The Market Sees What’s Coming—And It’s Not A Rate Cut Picnic

Image Source: Unsplash

It’s a Forward Looking Machine !!

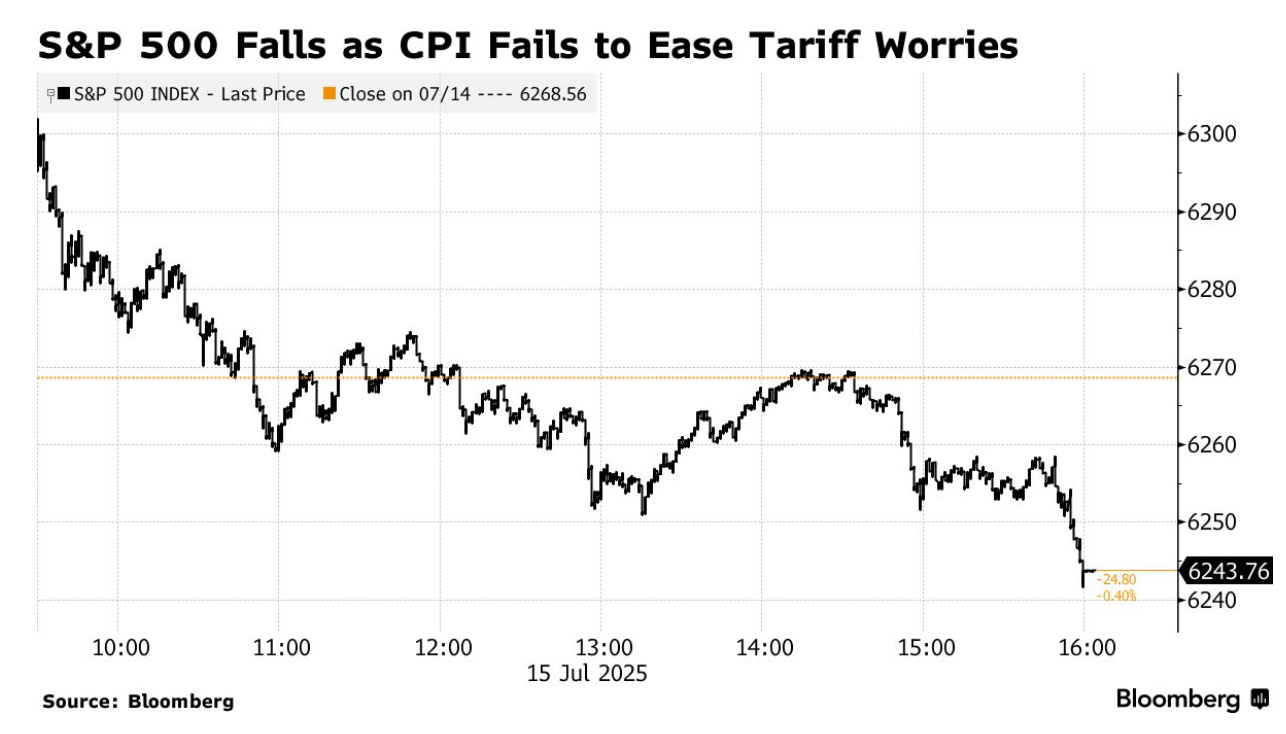

Wall Street had hoped that a soft CPI would act like a balm, soothing the sting of Trump’s tariff broadside. But instead of dousing the fire, it merely exposed the dry brush beneath.

The CPI core print may have whispered relief, but the market heard a different melody—one laced with caution and unresolved tension. While headline numbers showed only muted pressure, traders know better than to take the soft read at face value when the shadows of tariffs are lengthening across the horizon. The early tremors of pass-through are starting to ripple through goods categories, but the main event is still ahead.

Evidence of tariff impulses is beginning to seep through the cracks like smoke before flame. Traditional tariff-sensitive import categories—household furnishings, recreational goods, apparel, and auto parts—all registered monthly increases, a subtle but unmistakable signal that the cost pressures from Trump’s renewed trade war are starting to bleed into the consumer basket.

It’s not yet a conflagration, but it’s more than background noise. Economists have responded by nudging up their PCE inflation forecast by 4 basis points to 0.29% month-on-month—a quiet recalibration that speaks volumes. It suggests the tariff tax is trickling in, and it’s creeping toward broader price measures.

This is, after all, a forward-looking machine—part seismograph, part crystal ball. Markets don’t wait for inflation to show up in full regalia; they react to the rustle of its cape. And in this case, even a faint uptick in select categories was enough to muddy the September rate-cut waters. The softer June core number—on paper—keeps a Fed pivot in play. But in practice, it’s conditional on the next two CPI prints playing ball. That’s no certainty.

August 1 is the next milestone. That’s when the tariff machinery grinds into its next gear. Both the Fed and “ The Street “are fully aware that tariffs don’t hit inflation with a sledgehammer—they infiltrate quietly, showing up in durable goods margins, import substitution, and retail shelf stickers long after the ink dries on the White House order. That lag is what haunts the FOMC. It’s the same reason they're looking for something stronger than CPI to hang a policy pivot on. Namely: labour.

Only clear, unambiguous softness in jobs data will give Powell and crew the confidence to move before year-end. Otherwise, they risk cutting into what could be a slow-burning inflation reacceleration driven not by wages, but by policy-induced cost-push dynamics. In other words, we’re not dealing with demand-pull inflation this time—it’s supply chain taxation masquerading as price stability.

The wildcard is Trump’s tariff barrage. It has all the hallmarks of 2018, but this time with a stickier labor market, a tighter Fed balance sheet, and far less market patience. The real question isn’t whether tariffs will show up in the data—they will. It’s whether they’ll arrive slowly enough to let the Fed act in September, or fast enough to trap them on the sidelines.

A tariff-driven inflation reckoning is no longer some tail-end risk. It’s a live probability, with the August CPI report as the potential ignition point. If that data confirms the feared pass-through—especially into core goods and services—the window for cuts may slam shut. Markets will need to recalibrate fast.

So while June gave us a glimpse of calm, it’s likely the eye of the storm. The CPI winds are shifting, and the Fed, caught between a slowing economy and an inflation forecast thick with geopolitical fog, may soon find itself short on safe harbours.

Initial rallies in equities and bonds flickered like faulty neon—brief, bright, and ultimately unreliable. The S&P 500 flirted with 6,300, only to lose altitude as the tape digested not just macro signals but micro cracks from the financial sector. Tech names caught a speculative tailwind on reports that Nvidia (NVDA) and AMD would resume limited chip sales to China—news that was more about the politics of semiconductors than fundamentals. But that short-term enthusiasm couldn’t mask a more structural discomfort: that tariffs, inflation, and fiscal decay are merging into a single, grinding macro concern.

Banks were the canaries this time. Wells Fargo (WFC) guided down net interest income, a sign the margin tailwind is turning stale. JPMorgan (JPM) dipped despite a modest upside in investment banking—proof that even alpha desks can't fully hedge against macro gravity. Citi (C) surged, but only because buybacks lit a temporary fire under the stock, not because of underlying strength. That alone tells you where we are in the cycle: financial engineering outperforms financial operations.

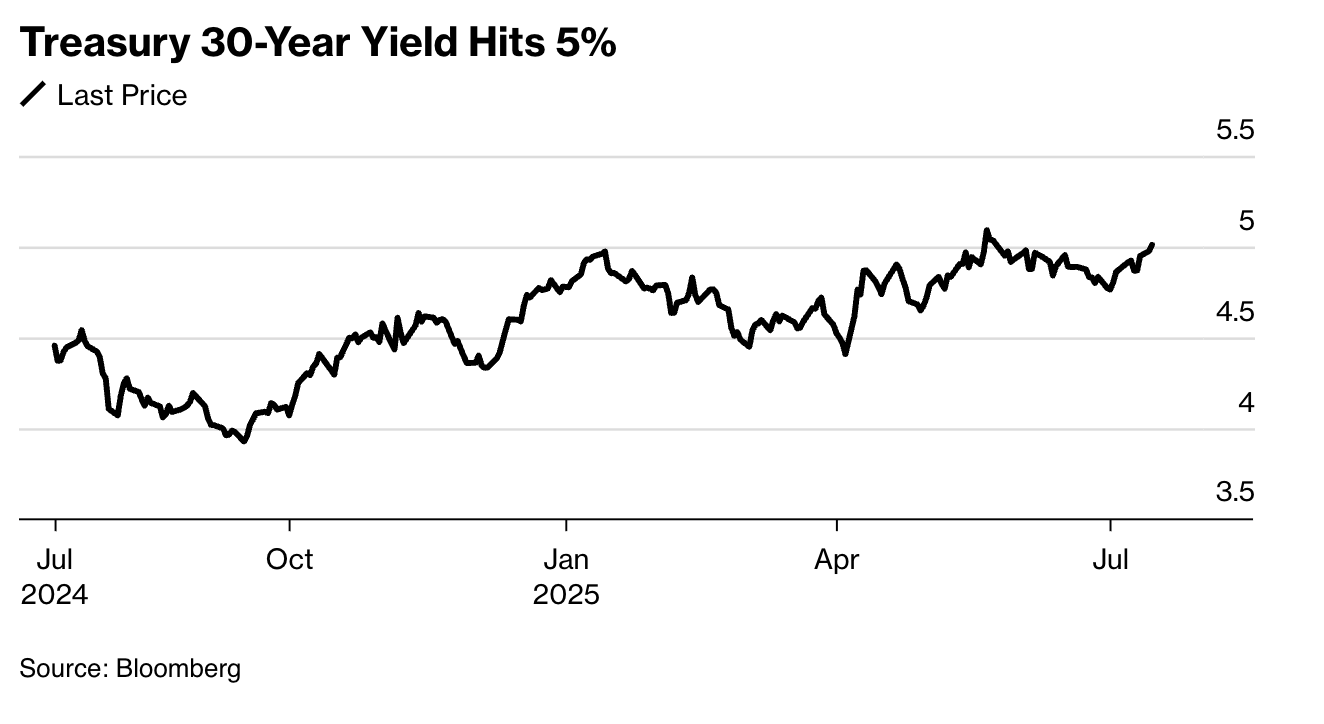

In rates, the front end got clipped as traders pared back dovish expectations. But it was the long end that turned heads. The 30-year yield punching through 5% isn’t a Fed story—it’s a fiscal one. It’s about term premium returning with a vengeance, demanding a real price for real risk in a world that’s once again wondering if the emperor—this time fiscal—has any clothes.

The inflation release showed a few wisps of tariff pass-through, but core pressures remain mostly in check. Still, markets aren't reacting to what is, but to what might be. That’s the forward-looking nature of the beast—pricing in not just today’s CPI, but tomorrow’s headlines, next month’s tariffs, and Q4’s political theatre. Traders are squinting into August and seeing a haze of uncertainty. The 1st of the month brings more tariffs, more potential pass-through, more reasons for the Fed to sit tight and wait for payrolls to blink before it does.

Fed officials, for their part, are caught between Scylla and Charybdis. On one side, small cracks in the labour market are showing up; on the other, the delayed inflationary impulse from tariffs threatens to reignite the fire.The risk is that July and August data come in hot—too hot to cut, too late to hedge.

That’s why the market’s message is muddled. Traders want to believe in a smooth rally glidepath, but every uptick in front-end yields, every whisper of foreign capital stepping back, and every earnings wobble says otherwise. It’s no longer about what the Fed should do—it’s about what it can do without lighting another fuse in an already unstable powder keg.

In the end, it’s the tariffs—not the CPI—that remain the lurking menace. They’re slow-moving, hard to model, and politically sticky. But their inflationary tail risk is growing. The market senses it. The Fed knows it. And that’s why today’s soft data isn’t enough. The battle ahead isn’t against the last print—it’s against what’s coming down the tracks.

Global Bond Market Fears Take The Wheel

Liquidity’s drying up in the world’s biggest bond markets, term premium is on the march, and yet everywhere I look, there’s barely a whiff of fiscal restraint. A crisis in a developed market used to be unthinkable. I no longer think that’s true.

We’ve had decades where EMs carried the stigma of fiscal fragility—defaults, capital flight, IMF visits. DMs got a pass because they borrow in their own currency. But that free lunch is getting cold. Debts are ballooning, deficits aren’t narrowing, and the dollar’s role as the global ballast is quietly eroding. A developed-market fiscal flare-up isn’t just some doomsday scenario—it’s a tail risk that’s growing teeth.

What’s especially worrying is the deterioration in bond market liquidity, which has been sliding ever since the pandemic, even in the deepest markets. You see it in the UK and Japan especially—bid-ask spreads widening, yields gapping away from their modeled curves. It’s a subtle but telling signal: markets are losing faith in fiscal management. And when liquidity fades, feedback loops start to form.

If the bond market starts to push back—higher yields, weaker currency, vanishing buyers—it forces policymakers into corner-cutting measures that often do more harm than good. We’ve seen this movie before in EMs. Now the UK, France, and yes, even the U.S. are auditioning for supporting roles.

Foreign ownership is another fragility point. In places like the UK and France, overseas buyers hold a big chunk of the debt, but they’re tourists—not lifers. They can and will walk away. Add to that a shift in domestic ownership structures—like the UK pension funds stepping back—and it leaves the door wide open for disorderly price action.

Long-end yields have been rising, and it’s not about Fed hikes anymore—it’s term premium doing the heavy lifting. Investors want more compensation to hold duration when fiscal policy looks rudderless and inflation risk hangs in the air like humidity. Japan is the canary here: long-end JGBs are breaking loose as the BOJ’s footprint crowds out real price discovery.

Globally, almost three-quarters of EM and DM economies are running wider deficits today than they were pre-COVID. Revenues haven’t recovered. Structural deficits have become a way of life. The U.S. is the standout: its fiscal deficit-to-tax revenue ratio is among the worst in the world—and it’s set to worsen with tax cuts on deck.

The real lit fuse is interest payments. This is what triggers fiscal doom loops. It’s not the total debt that kills you—it’s the compounding cost of servicing it at higher yields. The U.S., again, is a glaring outlier here. Its interest bill as a share of revenue is punching well above the EM average. That’s not sustainable.

No one can predict the exact trigger—a failed auction, a Fed misstep, or even a political gaffe could light the match. The UK’s gilt crisis showed just how fast confidence can evaporate. But the underlying kindling is everywhere: soaring debt loads, political gridlock, short-duration issuance, and zero appetite for belt-tightening.

The warning lights are flashing. If you’re not thinking about the unthinkable, you’re not prepared.

More By This Author:

The Boy Who Cried Tariff: Markets Yawn, Inflation Looms

Executive Orders And Empty Assumptions: Monday Opens On Edge As TACO Theory Gets Tested

Week Ahead : Earnings, CPI, And Tariffs - Welcome To The Tunnel Of Truth