The Nasdaq 100 Outlook Is Underpinned By Just Seven Companies

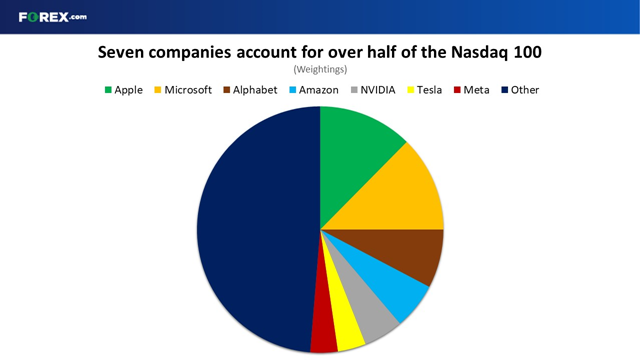

Just seven companies make up over half of the Nasdaq 100.

Key takeaways

- Just seven companies make up half of the Nasdaq 100

- Heavy weighting to tech has proven fruitful during the bull run over the past decade

- But high concentration does raise risks, especially as growth slows

If you’re trading indices, specifically the Nasdaq 100, because they provide an easy way to diversify then be aware that they aren’t as diversified as you may think…

The Big Seven of the Nasdaq 100

Just seven companies currently account for over half of the Nasdaq 100; Apple, Microsoft, Alphabet, Amazon, NVIDIA, Tesla, and Meta.

(Source: Nasdaq 100 QQQ components, data from Slickcharts)

How is the Nasdaq 100 weighted?

The Nasdaq 100 aggregates and tracks the performance of the 100 largest publicly-listed non-financial companies. It is known for containing a lot of fast-growing companies, particularly in the tech space.

However, the Nasdaq 100 is weighted based on the market capitalizations of its constituents, with some modifications. This means that the largest stocks have the greatest influence, compared to an equal-weight system whereby every constituent is given the same weight.

Importantly, this method has proven fruitful for the Nasdaq 100 during the great bull run for tech we have seen over the past decade.

The market-cap weighting system ultimately means greater movements, demonstrated by the comparison between the market-cap weighted Nasdaq 100, which carries the NDX ticker, and the equal-weighted version of the index which goes by the ticker NDXE. We see the Nasdaq 100 outperforms its equal-weight counterpart in good years and underperforms when markets are sliding, with a similar trend evident versus the S&P 500.

|

Price Movements |

YTD |

1 Year |

2 Year |

3 Year |

4 Year |

5 Year |

|

Nasdaq 100 Market Cap-Weighted |

17.6% |

-14.7% |

-1.5% |

68.4% |

73.2% |

98.7% |

|

Nasdaq 100 Equal-Weighted |

10.2% |

-9.8% |

-5.6% |

59.5% |

51.0% |

69.5% |

|

S&P 500 |

4.2% |

-12.8% |

0.3% |

56.8% |

40.6% |

53% |

Why is the Nasdaq 100 so concentrated?

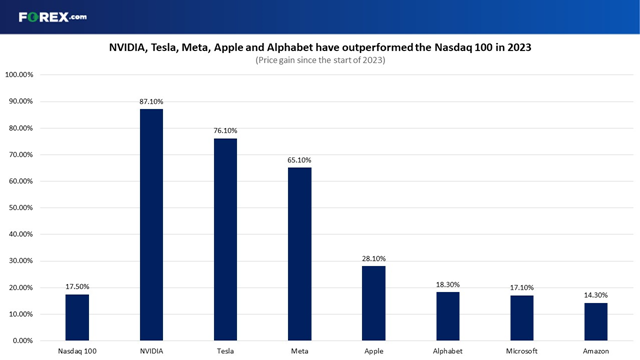

The Nasdaq 100 has become more concentrated on these seven stocks considering they accounted for around 40% of the index at the end of 2022. That has happened because five of the seven have significantly outperformed the rest of the index, growing their valuations faster and giving these behemoths even more weight in the Nasdaq 100.

Is the Nasdaq 100 facing concentration risk?

The Nasdaq 100 is not the only index that uses a market cap-based weighting system and leans into its largest and most successful businesses. However, it is more concentrated than others. For example, the seven companies that make up over half of the Nasdaq 100 account for just under 25% of the S&P 500.

One of the major benefits of trading indices is the lower risk they offer compared to trading individual equities, but these can deteriorate when things are concentrated. If you’re trading the Nasdaq 100, then you are putting almost equal amounts behind those seven companies as you are in the other 93 members of the index.

It means the Nasdaq 100’s fate can be decided by just a handful of major players, which are now largely responsible for deciding whether the index books gains or losses. That level of concentration raises the risk attached to the index.

Its performance has been largely driven by the unabated growth enjoyed by Big Tech over the last 15 years but that era could be drawing to a close and leading to a new one plagued by slower growth. We have already seen growth stall and earnings fall for the first time in years at Big Tech and Meta’s CEO Mark Zuckerberg has already warned that he believes this new ‘economic reality’ plagued by slower growth could last for several years.

Where next for the Nasdaq 100?

The Nasdaq 100 opened at its highest level in six months today before swiftly giving back the gains and losing ground. The index is now attempting to break above the five-month high of 12,803 that was hit in early February, having tried and failed twice last week to close above this level.

A move above here could pave the way for a return back above the 13,000 threshold, toward the lows we saw just over a year ago. The longer-term goal is to retake the peak of 13,667 seen last August.

The fact the index sank to 12,611 and rebounded three times last week suggests this could provide some support if the index comes under renewed pressure, with a drop below 12,400 likely if it fails.

(Click on image to enlarge)

More By This Author:

Earnings This Week: Carnival, Micron And Next In UK

Block Stock Chopped As Hindenburg Goes Short: Where Next For SQ Stock?

Big Tech Layoffs: Are There More Job Cuts To Come?

Disclosure: For our complete disclosure and risk warning, please click here.