“The Return Of The Boring” Stock Market (And Sentiment Results)

Key Market Outlook(s) and Pick(s)

Baxter Update (BAX)

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

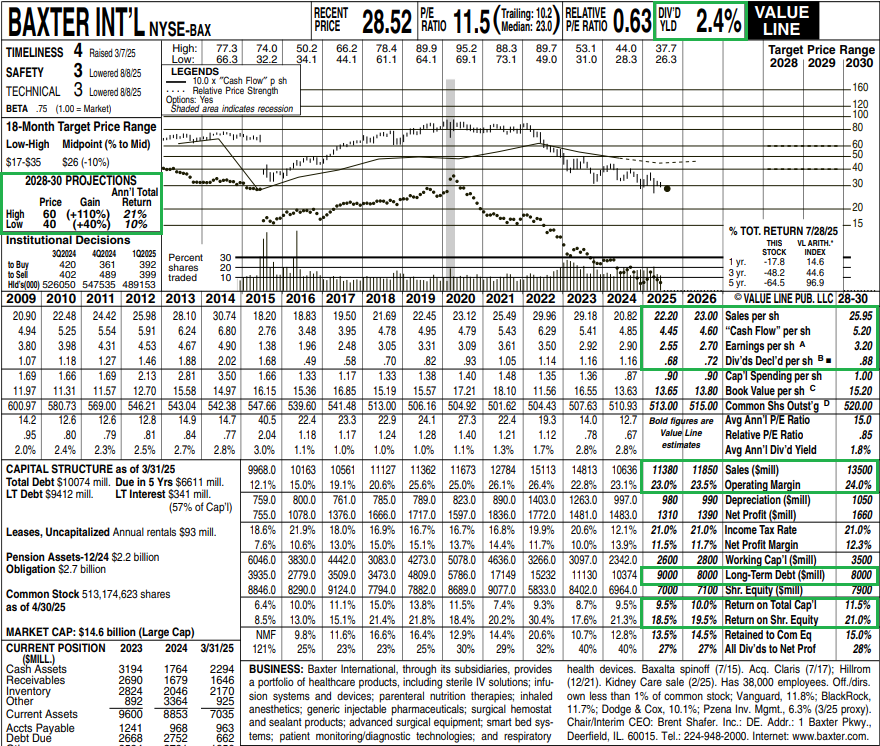

Baxter International, our sleepy medical device pick, reported what we would call the textbook definition of a kitchen sink quarter last week. Take all the medicine at once and set the stage for new CEO Andrew Hider to walk in like a hero, suddenly having the Midas touch for a business that has gone nowhere but down for years.

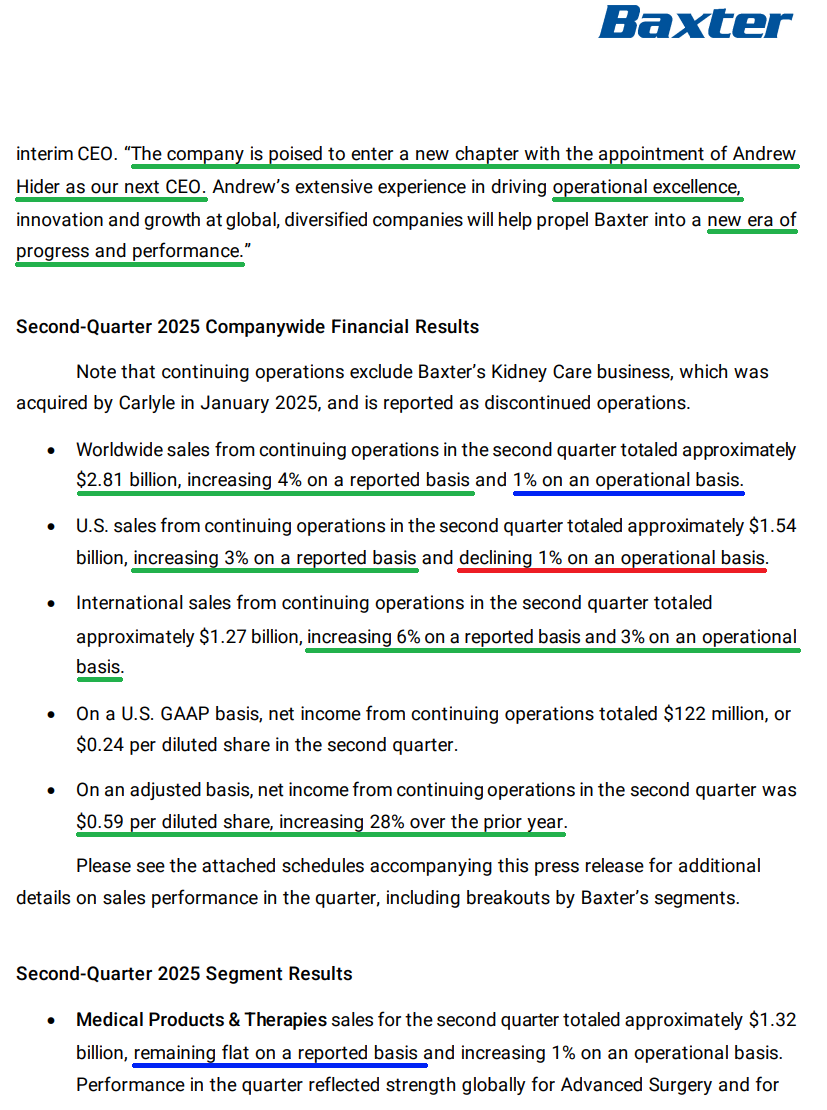

There were two shots of medicine in the Q2 report that spooked the market and led to a full year guidance cut.

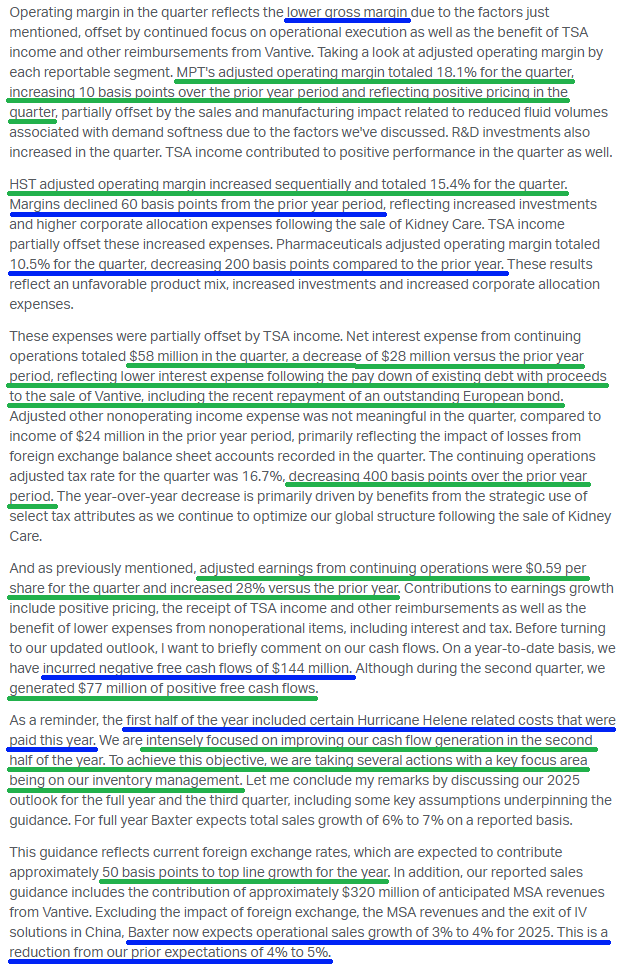

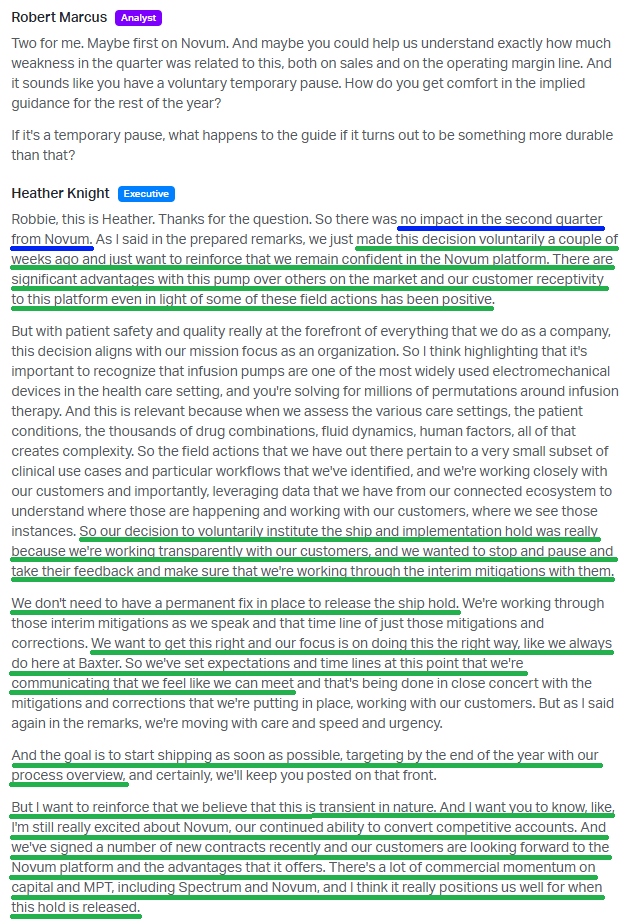

First, management voluntarily paused shipments and installations of its Novum IQ infusion platform to work with customers and address feedback. Novum was Baxter’s shiny new product with a strong backlog, already taking nearly 2 points of market share annually, and a key driver behind the 6% growth in the MPT segment last quarter.

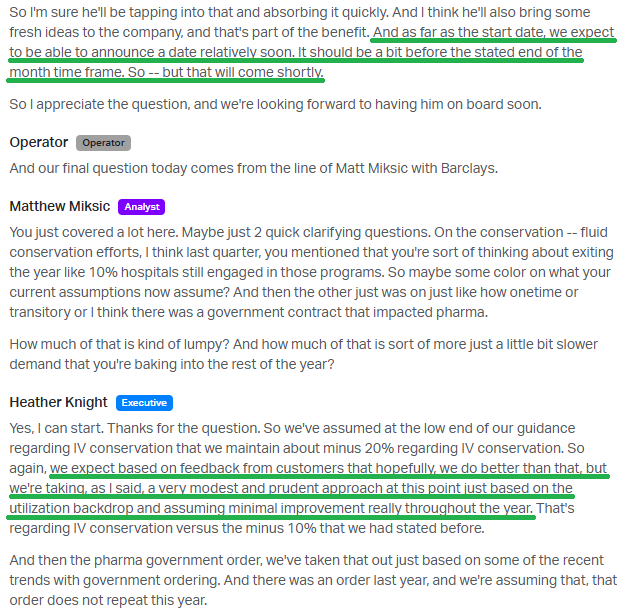

Second, hospital IV fluid conservation efforts have lingered longer than expected following Hurricane Helene and the North Cove recovery, delaying a return to historical norms.

Combined, these overhangs led management to lower full year sales guidance from 4 to 5% growth to 3 to 4% and trim EPS guidance from a range of $2.47 to $2.55 down to $2.42 to $2.52.

In Mr. Market’s eyes, that was enough to knock the stock down over 20%. We had a much different reaction to the news. In fact, we will be mailing Christmas cards for the next couple of years to those who handed over their shares as BAX hovers near 19-year lows.

Not only are both headwinds temporary, but this guidance is what we call the mortician’s forecast for the back half of the year. AKA, this was sandbagging at its finest.

Take the fluid conservation story. Management has already seen improvement and expects more into the back half and into 2026, yet their outlook assumes zero recovery this year. And even if hospitals remain cautious, these IV fluid customers have minimum volume commitments. Either they buy more or they pay more.

Then there’s the Novum IQ pause. The low end of guidance now assumes it stays off the market through year end. This is despite management aiming to resume shipments as soon as possible and the decision to pause being completely voluntary. There was no FDA mandate and no requirement for a permanent fix. Even so, they chose to model ZERO contribution from their most important new product through year-end.

Here’s how we see it potentially playing out. Andrew Hider steps in this September. By his first (or second) earnings call in Q4/Q1, Baxter will suddenly report that Novum IQ is shipping again and flying off the shelves. Meanwhile fluid conservation trends have magically improved. Hider will be hailed as a miracle worker and the turnaround will suddenly feel obvious overnight. Tomorrow’s newspaper, today.

But really, this is all just short-term noise.

The big picture turnaround remains well on track. Priority #1 was cleaning up the balance sheet, and that box is checked. Selling the Kidney Care business for $3.8 billion not only brought leverage down to a projected 3x by year-end, it also got rid of the slowest growth and lowest margin (6.7%) segment in the portfolio.

Now it’s all about execution. And the good news is, this isn’t the type of business that needs to reinvent the wheel. This is IV bags, pumps, hospital beds, etc. Boring, stable, and predictable. And that’s Andrew Hider’s bread and butter. During his time as CEO of ATS, a company that designs and manufactures automated systems and equipment, the stock hit a peak of ~5x from when he joined – after just 6 years at the helm. Before that, he learned from the best at Danaher.

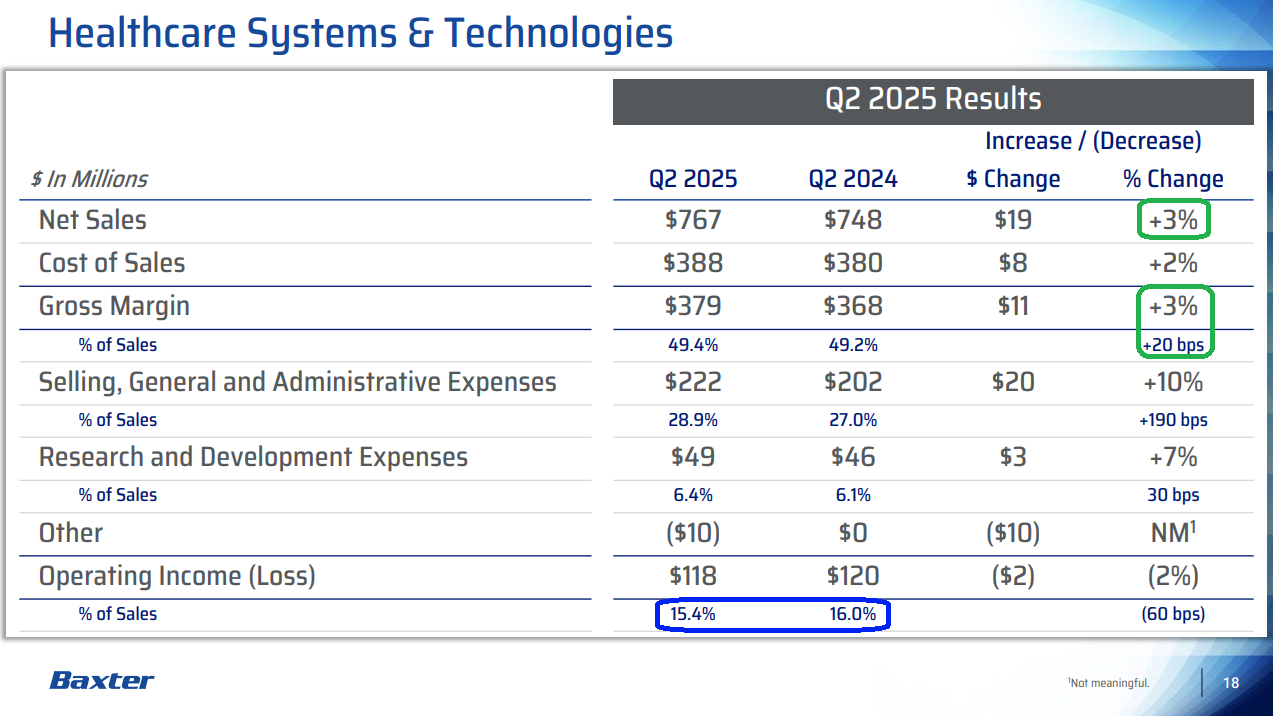

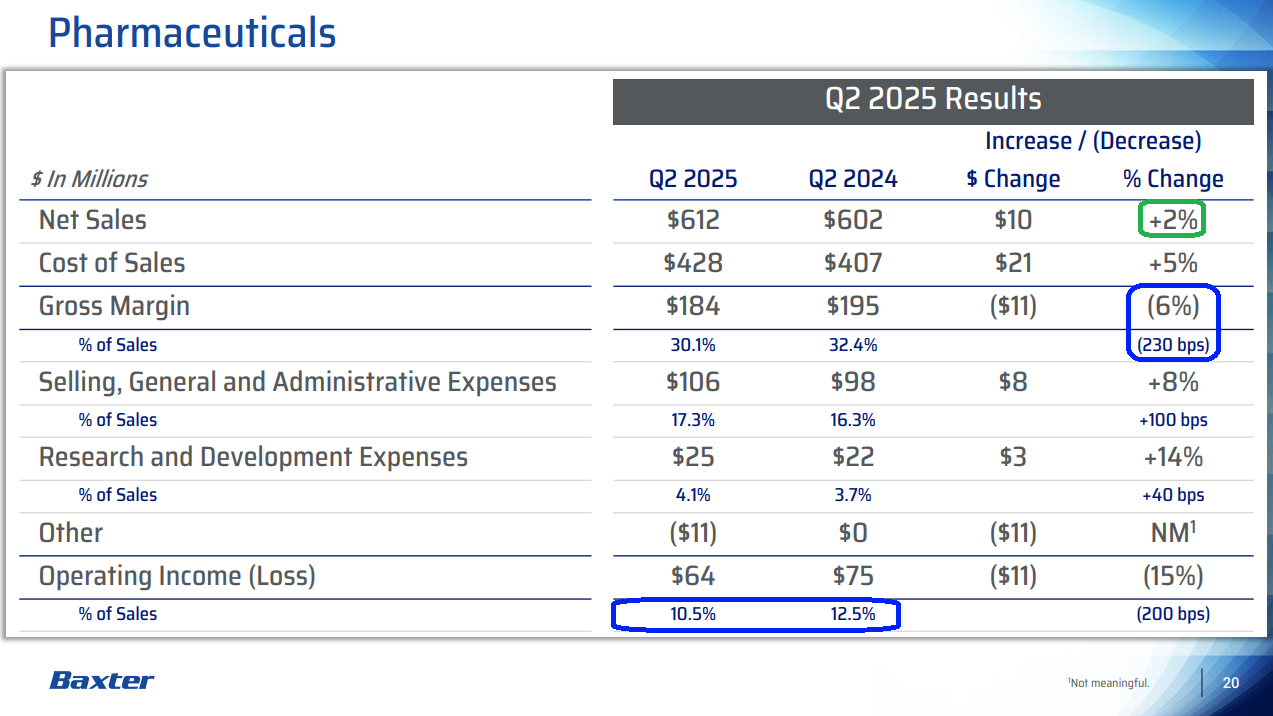

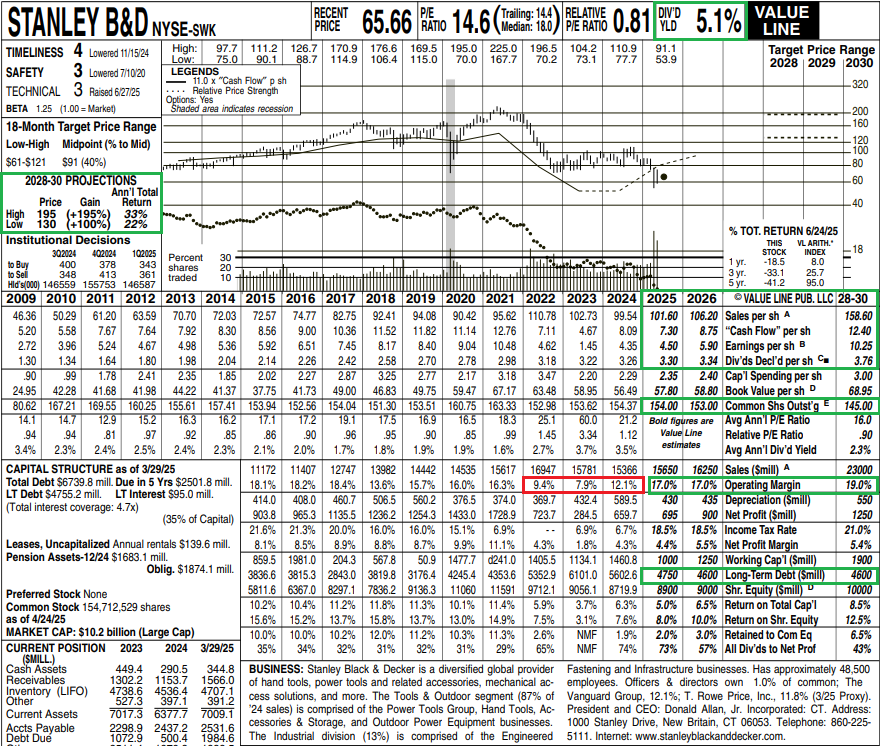

In the case of Baxter, we think a couple of clean quarters of solid execution and proof that they can get back to the 4-5% growth range will go a long way. Management still sees a clear path back to high teens operating margins and has already made solid progress, improving from a trough of 14.3% in 2023 to 15-16% this year.

Once it becomes obvious, we expect the market to reward that progress with a meaningful rerating. Baxter currently trades at just 9x earnings, the lowest we have seen since 2003 when the company was dealing with patient deaths linked to contaminated dialysis machines. A move back toward the sector average and Baxter’s own historical 16-17x multiple feels inevitable once the dust settles.

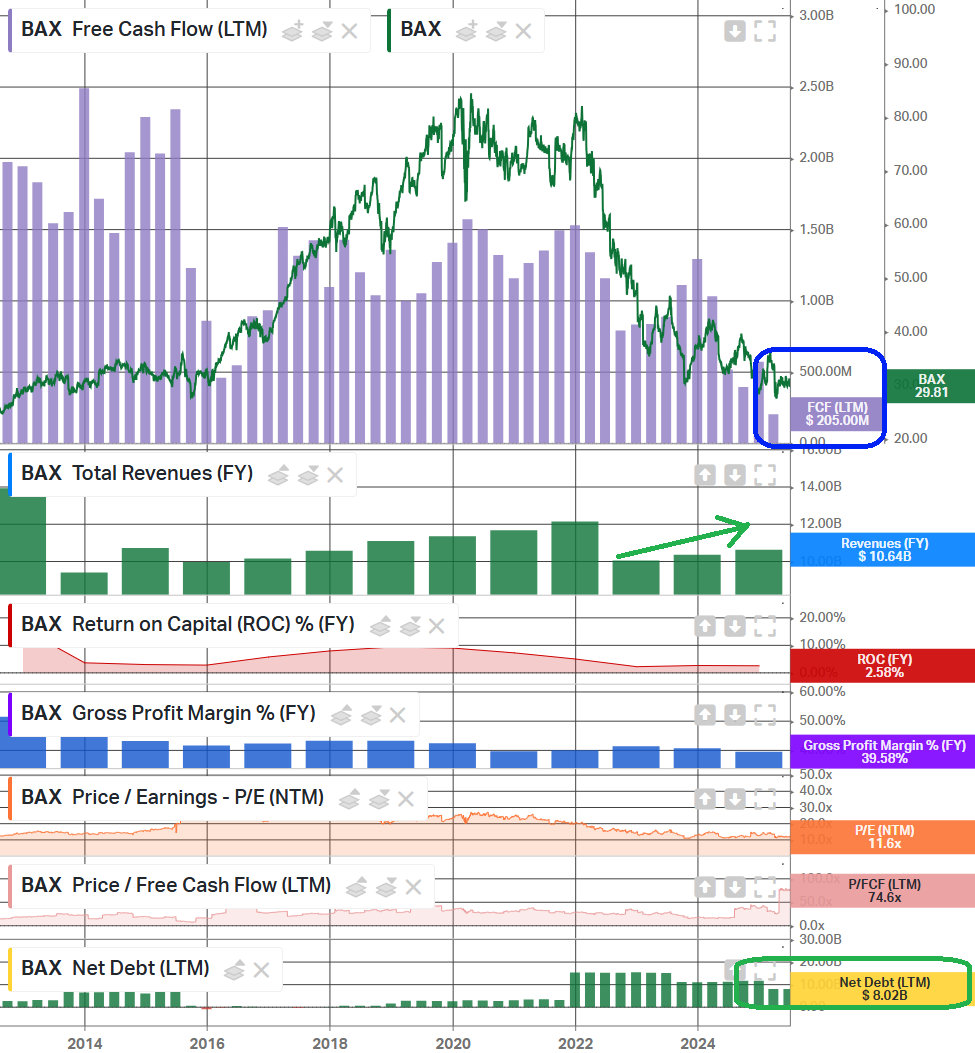

(Click on image to enlarge)

Until then, we will sit on our hands, collect the dividend, and let the story play out. Sooner or later, boring will be beautiful. And Baxter wins that prize all day long.

Q2 Earnings Breakdown

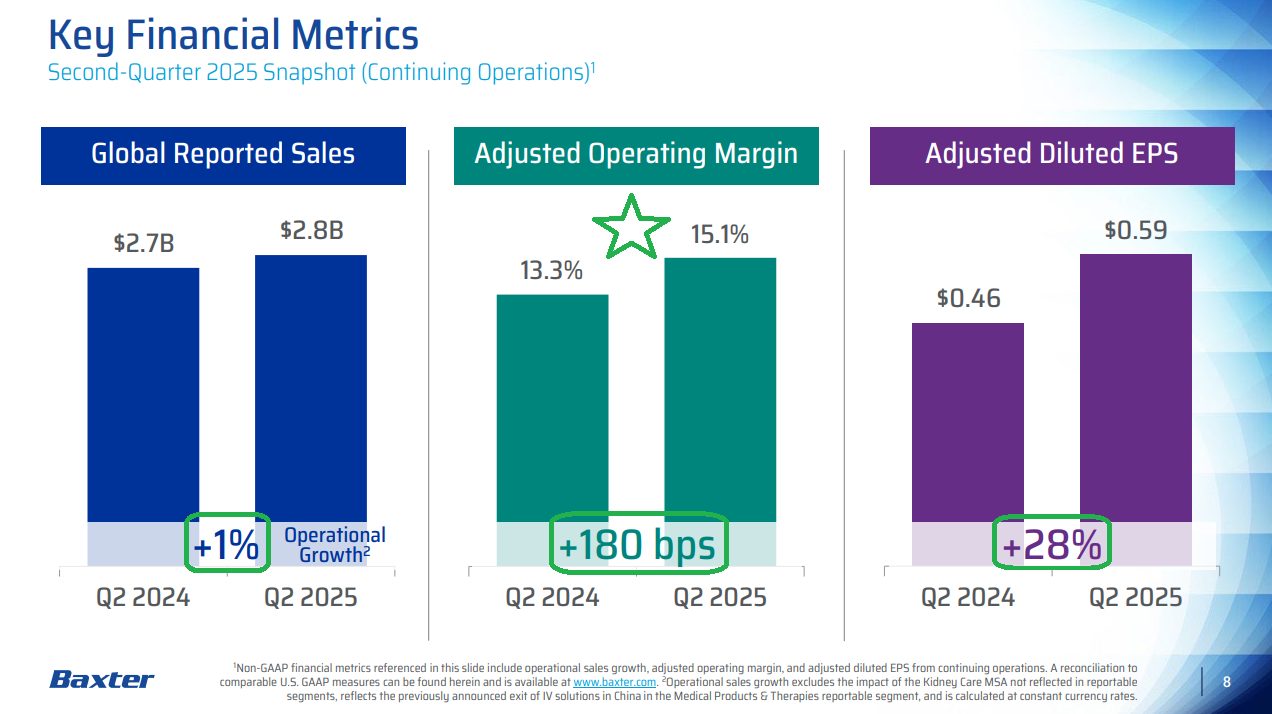

(Click on image to enlarge)

Earnings Call Highlights

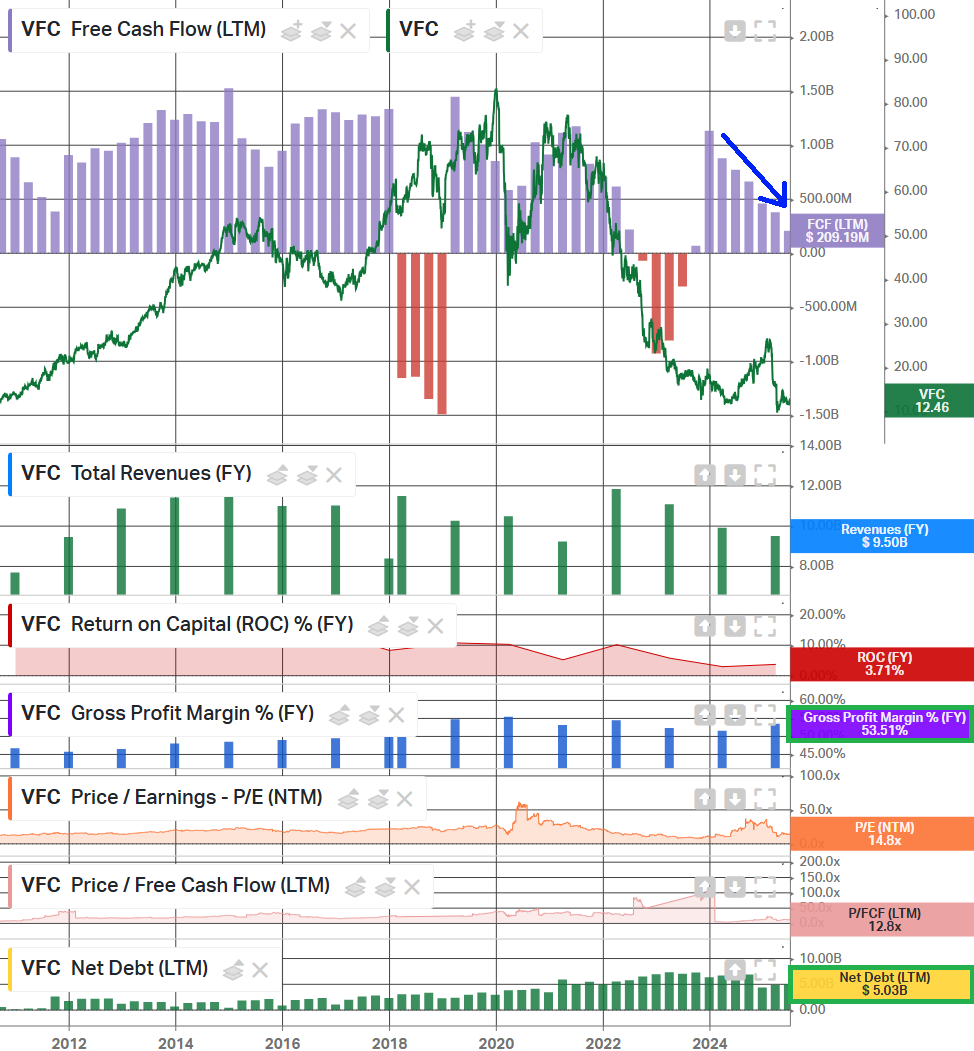

Stanley Black & Decker Update (SWK)

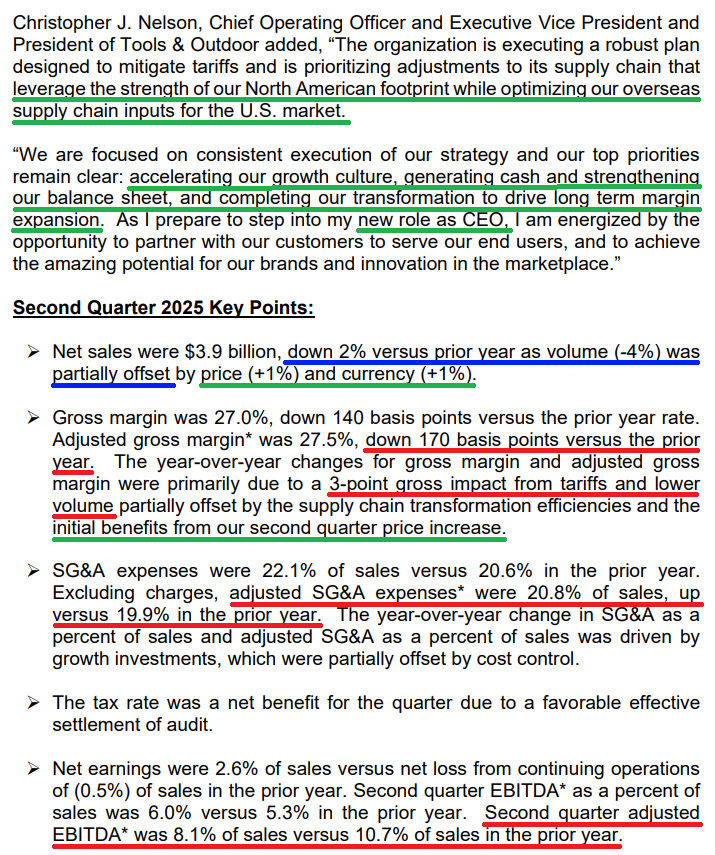

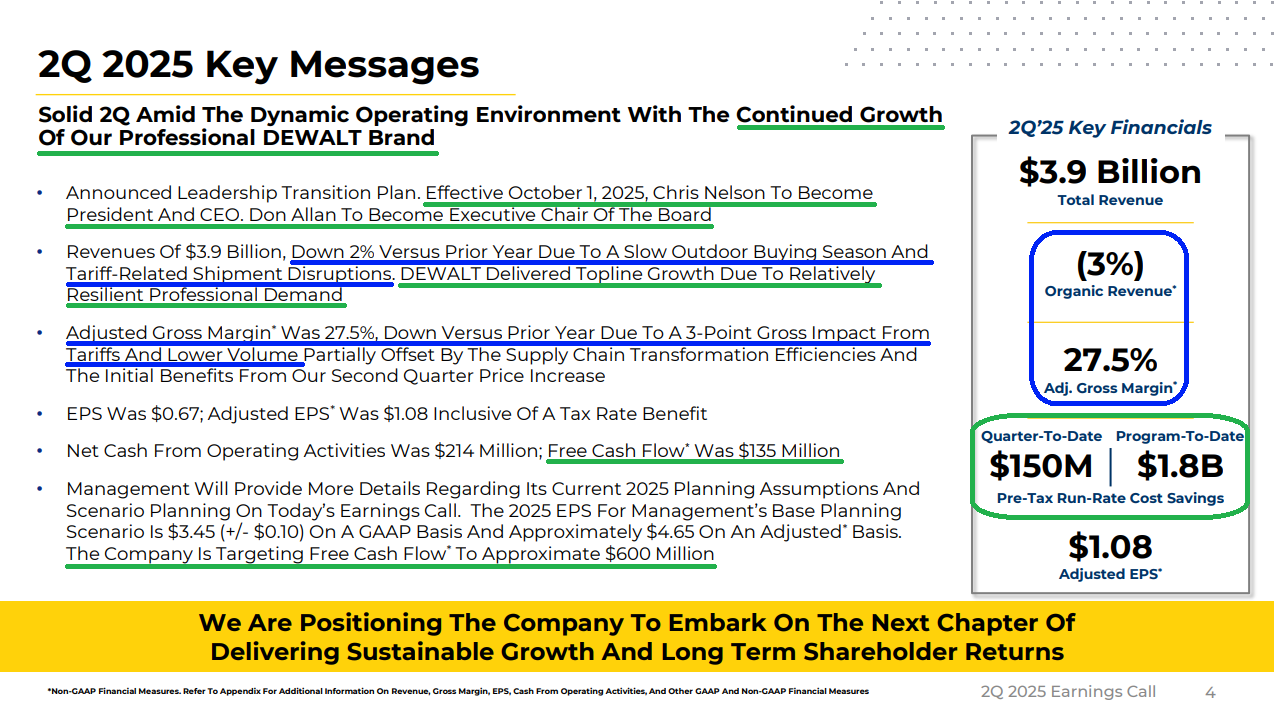

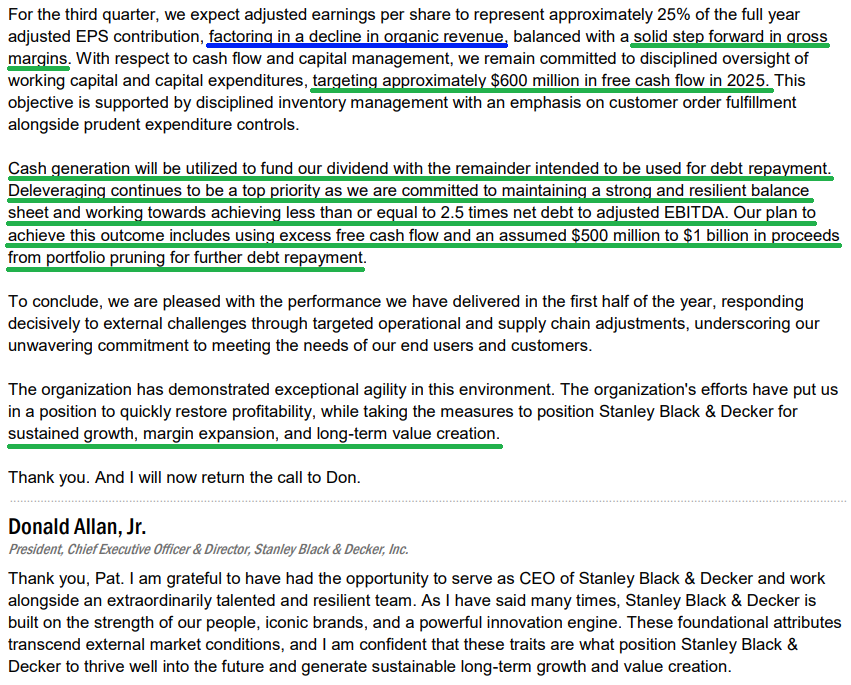

Despite headline numbers that CRUSHED expectations, reporting adjusted earnings of $1.08 per share versus $0.42 consensus and revenue of $3.95 billion in line with estimates, SWK’s solid second quarter and continued progress in the turnaround were overshadowed by the market’s tariff meltdown, turning what was a fundamentally strong print into what looked like a weak quarter.

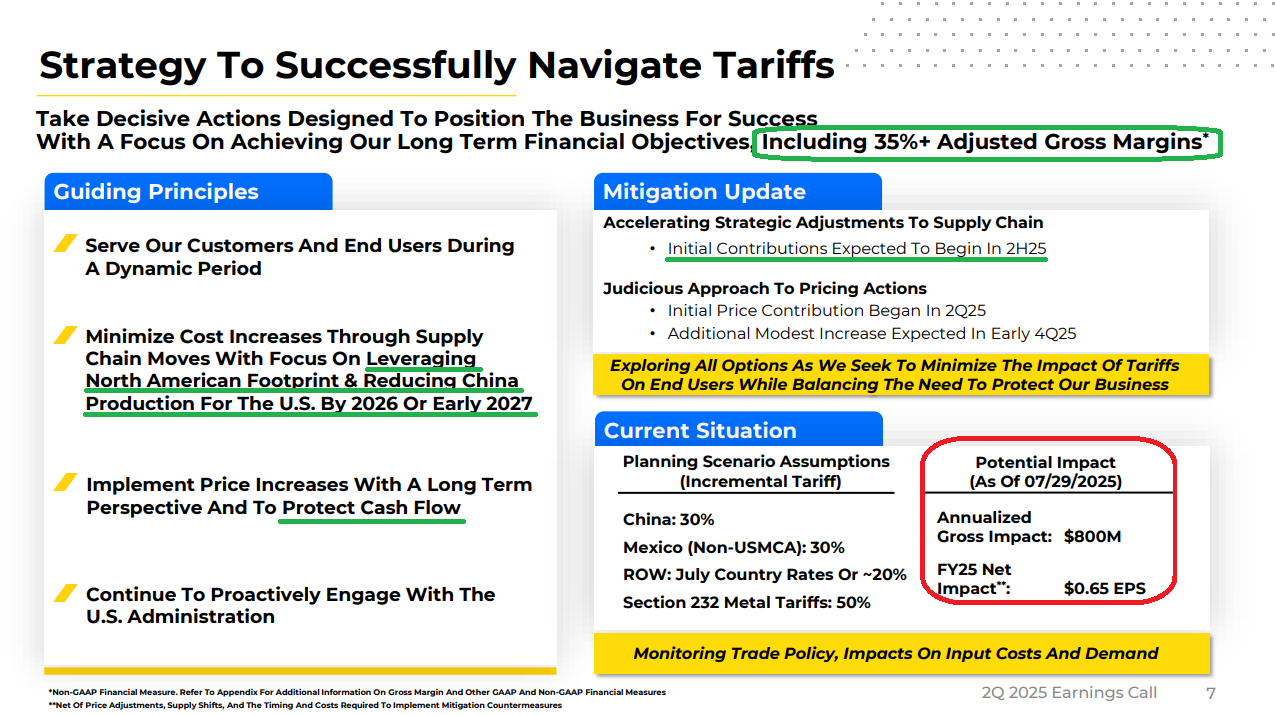

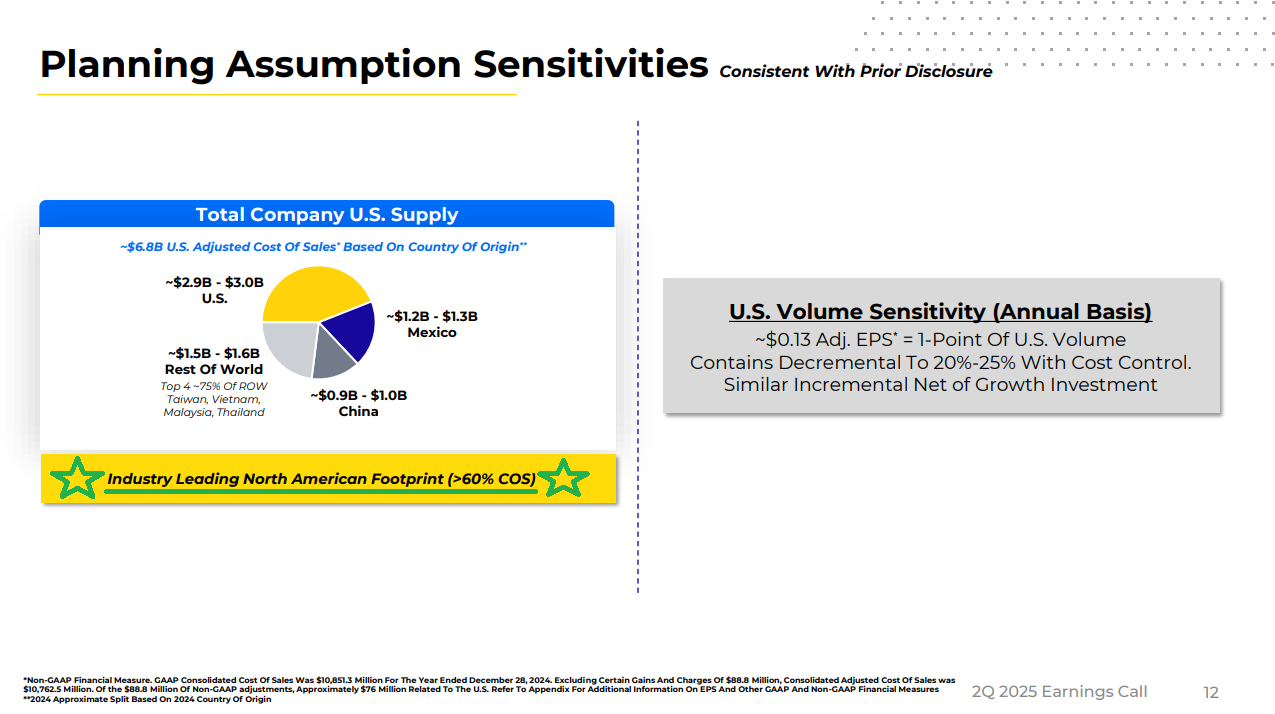

Management guided to a potential $800 million annualized impact from tariffs in 2025, which hit the single most important metric in the turnaround story: gross margins. Margins fell to 27.5% in Q2, down 170 bps YoY, with ~3% of that tied directly to tariff pressure.

Those two numbers were all the market needed to write this quarter off as an ugly one. But when you actually do the work and look under the surface, it is nowhere near as bad as Mr. Market’s knee-jerk reaction would suggest.

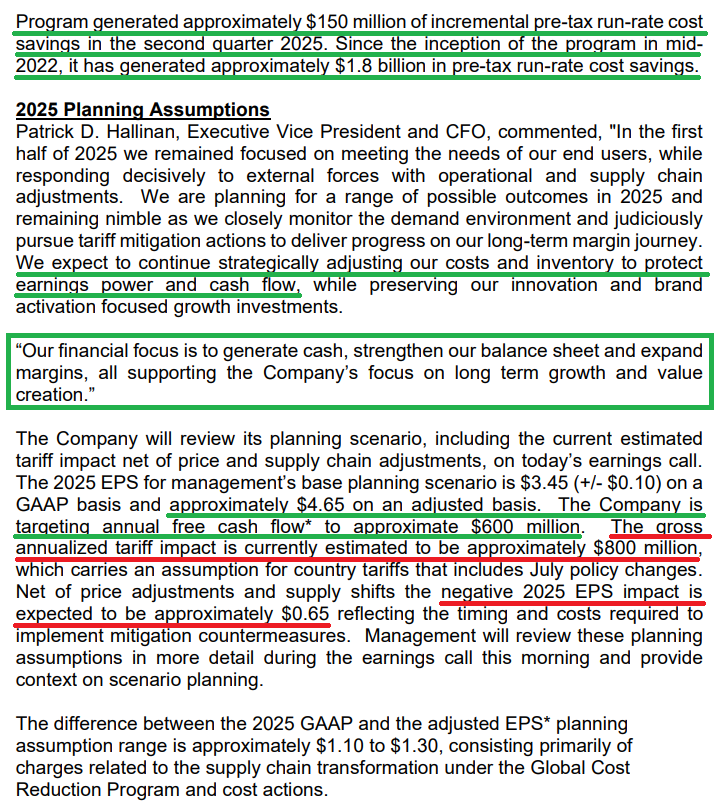

That $800 million doomsday figure EXCLUDES ANY MITIGATION ACTIONS, which are already well underway. Management implemented an initial price increase back in April, with demand remaining consistent post-increase, and another modest increase is planned for early Q4. They are also working to improve USMCA compliance where possible and plan to reduce their China manufacturing footprint to under 5% by the end of 2026. These steps are expected to reduce the actual tariff impact to just 60-65% of the $800 million. Most importantly, management expects pricing and mitigation to LARGELY OFFSET THE ENTIRE TARIFF HEADWIND BY 2026.

That sets up Q2 gross margins as an inflection point for the year. Both Q3 and Q4 are expected to show 150 to north of 200 bps of YoY margin expansion, with Q4 margins landing in the 33-34% range. That puts SWK just a hair shy of its long-term target of above 35%, a level management expects to reach in the second half of 2026. Keep in mind, the last time this business had gross margins above 35%, it generated $8.05 in EPS and traded north of $150…

And by the way, none of this recovery depends on VOLUME. This is pure cost-driven margin improvement. No market rebound, no operating leverage, just execution.

But when the market does turn, and it’s inevitable, SWK will be a cash machine. Tariffs don’t change the multi-million unit housing shortage caused by a decade plus of under-building. They don’t change demographics, with over 70 million millennials entering prime family formation years. And they don’t change this administration’s laser focus on cutting red tape and improving housing.

Ladies and gentlemen, when rates come down and housing wakes up from the dead, it will suddenly become the new shiny object trade of the market, and this beach ball (that has been held under water) will EXPLODE HIGHER.

We skate to where the puck is going, not to where it’s already been. It is only a matter of time…

Q2 Earnings Breakdown

10 Key Points

1) Revenue came in at $3.95 billion, down ~2% YoY and in line with expectations. Adjusted EPS of $1.08 crushed the $0.42 consensus estimate.

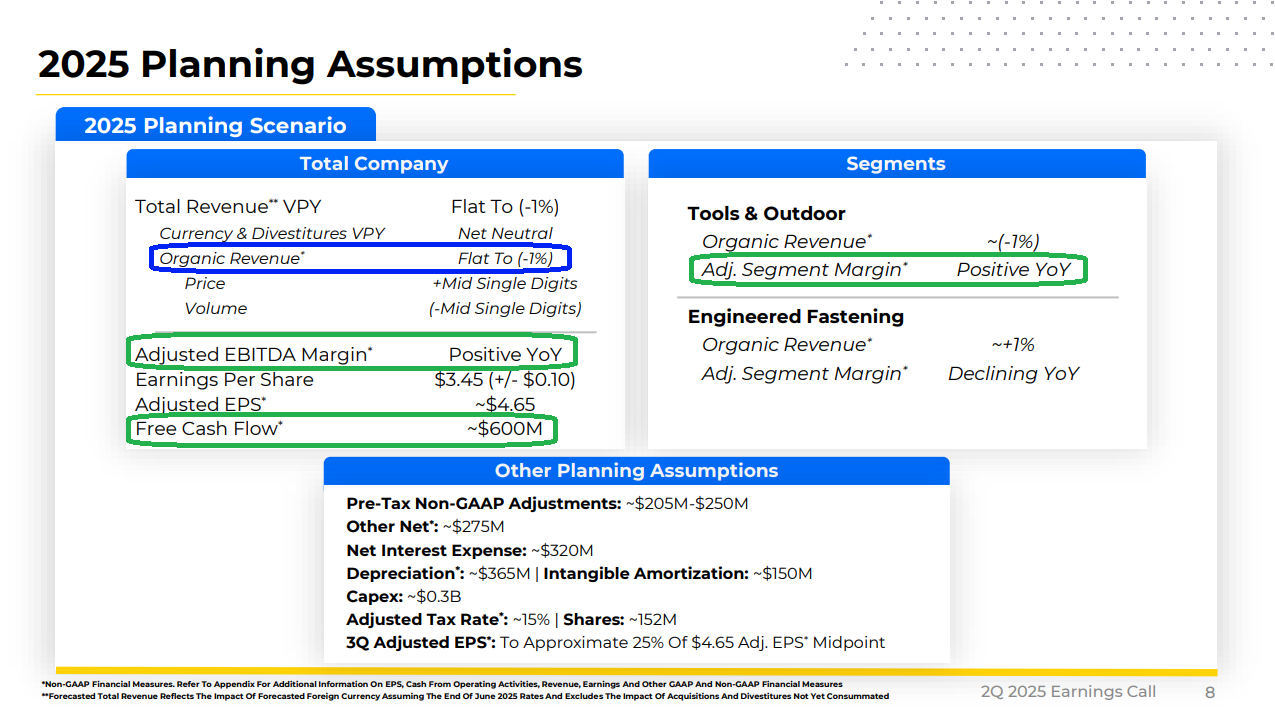

2) Adjusted gross margin came in at 27.5%, down 170 bps YoY, with ~3% of the decline tied to tariffs. Management expects Q2 to mark the low point for margins this year, with mitigation efforts driving continued YoY expansion of 150 to north of 200 bps in both Q3 and Q4, ending the year in the 33–34% range. Most importantly, they remain confident in reaching the long-term target of 35% margins in the back half of 2026, assuming no major changes to government policy.

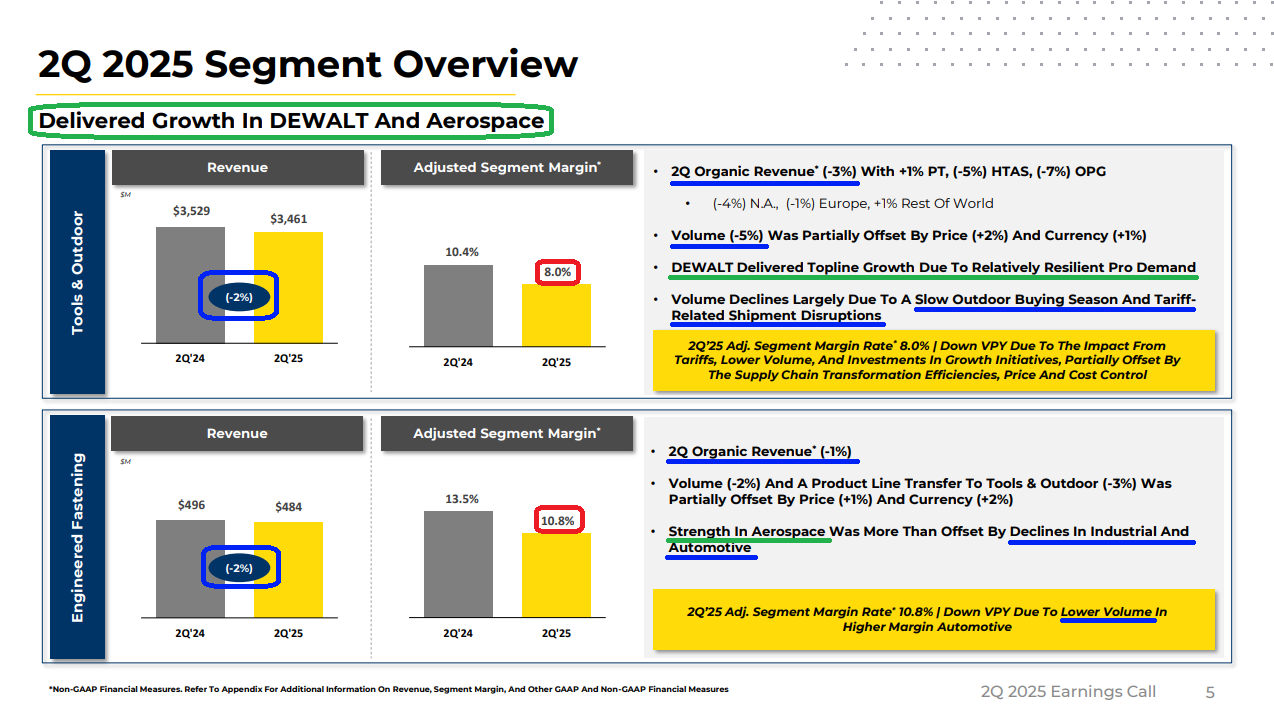

3) DeWalt continued to perform well in Q2, with top-line growth driven by resilient pro demand. The brand has now delivered growth across every product line and region year to date, marking over two years of consistent expansion.

4) Aerospace remains a bright spot within the Engineered Fastening segment, delivering over 20% organic growth in Q2. The business reached a new high of $400 million in annualized run-rate revenue, supported by a strong multiyear backlog and solid growth outlook.

5) Management expects an annualized gross tariff cost of ~$800 million in 2025, excluding any mitigation actions. However, several mitigation and pricing strategies are already underway. An initial price increase implemented in April is fully in place, with another modest increase planned for early Q4. Management is also working to increase USMCA compliance in Mexico (~18% of the U.S. supply footprint) and sees no structural barriers to reaching industry-average levels. In addition, the current plan aims to reduce Chinese production (~14% of the U.S. supply footprint) to under 5% by the end of 2026. Combined, these efforts are expected to reduce the actual tariff impact in 2025 to just 60–65% of the $800 million, with management expecting to largely offset the entire headwind by the end of 2026.

6) SWK continues to benefit from its industry leading North American footprint, which accounts for over 60% of cost of sales. Unless competitors are suddenly willing to build tool factories in the middle of Ohio, meaningful market share losses from tariffs look highly unlikely and SWK may even be positioned to gain share from industry peers that are more exposed to tariffs.

7) SWK delivered $135 million of free cash flow in Q2, well below the $486 million generated in the prior year but a solid result given the operational impact of new trade policies. Most importantly, management continues to expect ~$600 million in free cash flow for the full year, with proceeds used to fund the dividend and excess cash earmarked for debt repayment. Management remains focused on reaching its 2.5x net leverage target, with deleveraging the balance sheet still a top priority. An additional $500 million to $1 billion in portfolio pruning is expected to support further debt reduction.

8) The global cost reduction program remains on track for completion by the end of 2025, with $150 million in pre-tax run-rate savings achieved during Q2. This brings total savings to date to $1.8 billion, keeping the company on pace to deliver $500 million in 2025.

9) Christopher Nelson, currently SWK’s Chief Operating Officer and President of Tools & Outdoor, will become CEO effective October 1, 2025. He will succeed Donald Allan, who will transition to Chairman of the Board.

10) For the full year, management expects total revenue to be flat to down 1%. Adjusted EPS is now projected at ~$4.65, ahead of the $4.48 consensus. Management also continues to expect adjusted EBITDA margin to improve year over year.

Earnings Call Highlights

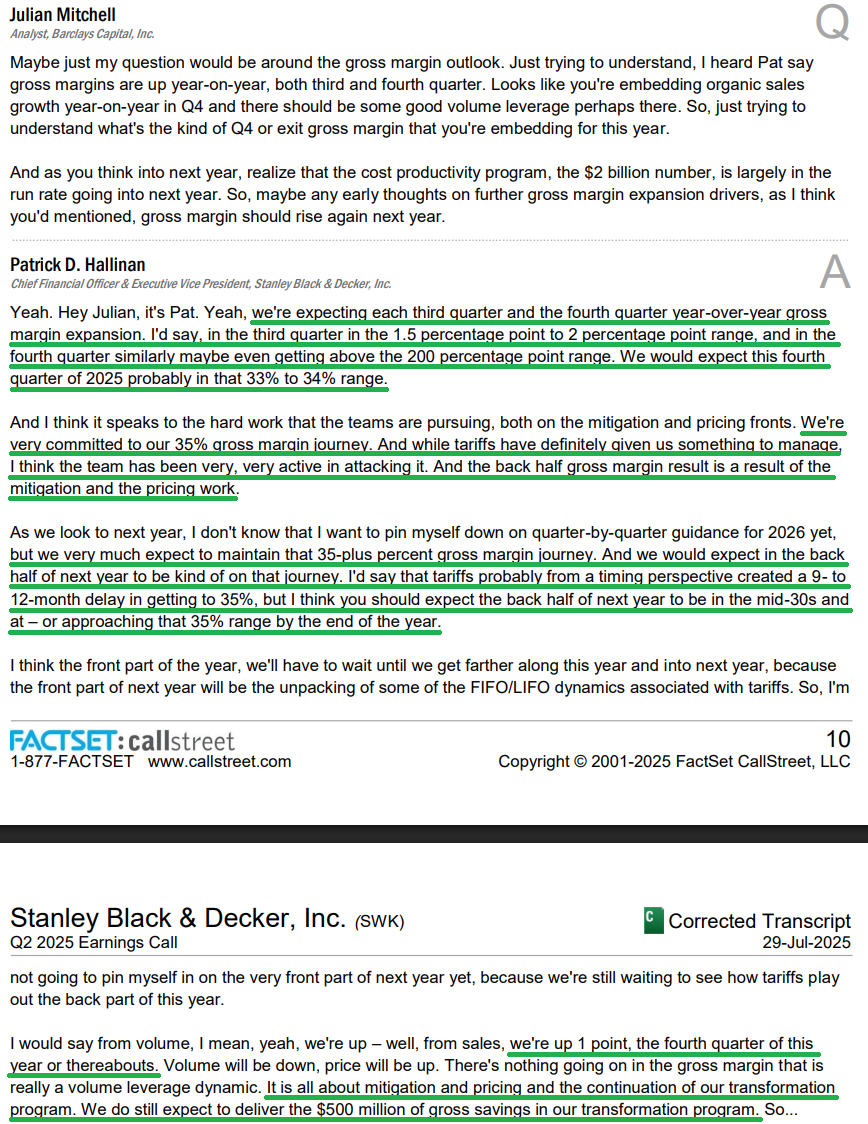

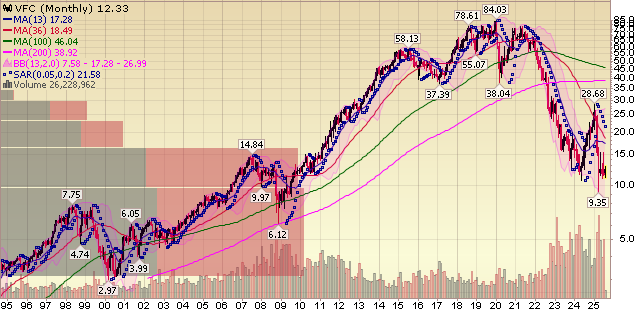

VF Corp Update (VFC)

Q1 Earnings Breakdown

10 Key Points

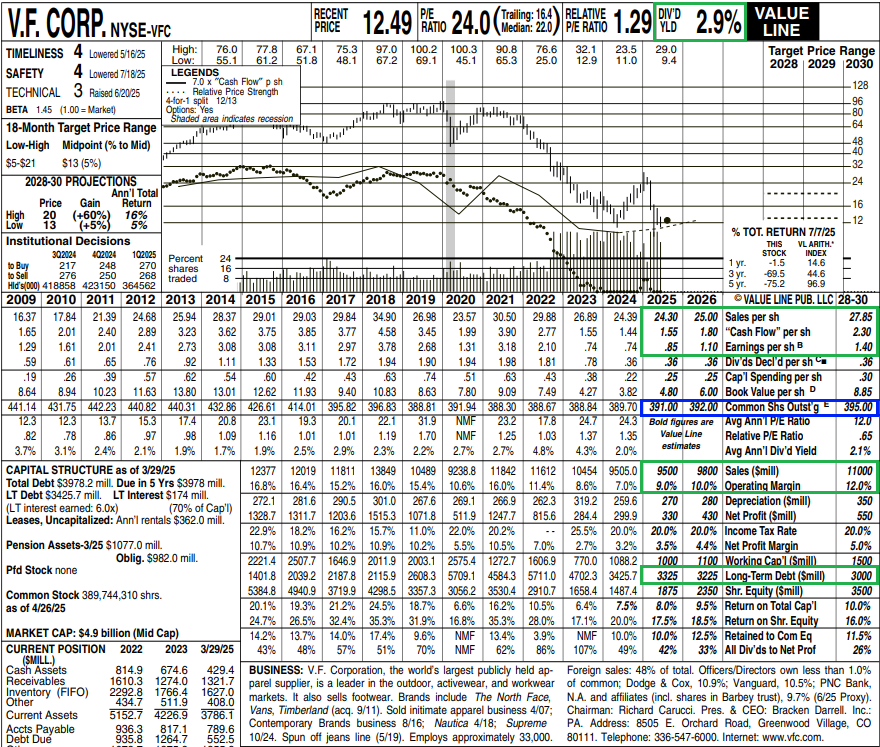

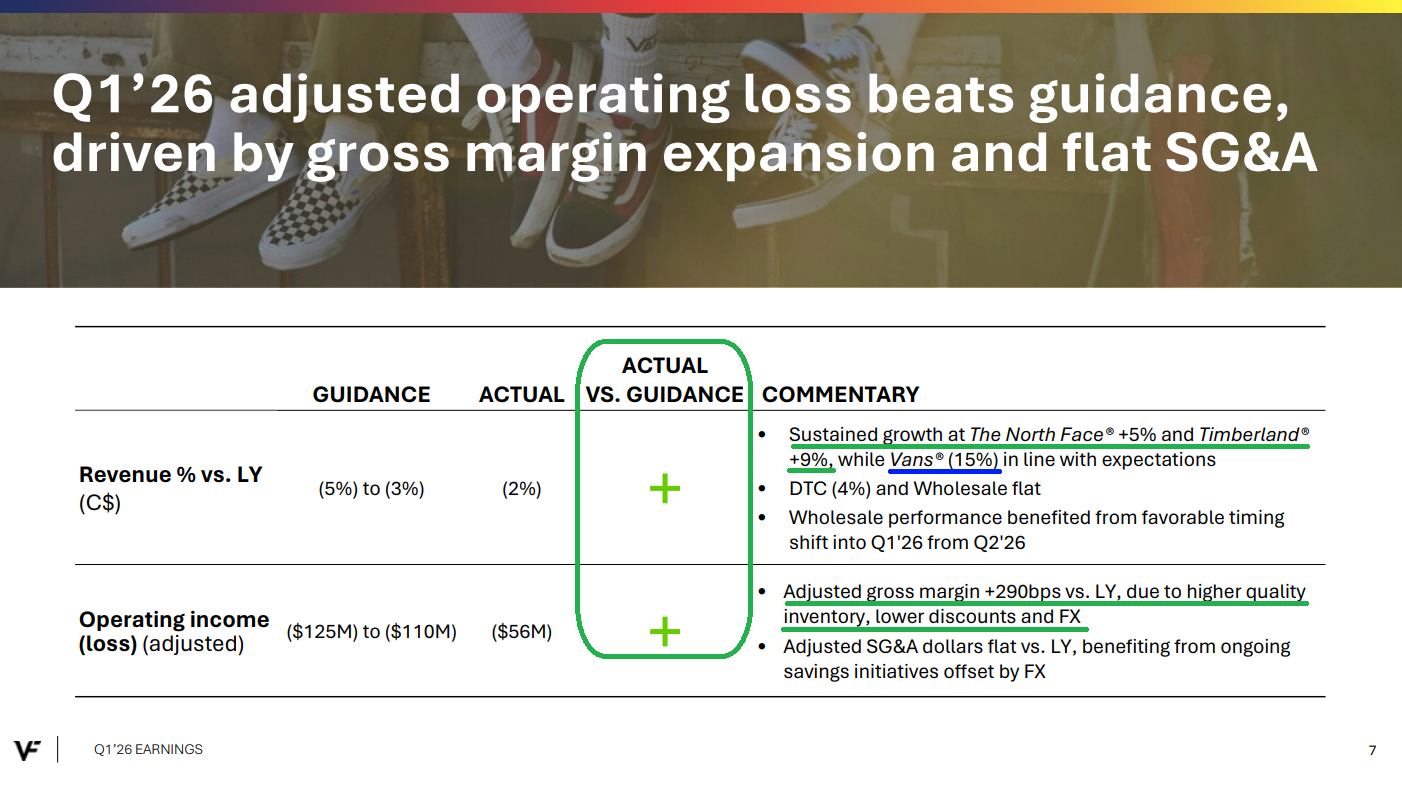

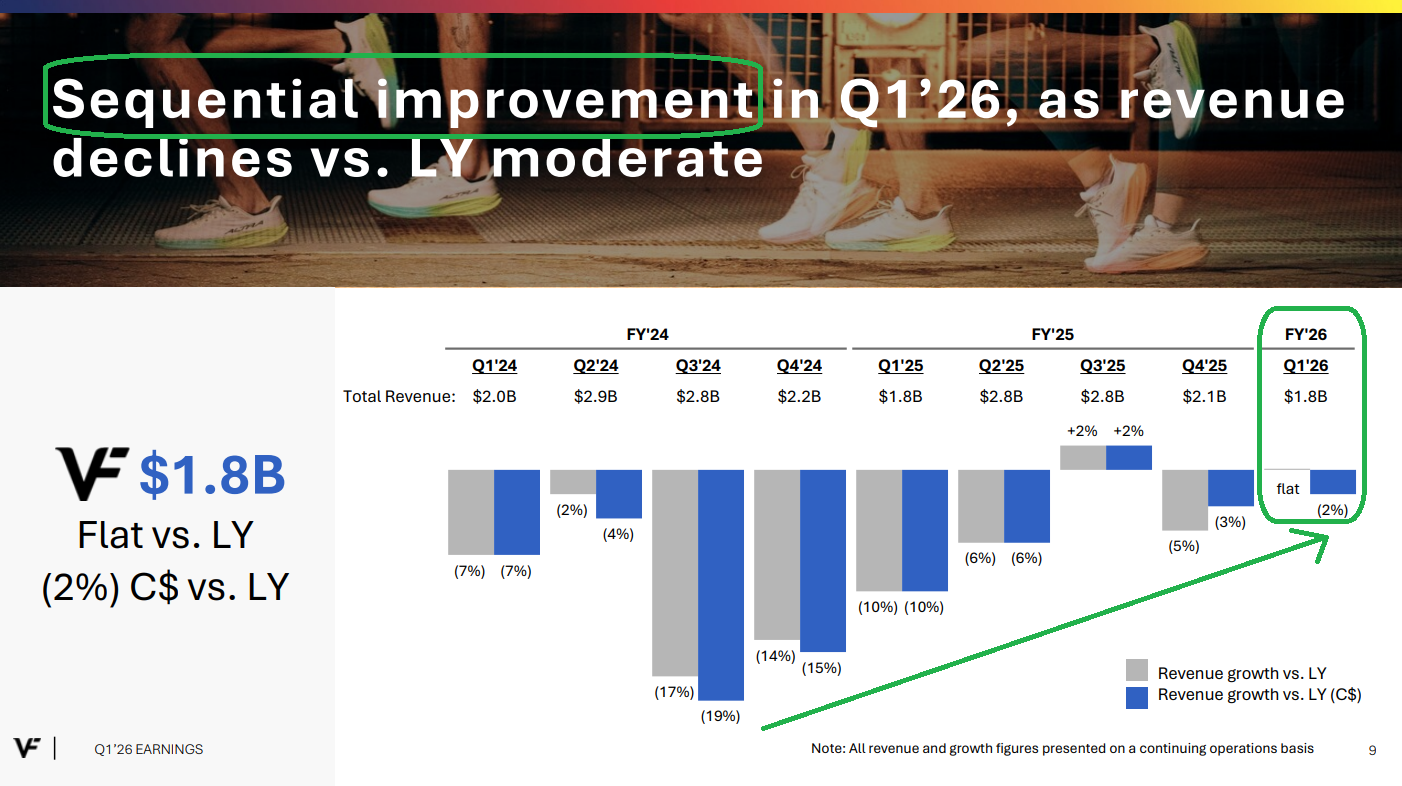

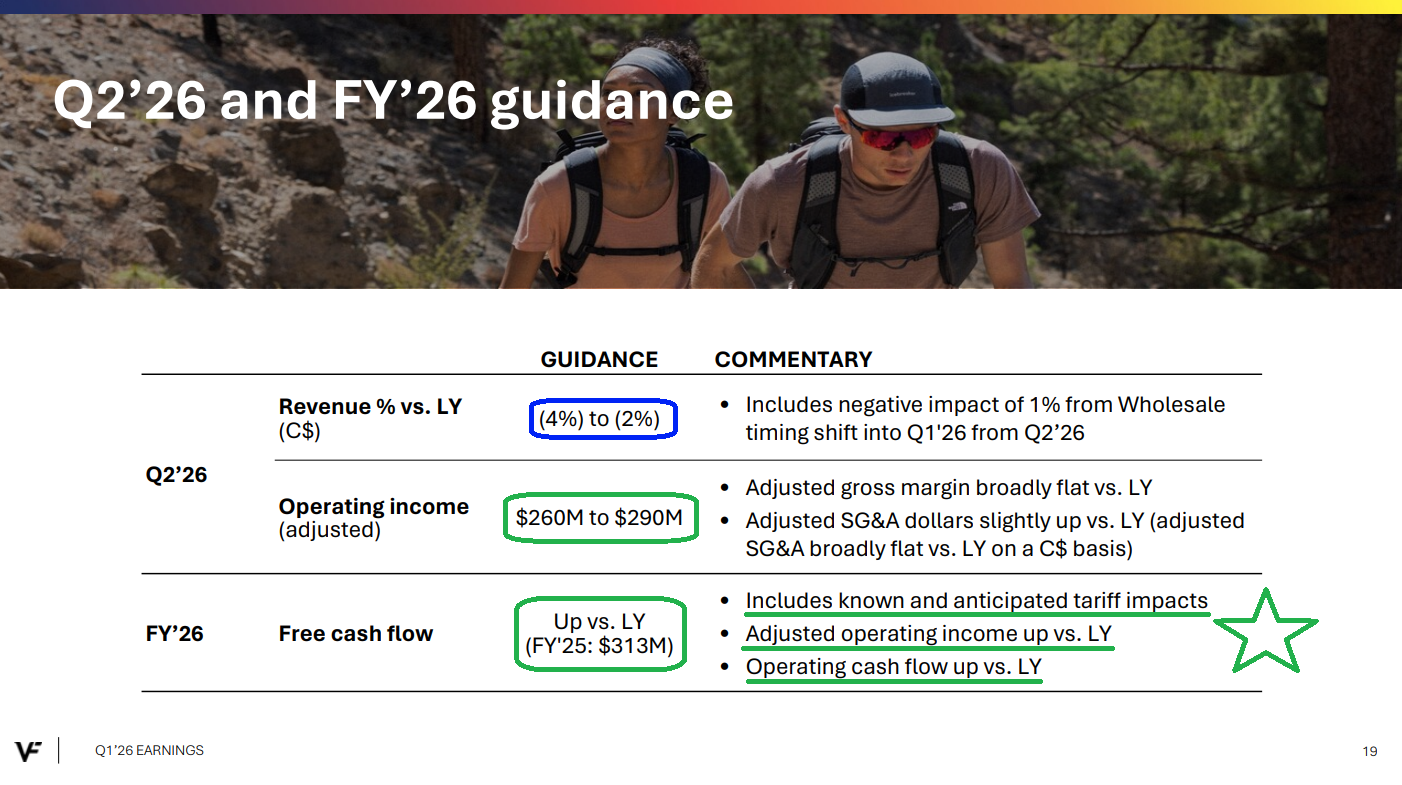

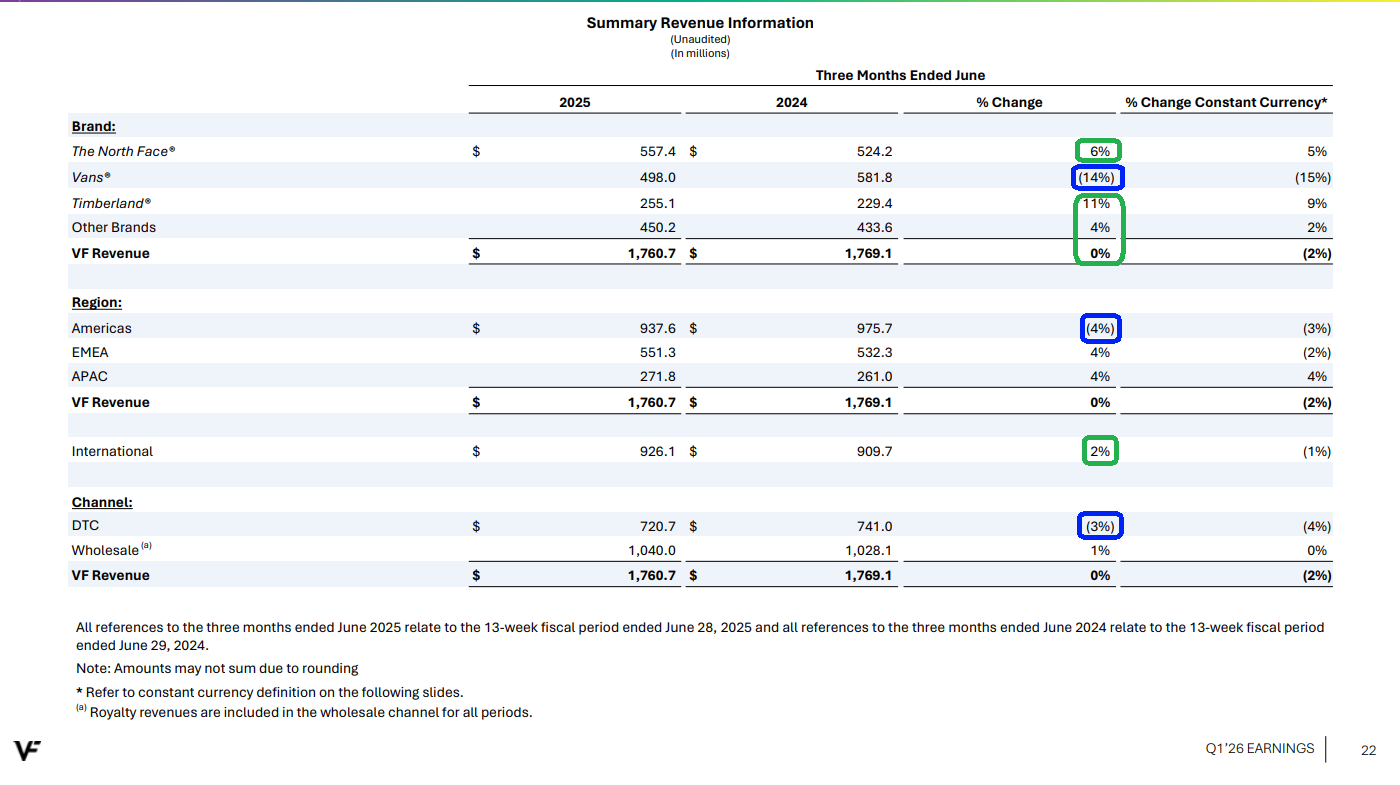

1) Q1 revenues of $1.8 billion, down 2% year over year, beat consensus by $59.85 million and came in ahead of prior guidance for a decline of 3 to 5%. Adjusted loss per share of $0.24 was $0.10 better than analyst expectations and compares to a loss of $0.35 in the same period last year.

2) Adjusted gross margins for the quarter came in at 54.1%, up 200 basis points year over year and well ahead of the 52.1% consensus estimate, driven by higher quality inventory, lower discounts, and favorable FX. This resulted in an adjusted operating loss of just $56 million, a significant improvement over prior guidance calling for a loss between $125 million and $110 million. Q2 gross margins are expected to remain broadly flat, with adjusted operating income projected in the range of $260 million to $290 million. Full-year operating income is still expected to grow compared to last year’s $556 million. Most importantly, the fiscal 2028 targets of 55% gross margins and 10% operating margins remain well on track.

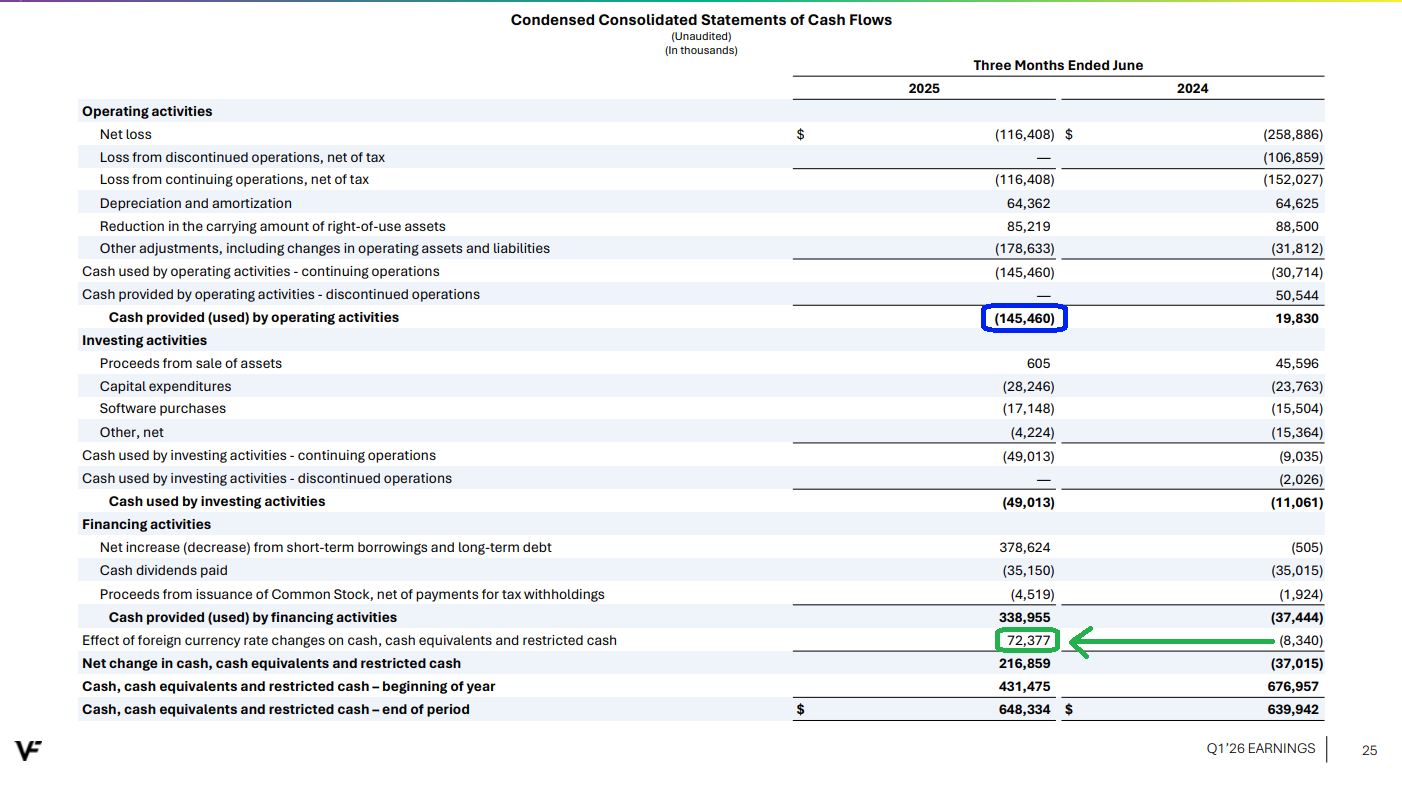

3) As we like to say, the #1 thing we want to see in any turnaround is free cash flow recovering. Management still expects free cash to be up versus last year’s $313 million, even after accounting for tariff impacts and excluding the sale of non-core assets.

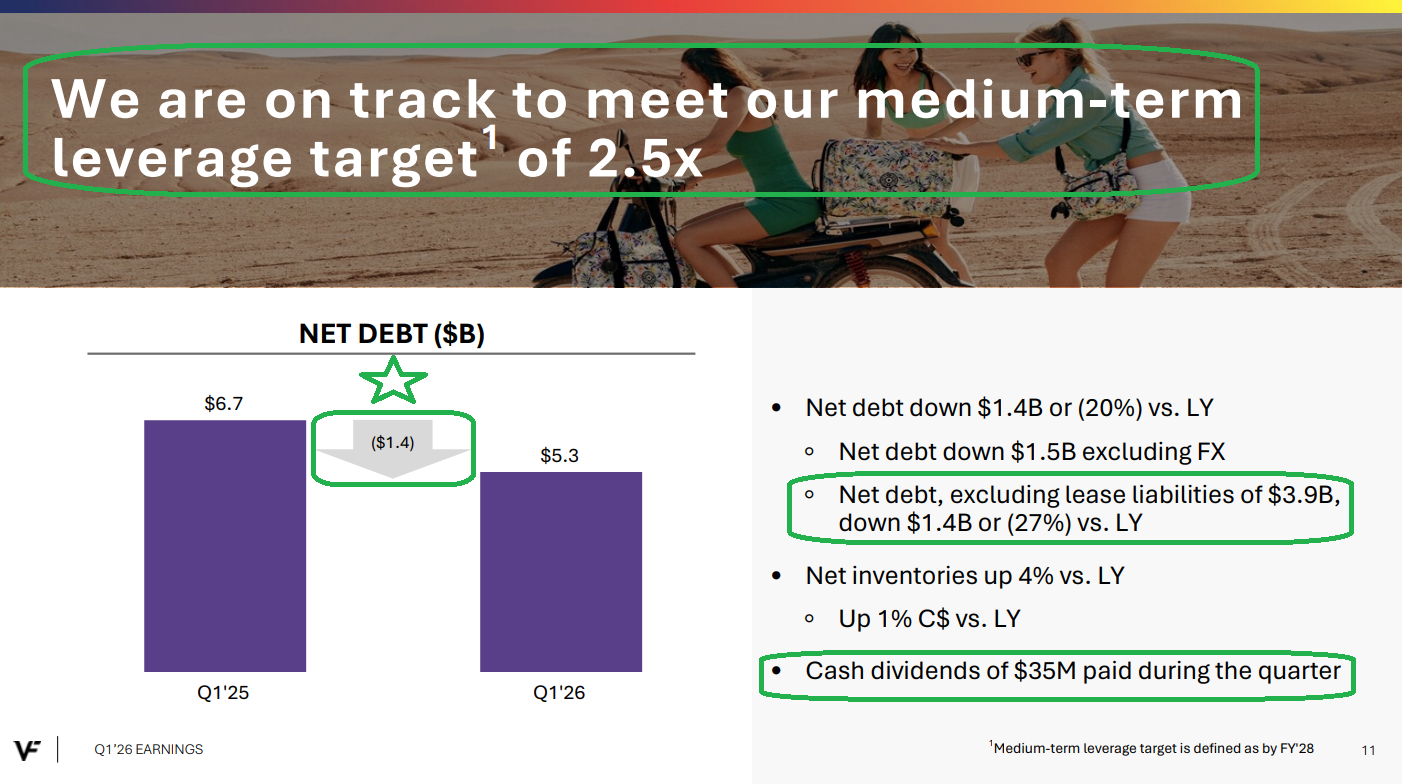

4) Net debt was down $1.4 billion, or 20%, compared to last year as management remains on track to achieve the medium term leverage target of 2.5x by FY2028. VFC ended last year at 4.1x and expects to be below that by the end of this fiscal year, with the ~$500 million bond expected to be paid down at year-end using free cash flow and other short term borrowing if needed.

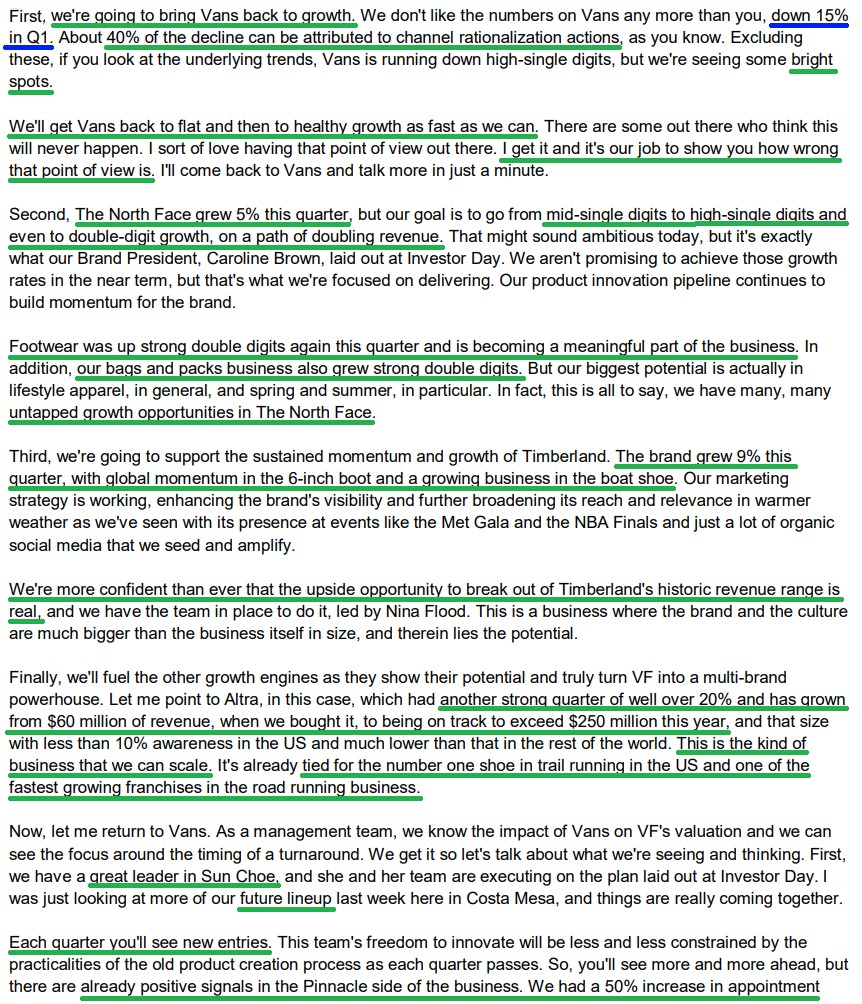

5) North Face continues to deliver solid growth, up 5% this quarter with strong improvement in overall profitability. Footwear was a standout, growing strong double digits, with bags and packs also seeing strong double digit growth. The brand remains on its path to doubling revenue over time as management works to turn it into a four-season style brand.

6) Vans revenues for the quarter were down 15%, with roughly 40% of the decline driven by deliberate channel rationalization. Excluding that, Vans would have been down high single digits. Management continues to see green shoots across the business, with Americas sell-out trends improving as non-value accounts grew again this quarter. Appointment bookings at Paris Fashion Week in June were up 50% as the brand leans further into premium product. New styles like the Super Lowpro and Curren Caples Skate are also driving strong sales from new products. With management optimistic about leaning into back to school marketing, an inflection point at Vans may be closer than many expect.

7) A key part of the Vans turnaround is returning the brand to its roots, and it doesn’t get much clearer than bringing back the Vans Warped Tour. Management planned three locations and expected to sell 50,000 tickets at each, which would have been 2x any previous single event. They sold out tickets in a matter of hours, and over two days in Long Beach drew more than 170,000 attendees making the event a huge boost and catalyst for the brand.

8) Timberland continues to perform well, with revenues up 9% during the quarter and higher overall margins driven by lower discounting. The brand saw growth across all channels, with Americas up 16% year over year as management remains more confident than ever about the upside opportunity to break out of Timberland’s historical revenue range.

9) Other brands grew 2% during the quarter, led by Altra which grew over 20% year over year as it maintained its position as the #1 trail running shoe in the US and continued gaining share in road running. When VFC acquired Altra in 2018, the brand was generating $60 million in revenue. This year, it is on track to exceed $250 million as management continues to scale the business.

10) Management expects the total annualized tariff impact to be $250 to $270 million, with 50% of that flowing through in FY2026 based on the timing of the expected increases. They anticipate a negative net impact to gross profit this year of $60 to $70 million. Most importantly, management remains confident they can fully mitigate all currently anticipated tariffs in fiscal 2027, with both medium term margin targets still on track.

Earnings Call Highlights

General Market

The CNN “Fear and Greed Index” ticked down to 56 this week from 69 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 76.85% this week from 81.07% equity exposure last week.

(Click on image to enlarge)

More By This Author:

“Ignore The Noise, Follow The Leader” Stock Market (And Sentiment Results)…

“The Crown Gets Its Shine Back” Stock Market (And Sentiment Results)

“There’s A Pony In This Pile” Stock Market (And Sentiment Results)…

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more