The Roadmap Ahead: Taking Inflation’s Measure

Ahead of the important March CPI this morning it seems like a good time to take a look at the road ahead for the next bunch of weeks.

(Click on image to enlarge)

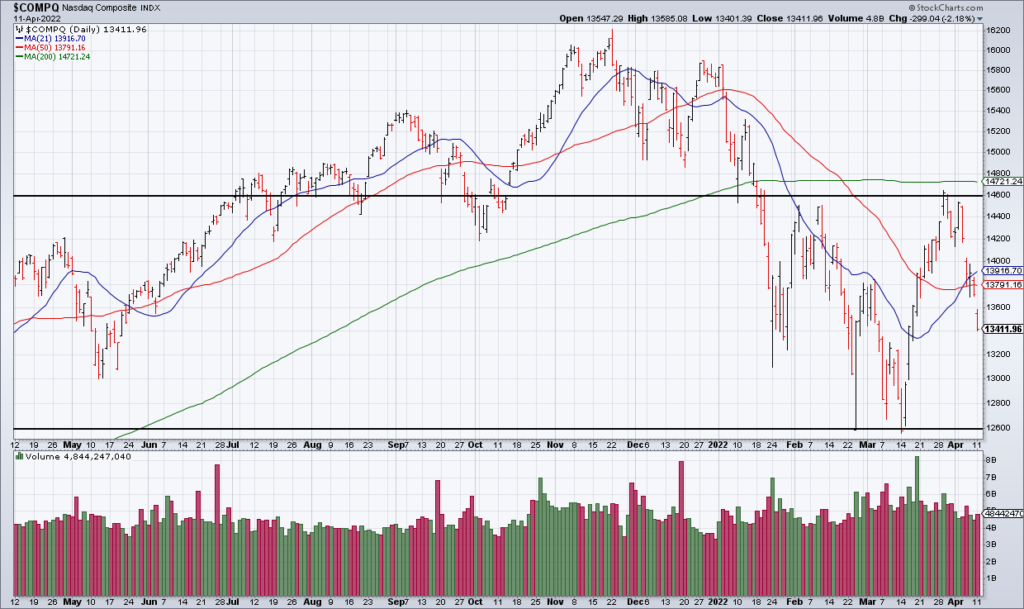

The first thing is that the rally off the March 14 lows is looking more and more like a classic bear market rally. 60% of Nasdaq’s gains have been erased as of the close Monday.

Odds of 125 basis points of tightening by the June meeting (a combo of a 50 bps hike and 75 bps hike) are up from 18% to 32% over the last week. pic.twitter.com/1LriPYjMul

— Bespoke (@bespokeinvest) April 8, 2022

Next the March CPI report this morning is important because it will be a key input for the Fed Decision in three weeks on Wednesday, May 4. Will they raise 25 or 50 basis points? As you can see in the tweet above by Bespoke, markets currently expect 50 basis points hikes at both the May and June meetings. If this comes to pass, I think the March 14 lows are very much in play.

Third: 1Q22 earnings season is upon us and swings into full gear next week. I will be focusing on how inflation is affecting the company’s results via demand destruction and margin compression. As I’ve written about before, inflation squeezes governments, businesses, and consumers' budgets. That means they have to cut back somewhere so I’d be interested to see how demand for discretionary items holds up. Second, I’ll be focused on margin compression.

(Click on image to enlarge)

Used car retailer Carmax (KMX) – whose quarter ended at the end of February – will provide us a preview this morning. As we all know by now, the automotive market is extremely tight so I’m interested to see KMX’s used car volume. How many cars were they able to acquire for inventory? Did the tight supply chain constrain them? Also: How did demand hold up given inflationary pressures on consumers' budgets? I’m also interested in their margins. How much did they have to pay for their used car inventory? Gross margin has been a problem for them the last two quarters and I don’t see any reason for that to change. Nevertheless, KMX stock has been beaten up and could easily get a relief rally.

Odds of 125 basis points of tightening by the June meeting (a combo of a 50 bps hike and 75 bps hike) are up from 18% to 32% over the last week. pic.twitter.com/1LriPYjMul

— Bespoke (@bespokeinvest) April 8, 2022