The Logical-Invest Newsletter For June 2025

Strong May for Stocks, But What’s the Bigger Picture?

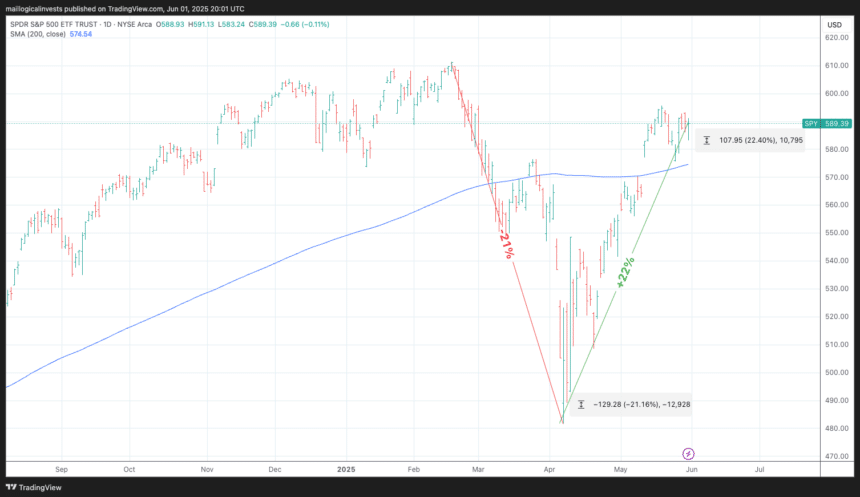

2025 has certainly kept us on our toes. After falling by 21% in March and April, spreading panic among investors who feared an all-out economic war with China, the S&P 500 staged an impressive rally. It regained part of that drop in April and added another 6.3% in May.

(Click on image to enlarge)

However, this surge paints only part of the picture, as the year-to-date return for the S&P 500 remains a modest 0.9%. This highlights the choppy waters we’ve been navigating throughout the first half of the year, influenced by persistent inflation, ongoing tariff negotiations (and some recent rollbacks), and signs of slowing U.S. economic growth even as some international markets show relative strength.

Logical Invest Strategies: Focusing on Resilient, Year-to-Date Gains

In such a dynamic environment, our systematic, rules-based strategies are designed to navigate beyond short-term market swings and aim for consistent, risk-adjusted returns over time.

While the SPY’s concentrated rally in May was notable, many of our diversified strategies focus on a broader set of opportunities and inherent risk management. Looking at the year-to-date performance, where the broader U.S. market has been largely flat, the benefits of this approach are more clear:

- Our Gold-Currency Strategy II continues its stellar run, up 25.4% YTD.

- Our Universal Investment Strategy 3x Leverage has delivered a strong 17.0% YTD.

- The well diversified Top 3 Strategies composite is up 14.0% YTD, showcasing the power of strategy blending.

- The World Top 4 Strategy is performing well at +11.3% YTD, and also delivered a positive 2.2% in May.

- Even strategies like the Hedge Strategy (+10.7% YTD) and Global Sector Rotation Strategy (+10.4% YTD) are demonstrating robust gains in a complex year.

While some strategies may not have captured the entirety of May’s specific U.S. equity surge, their strong year-to-date performance underscores their design: to seek out returns across various market conditions and asset classes, not just chase the hottest trend of the month. Case in point our Top 3 Strategies that achieved only 0.6% (vs 6% for SPY) for May but has returned a solid 14% YTD (vs 0.9% for SPY).

This divergence between a strong month for a single benchmark and the more resilient year-to-date performance of diversified strategies is a key takeaway. It emphasizes why a disciplined, quantitative approach—which avoids emotional decision-making—can be so valuable in achieving long-term investment goals.

Looking Ahead

The remainder of 2025 is likely to present further challenges. Geopolitical factors, central bank policies, and inflationary pressures will continue to shape the investment landscape. In this environment, we believe that maintaining a strategic, diversified, and rules-based investment approach is critical.

Ready to think tactically?

We encourage you to review your allocations and ensure they align with your long-term objectives. As always, we remain committed to providing transparent, data-driven insights to help you navigate your investment journey.

More By This Author:

The Logical-Invest Newsletter For April 2025The Logical-Invest Newsletter For March 2025

The Logical-Invest Newsletter For February 2025

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more