The Next Big Energy Investment Cycle Is Here

Photo by Matthew Henry on Unsplash

Recent global events have made it clear that the world’s economies are a long way off from producing the necessary energy from entirely renewable sources.

European countries were too quick to shut down coal and nuclear power plants to focus on wind and solar renewable energy sources. The transition was not close to fast enough to provide for the continent’s energy needs. As a result, European countries relied on importing large amounts of natural gas from Russia.

The U.S. will also discover that it is not possible to develop wind and solar infrastructure fast enough to meet government renewable energy goals. The good news is that, according to the American Petroleum Institute, the U.S. has about a hundred-year supply of natural gas. This energy in the ground has been discovered over the last half-dozen years.

The end result: natural gas is set to become the dominant energy source for the next several decades. Many countries, especially in Europe, will need to rethink their long-term energy plans.

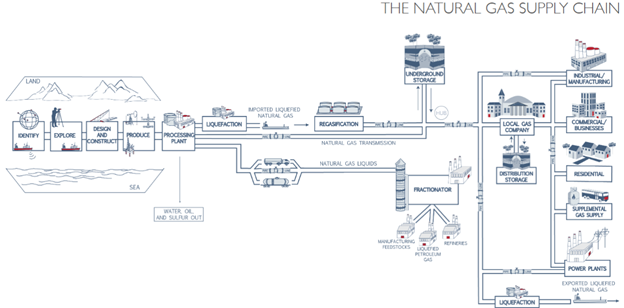

For investors, that means opportunities all along the natural gas supply chain…

(Click on image to enlarge)

At the exploration end, natural gas can be produced in addition to oil from oil-rich plays or solely from natural gas plays such as the Marcellus Shale. At the consumption end, gas generates electricity, is burned to heat homes and businesses, is used in manufacturing, provide vehicle fuel, and can be liquefied to LNG for export to the rest of the world.

Investors have the choices of integrated oil and gas companies such as Exxon Mobil (XOM) or shares of independent companies that focus on one of the three segments energy production naturally falls into. Here are the segments, with descriptions straight from the Library of Congress:

- Upstream companies focus on exploration and production. Most crude oil production is controlled by National Oil Companies, which includes OPEC, or integrated international oil companies. Upstream companies benefit from high oil and gas prices and high volumes. Other metrics include rig count and capital spending.

- Midstream companies handle the transportation and storage of oil and gas. This segment is made up of many independent transportation operators. Oil and gas volumes are important to midstream companies, and prices as they relate to volume: If the price drops so low that upstream companies stop producing, midstream companies are not needed for transportation.

- Downstream companies manage the refining and marketing of oil and gas. There is lower market concentration than the upstream segment. Downstream companies benefit from profit margins where they are able to sell their refined products for more than the cost of acquiring the crude resources. Other metrics include the number and size of refineries.

For natural gas-focused companies, upstream lets investors profit from higher natural gas prices. Midstream companies operate on fee-for-service contracts and usually pay attractive and growing dividends. Downstream in natural gas focuses on the LNG processors and the global marketing of LNG.

Midstream operator ONEOK Inc. (OKE) is an excellent stock for investors to start with when building their natural gas portfolios. ONEOK gathers, processes, stores, and transports natural gas and natural gas liquids (propane, butane, ethane, pentane, isobutane). More than 10 billion cf/d, or 10% of the U.S. natural gas production, relies on the ONEOK network.

ONEOK has grown EBITDA for eight consecutive years, with a 13% compound annual growth rate. The dividend rate has matched the EBITDA growth. OKE currently yields 5.8%

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

This is true for $SWN, $DVN, $XLE, $OXY and others!