The Newsletter For July 2024

Our strategies YTD

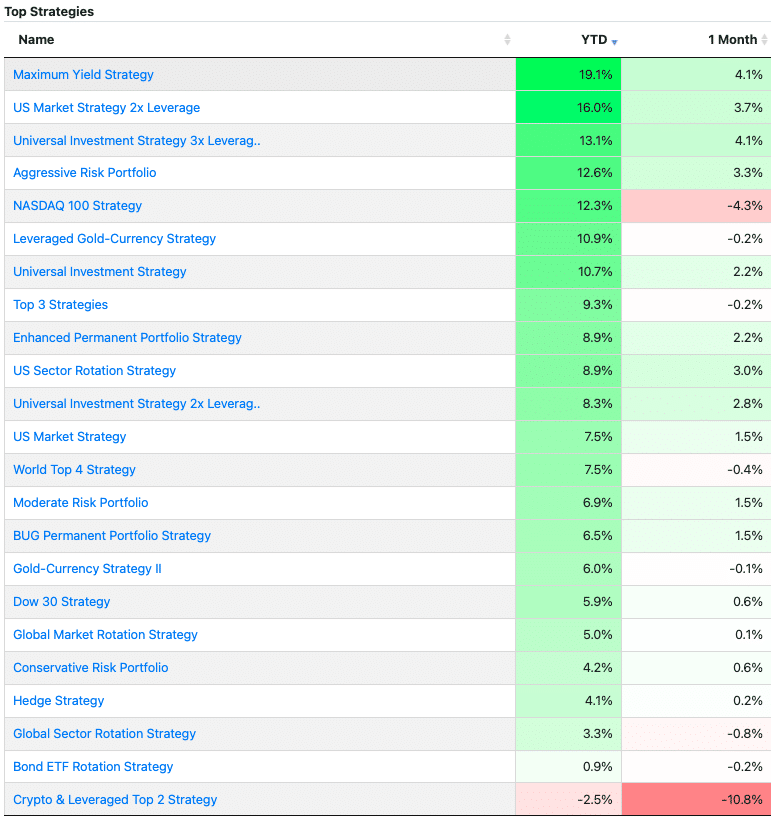

This newsletter will be brief and to the point. Below you can see strategy returns year-to-date as well as the monthly returns.

https://logical-invest.com/app/testRank.php

For June, the Maximum Yield Strategy continued its strong performance adding 4.1% as it continues to harvest volatility premium. Second came the Universal Investment Strategy 3x Leveraged, also with 4.1%, benefitting from holding leveraged S&P500 (SPXL) and gold.

The Nasdaq 100 Strategy lost 4.3%, which contrasts with last month’s outsized +13% gain.

The Nasdaq 100 strategy

Based on @Peticolas newbies-reflections post on our forum, as well as discussion around the Nasdaq 100 strategy, here is a comparison of our methodology compared to common practices:

Traditional approach: A typical Nasdaq 100 strategy involves ranking the N100 stocks using returns or other risk-adjusted metrics, then selecting the top performers.

Logical-Invest approach: Our approach is more sophisticated, comprising several interconnected sub-strategies:

On the top level there are two basic sub-strategies: An “Equity only” strategy that decides if we pick aggressive stocks or lower volatility stocks and a ‘Hedge” sub-strategy that allocates part of the portfolio to a safer and uncorrelated assets that can include short term cash (GSY), gold or Bonds.

The “Equity only” strategy is the Nasdaq 100 Balanced unhedged Strategy. This is an equity only strategy that picks between the aggressive Nasdaq 100 Leaders Strategy and the Nasdaq 100 Low volatility Strategy. Depending on market conditions the equity part of the strategy picks the more or less aggressive variant.

One could stop right here and trade the Nasdaq 100 Balanced unhedged Strategy alone, without using any hedge. But the next logical step would be to combine this strategy with an uncorrelated one that has positive return. We happen to have one ready: The “HEDGE“.

The HEDGE sub-strategy consist of various sub-strategies whose job is to pick between safe-assets and combine them.

In other words the LI Nasdaq 100 strategy model is created as a whole portfolio allocation model. One could just follow it to track U.S. Tech performance while lessening downside in case of a large crash.

More By This Author:

The Logical-Invest Newsletter For June 2024The Newsletter For April 2024

The Logical-Invest Newsletter For March 2024

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more