The Nasdaq Index Reached Its All-Time High 14 Long Years Ago And Now Might Finally Be Back

On March 10, 2000, the Nasdaq Composite Index (NYSEARCA:QQQ) reached its all time closing high of 5048.62.

It was a Friday afternoon and the financial media was abuzz with the news.

Unfortunately, the milestone was relatively short lived as the Nasdaq soon after began a steep descent that saw its value decline by 50% within a year and bottom out on October 10, 2002, with an intra-day low of 1108.

Today the Nasdaq stands at 4675 and so, fourteen years later is back to within 8% of its all time record.

Now that the correction is over, we have returned to seeing the Dow Jones Industrial Average (NYSEARCA:DIA) and the S&P 500 (NYSEARCA:SPY) reaching new, record highs on an almost-daily basis. As the situation becomes more routine, people are beginning to wonder whether the Nasdaq will return to its 2000 record high.

Many investors are afraid to think about the Nasdaq’s returning to its record high level. Once the quantitative easing program began to send the stock market to record highs for the first time after the financial crisis, we were warned of valuation bubbles and the risk of another dot-com-style crash. As a result, for those who suffer from post-dotcom stress disorder, the very idea that the Nasdaq could return to such levels is seen as a bad thing rather than a good thing.

As the Nasdaq climbs higher, one cannot avoid wondering how long it will take the tech-heavy index to reach new record highs. After all, the big momentum stocks are usually Nasdaq stocks.

In addressing the question of whether the Nasdaq could return to its record highs, it becomes necessary to distinguish between the Nasdaq 100 and the Nasdaq Composite. The Nasdaq Composite is just not the same animal it was back in 2000. In those days, the Nasdaq Composite was comprised of over 4,700 stocks.

Today, there are only 2,565 stocks which comprise the Nasdaq Composite. Accordingly, some analysts argue that it makes little sense to compare the 2000 version of the Nasdaq Composite to the present-day version. On the other hand, the Nasdaq 100 is the index upon which the PowerShares QQQ Trust ETF is based. The QQQ ETF was also in existence back in 2000. True to its name, the Nasdaq 100 has always been comprised of only 100 stocks. As a result, it makes more sense to focus our inquiry on the Nasdaq 100.

The record intraday high for the Nasdaq 100 occurred on Friday, March 24 of 2000, when the index reached 4,816.35. Its record-high close occurred on Monday, March 27, 2000 at 4,704.73. Keep in mind that on February 23, 2000, the Nasdaq 100 had advanced to 4,170 – close enough to its recent close at 4,175. By Friday, March 10, the Nasdaq had advanced to an intraday high of 4,610 – although the ensuing three days brought a pullback to 4,130 by Wednesday, March 15. Thus, it took the Nasdaq 100 only seven more trading sessions to run from 4,130 to its record, intraday high of 4,816.35 and eight trading sessions to reach its record-high close.

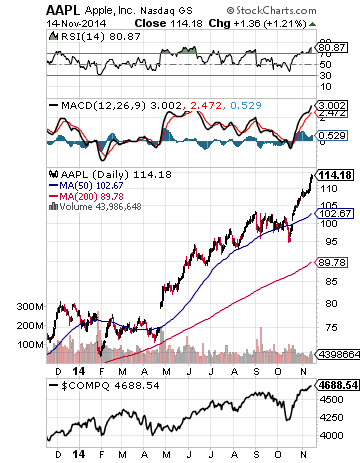

Today the Nasdaq is at near overbought levels and momentum seems to be waning a bit after the recent V-shaped run. Nevertheless, global darling Apple (AAPL) could continue powering the Nasdaq to new and historic highs. In the chart of Apple above, it’s easy to see how Apple and the Nasdaq are tightly correlated and have been heading higher into overbought levels.

The last word: People will be watching to see if the Nasdaq can reach its old record high. Should history repeat and we see a run like in 2000, we can easily conclude that the Nasdaq 100 could reach a new, record high within two weeks to one month. Of course, the old disclaimer which you always see from mutual fund firms becomes especially relevant here: Past performance is no guarantee of future performance. The Nasdaq could just as easily find itself facing any number of potential headwinds between 4,200 and 4,817 which would delay its arrival at a new record high. Breaching new highs would be psychologically important and a global news maker. If and when it happens, investors will be hoping that history won't repeat itself with a new record being shortly followed by an epic bust.

None.

Enjoyed the article. If the all-time high is again reached a correction should be expected, but nothing near the 50% decline seen in the past. For the most part, the relative highs are here to stay.

Great piece, thanks for sharing.