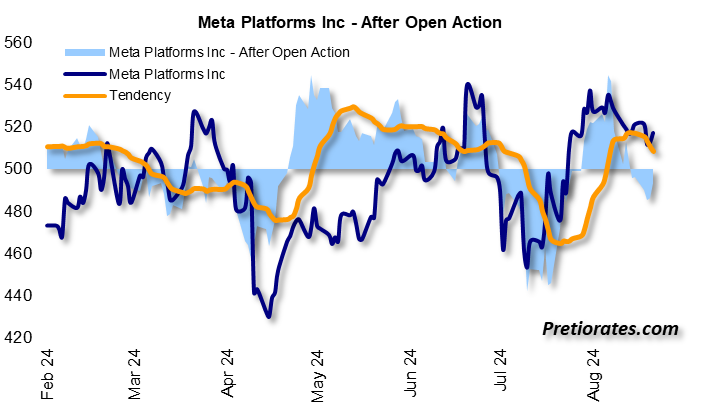

META was able to realize a stronger recovery, but here, too, distribution is already taking place again...

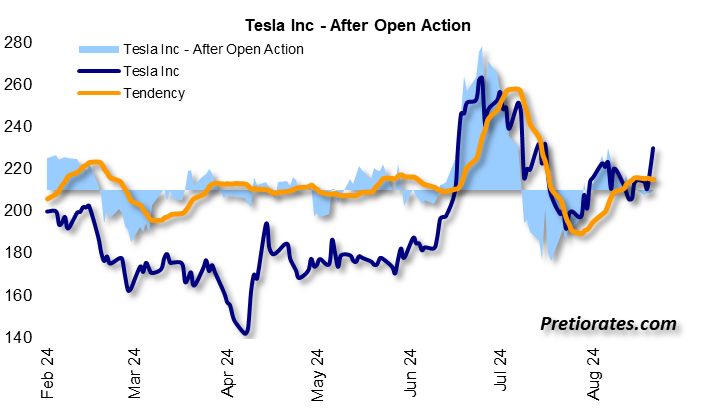

Tesla (TSLA) seems to have a life of its own. Although the recovery was cautious, it remains intact...

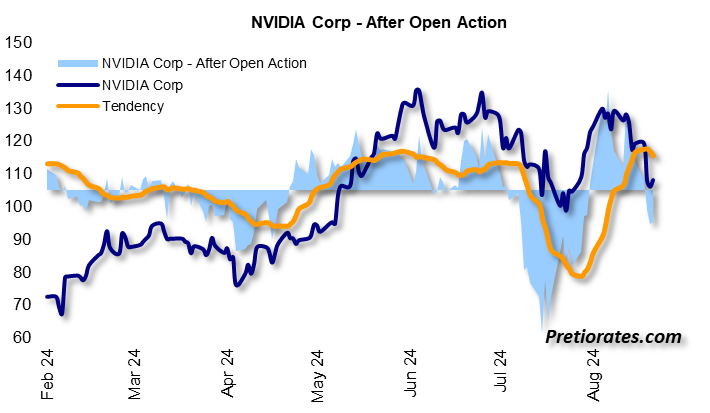

Market leader Nvidia (NVDA) is also already having to cope with distribution again...

Conclusion: The US labor data due for publication tomorrow is likely to have a greater impact on the stock market in the short term. However, sentiment will determine which of the two sides receives more attention. At present, a positive surprise would have to be very strong for the US equity market to reward it with a pronounced advance. If, on the other hand, there is a negative surprise, it is likely to be a party of the bears.

More By This Author:

The Bond Market Should Be Careful What It Wishes ForThe Bulls In The Stock Market Shouldn't Feel Like Winners Yet

Gold Is Watching The Growing Possibility Of Kamalanomics

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more

Good read, thanks.